- Home

- Food Packaging

- Fast Food Container Market Size, Future Growth and Forecast 2033

Fast Food Container Market Size, Future Growth and Forecast 2033

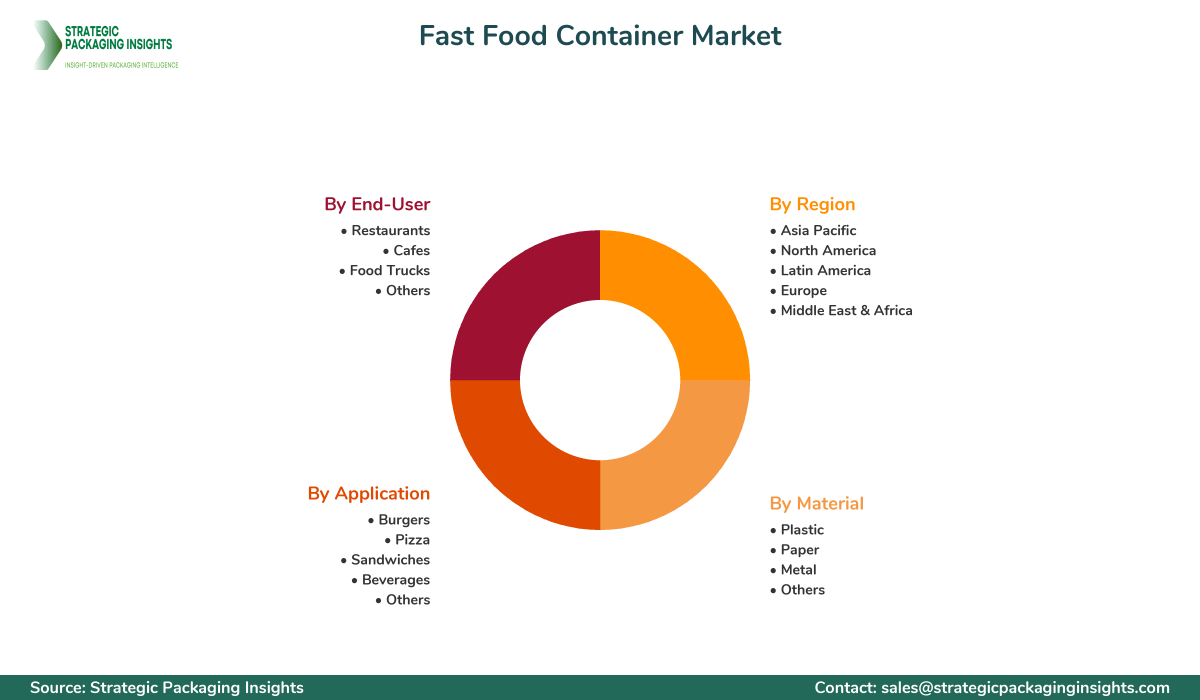

Fast Food Container Market Segments - by Material (Plastic, Paper, Metal, Others), Application (Burgers, Pizza, Sandwiches, Beverages, Others), End-User (Restaurants, Cafes, Food Trucks, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Fast Food Container Market Outlook

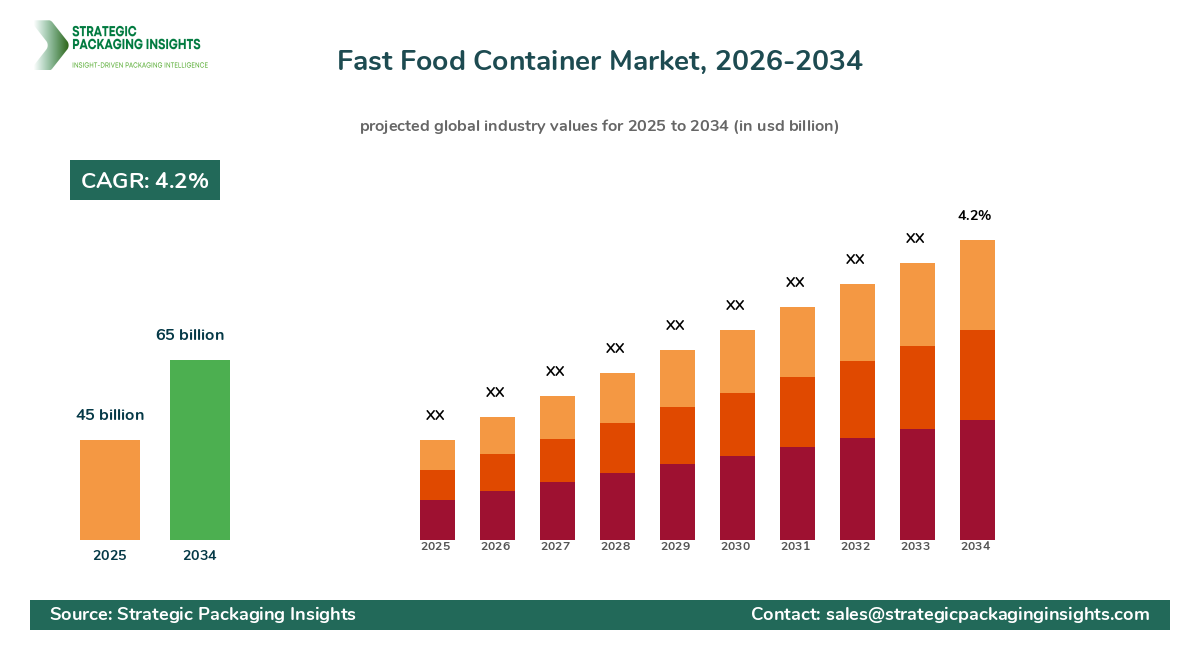

The fast food container market was valued at $45 billion in 2024 and is projected to reach $65 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033. This market is driven by the increasing demand for convenient and Sustainable Packaging solutions in the fast food industry. As consumer lifestyles become busier, the need for on-the-go food options has surged, leading to a higher demand for fast food containers. Additionally, the growing awareness of environmental issues has prompted manufacturers to innovate and produce eco-friendly packaging solutions, further propelling market growth.

Report Scope

| Attributes | Details |

| Report Title | Fast Food Container Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 129 |

| Material | Plastic, Paper, Metal, Others |

| Application | Burgers, Pizza, Sandwiches, Beverages, Others |

| End-User | Restaurants, Cafes, Food Trucks, Others |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

One of the significant opportunities in the fast Food Container market is the rising trend of sustainable packaging. With increasing environmental concerns, consumers and regulatory bodies are pushing for eco-friendly packaging solutions. This shift is encouraging manufacturers to invest in biodegradable and recyclable materials, opening new avenues for growth. Furthermore, the expansion of the fast food industry in emerging markets presents a lucrative opportunity for market players. As urbanization and disposable incomes rise, the demand for fast food and, consequently, fast food containers is expected to increase significantly.

Another opportunity lies in technological advancements in packaging. Innovations such as smart packaging, which can enhance food safety and extend shelf life, are gaining traction. These advancements not only improve the consumer experience but also offer a competitive edge to companies investing in such technologies. Additionally, the growing trend of online food delivery services is boosting the demand for durable and efficient packaging solutions, providing further growth prospects for the fast food container market.

However, the market faces challenges such as stringent regulations regarding packaging waste and environmental impact. Governments worldwide are implementing policies to reduce plastic waste, which could hinder the growth of plastic-based fast food containers. Companies need to adapt to these regulations by developing alternative materials and sustainable practices. Additionally, fluctuations in raw material prices can impact production costs, posing a threat to market profitability.

The fast food container market is highly competitive, with numerous players vying for market share. The competitive landscape is characterized by the presence of both global and regional companies, each striving to enhance their product offerings and expand their market presence. Key players are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and product innovations to strengthen their foothold in the market. The market is also witnessing increased investments in research and development to create sustainable and innovative packaging solutions.

Major companies in the fast food container market include Dart Container Corporation, Huhtamaki Oyj, WestRock Company, Berry Global Inc., and Genpak LLC. Dart Container Corporation is a leading player known for its extensive range of foodservice packaging products. The company focuses on sustainability and innovation, offering eco-friendly solutions to meet consumer demands. Huhtamaki Oyj, a global packaging specialist, emphasizes sustainable packaging and has a strong presence in the fast food container market.

WestRock Company is another prominent player, providing comprehensive packaging solutions across various industries, including foodservice. The company's focus on innovation and sustainability has helped it maintain a competitive edge. Berry Global Inc. is known for its diverse product portfolio and commitment to sustainability, offering a range of recyclable and Biodegradable Packaging solutions. Genpak LLC specializes in food packaging and is recognized for its innovative designs and sustainable practices.

Key Highlights Fast Food Container Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Technological advancements in smart packaging for enhanced food safety.

- Expansion of the fast food industry in emerging markets.

- Growing trend of online food delivery services boosting packaging demand.

- Stringent regulations on packaging waste impacting market dynamics.

- Fluctuations in raw material prices affecting production costs.

- Strategic initiatives by key players to strengthen market presence.

- Rising consumer awareness of environmental issues driving market growth.

- Investments in research and development for innovative packaging solutions.

- Competitive landscape characterized by global and regional players.

Premium Insights - Key Investment Analysis

The fast food container market is witnessing significant investment activity, driven by the growing demand for sustainable packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and innovative packaging products. The market is also seeing a rise in mergers and acquisitions as companies seek to expand their product portfolios and geographic reach. Investment valuations in the fast food container market are influenced by factors such as technological advancements, regulatory compliance, and consumer preferences for sustainable packaging.

Return on investment (ROI) expectations in this market are high, given the increasing consumer demand for convenient and environmentally friendly packaging solutions. Emerging investment themes include the development of biodegradable materials, smart packaging technologies, and the expansion of production capacities in emerging markets. However, investors must consider risk factors such as regulatory changes, raw material price volatility, and competition from alternative packaging solutions. Strategic rationale behind major deals often involves gaining access to new markets, enhancing product offerings, and leveraging technological advancements to meet consumer demands.

Fast Food Container Market Segments Insights

Material Analysis

The fast food container market is segmented by material into plastic, paper, metal, and others. Plastic containers dominate the market due to their lightweight, cost-effectiveness, and versatility. However, the increasing environmental concerns and regulatory pressures are driving the demand for paper and biodegradable materials. Paper containers are gaining popularity as they are recyclable and compostable, aligning with the growing trend of sustainable packaging. Metal containers, although less common, are used for specific applications where durability and heat retention are crucial.

The competition among material providers is intense, with companies focusing on developing innovative and eco-friendly solutions to meet consumer demands. The shift towards sustainable materials is a significant driver in this segment, with manufacturers investing in research and development to create biodegradable and recyclable options. Customer demand for environmentally friendly packaging is influencing material choices, with a growing preference for paper and biodegradable containers over traditional plastic options.

Application Analysis

The application segment of the fast food container market includes burgers, pizza, sandwiches, beverages, and others. Each application has specific packaging requirements, influencing the choice of materials and designs. Burger containers, for instance, require grease-resistant and heat-retaining properties, while pizza boxes need to maintain freshness and prevent sogginess. The demand for beverage containers is driven by the growing trend of on-the-go consumption, with a focus on spill-proof and insulated designs.

Trends in this segment include the development of customized packaging solutions to enhance brand identity and consumer experience. Companies are investing in innovative designs and materials to cater to the specific needs of each application. The competition is fierce, with players striving to offer unique and functional packaging solutions that meet consumer expectations. Customer demand for convenience and sustainability is driving innovation in this segment, with a focus on creating packaging that is both practical and environmentally friendly.

End-User Analysis

The fast food container market is segmented by end-user into restaurants, cafes, food trucks, and others. Restaurants are the largest end-user segment, accounting for a significant share of the market. The demand for fast food containers in restaurants is driven by the need for efficient and sustainable packaging solutions that enhance the dining experience. Cafes and food trucks also contribute to the market, with a focus on convenient and portable packaging options.

Trends in this segment include the adoption of eco-friendly packaging solutions to meet consumer preferences for sustainability. Restaurants and cafes are increasingly opting for biodegradable and recyclable containers to align with environmental regulations and consumer expectations. The competition among end-users is intense, with players striving to differentiate themselves through innovative packaging solutions. Customer demand for convenience, sustainability, and brand identity is influencing packaging choices in this segment.

Regional Analysis

The fast food container market is segmented by region into Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. North America holds a significant share of the market, driven by the high consumption of fast food and the presence of major fast food chains. The demand for sustainable packaging solutions is also high in this region, influencing market dynamics. Europe is another key market, with a strong focus on environmental sustainability and regulatory compliance.

Asia Pacific is expected to witness the highest growth rate during the forecast period, driven by the expanding fast food industry and increasing urbanization. The demand for convenient and affordable packaging solutions is rising in this region, presenting lucrative opportunities for market players. Latin America and Middle East & Africa are also experiencing growth, driven by the increasing adoption of fast food and the demand for innovative packaging solutions. The competition in these regions is intense, with players focusing on expanding their market presence and offering sustainable packaging options.

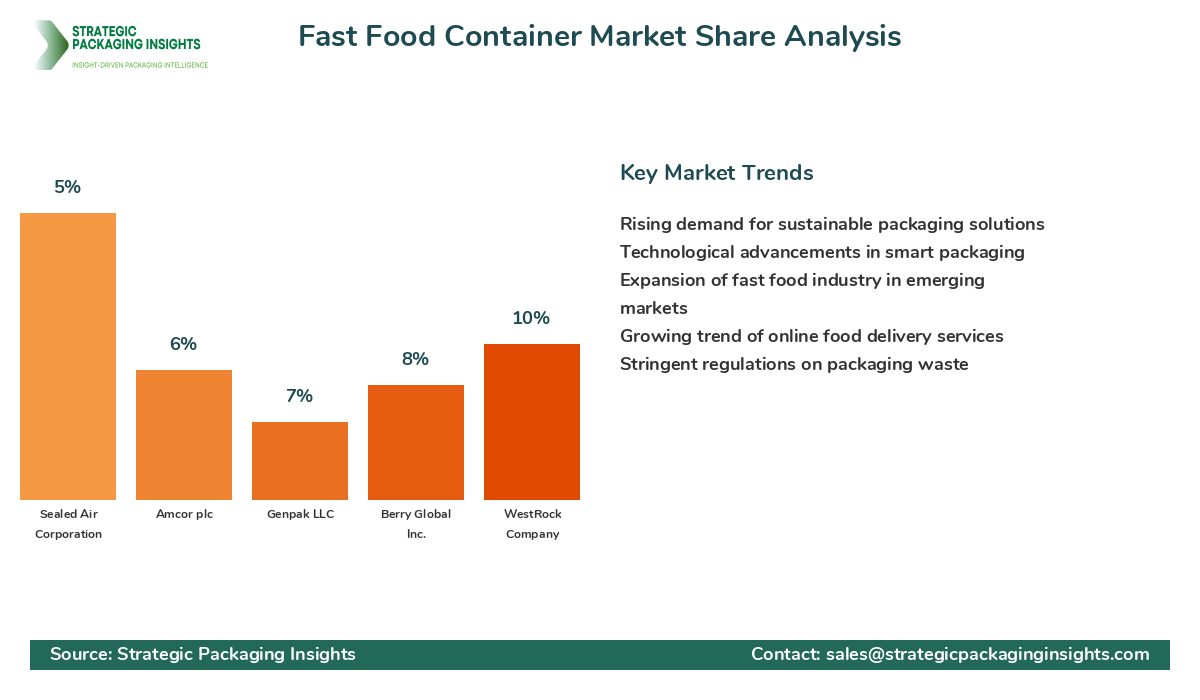

Market Share Analysis

The market share distribution of key players in the fast food container market is influenced by factors such as product innovation, sustainability initiatives, and strategic partnerships. Companies leading the market are those that have successfully adapted to changing consumer preferences and regulatory requirements. These players are gaining market share by offering eco-friendly and innovative packaging solutions that meet the demands of both consumers and regulatory bodies.

Competitive positioning trends indicate that companies investing in research and development to create sustainable and innovative packaging solutions are gaining a competitive edge. The market share distribution affects pricing strategies, with companies offering premium products commanding higher prices. Partnerships and collaborations are also influencing market dynamics, with companies joining forces to enhance their product offerings and expand their market reach. The focus on sustainability and innovation is driving competition, with players striving to differentiate themselves through unique and environmentally friendly packaging solutions.

Top Countries Insights in Fast Food Container

The United States is a leading market for fast food containers, with a market size of $15 billion and a CAGR of 4%. The demand is driven by the high consumption of fast food and the presence of major fast food chains. The focus on sustainable packaging solutions is also influencing market dynamics, with companies investing in eco-friendly materials and designs.

China is another key market, with a market size of $10 billion and a CAGR of 6%. The expanding fast food industry and increasing urbanization are driving the demand for convenient and affordable packaging solutions. The focus on sustainability is also growing, with companies investing in biodegradable and recyclable materials to meet consumer preferences and regulatory requirements.

India is experiencing significant growth, with a market size of $5 billion and a CAGR of 8%. The rising disposable incomes and changing consumer lifestyles are driving the demand for fast food and, consequently, fast food containers. The focus on sustainability is also influencing market dynamics, with companies investing in eco-friendly packaging solutions to meet consumer demands.

Germany is a key market in Europe, with a market size of $4 billion and a CAGR of 3%. The demand for sustainable packaging solutions is high, driven by stringent environmental regulations and consumer preferences for eco-friendly products. Companies are investing in innovative materials and designs to meet these demands and gain a competitive edge.

Brazil is a growing market, with a market size of $3 billion and a CAGR of 5%. The increasing adoption of fast food and the demand for innovative packaging solutions are driving market growth. The focus on sustainability is also influencing market dynamics, with companies investing in biodegradable and recyclable materials to meet consumer preferences and regulatory requirements.

Fast Food Container Market Segments

The Fast Food Container market has been segmented on the basis of

Material

- Plastic

- Paper

- Metal

- Others

Application

- Burgers

- Pizza

- Sandwiches

- Beverages

- Others

End-User

- Restaurants

- Cafes

- Food Trucks

- Others

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers for the fast food container market?

What challenges does the fast food container market face?

How is the market responding to environmental concerns?

What opportunities exist in the fast food container market?

How are companies gaining a competitive edge in this market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.