- Home

- Food Packaging

- Aseptic Food Packaging Market Size, Future Growth and Forecast 2033

Aseptic Food Packaging Market Size, Future Growth and Forecast 2033

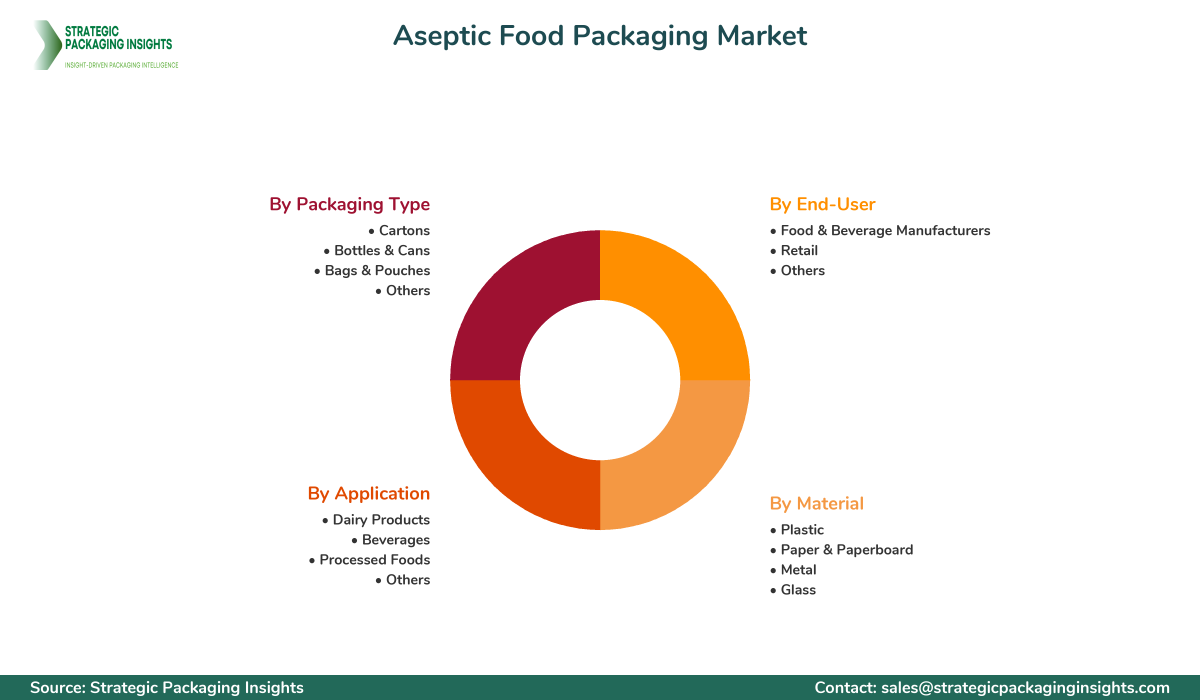

Aseptic Food Packaging Market Segments - by Material (Plastic, Paper & Paperboard, Metal, Glass), Application (Dairy Products, Beverages, Processed Foods, Others), Packaging Type (Cartons, Bottles & Cans, Bags & Pouches, Others), End-User (Food & Beverage Manufacturers, Retail, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Aseptic Food Packaging Market Outlook

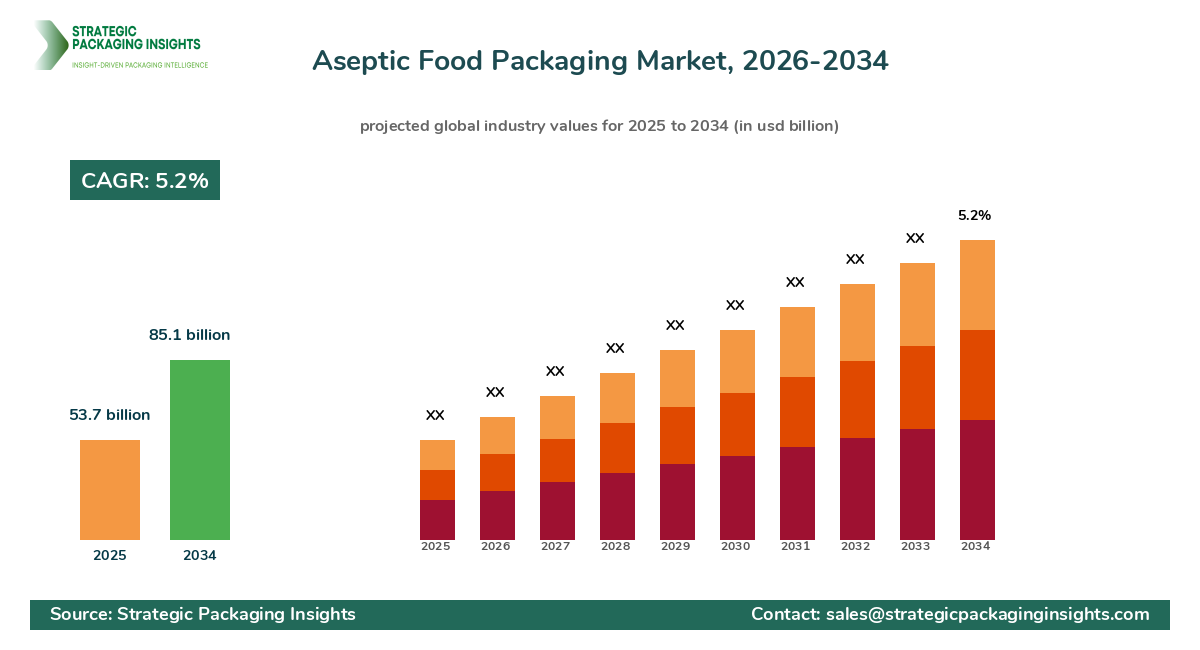

The aseptic food packaging market was valued at $53.7 billion in 2024 and is projected to reach $85.1 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025-2033. This market is driven by the increasing demand for longer shelf life of food products without the need for refrigeration, which is a significant advantage of aseptic packaging. The growing consumer preference for convenient and ready-to-eat food products is also propelling the market forward. Additionally, the rise in urbanization and the busy lifestyles of consumers are contributing to the increased demand for Aseptic Packaging Solutions, as they offer a practical and efficient way to store and transport food products.

Report Scope

| Attributes | Details |

| Report Title | Aseptic Food Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 155 |

| Material | Plastic, Paper & Paperboard, Metal, Glass |

| Application | Dairy Products, Beverages, Processed Foods, Others |

| Packaging Type | Cartons, Bottles & Cans, Bags & Pouches, Others |

| End-User | Food & Beverage Manufacturers, Retail, Others |

| Customization Available | Yes* |

Opportunities & Threats

One of the primary opportunities in the aseptic food packaging market is the increasing demand for sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging that reduces waste and minimizes environmental impact. This trend is encouraging manufacturers to innovate and develop packaging materials that are recyclable and biodegradable, which can significantly enhance their market position. Furthermore, the expansion of the food and beverage industry in emerging markets presents a lucrative opportunity for aseptic packaging providers to tap into new customer bases and expand their global footprint.

Another opportunity lies in the technological advancements in aseptic packaging processes. Innovations such as advanced sterilization techniques and improved filling technologies are enhancing the efficiency and effectiveness of aseptic packaging. These advancements not only improve the quality and safety of packaged food products but also reduce production costs, making aseptic packaging more accessible to a broader range of manufacturers. As a result, companies that invest in cutting-edge technologies are likely to gain a competitive edge in the market.

However, the aseptic food packaging market faces certain restrainers, such as the high initial investment required for setting up aseptic packaging facilities. The cost of advanced machinery and equipment can be a significant barrier for small and medium-sized enterprises (SMEs) looking to enter the market. Additionally, the complexity of the aseptic packaging process requires skilled labor and expertise, which can further increase operational costs. These factors may limit the adoption of aseptic packaging solutions, particularly among smaller players in the industry.

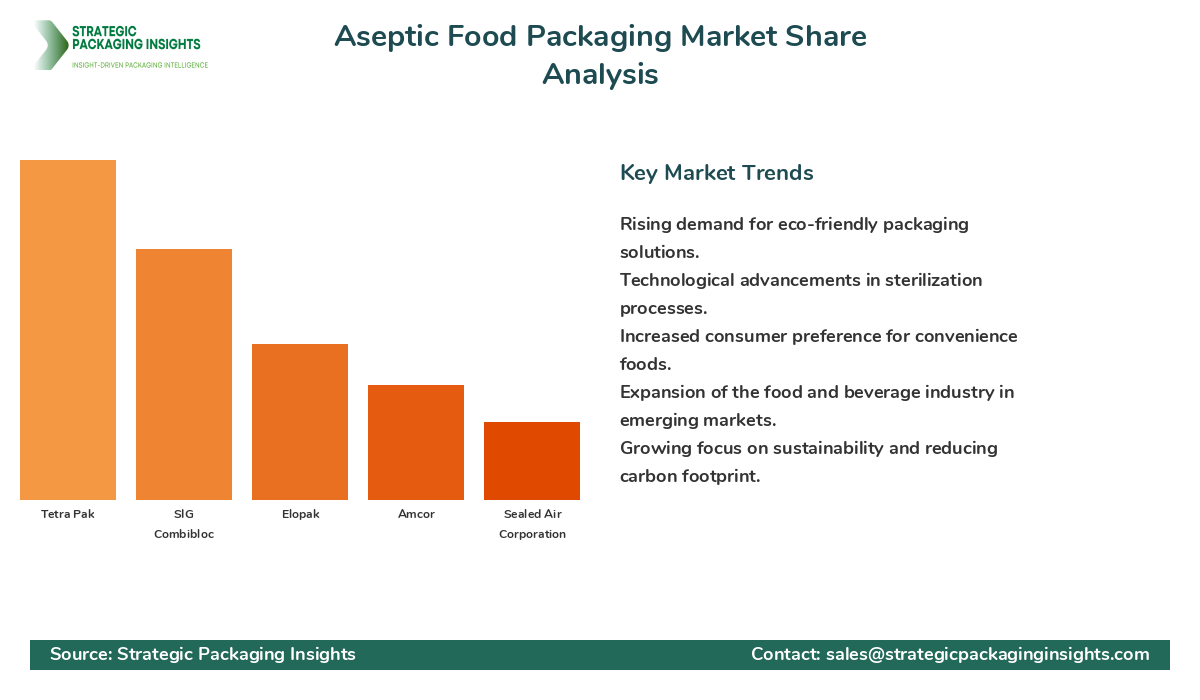

The competitive landscape of the aseptic food packaging market is characterized by the presence of several key players who are actively engaged in product innovation and strategic partnerships to strengthen their market position. Companies such as Tetra Pak, SIG Combibloc, and Elopak are leading the market with their extensive product portfolios and strong distribution networks. These companies are focusing on expanding their production capacities and enhancing their technological capabilities to meet the growing demand for aseptic packaging solutions.

Tetra Pak, for instance, holds a significant market share due to its comprehensive range of aseptic packaging solutions and its commitment to sustainability. The company has been at the forefront of developing eco-friendly packaging materials and has established a strong presence in both developed and emerging markets. Similarly, SIG Combibloc is known for its innovative packaging designs and efficient filling technologies, which have helped it capture a substantial share of the market.

Elopak, another major player, is recognized for its focus on renewable and Sustainable Packaging solutions. The company's emphasis on reducing carbon footprint and promoting circular economy principles has resonated well with environmentally conscious consumers, further solidifying its market position. Other notable companies in the market include Amcor, Sealed Air Corporation, and Greatview Aseptic Packaging, each of which has carved out a niche by offering specialized packaging solutions tailored to specific customer needs.

Amcor, for example, has leveraged its expertise in flexible and Rigid Packaging to offer a diverse range of aseptic packaging options. The company's strategic acquisitions and collaborations have enabled it to expand its product offerings and enhance its market reach. Sealed Air Corporation, on the other hand, is known for its innovative packaging technologies that ensure product safety and extend shelf life, making it a preferred choice for many food and beverage manufacturers.

Key Highlights Aseptic Food Packaging Market

- The aseptic food packaging market is projected to grow at a CAGR of 5.2% from 2025 to 2033.

- Increasing demand for longer shelf life and convenience in food products is driving market growth.

- Technological advancements in sterilization and filling processes are enhancing packaging efficiency.

- Eco-friendly and sustainable packaging solutions are gaining traction among consumers.

- High initial investment costs pose a challenge for small and medium-sized enterprises.

- Key players are focusing on product innovation and strategic partnerships to strengthen their market position.

- Emerging markets offer significant growth opportunities for aseptic packaging providers.

- Regulatory standards and food safety concerns are influencing packaging material choices.

- Consumer preference for ready-to-eat and on-the-go food products is boosting demand.

Premium Insights - Key Investment Analysis

The aseptic food packaging market is witnessing significant investment activity, driven by the growing demand for innovative and sustainable packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and technologically Advanced Packaging options. This trend is evident in the rising number of funding rounds and capital allocations towards startups and established players in the aseptic packaging space.

Merger and acquisition (M&A) activity is also on the rise, as larger companies seek to expand their product portfolios and enhance their market presence through strategic acquisitions. Recent deals have highlighted the strategic rationale behind such transactions, with companies aiming to leverage synergies, access new markets, and strengthen their competitive positioning. The focus on sustainability and innovation is a common theme in these investments, as companies strive to meet evolving consumer preferences and regulatory requirements.

Investment valuations in the aseptic food packaging market are being driven by the potential for high returns on investment (ROI) and the growing importance of sustainable packaging solutions. Investors are particularly interested in companies that demonstrate strong growth potential, innovative product offerings, and a commitment to environmental sustainability. As a result, sectors such as Biodegradable Packaging materials and advanced sterilization technologies are attracting significant investor interest.

Aseptic Food Packaging Market Segments Insights

Material Analysis

The material segment of the aseptic food packaging market is dominated by plastic, paper & Paperboard, metal, and glass. Plastic remains the most widely used material due to its versatility, durability, and cost-effectiveness. However, the growing environmental concerns associated with plastic waste are driving the demand for alternative materials such as paper & paperboard, which are biodegradable and recyclable. Metal and glass are also gaining traction, particularly in premium packaging applications where product integrity and shelf life are critical.

Within the plastic subsegment, innovations in biodegradable and compostable plastics are gaining momentum, as manufacturers seek to address environmental concerns and meet consumer demand for sustainable packaging solutions. The paper & paperboard subsegment is benefiting from advancements in barrier coatings and printing technologies, which enhance the functionality and aesthetic appeal of packaging. Metal and glass packaging are favored for their ability to preserve product quality and extend shelf life, making them ideal for high-value and sensitive food products.

Application Analysis

The application segment of the aseptic food packaging market includes dairy products, beverages, processed foods, and others. Dairy products represent a significant portion of the market, driven by the need for extended shelf life and preservation of nutritional value. Aseptic packaging is particularly beneficial for liquid dairy products, as it prevents contamination and spoilage, ensuring product safety and quality.

The beverage subsegment is experiencing robust growth, fueled by the increasing demand for ready-to-drink beverages and health-conscious products. Aseptic packaging offers a convenient and efficient solution for packaging juices, teas, and other non-carbonated beverages, as it maintains product freshness and flavor without the need for preservatives. Processed foods, including soups, sauces, and ready meals, are also benefiting from aseptic packaging, as it provides a practical and cost-effective way to extend shelf life and reduce food waste.

Packaging Type Analysis

The packaging type segment of the aseptic food packaging market comprises cartons, bottles & cans, bags & pouches, and others. Cartons are the most popular packaging type, owing to their lightweight, cost-effectiveness, and ease of storage and transportation. They are widely used for packaging liquid products such as milk, juices, and soups, as they offer excellent barrier properties and protection against light and oxygen.

Bottles & cans are favored for their durability and ability to preserve product quality, making them suitable for a wide range of food and beverage applications. Bags & pouches are gaining popularity due to their flexibility, convenience, and reduced material usage, which aligns with the growing demand for sustainable packaging solutions. The versatility of bags & pouches makes them ideal for packaging a variety of products, from snacks and cereals to sauces and condiments.

End-User Analysis

The end-user segment of the aseptic food packaging market includes food & beverage manufacturers, retail, and others. Food & beverage manufacturers are the primary users of aseptic packaging, as it enables them to extend the shelf life of their products and maintain quality and safety standards. The growing demand for convenience foods and ready-to-drink beverages is driving manufacturers to adopt aseptic packaging solutions to meet consumer expectations.

The retail sector is also a significant end-user of aseptic packaging, as it offers a practical and efficient way to store and display food products. Retailers benefit from the extended shelf life and reduced spoilage associated with aseptic packaging, which helps minimize inventory losses and enhance profitability. Other end-users, such as foodservice providers and institutional buyers, are increasingly adopting aseptic packaging to ensure product safety and quality in their operations.

Market Share Analysis

The market share distribution of key players in the aseptic food packaging market is influenced by factors such as product innovation, technological advancements, and strategic partnerships. Companies that lead the market, such as Tetra Pak, SIG Combibloc, and Elopak, have established strong brand recognition and customer loyalty through their commitment to quality and sustainability. These companies are continuously investing in research and development to enhance their product offerings and maintain their competitive edge.

Smaller players in the market are focusing on niche segments and specialized packaging solutions to differentiate themselves and capture market share. The competitive positioning of companies is also affected by their ability to adapt to changing consumer preferences and regulatory requirements. As the market evolves, companies that can effectively leverage their strengths and capitalize on emerging opportunities are likely to gain a larger share of the market.

Top Countries Insights in Aseptic Food Packaging

The United States is a leading market for aseptic food packaging, with a market size of $12.5 billion and a CAGR of 6%. The country's strong demand for convenience foods and beverages, coupled with advancements in packaging technologies, is driving market growth. Regulatory standards and consumer preferences for sustainable packaging are also influencing the market dynamics.

China is another significant market, with a market size of $10.3 billion and a CAGR of 8%. The rapid urbanization and increasing disposable incomes in the country are fueling the demand for packaged food products. The government's focus on food safety and quality standards is further boosting the adoption of aseptic packaging solutions.

Germany, with a market size of $7.8 billion and a CAGR of 5%, is a key player in the European aseptic food packaging market. The country's emphasis on sustainability and innovation is driving the demand for eco-friendly packaging solutions. The presence of leading packaging companies and a strong focus on research and development are contributing to market growth.

India, with a market size of $6.2 billion and a CAGR of 9%, is experiencing rapid growth in the aseptic food packaging market. The increasing demand for processed and packaged foods, along with the expansion of the food and beverage industry, is driving market growth. Government initiatives to promote food safety and quality are also supporting the adoption of aseptic packaging solutions.

Brazil, with a market size of $5.4 billion and a CAGR of 7%, is a prominent market in Latin America. The country's growing middle class and increasing consumer awareness of food safety and quality are driving the demand for aseptic packaging. The expansion of the food and beverage industry and the focus on sustainability are also contributing to market growth.

Aseptic Food Packaging Market Segments

The Aseptic Food Packaging market has been segmented on the basis of

Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

Application

- Dairy Products

- Beverages

- Processed Foods

- Others

Packaging Type

- Cartons

- Bottles & Cans

- Bags & Pouches

- Others

End-User

- Food & Beverage Manufacturers

- Retail

- Others

Primary Interview Insights

What are the key drivers of growth in the aseptic food packaging market?

What challenges does the aseptic food packaging market face?

How is sustainability influencing the aseptic food packaging market?

Which regions are experiencing the fastest growth in the aseptic food packaging market?

What role do technological advancements play in the aseptic food packaging market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.