- Home

- Food Packaging

- Aseptic Packaging For Meat Market Size, Future Growth and Forecast 2033

Aseptic Packaging For Meat Market Size, Future Growth and Forecast 2033

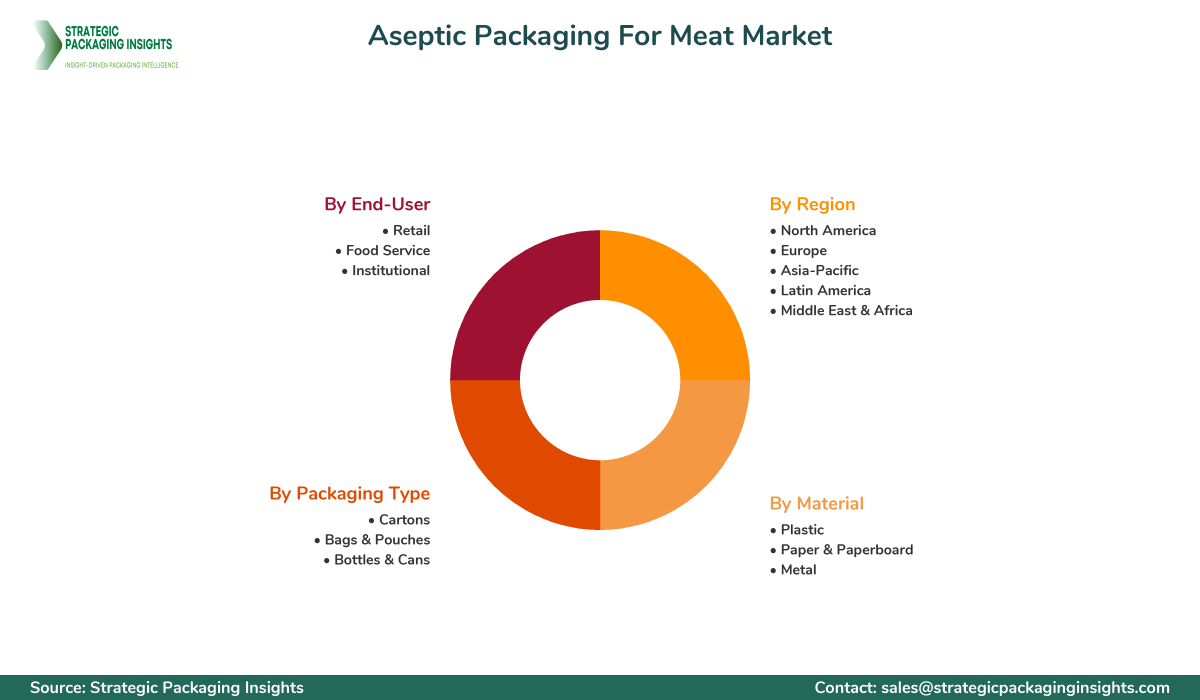

Aseptic Packaging For Meat Market Segments - by Material (Plastic, Paper & Paperboard, Metal), Packaging Type (Cartons, Bags & Pouches, Bottles & Cans), End-User (Retail, Food Service, Institutional), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Aseptic Packaging For Meat Market Outlook

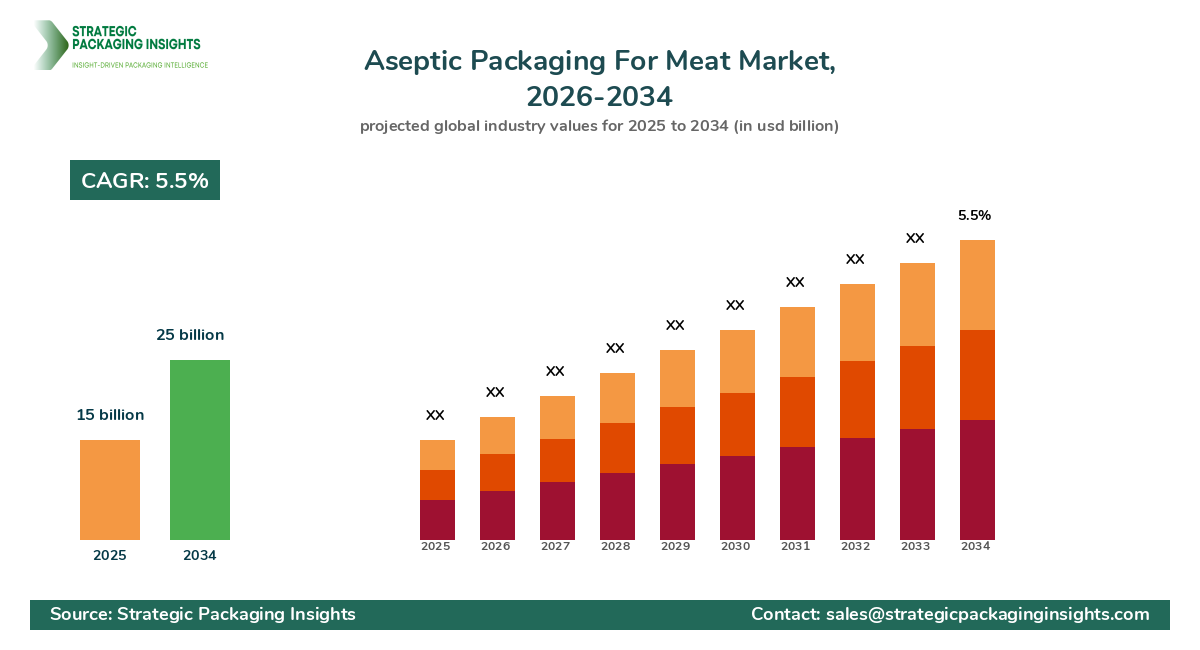

The Aseptic Packaging for meat market was valued at $15 billion in 2024 and is projected to reach $25 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033. This market is experiencing significant growth due to the increasing demand for longer shelf life and the rising consumption of meat products globally. The aseptic packaging process, which involves sterilizing the packaging material and the product separately before filling, ensures that the meat remains fresh without the need for refrigeration. This is particularly beneficial in regions with limited cold chain infrastructure. The market is also driven by the growing awareness of food safety and hygiene, as aseptic packaging minimizes the risk of contamination. Additionally, the convenience offered by aseptic packaging, such as easy storage and transportation, further boosts its adoption in the meat industry.

However, the market faces challenges such as the high initial investment required for aseptic packaging equipment and the complexity of the packaging process. Regulatory constraints related to food packaging materials and environmental concerns regarding the disposal of packaging waste also pose significant hurdles. Despite these challenges, the market holds immense growth potential, driven by technological advancements in packaging materials and processes. Innovations such as biodegradable and recyclable Aseptic Packaging Solutions are expected to create new opportunities for market players. Furthermore, the increasing demand for ready-to-eat and processed meat products is likely to fuel the growth of the aseptic packaging for meat market in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Aseptic Packaging For Meat Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 146 |

| Material | Plastic, Paper & Paperboard, Metal |

| Packaging Type | Cartons, Bags & Pouches, Bottles & Cans |

| End-User | Retail, Food Service, Institutional |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Key Highlights Aseptic Packaging For Meat Market

- Growing demand for extended shelf life of meat products.

- Increasing adoption of aseptic packaging in emerging markets.

- Technological advancements in packaging materials and processes.

- Rising consumer awareness about food safety and hygiene.

- Challenges related to high initial investment and regulatory constraints.

- Emergence of biodegradable and recyclable packaging solutions.

- Expansion of the ready-to-eat and processed meat market.

- Impact of environmental concerns on packaging waste management.

- Strategic partnerships and collaborations among key players.

- Focus on innovation to enhance product differentiation.

Competitive Intelligence

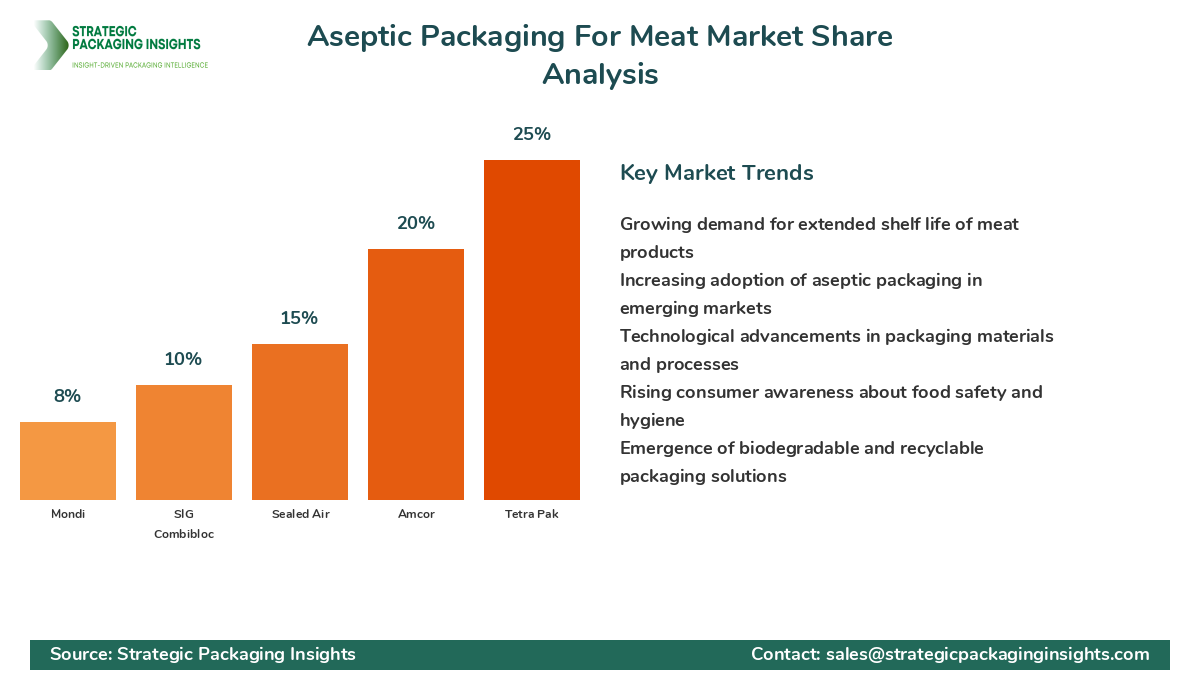

The aseptic packaging for meat market is highly competitive, with several key players striving to gain a larger market share. Tetra Pak International S.A., a leader in the aseptic packaging industry, continues to dominate the market with its extensive product portfolio and strong global presence. The company focuses on innovation and sustainability, offering eco-friendly packaging solutions that cater to the growing demand for sustainable practices. Amcor Limited, another major player, emphasizes its commitment to R&D and has introduced several Advanced Packaging solutions that enhance product safety and shelf life. The company's strategic acquisitions and partnerships have further strengthened its market position.

Sealed Air Corporation is known for its innovative packaging technologies and has a significant presence in the aseptic packaging for meat market. The company's focus on customer-centric solutions and its extensive distribution network have contributed to its success. SIG Combibloc Group AG, with its strong emphasis on sustainability and innovation, has gained a competitive edge by offering unique packaging solutions that meet the evolving needs of the meat industry. Other notable players include Mondi Group, DS Smith Plc, and Smurfit Kappa Group, each leveraging their strengths in packaging design and material innovation to capture market share. While some companies are gaining ground through strategic expansions and product launches, others face challenges in maintaining their market position due to intense competition and changing consumer preferences.

Regional Market Intelligence of Aseptic Packaging For Meat

In North America, the aseptic packaging for meat market is valued at $4 billion and is expected to grow steadily due to the high demand for processed and packaged meat products. The region's well-established cold chain infrastructure and stringent food safety regulations drive the adoption of aseptic packaging. In Europe, the market is valued at $3.5 billion, with a focus on sustainability and eco-friendly packaging solutions. The region's strong emphasis on reducing food waste and enhancing food safety standards contributes to market growth.

Asia-Pacific is the fastest-growing region, with a market size of $5 billion, driven by the increasing consumption of meat products and the rising demand for convenient packaging solutions. The region's expanding middle-class population and urbanization trends further boost market growth. In Latin America, the market is valued at $1.5 billion, with growth driven by the increasing demand for packaged meat products and the expansion of the retail sector. The Middle East & Africa region, with a market size of $1 billion, is witnessing growth due to the rising awareness of food safety and the increasing adoption of modern packaging technologies.

Top Countries Insights in Aseptic Packaging For Meat

The United States, with a market size of $3 billion and a CAGR of 4%, is a leading country in the aseptic packaging for meat market. The country's strong focus on food safety and the growing demand for processed meat products drive market growth. In China, the market is valued at $2.5 billion, with a CAGR of 6%, driven by the increasing consumption of meat products and the rising demand for convenient packaging solutions. Germany, with a market size of $1.8 billion and a CAGR of 5%, emphasizes sustainability and eco-friendly packaging solutions, contributing to market growth.

Brazil, with a market size of $1.2 billion and a CAGR of 5%, is experiencing growth due to the increasing demand for packaged meat products and the expansion of the retail sector. In India, the market is valued at $1 billion, with a CAGR of 7%, driven by the rising awareness of food safety and the increasing adoption of modern packaging technologies. The country's expanding middle-class population and urbanization trends further boost market growth.

Aseptic Packaging For Meat Market Segments Insights

Material Analysis

The material segment in the aseptic packaging for meat market is primarily categorized into plastic, paper & Paperboard, and metal. Plastic remains the dominant material due to its versatility, durability, and cost-effectiveness. The demand for Plastic Aseptic packaging is driven by its ability to provide a strong barrier against moisture and oxygen, ensuring the freshness and safety of meat products. However, environmental concerns regarding plastic waste have led to increased interest in biodegradable and recyclable alternatives. Paper & paperboard are gaining traction as eco-friendly options, with advancements in coating technologies enhancing their barrier properties. Metal, though less commonly used, offers excellent protection and is favored for its recyclability and robustness.

In recent years, there has been a significant shift towards sustainable materials, with companies investing in R&D to develop innovative solutions that meet environmental standards. The growing consumer preference for eco-friendly packaging has prompted manufacturers to explore new materials and technologies. This trend is expected to continue, with sustainable materials playing a crucial role in shaping the future of the aseptic packaging for meat market. As regulatory pressures increase and consumer awareness grows, the demand for Sustainable Packaging solutions is likely to drive innovation and competition in the material segment.

Packaging Type Analysis

The packaging type segment includes cartons, bags & pouches, and bottles & cans. Cartons are widely used due to their convenience, lightweight nature, and ability to preserve the quality of meat products. The demand for cartons is driven by their recyclability and the increasing focus on reducing packaging waste. Bags & pouches are gaining popularity for their flexibility, ease of use, and cost-effectiveness. They offer excellent barrier properties and are ideal for vacuum-sealed packaging, which extends the shelf life of meat products.

Bottles & cans, though less common in the meat industry, are used for specific products that require additional protection and durability. The choice of packaging type is influenced by factors such as product type, shelf life requirements, and consumer preferences. As the market evolves, manufacturers are exploring innovative packaging designs and technologies to enhance product differentiation and meet the changing needs of consumers. The trend towards convenience and sustainability is expected to drive the adoption of new packaging types in the aseptic packaging for meat market.

End-User Analysis

The end-user segment of the aseptic packaging for meat market is divided into retail, food service, and institutional sectors. The retail sector is the largest end-user, driven by the increasing demand for packaged meat products in supermarkets and hypermarkets. The convenience offered by aseptic packaging, such as extended shelf life and easy storage, makes it an attractive option for retailers. The food service sector, including restaurants and catering services, is also a significant end-user, with the growing trend of ready-to-eat and processed meat products driving demand.

The institutional sector, comprising hospitals, schools, and other large-scale establishments, is witnessing growth due to the increasing focus on food safety and hygiene. Aseptic packaging ensures that meat products remain fresh and safe for consumption, making it a preferred choice for institutional buyers. As consumer preferences shift towards convenience and quality, the demand for aseptic packaging in the end-user segment is expected to grow, with manufacturers focusing on developing tailored solutions to meet the specific needs of each sector.

Regional Analysis

The regional analysis of the aseptic packaging for meat market highlights significant differences in market dynamics and growth patterns across various regions. North America, with its well-established cold chain infrastructure and stringent food safety regulations, is a mature market with steady growth. The region's focus on innovation and sustainability drives the adoption of advanced packaging solutions. Europe, with its emphasis on reducing food waste and enhancing food safety standards, is a key market for eco-friendly packaging solutions.

Asia-Pacific is the fastest-growing region, driven by the increasing consumption of meat products and the rising demand for convenient packaging solutions. The region's expanding middle-class population and urbanization trends further boost market growth. Latin America and the Middle East & Africa are emerging markets, with growth driven by the increasing demand for packaged meat products and the expansion of the retail sector. As the market evolves, regional differences in consumer preferences, regulatory frameworks, and economic conditions will continue to shape the growth and development of the aseptic packaging for meat market.

The market share distribution in the aseptic packaging for meat market is characterized by the dominance of a few key players, with Tetra Pak International S.A. leading the market due to its extensive product portfolio and strong global presence. The company's focus on innovation and sustainability has enabled it to capture a significant share of the market. Amcor Limited and Sealed Air Corporation are also major players, leveraging their strengths in R&D and customer-centric solutions to gain a competitive edge. While some companies are gaining market share through strategic expansions and product launches, others face challenges in maintaining their position due to intense competition and changing consumer preferences. The market share distribution affects pricing strategies, innovation efforts, and partnerships, with companies striving to differentiate themselves through unique offerings and value-added services.

Aseptic Packaging For Meat Market Segments

The Aseptic Packaging For Meat market has been segmented on the basis of

Material

- Plastic

- Paper & Paperboard

- Metal

Packaging Type

- Cartons

- Bags & Pouches

- Bottles & Cans

End-User

- Retail

- Food Service

- Institutional

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers for the aseptic packaging for meat market?

What challenges does the aseptic packaging for meat market face?

How is the market expected to evolve in the coming years?

Which regions are expected to see the most growth?

What role does sustainability play in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.