- Home

- Food Packaging

- Absorbent Pads For Food Packaging Market Size, Future Growth and Forecast 2033

Absorbent Pads For Food Packaging Market Size, Future Growth and Forecast 2033

Absorbent Pads For Food Packaging Market Segments - by Material Type (Cellulose, Superabsorbent Polymer, Non-Woven Fabric), Application (Meat & Poultry, Seafood, Fruits & Vegetables, Ready-to-Eat Meals), End-User (Retail, Food Service, Institutional), and Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Absorbent Pads For Food Packaging Market Outlook

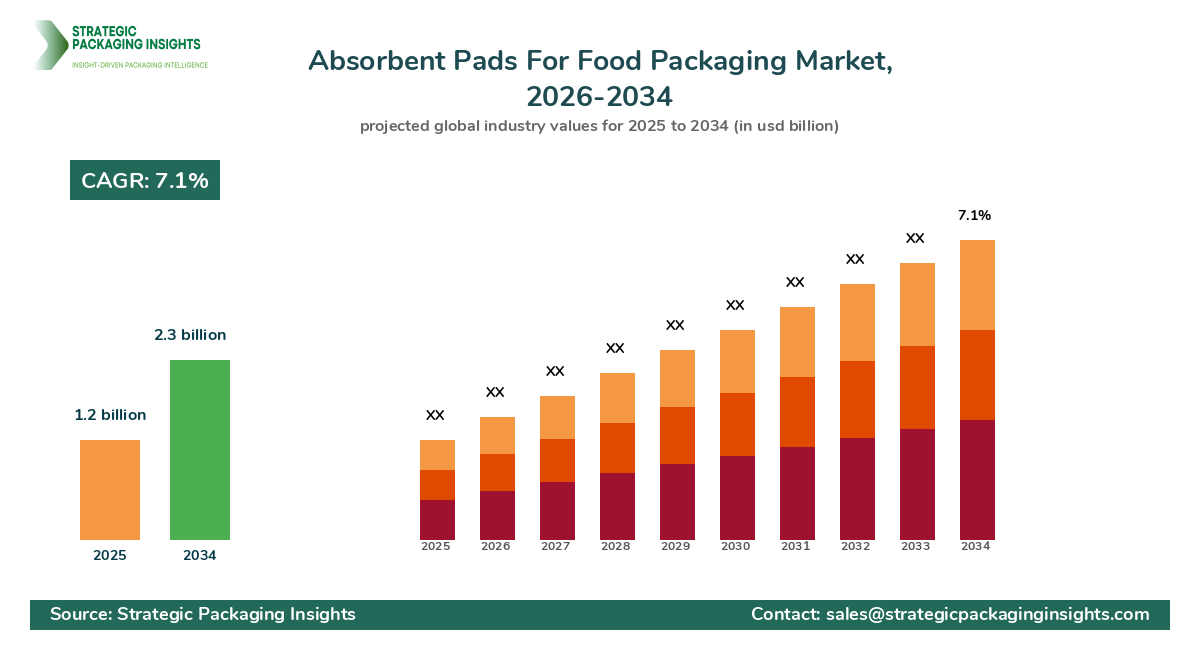

The absorbent pads for food packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033. This market is driven by the increasing demand for fresh and safe food products, which necessitates effective packaging solutions to extend shelf life and maintain product quality. The rise in consumer awareness regarding food safety and hygiene has further propelled the adoption of absorbent pads in food packaging. Additionally, the growth of the retail and food service sectors, coupled with the expansion of e-commerce, has significantly contributed to the market's expansion. The development of innovative and eco-friendly absorbent materials is also expected to create lucrative opportunities for market players.

However, the market faces certain restraints, including the high cost of raw materials and stringent regulatory standards governing food packaging materials. These factors may hinder the growth potential of the market to some extent. Despite these challenges, the market is poised for substantial growth due to the increasing focus on Sustainable Packaging solutions and the rising demand for convenience foods. The ongoing research and development activities aimed at enhancing the performance and cost-effectiveness of absorbent pads are expected to further drive market growth.

Report Scope

| Attributes | Details |

| Report Title | Absorbent Pads For Food Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 112 |

| Material Type | Cellulose, Superabsorbent Polymer, Non-Woven Fabric |

| Application | Meat & Poultry, Seafood, Fruits & Vegetables, Ready-to-Eat Meals |

| End-User | Retail, Food Service, Institutional |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The absorbent pads for food packaging market presents numerous opportunities for growth, primarily driven by the increasing demand for sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious, there is a growing preference for biodegradable and Recyclable Packaging materials. This trend is encouraging manufacturers to develop innovative absorbent pads that are not only effective in maintaining food freshness but also environmentally friendly. The adoption of advanced technologies in the production of absorbent pads, such as the use of superabsorbent polymers and nanotechnology, is expected to enhance the performance and efficiency of these products, thereby creating new growth avenues for market players.

Another significant opportunity lies in the expanding e-commerce sector, which has led to an increased demand for effective packaging solutions to ensure the safe delivery of perishable food items. The rise in online grocery shopping and meal delivery services has necessitated the use of absorbent pads to prevent leakage and maintain the quality of food products during transit. This trend is expected to drive the demand for absorbent pads in the food packaging market, providing lucrative opportunities for manufacturers to expand their product offerings and cater to the evolving needs of consumers.

Despite the promising growth prospects, the market faces certain threats that could impede its expansion. One of the primary challenges is the fluctuating prices of raw materials, which can impact the overall production costs and profitability of manufacturers. Additionally, the stringent regulatory standards governing food packaging materials pose a significant challenge for market players, as they must ensure compliance with various safety and quality requirements. These factors may limit the entry of new players into the market and hinder the growth of existing ones.

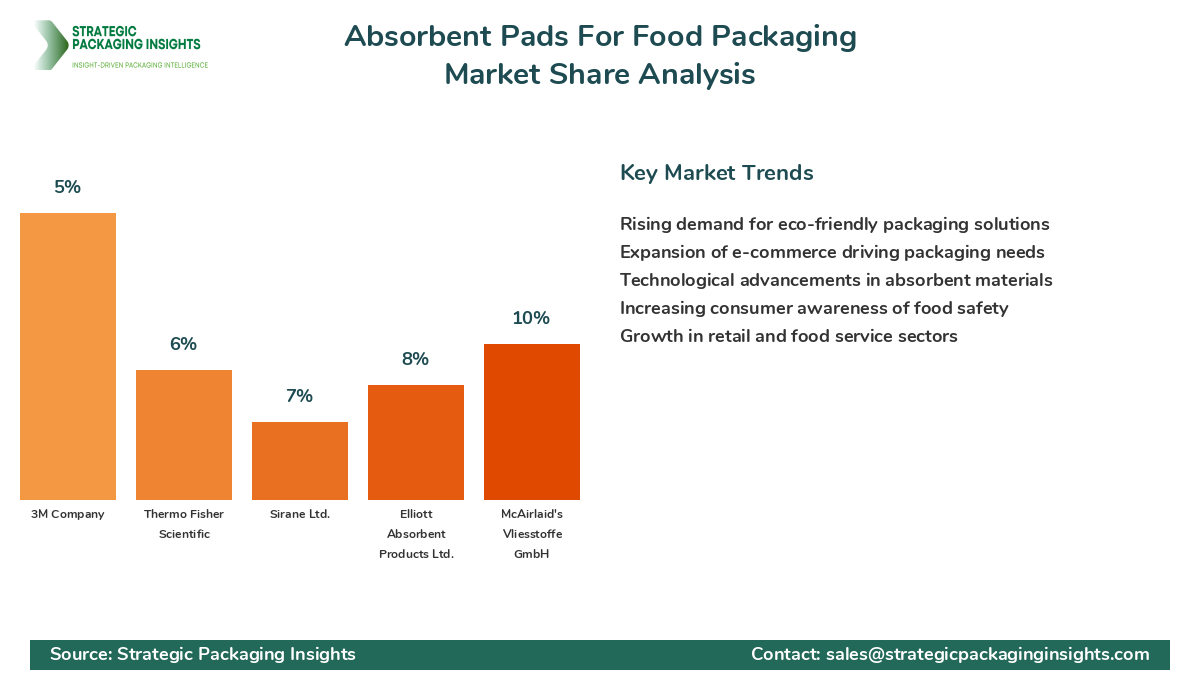

The absorbent pads for food packaging market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a few major companies that hold a significant share, while numerous small and medium-sized enterprises also contribute to the market dynamics. The competitive rivalry among these players is intense, driven by the need to innovate and offer high-quality products to meet the evolving demands of consumers. Companies are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to strengthen their market position and expand their product portfolios.

Among the leading companies in the market, Sealed Air Corporation holds a prominent position with its extensive range of absorbent pads designed for various food packaging applications. The company's focus on innovation and sustainability has enabled it to maintain a competitive edge in the market. Similarly, Novipax is another key player known for its advanced absorbent pad solutions that cater to the needs of the food packaging industry. The company's commitment to quality and customer satisfaction has contributed to its strong market presence.

Other notable players in the market include McAirlaid's Vliesstoffe GmbH, which specializes in the production of airlaid nonwoven materials used in absorbent pads. The company's emphasis on research and development has resulted in the creation of high-performance products that meet the stringent requirements of the food packaging industry. Additionally, Elliott Absorbent Products Ltd. is recognized for its innovative absorbent solutions that are widely used in the packaging of fresh and frozen foods. The company's focus on sustainability and environmental responsibility has positioned it as a key player in the market.

Overall, the competitive landscape of the absorbent pads for food packaging market is shaped by the presence of both established players and emerging companies. The market is expected to witness increased competition as new entrants seek to capitalize on the growing demand for effective and sustainable packaging solutions. Companies are likely to invest in research and development activities to enhance their product offerings and gain a competitive advantage in the market.

Key Highlights Absorbent Pads For Food Packaging Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Rising consumer awareness regarding food safety and hygiene.

- Expansion of the retail and food service sectors driving market growth.

- Growing adoption of advanced technologies in absorbent pad production.

- Significant opportunities in the expanding e-commerce sector.

- Challenges posed by fluctuating raw material prices and regulatory standards.

- Intense competitive rivalry among key market players.

- Focus on innovation and sustainability to gain a competitive edge.

- Emergence of new entrants seeking to capitalize on market opportunities.

- Ongoing research and development activities to enhance product performance.

Top Countries Insights in Absorbent Pads For Food Packaging

The United States is a leading market for absorbent pads in food packaging, with a market size of approximately $350 million and a CAGR of 6%. The country's robust retail and food service sectors, coupled with a high demand for convenience foods, drive the market. Additionally, stringent food safety regulations and a focus on sustainable packaging solutions contribute to market growth.

In Europe, Germany is a key market with a market size of around $250 million and a CAGR of 5%. The country's strong emphasis on environmental sustainability and innovation in packaging technologies supports the growth of the absorbent pads market. The presence of major food packaging companies and a well-established retail sector further bolster market expansion.

China represents a rapidly growing market in the Asia Pacific region, with a market size of approximately $200 million and a CAGR of 8%. The country's expanding middle class, increasing disposable incomes, and growing demand for packaged foods drive the market. Government initiatives promoting food safety and hygiene also play a crucial role in market development.

In Latin America, Brazil is a significant market with a market size of about $150 million and a CAGR of 7%. The country's growing food processing industry and rising consumer awareness regarding food safety contribute to market growth. The increasing adoption of absorbent pads in the packaging of fresh and frozen foods further supports market expansion.

South Africa is an emerging market in the Middle East & Africa region, with a market size of approximately $100 million and a CAGR of 6%. The country's growing retail sector and increasing demand for convenience foods drive the market. Additionally, the focus on improving food safety standards and packaging solutions supports market growth.

Value Chain Profitability Analysis

The value chain profitability analysis for the absorbent pads for food packaging market reveals a complex ecosystem involving various stakeholders, including raw material suppliers, manufacturers, distributors, and end-users. Each stage of the value chain contributes to the overall profitability and revenue distribution within the market. Raw material suppliers play a crucial role in providing the necessary inputs for the production of absorbent pads, with profit margins typically ranging from 10% to 15%. Manufacturers, who are responsible for converting raw materials into finished products, capture a significant share of the market value, with profit margins ranging from 20% to 25%.

Distributors and wholesalers act as intermediaries, facilitating the distribution of absorbent pads to various end-users, including retailers, food service providers, and institutional buyers. Their profit margins generally range from 5% to 10%, depending on the scale of operations and distribution networks. End-users, who utilize absorbent pads in food packaging applications, benefit from the enhanced shelf life and quality of food products, contributing to their overall profitability.

The digital transformation of the packaging industry is reshaping the value chain, with technology platforms and service providers playing an increasingly important role. These stakeholders offer innovative solutions and services that enhance the efficiency and effectiveness of the value chain, capturing a growing share of the market value. The integration of digital technologies, such as automation and data analytics, is expected to further optimize the value chain, creating new revenue opportunities for market players.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The absorbent pads for food packaging market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences, technological advancements, and regulatory developments. During this period, the market experienced a steady growth rate, with a CAGR of approximately 5.5%. The increasing demand for convenience foods and the expansion of the retail and food service sectors were key drivers of market growth. The adoption of advanced technologies in absorbent pad production, such as superabsorbent polymers and nanotechnology, enhanced product performance and efficiency, contributing to market expansion.

Looking ahead to the forecast period of 2025 to 2033, the market is expected to witness accelerated growth, with a projected CAGR of 7.1%. The focus on sustainability and eco-friendly packaging solutions is anticipated to drive market demand, as consumers and regulatory bodies increasingly prioritize environmental responsibility. The expanding e-commerce sector and the rising demand for effective packaging solutions for perishable food items are expected to create new growth opportunities for market players. Additionally, ongoing research and development activities aimed at enhancing the performance and cost-effectiveness of absorbent pads are likely to further propel market growth.

In terms of regional contributions, the Asia Pacific region is expected to emerge as a key growth driver, with countries such as China and India witnessing significant market expansion. The increasing disposable incomes, growing middle class, and rising demand for packaged foods in these countries are expected to fuel market growth. Meanwhile, North America and Europe are anticipated to maintain their strong market positions, driven by the presence of established food packaging industries and a focus on innovation and sustainability.

Absorbent Pads For Food Packaging Market Segments Insights

Material Type Analysis

The material type segment of the absorbent pads for food packaging market is primarily categorized into cellulose, superabsorbent polymer, and non-woven fabric. Cellulose-based absorbent pads are widely used due to their biodegradability and cost-effectiveness. These pads are favored for their ability to absorb moisture effectively, making them suitable for various food packaging applications. The increasing demand for sustainable packaging solutions is driving the adoption of cellulose-based pads, as they align with the growing consumer preference for eco-friendly products.

Superabsorbent polymer (SAP) pads are gaining traction in the market due to their superior absorbency and ability to retain large volumes of liquid. These pads are particularly popular in the packaging of meat, poultry, and seafood, where effective moisture control is crucial to maintaining product quality. The development of advanced SAP materials with enhanced performance characteristics is expected to drive the growth of this segment. Additionally, the non-woven fabric segment is witnessing steady growth, driven by its versatility and ability to provide effective moisture management in food packaging applications.

Application Analysis

The application segment of the absorbent pads for food packaging market is divided into meat & poultry, seafood, fruits & vegetables, and ready-to-eat meals. The meat & poultry segment holds a significant share of the market, driven by the high demand for effective packaging solutions to maintain the freshness and quality of these perishable products. Absorbent pads play a crucial role in preventing leakage and controlling moisture, thereby extending the shelf life of meat and poultry products.

The seafood segment is also a major contributor to the market, as absorbent pads are essential for maintaining the quality and safety of seafood products during storage and transportation. The fruits & vegetables segment is witnessing growth due to the increasing demand for fresh produce and the need for effective packaging solutions to prevent spoilage. Additionally, the ready-to-eat meals segment is gaining traction, driven by the rising consumer preference for convenience foods and the need for packaging solutions that ensure product safety and quality.

End-User Analysis

The end-user segment of the absorbent pads for food packaging market includes retail, food service, and institutional sectors. The retail sector is a major end-user of absorbent pads, driven by the increasing demand for packaged foods and the need for effective packaging solutions to enhance product shelf life. The growth of the retail sector, particularly in emerging markets, is expected to drive the demand for absorbent pads in this segment.

The food service sector is also a significant end-user, as absorbent pads are widely used in the packaging of ready-to-eat meals and other perishable food items. The increasing popularity of meal delivery services and online food ordering is expected to boost the demand for absorbent pads in this segment. Additionally, the institutional sector, which includes hospitals, schools, and other large-scale food service providers, is witnessing growth due to the need for effective packaging solutions to ensure food safety and hygiene.

Regional Analysis

The regional analysis of the absorbent pads for food packaging market reveals significant growth opportunities across various regions. North America and Europe are key markets, driven by the presence of established food packaging industries and a focus on innovation and sustainability. The Asia Pacific region is expected to witness the highest growth rate, driven by the increasing demand for packaged foods and the expanding middle class in countries such as China and India.

Latin America and the Middle East & Africa are also emerging markets, with growing food processing industries and increasing consumer awareness regarding food safety. The focus on improving food safety standards and packaging solutions in these regions is expected to drive market growth. Overall, the regional analysis highlights the diverse growth opportunities and challenges faced by market players in different parts of the world.

Absorbent Pads For Food Packaging Market Segments

The Absorbent Pads For Food Packaging market has been segmented on the basis of

Material Type

- Cellulose

- Superabsorbent Polymer

- Non-Woven Fabric

Application

- Meat & Poultry

- Seafood

- Fruits & Vegetables

- Ready-to-Eat Meals

End-User

- Retail

- Food Service

- Institutional

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the absorbent pads for food packaging market?

What challenges does the market face?

How is the market expected to evolve in the coming years?

Which regions are expected to drive market growth?

What role does technology play in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.