- Home

- Food Packaging

- Absorbent Pads For Meat Food Packaging Market Size, Future Growth and Forecast 2033

Absorbent Pads For Meat Food Packaging Market Size, Future Growth and Forecast 2033

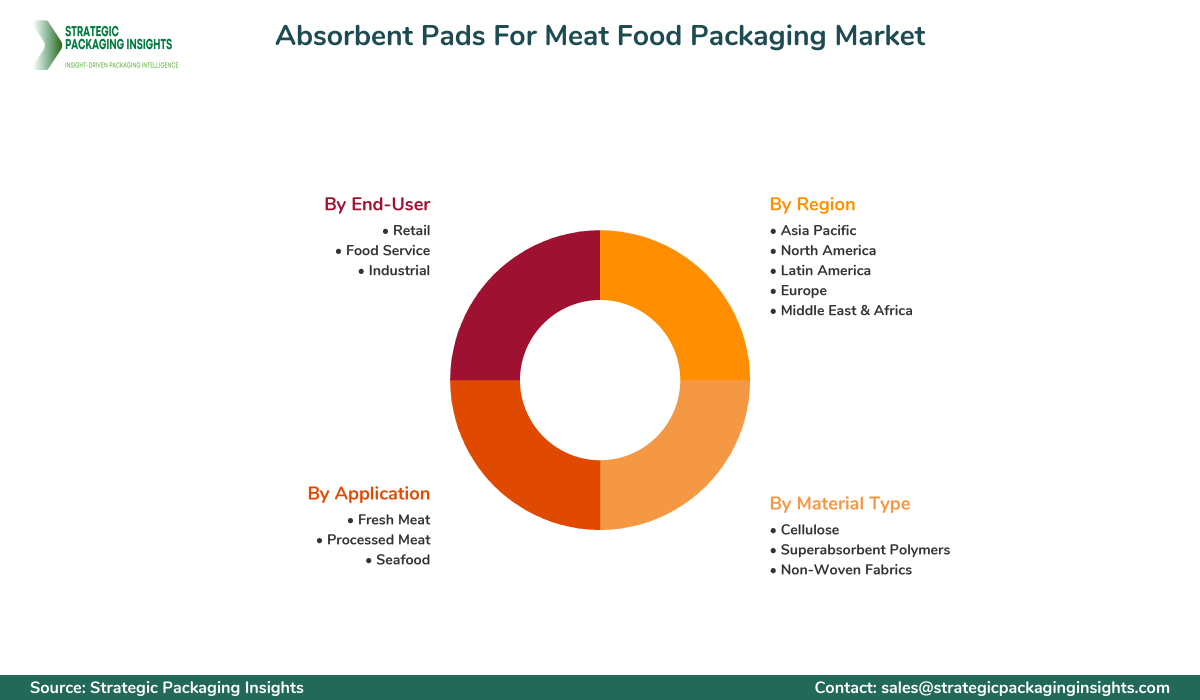

Absorbent Pads For Meat Food Packaging Market Segments - by Material Type (Cellulose, Superabsorbent Polymers, Non-Woven Fabrics), Application (Fresh Meat, Processed Meat, Seafood), End-User (Retail, Food Service, Industrial), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Absorbent Pads For Meat Food Packaging Market Outlook

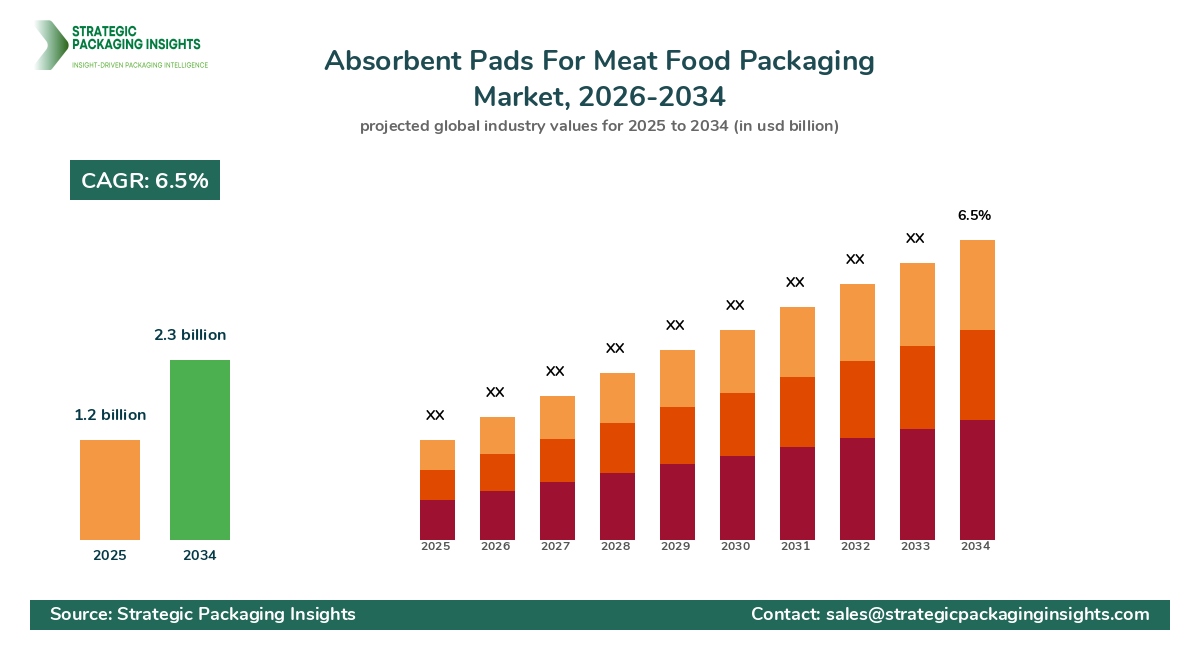

The absorbent pads for meat food packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.3 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025-2033. This market is driven by the increasing demand for fresh and processed meat products, which necessitates effective packaging solutions to maintain product quality and extend shelf life. The rise in consumer awareness regarding food safety and hygiene has further propelled the demand for absorbent pads, as they help in preventing contamination and spoilage by absorbing excess fluids. Additionally, the growth of the retail and food service sectors, coupled with advancements in packaging technologies, is expected to fuel market expansion.

However, the market faces certain challenges, such as the high cost of raw materials used in the production of absorbent pads, which can impact pricing strategies and profit margins. Regulatory restrictions related to food packaging materials and environmental concerns regarding the disposal of non-biodegradable pads also pose significant restraints. Despite these challenges, the market holds substantial growth potential, driven by innovations in biodegradable and eco-friendly absorbent pad materials, which align with the global shift towards Sustainable Packaging solutions. The increasing adoption of these eco-friendly alternatives is expected to open new avenues for market players, enhancing their competitive edge and market share.

Report Scope

| Attributes | Details |

| Report Title | Absorbent Pads For Meat Food Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 156 |

| Material Type | Cellulose, Superabsorbent Polymers, Non-Woven Fabrics |

| Application | Fresh Meat, Processed Meat, Seafood |

| End-User | Retail, Food Service, Industrial |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The absorbent pads for meat food packaging market presents numerous opportunities for growth, primarily driven by the rising demand for convenience foods and ready-to-eat meat products. As consumers increasingly seek quick and easy meal solutions, the need for effective packaging that ensures product freshness and safety becomes paramount. This trend is particularly evident in urban areas, where busy lifestyles and higher disposable incomes drive the consumption of packaged meat products. Additionally, the expansion of e-commerce platforms and online grocery shopping has created a significant demand for reliable packaging solutions that can withstand the rigors of transportation and delivery, further boosting the market for absorbent pads.

Another opportunity lies in the development of innovative and sustainable absorbent pad materials. With growing environmental concerns and stringent regulations on plastic waste, there is a heightened focus on biodegradable and compostable packaging solutions. Companies investing in research and development to create eco-friendly absorbent pads are likely to gain a competitive advantage, as consumers and retailers increasingly prioritize sustainability. Furthermore, the integration of smart packaging technologies, such as moisture indicators and antimicrobial properties, offers additional growth prospects by enhancing product safety and extending shelf life.

Despite the promising opportunities, the market faces certain threats that could hinder its growth. One of the primary challenges is the volatility in raw material prices, which can significantly impact production costs and profit margins. Additionally, the stringent regulatory landscape governing food packaging materials poses compliance challenges for manufacturers, requiring continuous investment in quality assurance and testing. The presence of alternative packaging solutions, such as Vacuum Packaging and Modified Atmosphere packaging, also presents a competitive threat, as these methods offer similar benefits in terms of product preservation and shelf life extension.

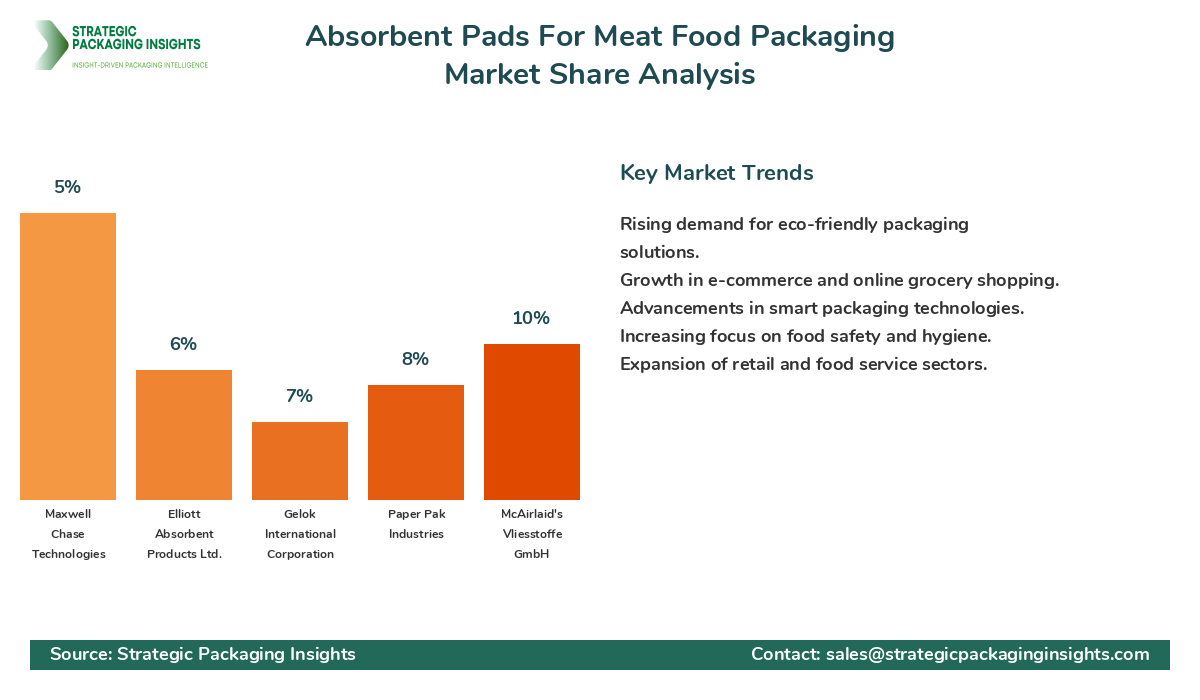

The competitive landscape of the absorbent pads for meat food packaging market is characterized by the presence of several key players, each striving to enhance their market position through strategic initiatives such as mergers and acquisitions, product innovations, and geographical expansion. The market is moderately fragmented, with a mix of established companies and emerging players vying for market share. Leading companies are focusing on expanding their product portfolios and investing in research and development to introduce innovative and sustainable packaging solutions that cater to evolving consumer preferences.

Among the major players in the market, Novipax holds a significant share, leveraging its extensive product range and strong distribution network to maintain its competitive edge. The company is known for its high-quality absorbent pads that cater to various meat packaging needs, including fresh and processed meats. Similarly, Sealed Air Corporation is a prominent player, renowned for its Cryovac brand, which offers Advanced Packaging solutions designed to enhance food safety and extend shelf life. The company's focus on sustainability and innovation has helped it secure a substantial market share.

Other notable companies in the market include McAirlaid's Vliesstoffe GmbH, which specializes in airlaid nonwoven materials used in absorbent pads, and Paper Pak Industries, known for its eco-friendly absorbent pad solutions. These companies are actively investing in research and development to create biodegradable and compostable products that align with the growing demand for sustainable packaging. Additionally, companies like Gelok International Corporation and Elliott Absorbent Products Ltd. are focusing on expanding their global presence through strategic partnerships and collaborations with retailers and food service providers.

Overall, the market share distribution is influenced by factors such as product innovation, pricing strategies, and distribution networks. Companies that can effectively address consumer demands for sustainability and convenience are likely to gain a competitive advantage, while those that fail to adapt to changing market dynamics may face challenges in maintaining their market position. The ongoing trend towards eco-friendly packaging solutions is expected to reshape the competitive landscape, with companies that prioritize sustainability poised to capture a larger share of the market.

Key Highlights Absorbent Pads For Meat Food Packaging Market

- Increasing demand for fresh and processed meat products is driving market growth.

- Advancements in packaging technologies are enhancing product safety and shelf life.

- Eco-friendly and biodegradable absorbent pads are gaining traction among consumers.

- Expansion of e-commerce platforms is boosting demand for reliable packaging solutions.

- Volatility in raw material prices poses a challenge for manufacturers.

- Stringent regulations on food packaging materials require continuous compliance efforts.

- Integration of smart packaging technologies offers additional growth prospects.

- Presence of alternative packaging solutions presents a competitive threat.

- Companies are focusing on product innovation and geographical expansion to enhance market share.

- Sustainability is a key focus area for market players, driving the development of eco-friendly products.

Premium Insights - Key Investment Analysis

The absorbent pads for meat food packaging market is witnessing significant investment activity, driven by the growing demand for innovative and sustainable packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and biodegradable absorbent pads, recognizing the potential for high returns in this rapidly evolving market. The shift towards sustainable packaging is not only driven by consumer preferences but also by regulatory mandates aimed at reducing plastic waste and promoting environmental conservation.

Investment valuations in the market are influenced by factors such as product innovation, market penetration, and growth potential. Companies that demonstrate a strong commitment to sustainability and have a robust pipeline of innovative products are attracting significant investor interest. Mergers and acquisitions are also prevalent, as established players seek to expand their product portfolios and enhance their market presence through strategic partnerships and collaborations. These transactions are often driven by the need to access new technologies, expand geographical reach, and tap into emerging markets.

Emerging investment themes in the market include the development of smart packaging solutions that incorporate features such as moisture indicators and antimicrobial properties. These innovations not only enhance product safety but also offer additional value to consumers, making them attractive investment opportunities. Additionally, the growing demand for convenience foods and ready-to-eat meat products is driving investment in packaging solutions that ensure product freshness and safety during transportation and storage.

Risk factors associated with investments in the absorbent pads for meat food packaging market include the volatility in raw material prices, which can impact production costs and profit margins. Regulatory compliance is another critical consideration, as companies must adhere to stringent standards governing food packaging materials. Despite these challenges, the market offers substantial growth potential, particularly for companies that prioritize sustainability and innovation. Investors are increasingly recognizing the strategic rationale behind investing in eco-friendly packaging solutions, as they align with global trends towards environmental conservation and sustainable development.

Absorbent Pads For Meat Food Packaging Market Segments Insights

Material Type Analysis

The material type segment of the absorbent pads for meat food packaging market is primarily categorized into cellulose, superabsorbent polymers, and non-woven fabrics. Cellulose-based absorbent pads are widely used due to their natural absorbency and biodegradability, making them an eco-friendly option for meat packaging. These pads are particularly popular among environmentally conscious consumers and retailers seeking sustainable packaging solutions. The demand for cellulose-based pads is expected to grow as more companies focus on reducing their environmental footprint and complying with regulatory mandates on plastic waste reduction.

Superabsorbent polymers (SAPs) are another key material type used in absorbent pads, known for their high absorbency and ability to retain large volumes of liquid. These polymers are commonly used in packaging solutions for fresh and processed meats, where effective moisture control is critical to maintaining product quality and extending shelf life. The market for SAP-based absorbent pads is driven by the increasing demand for high-performance packaging solutions that offer superior moisture management and product protection.

Non-woven fabrics are also gaining traction in the market, offering a versatile and cost-effective solution for absorbent pads. These fabrics are often used in combination with other materials to enhance absorbency and durability, making them suitable for a wide range of meat packaging applications. The growing demand for non-woven fabric-based pads is attributed to their lightweight nature, ease of customization, and ability to incorporate additional features such as antimicrobial properties and moisture indicators. As the market continues to evolve, companies are investing in research and development to create innovative non-woven fabric solutions that meet the diverse needs of consumers and retailers.

Application Analysis

The application segment of the absorbent pads for meat food packaging market is divided into fresh meat, processed meat, and seafood. Fresh meat packaging is a significant application area, driven by the need to maintain product freshness and prevent contamination during storage and transportation. Absorbent pads play a crucial role in this segment by effectively managing moisture and preventing the growth of harmful bacteria, thereby ensuring food safety and extending shelf life. The demand for absorbent pads in fresh meat packaging is expected to grow as consumers increasingly prioritize food safety and hygiene.

Processed meat packaging is another key application area, where absorbent pads are used to manage excess fluids and maintain product quality. The growing popularity of ready-to-eat and convenience meat products is driving the demand for effective packaging solutions that can withstand the rigors of transportation and storage. Absorbent pads are particularly important in this segment, as they help prevent spoilage and maintain the visual appeal of processed meat products, which is a critical factor influencing consumer purchasing decisions.

Seafood packaging is also a significant application area for absorbent pads, as seafood products are highly perishable and require effective moisture management to maintain quality and safety. The use of absorbent pads in seafood packaging helps prevent the accumulation of excess fluids, which can lead to spoilage and contamination. The demand for absorbent pads in this segment is driven by the increasing consumption of seafood products and the growing focus on food safety and hygiene. As the market continues to expand, companies are investing in innovative packaging solutions that cater to the unique needs of the seafood industry, offering enhanced moisture management and product protection.

End-User Analysis

The end-user segment of the absorbent pads for meat food packaging market is categorized into retail, food service, and industrial. The retail sector is a major end-user of absorbent pads, driven by the increasing demand for packaged meat products in supermarkets, hypermarkets, and convenience stores. Retailers are increasingly focusing on offering high-quality and safe meat products to consumers, necessitating the use of effective packaging solutions that ensure product freshness and safety. The demand for absorbent pads in the retail sector is expected to grow as consumers continue to prioritize convenience and food safety.

The food service sector is another significant end-user of absorbent pads, with restaurants, catering services, and food delivery companies relying on effective packaging solutions to maintain the quality and safety of meat products. The growing popularity of food delivery services and the increasing demand for ready-to-eat meals are driving the need for reliable packaging solutions that can withstand the rigors of transportation and delivery. Absorbent pads play a crucial role in this sector by preventing leakage and contamination, ensuring that meat products reach consumers in optimal condition.

The industrial sector, which includes meat processing plants and packaging companies, is also a key end-user of absorbent pads. These companies require high-performance packaging solutions that can effectively manage moisture and prevent spoilage during processing and storage. The demand for absorbent pads in the industrial sector is driven by the need to maintain product quality and safety, as well as comply with stringent regulatory standards governing food packaging materials. As the market continues to evolve, companies are investing in advanced packaging technologies that cater to the specific needs of the industrial sector, offering enhanced moisture management and product protection.

Market Share Analysis

The market share distribution of key players in the absorbent pads for meat food packaging market is influenced by factors such as product innovation, pricing strategies, and distribution networks. Leading companies like Novipax and Sealed Air Corporation are at the forefront, leveraging their extensive product portfolios and strong distribution channels to maintain a competitive edge. These companies are focusing on expanding their market presence through strategic partnerships and collaborations, as well as investing in research and development to introduce innovative and sustainable packaging solutions.

Companies that prioritize sustainability and eco-friendly packaging solutions are gaining a competitive advantage, as consumers and retailers increasingly demand environmentally responsible products. The ongoing trend towards biodegradable and compostable absorbent pads is reshaping the competitive landscape, with companies that can effectively address these demands poised to capture a larger share of the market. Additionally, the integration of smart packaging technologies, such as moisture indicators and antimicrobial properties, is offering new growth opportunities for market players, enhancing their competitive positioning and market share.

Top Countries Insights in Absorbent Pads For Meat Food Packaging

The United States is a leading market for absorbent pads for meat food packaging, with a market size of $400 million and a CAGR of 5%. The growth in this market is driven by the increasing demand for packaged meat products and the expansion of the retail and food service sectors. The presence of major market players and advancements in packaging technologies further contribute to the market's growth. However, regulatory challenges related to food packaging materials and environmental concerns regarding plastic waste pose significant challenges.

Germany is another key market, with a market size of $250 million and a CAGR of 4%. The demand for absorbent pads in Germany is driven by the growing focus on food safety and hygiene, as well as the increasing consumption of convenience foods. The country's stringent regulations on food packaging materials and the emphasis on sustainability are driving the demand for eco-friendly absorbent pads. Companies in Germany are investing in research and development to create innovative and sustainable packaging solutions that meet regulatory standards and consumer preferences.

China is a rapidly growing market for absorbent pads, with a market size of $300 million and a CAGR of 7%. The growth in this market is driven by the increasing consumption of meat products and the expansion of the retail and food service sectors. The rising demand for convenience foods and the growing focus on food safety and hygiene are further boosting the market for absorbent pads. However, the market faces challenges related to regulatory compliance and the availability of raw materials.

Brazil is an emerging market for absorbent pads, with a market size of $150 million and a CAGR of 6%. The growth in this market is driven by the increasing demand for packaged meat products and the expansion of the retail and food service sectors. The country's focus on food safety and hygiene, as well as the growing popularity of convenience foods, are driving the demand for absorbent pads. However, the market faces challenges related to regulatory compliance and the availability of raw materials.

India is a promising market for absorbent pads, with a market size of $200 million and a CAGR of 8%. The growth in this market is driven by the increasing consumption of meat products and the expansion of the retail and food service sectors. The rising demand for convenience foods and the growing focus on food safety and hygiene are further boosting the market for absorbent pads. However, the market faces challenges related to regulatory compliance and the availability of raw materials.

Absorbent Pads For Meat Food Packaging Market Segments

The Absorbent Pads For Meat Food Packaging market has been segmented on the basis of

Material Type

- Cellulose

- Superabsorbent Polymers

- Non-Woven Fabrics

Application

- Fresh Meat

- Processed Meat

- Seafood

End-User

- Retail

- Food Service

- Industrial

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the absorbent pads for meat food packaging market?

What challenges does the market face?

How are companies addressing sustainability in this market?

What role does innovation play in this market?

Which regions are experiencing the most growth in this market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.