- Home

- Food Packaging

- Food Grade Bopp Film Market Size, Future Growth and Forecast 2033

Food Grade Bopp Film Market Size, Future Growth and Forecast 2033

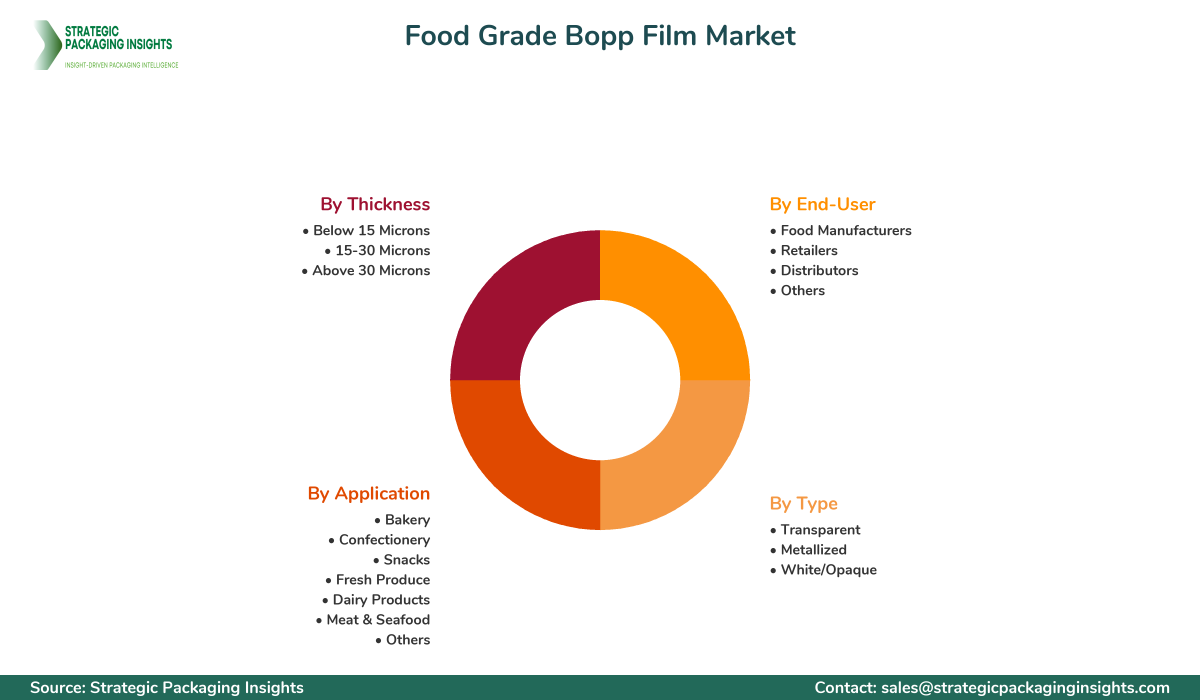

Food Grade Bopp Film Market Segments - by Type (Transparent, Metallized, White/Opaque), Application (Bakery, Confectionery, Snacks, Fresh Produce, Dairy Products, Meat & Seafood, Others), Thickness (Below 15 Microns, 15-30 Microns, Above 30 Microns), End-User (Food Manufacturers, Retailers, Distributors, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Food Grade Bopp Film Market Outlook

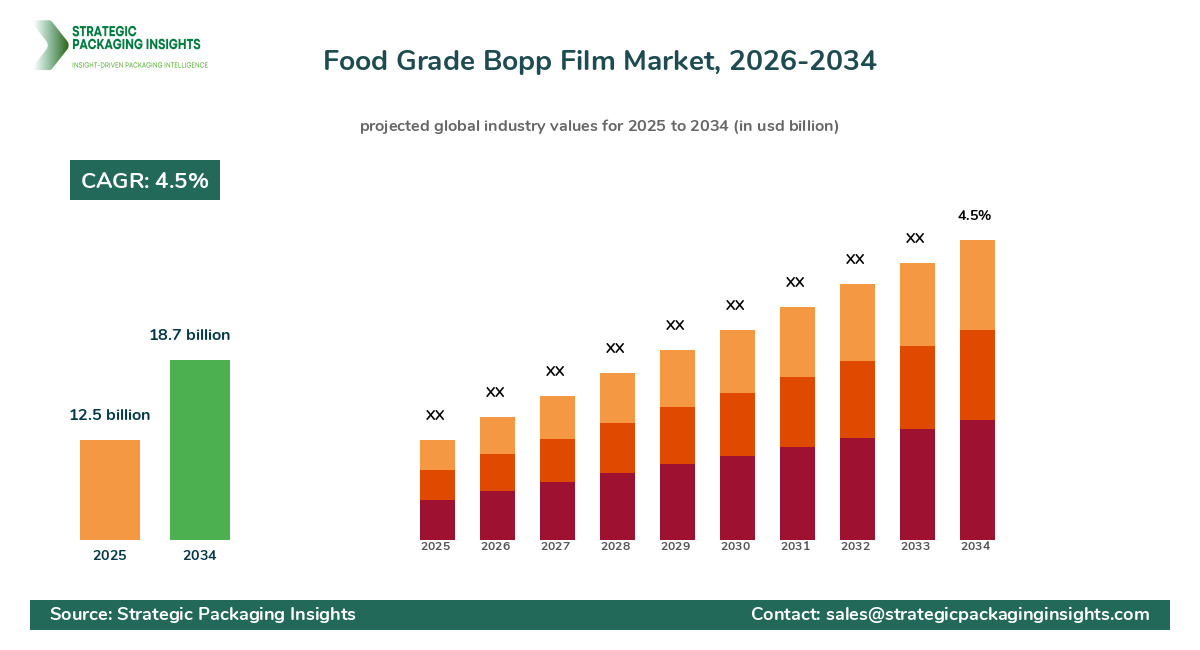

The Food Grade Bopp Film market was valued at $12.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025-2033. This market is driven by the increasing demand for sustainable and efficient packaging solutions in the food industry. BOPP Films are known for their excellent clarity, moisture resistance, and barrier properties, making them ideal for food packaging applications. The rising consumer preference for packaged food products, coupled with the growth of the retail sector, is further propelling the market growth. Additionally, advancements in Bopp film technology, such as the development of metallized and coated films, are enhancing the functionality and appeal of these films, thereby boosting their adoption in various food packaging applications.

However, the market faces certain challenges, including stringent regulatory requirements related to food safety and packaging materials. Compliance with these regulations necessitates significant investments in research and development, which can be a barrier for small and medium-sized enterprises. Despite these challenges, the market holds significant growth potential, driven by the increasing demand for eco-friendly and recyclable packaging solutions. The development of bio-based Bopp films and the incorporation of advanced technologies, such as nanotechnology, are expected to create lucrative opportunities for market players in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Food Grade Bopp Film Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 119 |

| Type | Transparent, Metallized, White/Opaque |

| Application | Bakery, Confectionery, Snacks, Fresh Produce, Dairy Products, Meat & Seafood, Others |

| Thickness | Below 15 Microns, 15-30 Microns, Above 30 Microns |

| End-User | Food Manufacturers, Retailers, Distributors, Others |

| Customization Available | Yes* |

Opportunities & Threats

The Food Grade Bopp Film market presents numerous opportunities for growth, primarily driven by the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are recyclable and have a lower environmental impact. Bopp films, being lightweight and recyclable, align well with these consumer preferences, making them an attractive option for food packaging. Additionally, the development of bio-based Bopp films, which are derived from renewable resources, is expected to further enhance the market's growth prospects. These films offer the dual benefits of sustainability and performance, making them ideal for use in various food packaging applications.

Another significant opportunity lies in the expanding e-commerce sector, which is driving the demand for efficient and durable packaging solutions. Bopp films, with their excellent barrier properties and durability, are well-suited for packaging food products sold online. The growth of online grocery shopping, in particular, is expected to boost the demand for Bopp films, as they provide the necessary protection to ensure the freshness and quality of food products during transit. Furthermore, the increasing focus on reducing food waste is driving the demand for packaging solutions that extend the shelf life of food products, thereby creating additional opportunities for Bopp film manufacturers.

Despite the numerous opportunities, the Food Grade Bopp Film market faces certain threats, primarily in the form of stringent regulatory requirements. Compliance with food safety and packaging regulations is essential for market players, and failure to meet these requirements can result in significant penalties and reputational damage. Additionally, the market is highly competitive, with numerous players vying for market share. This intense competition can lead to price wars, which can negatively impact profit margins. Moreover, fluctuations in raw material prices can pose a threat to market stability, as they can affect production costs and pricing strategies.

The Food Grade Bopp Film market is characterized by a highly competitive landscape, with numerous players operating at both global and regional levels. The market is dominated by a few key players who hold significant market shares, while several smaller players compete for the remaining share. The competitive landscape is shaped by factors such as product innovation, pricing strategies, and distribution networks. Companies are increasingly focusing on expanding their product portfolios and enhancing their production capabilities to gain a competitive edge. Strategic partnerships and collaborations are also common in this market, as companies seek to leverage each other's strengths and expand their market presence.

Some of the major companies operating in the Food Grade Bopp Film market include Jindal Poly Films Ltd., Cosmo Films Ltd., Taghleef Industries, Treofan Group, and Innovia Films. Jindal Poly Films Ltd. is a leading player in the market, known for its extensive product portfolio and strong distribution network. The company focuses on continuous innovation and has made significant investments in research and development to enhance its product offerings. Cosmo Films Ltd. is another key player, recognized for its high-quality Bopp films and strong customer relationships. The company has a global presence and is committed to sustainability, with a focus on developing eco-friendly packaging solutions.

Taghleef Industries is a prominent player in the market, known for its wide range of Bopp films and strong focus on customer satisfaction. The company has a robust production capacity and is continuously expanding its operations to meet the growing demand for Bopp films. Treofan Group is another major player, offering a diverse range of Bopp films for various applications. The company is known for its innovative products and strong focus on quality, which has helped it establish a strong foothold in the market. Innovia Films is a leading manufacturer of Bopp films, recognized for its high-performance products and commitment to sustainability. The company has a strong global presence and is focused on expanding its product offerings to cater to the evolving needs of the food packaging industry.

Key Highlights Food Grade Bopp Film Market

- The Food Grade Bopp Film market is projected to grow at a CAGR of 4.5% from 2025 to 2033.

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- Advancements in Bopp film technology, such as metallized and coated films, are enhancing product functionality.

- The expanding e-commerce sector is boosting the demand for durable packaging solutions.

- Stringent regulatory requirements pose a challenge for market players.

- Development of bio-based Bopp films offers significant growth opportunities.

- Intense competition in the market can lead to price wars and impact profit margins.

- Fluctuations in raw material prices can affect production costs and pricing strategies.

- Strategic partnerships and collaborations are common in the market.

- Key players include Jindal Poly Films Ltd., Cosmo Films Ltd., Taghleef Industries, Treofan Group, and Innovia Films.

Premium Insights - Key Investment Analysis

The Food Grade Bopp Film market is witnessing significant investment activity, driven by the increasing demand for sustainable packaging solutions and the growth of the food industry. Venture capital firms and private equity investors are actively investing in companies that offer innovative and eco-friendly Bopp films. The development of bio-based Bopp films is attracting significant investor interest, as these films align with the growing consumer preference for sustainable packaging solutions. Additionally, mergers and acquisitions are common in this market, as companies seek to expand their product portfolios and enhance their market presence.

Investment valuations in the Food Grade Bopp Film market are influenced by factors such as product innovation, market demand, and regulatory compliance. Companies that offer high-performance and sustainable Bopp films are attracting higher valuations, as they are well-positioned to capitalize on the growing demand for eco-friendly packaging solutions. Return on investment (ROI) expectations in this market are driven by the potential for market growth and the ability to capture a significant share of the expanding food packaging market. Emerging investment themes in this market include the development of bio-based films, the incorporation of advanced technologies, and the expansion of production capacities.

Risk factors in the Food Grade Bopp Film market include regulatory compliance, raw material price fluctuations, and intense competition. Companies that can effectively manage these risks and capitalize on emerging opportunities are likely to attract significant investor interest. The strategic rationale behind major deals in this market is often driven by the desire to enhance product offerings, expand market presence, and leverage synergies. High-potential investment opportunities in this market include companies that offer innovative and sustainable Bopp films, as well as those that have a strong focus on research and development.

Food Grade Bopp Film Market Segments Insights

Type Analysis

The Food Grade Bopp Film market is segmented by type into Transparent, Metallized, and White/Opaque films. Transparent Bopp films are widely used in food packaging due to their excellent clarity and moisture resistance. These films are ideal for packaging products that require high visibility, such as fresh produce and bakery items. The demand for transparent Bopp films is driven by the growing consumer preference for visually appealing packaging and the need for efficient product protection. Metallized Bopp films, on the other hand, offer superior barrier properties and are used for packaging products that require extended shelf life, such as snacks and confectionery. The demand for metallized films is driven by the increasing focus on reducing food waste and enhancing product shelf life.

White/Opaque Bopp films are used for packaging products that require light protection, such as dairy products and meat. These films offer excellent opacity and are ideal for products that are sensitive to light exposure. The demand for white/opaque films is driven by the need for efficient product protection and the growing consumer preference for visually appealing packaging. The competition in the type segment is intense, with numerous players offering a wide range of products to cater to the diverse needs of the food packaging industry. Companies are focusing on product innovation and the development of high-performance films to gain a competitive edge in this segment.

Application Analysis

The Food Grade Bopp Film market is segmented by application into Bakery, Confectionery, Snacks, Fresh Produce, Dairy Products, Meat & Seafood, and Others. The bakery segment is a major application area for Bopp films, driven by the increasing demand for packaged bakery products. Bopp films offer excellent moisture resistance and barrier properties, making them ideal for packaging bakery items. The confectionery segment is another significant application area, with Bopp films being used for packaging chocolates, candies, and other confectionery products. The demand for Bopp films in this segment is driven by the need for efficient product protection and the growing consumer preference for visually appealing packaging.

The snacks segment is witnessing significant growth, driven by the increasing demand for packaged snacks and the need for efficient packaging solutions. Bopp films offer excellent barrier properties and are ideal for packaging snacks that require extended shelf life. The fresh produce segment is another important application area, with Bopp films being used for packaging fruits and vegetables. The demand for Bopp films in this segment is driven by the need for efficient product protection and the growing consumer preference for fresh and healthy food products. The competition in the application segment is intense, with numerous players offering a wide range of products to cater to the diverse needs of the food packaging industry.

Thickness Analysis

The Food Grade Bopp Film market is segmented by thickness into Below 15 Microns, 15-30 Microns, and Above 30 Microns. Films with a thickness below 15 microns are used for packaging lightweight products that require minimal protection. These films are ideal for packaging products such as bakery items and fresh produce. The demand for films with a thickness below 15 microns is driven by the need for cost-effective packaging solutions and the growing consumer preference for lightweight packaging. Films with a thickness of 15-30 microns are used for packaging products that require moderate protection, such as snacks and confectionery. The demand for films in this thickness range is driven by the need for efficient product protection and the growing consumer preference for visually appealing packaging.

Films with a thickness above 30 microns are used for packaging products that require high protection, such as dairy products and meat. These films offer excellent barrier properties and are ideal for products that are sensitive to light and moisture exposure. The demand for films with a thickness above 30 microns is driven by the need for efficient product protection and the growing consumer preference for high-quality packaging. The competition in the thickness segment is intense, with numerous players offering a wide range of products to cater to the diverse needs of the food packaging industry. Companies are focusing on product innovation and the development of high-performance films to gain a competitive edge in this segment.

End-User Analysis

The Food Grade Bopp Film market is segmented by end-user into Food Manufacturers, Retailers, Distributors, and Others. Food manufacturers are the largest end-users of Bopp films, driven by the increasing demand for packaged food products and the need for efficient packaging solutions. Bopp films offer excellent barrier properties and are ideal for packaging a wide range of food products. The demand for Bopp films among food manufacturers is driven by the need for efficient product protection and the growing consumer preference for visually appealing packaging. Retailers are another significant end-user segment, with Bopp films being used for packaging products sold in retail stores.

The demand for Bopp films among retailers is driven by the need for efficient product protection and the growing consumer preference for high-quality packaging. Distributors are also important end-users of Bopp films, with these films being used for packaging products that are distributed to various retail outlets. The demand for Bopp films among distributors is driven by the need for efficient product protection and the growing consumer preference for visually appealing packaging. The competition in the end-user segment is intense, with numerous players offering a wide range of products to cater to the diverse needs of the food packaging industry. Companies are focusing on product innovation and the development of high-performance films to gain a competitive edge in this segment.

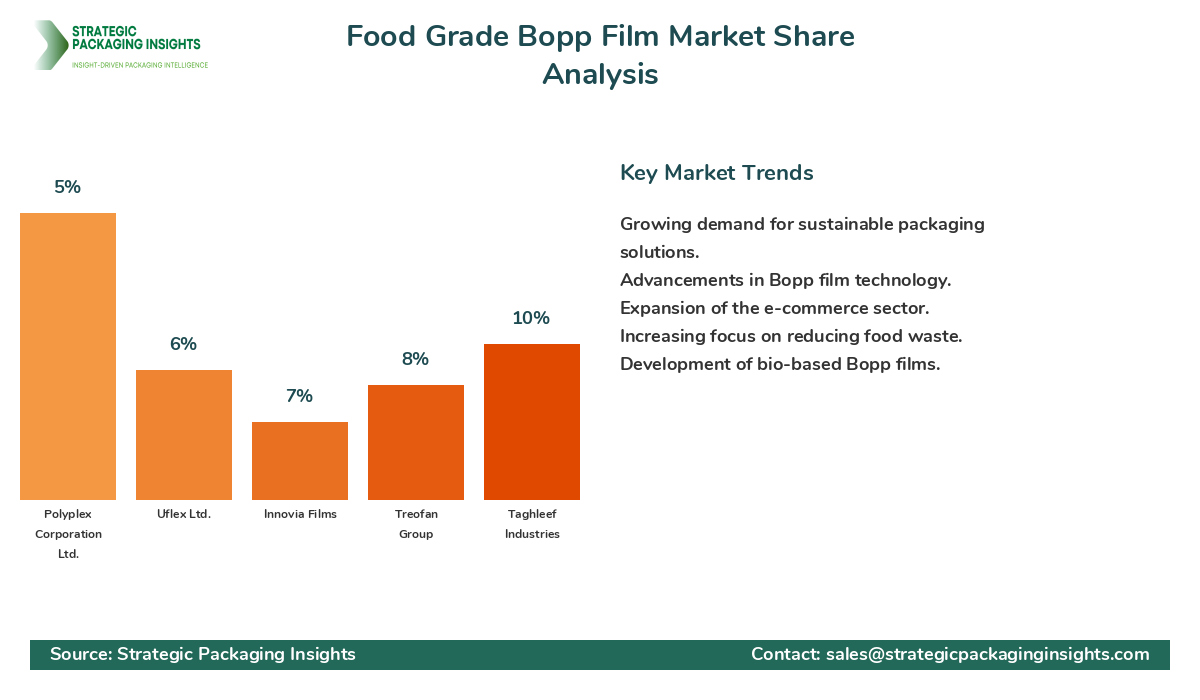

Market Share Analysis

The market share distribution of key players in the Food Grade Bopp Film market is characterized by a few dominant players holding significant shares, while several smaller players compete for the remaining market share. Companies like Jindal Poly Films Ltd., Cosmo Films Ltd., and Taghleef Industries are leading the market, leveraging their extensive product portfolios and strong distribution networks. These companies are continuously investing in research and development to enhance their product offerings and maintain their competitive edge. The market share distribution affects pricing strategies, with leading players often setting the price benchmarks for the industry. Innovation is a key competitive factor, with companies focusing on developing high-performance and sustainable Bopp films to meet the evolving needs of the food packaging industry. Partnerships and collaborations are also common, as companies seek to expand their market presence and leverage each other's strengths.

Top Countries Insights in Food Grade Bopp Film

The United States is one of the leading markets for Food Grade Bopp Film, with a market size of $3.2 billion and a CAGR of 5%. The growth in this market is driven by the increasing demand for packaged food products and the need for efficient packaging solutions. The presence of major food manufacturers and retailers in the country further boosts the demand for Bopp films. China is another significant market, with a market size of $2.8 billion and a CAGR of 6%. The growth in this market is driven by the expanding food industry and the increasing consumer preference for packaged food products. The government's focus on promoting sustainable packaging solutions is also contributing to market growth.

India is witnessing significant growth in the Food Grade Bopp Film market, with a market size of $1.5 billion and a CAGR of 7%. The growth in this market is driven by the increasing demand for packaged food products and the need for efficient packaging solutions. The presence of a large number of food manufacturers and retailers in the country further boosts the demand for Bopp films. Germany is another important market, with a market size of $1.2 billion and a CAGR of 4%. The growth in this market is driven by the increasing demand for sustainable packaging solutions and the presence of major food manufacturers in the country. Brazil is also witnessing growth in the Food Grade Bopp Film market, with a market size of $1 billion and a CAGR of 5%. The growth in this market is driven by the increasing demand for packaged food products and the need for efficient packaging solutions.

Food Grade Bopp Film Market Segments

The Food Grade Bopp Film market has been segmented on the basis of

Type

- Transparent

- Metallized

- White/Opaque

Application

- Bakery

- Confectionery

- Snacks

- Fresh Produce

- Dairy Products

- Meat & Seafood

- Others

Thickness

- Below 15 Microns

- 15-30 Microns

- Above 30 Microns

End-User

- Food Manufacturers

- Retailers

- Distributors

- Others

Primary Interview Insights

What are the key drivers for the Food Grade Bopp Film market?

What challenges does the Food Grade Bopp Film market face?

What opportunities exist in the Food Grade Bopp Film market?

How is the competitive landscape shaping up in the Food Grade Bopp Film market?

Which regions are witnessing significant growth in the Food Grade Bopp Film market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.