- Home

- Packaging Products

- End Of Line Packaging Market Size, Future Growth and Forecast 2033

End Of Line Packaging Market Size, Future Growth and Forecast 2033

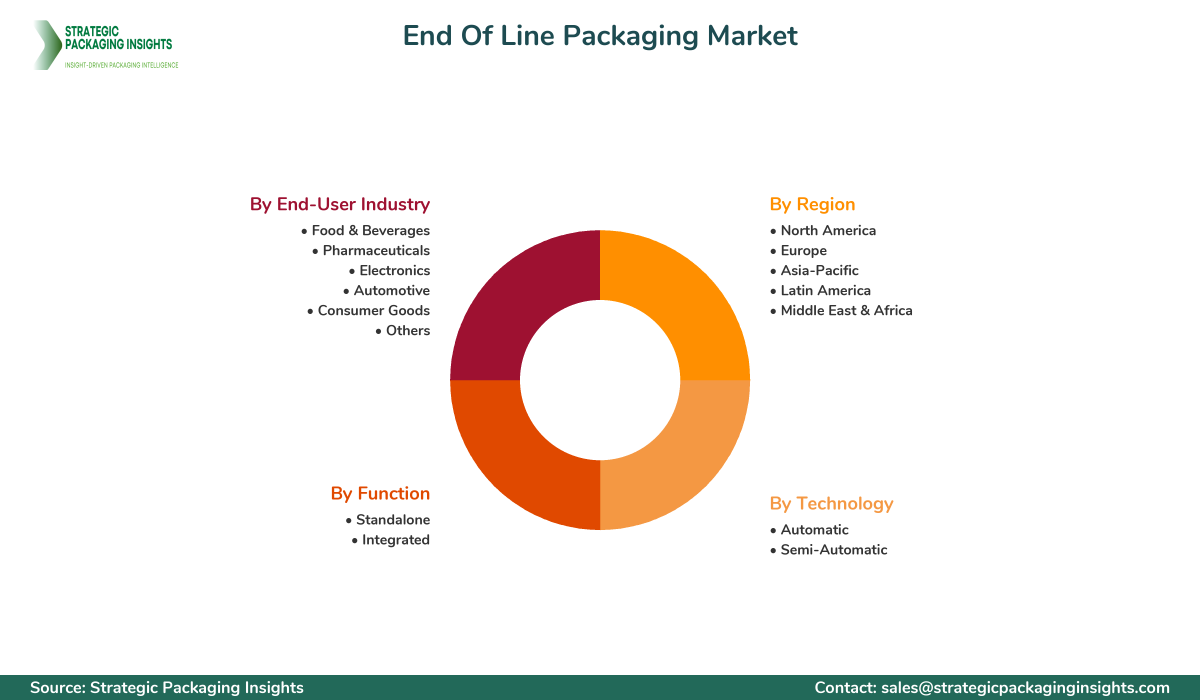

End Of Line Packaging Market Segments - by Technology (Automatic, Semi-Automatic), Function (Standalone, Integrated), End-User Industry (Food & Beverages, Pharmaceuticals, Electronics, Automotive, Consumer Goods, and Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

End Of Line Packaging Market Outlook

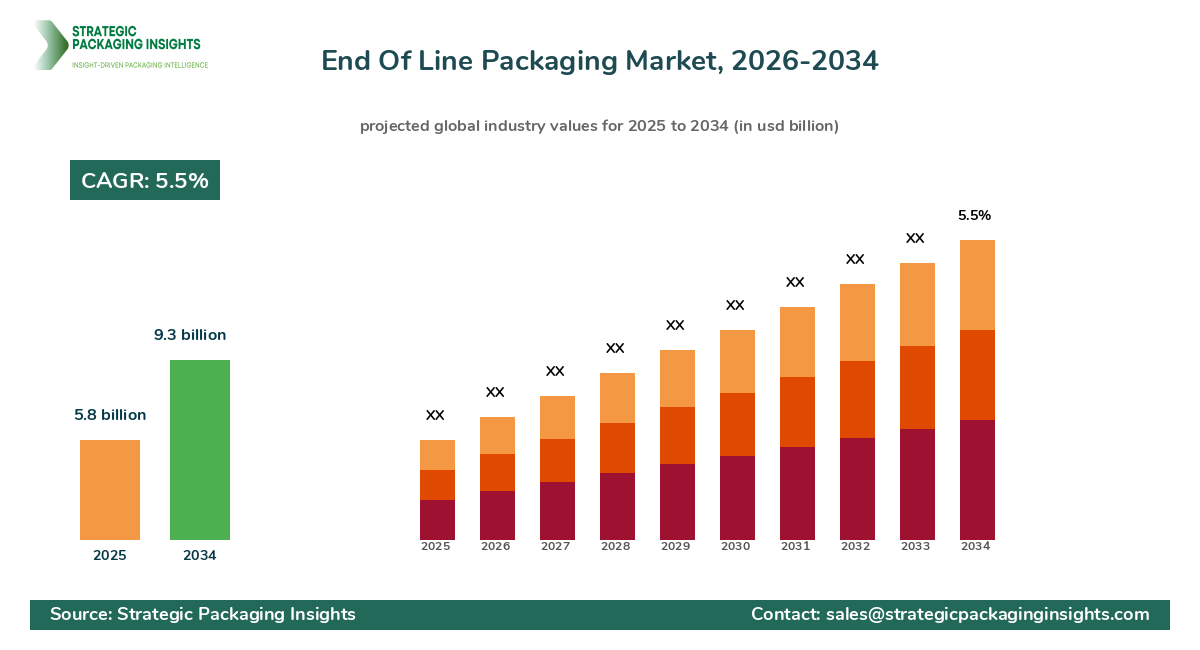

The End Of Line Packaging market was valued at $5.8 billion in 2024 and is projected to reach $9.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033. This market is witnessing significant growth due to the increasing demand for automation in packaging processes across various industries. The need for efficient and cost-effective packaging solutions is driving the adoption of end-of-line packaging systems. These systems help in reducing labor costs, improving packaging quality, and increasing production efficiency. The rise in e-commerce and the growing demand for packaged goods are further propelling the market growth. Additionally, advancements in technology, such as the integration of IoT and AI in packaging systems, are expected to create new opportunities for market expansion.

Report Scope

| Attributes | Details |

| Report Title | End Of Line Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 238 |

| Technology | Automatic, Semi-Automatic |

| Function | Standalone, Integrated |

| End-User Industry | Food & Beverages, Pharmaceuticals, Electronics, Automotive, Consumer Goods, Others |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Key Highlights End Of Line Packaging Market

- The market is experiencing a shift towards automated packaging solutions to enhance operational efficiency.

- Integration of IoT and AI technologies in packaging systems is gaining traction.

- Food & beverages and pharmaceuticals are the leading end-user industries driving market demand.

- Asia-Pacific is expected to witness the highest growth rate during the forecast period.

- Increasing focus on sustainable and eco-friendly packaging solutions.

- Rising demand for flexible packaging solutions in the consumer goods sector.

- Technological advancements are leading to the development of smart packaging solutions.

- Growing e-commerce industry is boosting the demand for efficient packaging systems.

- Manufacturers are focusing on reducing packaging waste and improving recyclability.

- Collaborations and partnerships are key strategies adopted by market players to expand their market presence.

Competitive Intelligence

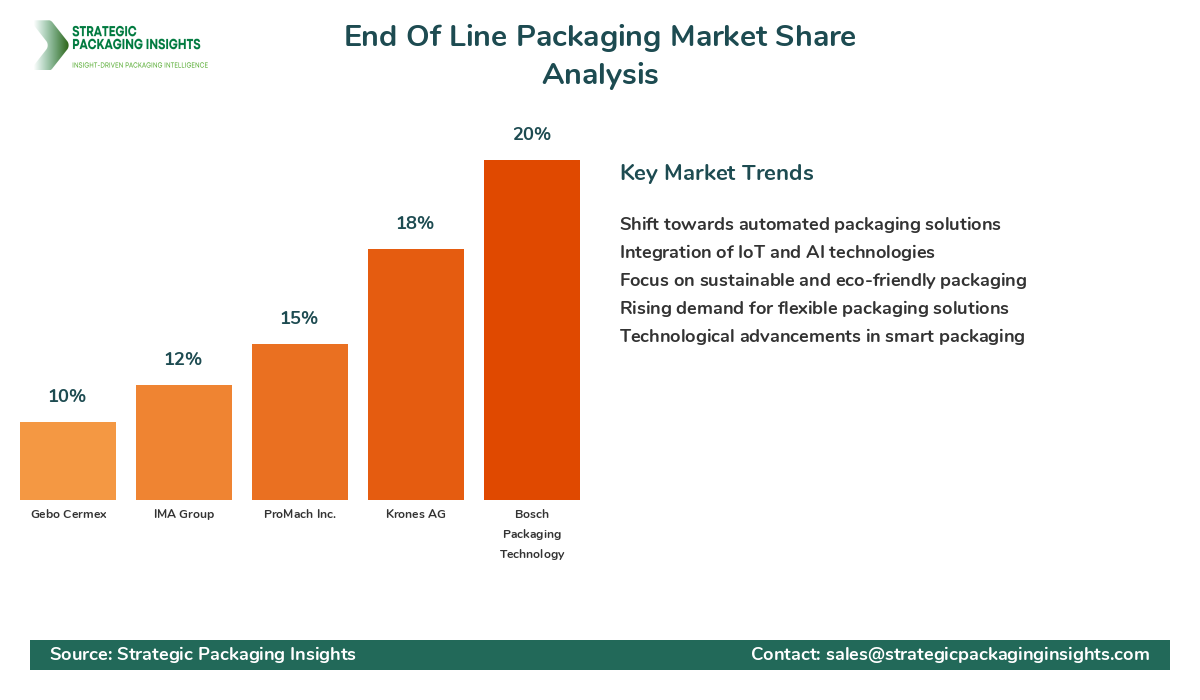

The End Of Line Packaging market is highly competitive, with several key players striving to gain a significant market share. Leading companies such as Bosch Packaging Technology, Krones AG, and ProMach Inc. are at the forefront, leveraging their extensive product portfolios and technological expertise. Bosch Packaging Technology, for instance, is known for its innovative solutions and strong focus on R&D, which has helped it maintain a competitive edge. Krones AG, with its wide geographic reach and comprehensive service offerings, continues to expand its market presence. ProMach Inc. is recognized for its customer-centric approach and robust client retention strategies.

Other notable players include IMA Group, Gebo Cermex, and Schneider Packaging Equipment Co., Inc., each with unique strengths and market strategies. IMA Group's emphasis on sustainability and eco-friendly solutions sets it apart, while Gebo Cermex's focus on integrated solutions and automation enhances its competitive positioning. Schneider Packaging Equipment Co., Inc. is gaining ground with its innovative packaging technologies and strong customer relationships. The competitive landscape is characterized by continuous innovation, strategic partnerships, and mergers and acquisitions, as companies aim to strengthen their market position and expand their product offerings.

Regional Market Intelligence of End Of Line Packaging

In North America, the End Of Line Packaging market is valued at $1.8 billion and is expected to grow steadily, driven by the strong presence of key market players and the increasing adoption of advanced packaging technologies. The region's focus on automation and efficiency in packaging processes is a significant growth driver. Europe, with a market size of $1.5 billion, is witnessing growth due to stringent regulations on packaging waste and a strong emphasis on sustainability. The demand for eco-friendly packaging solutions is particularly high in this region.

Asia-Pacific, the fastest-growing region with a market size of $2.0 billion, is experiencing rapid industrialization and urbanization, leading to increased demand for packaged goods. The booming e-commerce industry and rising disposable incomes are further fueling market growth. In Latin America, valued at $0.8 billion, the market is driven by the growing food and beverage industry and increasing investments in packaging infrastructure. The Middle East & Africa, with a market size of $0.7 billion, is seeing growth due to the expanding consumer goods sector and rising demand for efficient packaging solutions.

Top Countries Insights in End Of Line Packaging

The United States, with a market size of $1.5 billion and a CAGR of 4%, is a leading country in the End Of Line Packaging market. The country's focus on automation and technological advancements in packaging systems is driving growth. China, with a market size of $1.2 billion and a CAGR of 7%, is experiencing rapid growth due to its booming e-commerce industry and increasing demand for packaged goods. Germany, valued at $0.9 billion with a CAGR of 5%, is driven by stringent packaging regulations and a strong emphasis on sustainability.

India, with a market size of $0.8 billion and a CAGR of 8%, is witnessing growth due to rapid industrialization and urbanization. The country's growing middle class and rising disposable incomes are contributing to increased demand for packaged goods. Brazil, with a market size of $0.6 billion and a CAGR of 6%, is driven by the expanding food and beverage industry and increasing investments in packaging infrastructure. These countries are focusing on technological advancements and sustainable packaging solutions to drive market growth.

End Of Line Packaging Market Segments Insights

Technology Analysis

The technology segment in the End Of Line Packaging market is primarily divided into automatic and semi-automatic systems. Automatic systems are gaining significant traction due to their ability to enhance operational efficiency and reduce labor costs. These systems are equipped with advanced features such as real-time monitoring and control, which help in optimizing the packaging process. The demand for automatic systems is particularly high in industries such as food & beverages and pharmaceuticals, where precision and speed are critical. On the other hand, semi-automatic systems are preferred by small and medium enterprises due to their cost-effectiveness and flexibility. These systems offer a balance between automation and manual intervention, making them suitable for businesses with limited budgets.

Technological advancements are playing a crucial role in the development of innovative packaging solutions. The integration of IoT and AI technologies in packaging systems is enabling real-time data collection and analysis, leading to improved decision-making and process optimization. Companies are investing in R&D to develop smart packaging solutions that can adapt to changing market demands and consumer preferences. The focus on sustainability is also driving the development of eco-friendly packaging technologies, which are gaining popularity among environmentally conscious consumers.

Function Analysis

The function segment of the End Of Line Packaging market is categorized into standalone and integrated systems. Standalone systems are widely used in industries where specific packaging tasks need to be performed independently. These systems offer flexibility and can be easily integrated into existing production lines. They are particularly popular in the food & beverages and consumer goods industries, where packaging requirements vary significantly. Integrated systems, on the other hand, are designed to perform multiple packaging tasks simultaneously, offering a comprehensive solution for end-of-line packaging needs. These systems are ideal for large-scale production facilities that require high levels of automation and efficiency.

The demand for integrated systems is increasing due to their ability to streamline packaging processes and reduce operational costs. These systems are equipped with advanced features such as automated sorting, labeling, and palletizing, which enhance productivity and reduce the need for manual intervention. Companies are focusing on developing integrated solutions that can be customized to meet specific industry requirements. The growing trend of Industry 4.0 is also driving the adoption of integrated systems, as manufacturers seek to create smart factories with interconnected and automated processes.

End-User Industry Analysis

The end-user industry segment in the End Of Line Packaging market includes food & beverages, pharmaceuticals, electronics, automotive, consumer goods, and others. The food & beverages industry is the largest end-user segment, driven by the increasing demand for packaged food products and beverages. The need for efficient and hygienic packaging solutions is a key driver in this industry. The pharmaceuticals industry is also a significant contributor to market growth, with a focus on ensuring product safety and compliance with regulatory standards. The demand for tamper-evident and child-resistant packaging solutions is particularly high in this industry.

The electronics industry is witnessing growth due to the increasing demand for protective packaging solutions that ensure the safe transportation of electronic products. The automotive industry is also contributing to market growth, with a focus on reducing packaging waste and improving recyclability. The consumer goods industry is experiencing a shift towards flexible packaging solutions that offer convenience and sustainability. Companies in this industry are investing in innovative packaging designs that enhance product appeal and meet consumer preferences. The growing trend of e-commerce is further driving demand for efficient and cost-effective packaging solutions across all end-user industries.

Regional Analysis

The regional analysis of the End Of Line Packaging market highlights significant growth opportunities across various regions. North America is a mature market with a strong focus on automation and technological advancements. The region's emphasis on sustainability and eco-friendly packaging solutions is driving market growth. Europe is witnessing growth due to stringent packaging regulations and a strong emphasis on reducing packaging waste. The demand for sustainable packaging solutions is particularly high in this region, with companies focusing on developing innovative and eco-friendly packaging technologies.

Asia-Pacific is the fastest-growing region, driven by rapid industrialization and urbanization. The region's booming e-commerce industry and rising disposable incomes are contributing to increased demand for packaged goods. The focus on automation and efficiency in packaging processes is a key growth driver in this region. Latin America is experiencing growth due to the expanding food and beverage industry and increasing investments in packaging infrastructure. The Middle East & Africa is seeing growth due to the expanding consumer goods sector and rising demand for efficient packaging solutions. The focus on technological advancements and sustainable packaging solutions is driving market growth across all regions.

The market share distribution in the End Of Line Packaging market is characterized by the dominance of a few key players, with Bosch Packaging Technology, Krones AG, and ProMach Inc. leading the market. These companies have established strong market positions through their extensive product portfolios, technological expertise, and strategic partnerships. Bosch Packaging Technology, for instance, is known for its innovative solutions and strong focus on R&D, which has helped it maintain a competitive edge. Krones AG, with its wide geographic reach and comprehensive service offerings, continues to expand its market presence. ProMach Inc. is recognized for its customer-centric approach and robust client retention strategies.

Other notable players include IMA Group, Gebo Cermex, and Schneider Packaging Equipment Co., Inc., each with unique strengths and market strategies. IMA Group's emphasis on sustainability and eco-friendly solutions sets it apart, while Gebo Cermex's focus on integrated solutions and automation enhances its competitive positioning. Schneider Packaging Equipment Co., Inc. is gaining ground with its innovative packaging technologies and strong customer relationships. The competitive landscape is characterized by continuous innovation, strategic partnerships, and mergers and acquisitions, as companies aim to strengthen their market position and expand their product offerings. The market share distribution affects pricing, innovation, and partnerships, with leading companies setting industry standards and influencing market trends.

End Of Line Packaging Market Segments

The End Of Line Packaging market has been segmented on the basis of

Technology

- Automatic

- Semi-Automatic

Function

- Standalone

- Integrated

End-User Industry

- Food & Beverages

- Pharmaceuticals

- Electronics

- Automotive

- Consumer Goods

- Others

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers for the End Of Line Packaging market?

How is technology impacting the End Of Line Packaging market?

What are the challenges faced by the End Of Line Packaging market?

Which regions are expected to witness the highest growth in the End Of Line Packaging market?

What strategies are companies adopting to gain a competitive edge in the End Of Line Packaging market?

Latest Reports

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.