- Home

- Food Packaging

- Food Grade Packaging Film Market Size, Future Growth and Forecast 2033

Food Grade Packaging Film Market Size, Future Growth and Forecast 2033

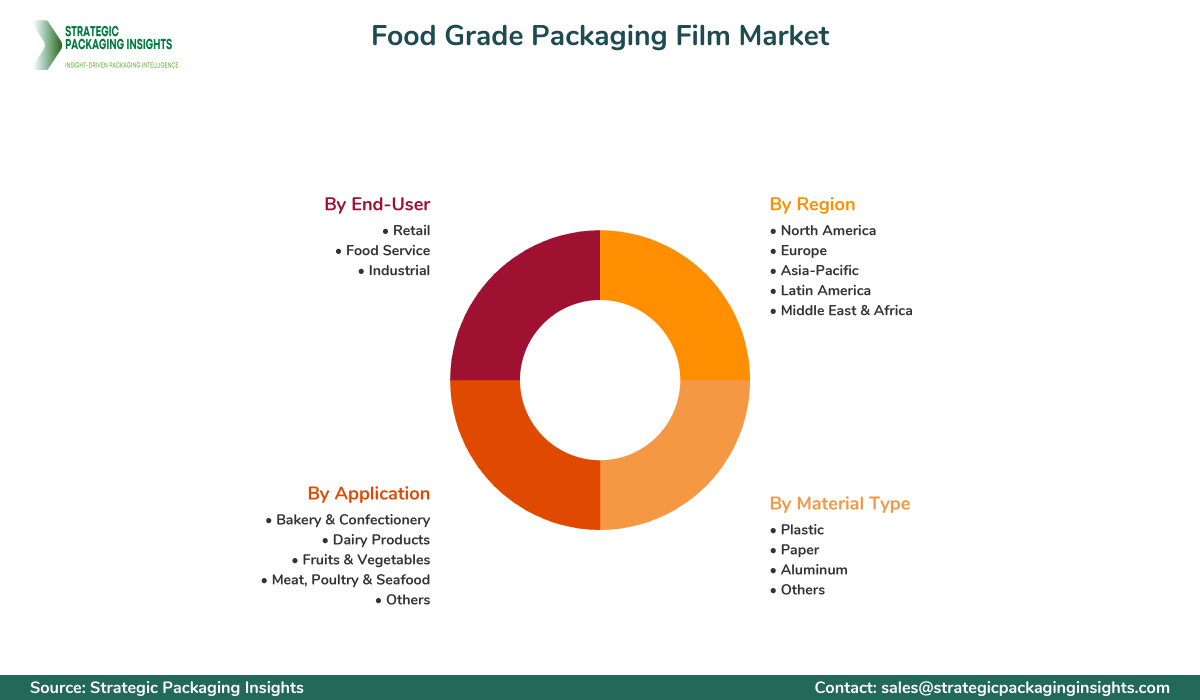

Food Grade Packaging Film Market Segments - by Material Type (Plastic, Paper, Aluminum, Others), Application (Bakery & Confectionery, Dairy Products, Fruits & Vegetables, Meat, Poultry & Seafood, Others), End-User (Retail, Food Service, Industrial), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Food Grade Packaging Film Market Outlook

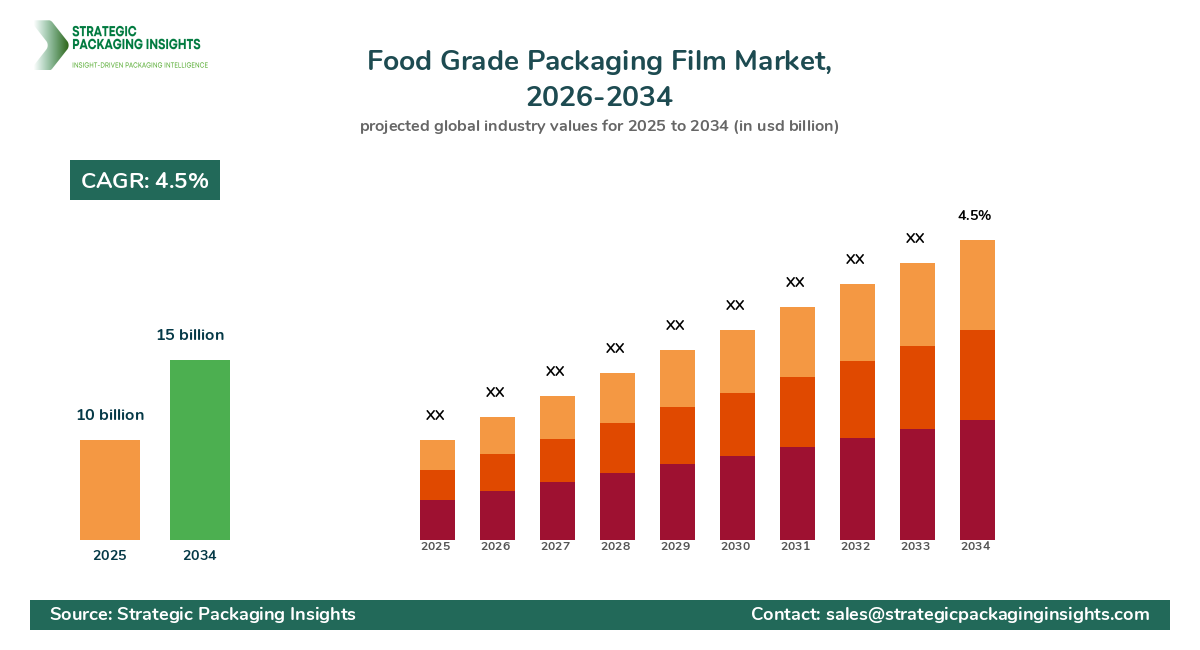

The food grade packaging film market was valued at $10 billion in 2024 and is projected to reach $15 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025-2033. This market is driven by the increasing demand for safe and sustainable packaging solutions in the food industry. As consumers become more health-conscious, the need for packaging that preserves food quality and extends shelf life has surged. Additionally, the rise in e-commerce and online food delivery services has further fueled the demand for food grade Packaging Films, as they ensure the safe transportation of food products. The market is also benefiting from technological advancements in packaging materials, which are enhancing the functionality and sustainability of these films.

However, the market faces certain restraints, including stringent regulatory requirements and environmental concerns related to plastic waste. Governments worldwide are implementing regulations to reduce plastic usage, which poses a challenge for manufacturers relying heavily on plastic-based packaging films. Despite these challenges, the market holds significant growth potential due to the increasing adoption of biodegradable and Recyclable Packaging materials. Companies are investing in research and development to create innovative solutions that meet regulatory standards while addressing environmental concerns. This shift towards eco-friendly packaging is expected to open new avenues for growth in the food grade packaging film market.

Report Scope

| Attributes | Details |

| Report Title | Food Grade Packaging Film Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 217 |

| Material Type | Plastic, Paper, Aluminum, Others |

| Application | Bakery & Confectionery, Dairy Products, Fruits & Vegetables, Meat, Poultry & Seafood, Others |

| End-User | Retail, Food Service, Industrial |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The food grade packaging film market presents numerous opportunities, particularly with the growing consumer preference for convenience foods. As lifestyles become busier, there is a rising demand for ready-to-eat meals and packaged food products, which require effective packaging solutions to maintain freshness and quality. This trend is driving the need for advanced packaging films that offer superior barrier properties and extend the shelf life of food products. Additionally, the increasing focus on sustainability is creating opportunities for manufacturers to develop eco-friendly packaging films that cater to environmentally conscious consumers. The integration of smart packaging technologies, such as QR codes and RFID tags, is also opening new possibilities for enhancing consumer engagement and product traceability.

Another significant opportunity lies in the expansion of the food and beverage industry in emerging markets. Rapid urbanization and rising disposable incomes in countries like China, India, and Brazil are boosting the demand for packaged food products, thereby driving the growth of the food grade packaging film market. Manufacturers are increasingly targeting these regions to capitalize on the growing consumer base and expanding retail sector. Furthermore, the increasing trend of online grocery shopping is creating a demand for packaging films that ensure the safe and efficient delivery of food products, presenting additional growth opportunities for the market.

Despite the promising opportunities, the food grade packaging film market faces certain threats, primarily related to environmental concerns and regulatory challenges. The growing awareness about the environmental impact of plastic waste is leading to stricter regulations on plastic packaging, which could hinder market growth. Manufacturers are under pressure to develop sustainable alternatives that comply with these regulations while maintaining the functionality and cost-effectiveness of traditional packaging films. Additionally, the volatility in raw material prices poses a threat to market stability, as fluctuations can impact production costs and profit margins for manufacturers.

The competitive landscape of the food grade packaging film market is characterized by the presence of several key players striving to gain a competitive edge through product innovation and strategic partnerships. The market is moderately fragmented, with a mix of global and regional players competing for market share. Companies are focusing on expanding their product portfolios and enhancing their production capabilities to meet the growing demand for food grade packaging films. The increasing emphasis on sustainability is also driving companies to invest in research and development to create eco-friendly packaging solutions.

Some of the major companies operating in the food grade packaging film market include Amcor plc, Berry Global Inc., Sealed Air Corporation, Mondi Group, and Huhtamaki Oyj. Amcor plc is a leading player in the market, known for its innovative packaging solutions and strong focus on sustainability. The company offers a wide range of food grade packaging films that cater to various applications, including bakery, dairy, and meat products. Berry Global Inc. is another prominent player, offering a diverse portfolio of packaging films with a focus on lightweight and recyclable solutions.

Sealed Air Corporation is renowned for its advanced packaging technologies, providing solutions that enhance food safety and extend shelf life. The company's Cryovac brand is widely recognized in the market for its high-performance packaging films. Mondi Group is a key player with a strong presence in the European market, offering sustainable packaging solutions that meet the evolving needs of consumers and businesses. Huhtamaki Oyj is known for its innovative packaging designs and commitment to sustainability, providing a range of food grade packaging films that cater to different end-user requirements.

Key Highlights Food Grade Packaging Film Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Rising consumer preference for convenience foods driving market growth.

- Technological advancements enhancing the functionality of packaging films.

- Expansion of the food and beverage industry in emerging markets.

- Growing trend of online grocery shopping boosting demand for packaging films.

- Stringent regulations on plastic packaging posing challenges for manufacturers.

- Integration of smart packaging technologies enhancing consumer engagement.

- Volatility in raw material prices impacting market stability.

- Focus on product innovation and strategic partnerships among key players.

- Increasing adoption of biodegradable and recyclable packaging materials.

Competitive Intelligence

The competitive landscape of the food grade packaging film market is shaped by the strategies and innovations of key players. Amcor plc, a leader in the market, is known for its commitment to sustainability and innovation. The company focuses on developing packaging solutions that reduce environmental impact while maintaining product quality. Amcor's extensive global presence and strong distribution network give it a competitive advantage in reaching diverse markets.

Berry Global Inc. is another major player, recognized for its diverse product portfolio and focus on lightweight, recyclable packaging solutions. The company's strategic acquisitions and partnerships have strengthened its market position and expanded its customer base. Sealed Air Corporation, with its Cryovac brand, is renowned for its advanced packaging technologies that enhance food safety and extend shelf life. The company's focus on innovation and customer-centric solutions has helped it maintain a strong market presence.

Mondi Group is a key player with a strong emphasis on sustainability and innovation. The company's integrated approach to packaging solutions, from design to production, allows it to offer customized solutions that meet the specific needs of its clients. Huhtamaki Oyj is known for its innovative packaging designs and commitment to sustainability. The company's focus on eco-friendly materials and efficient production processes has positioned it as a leader in the market.

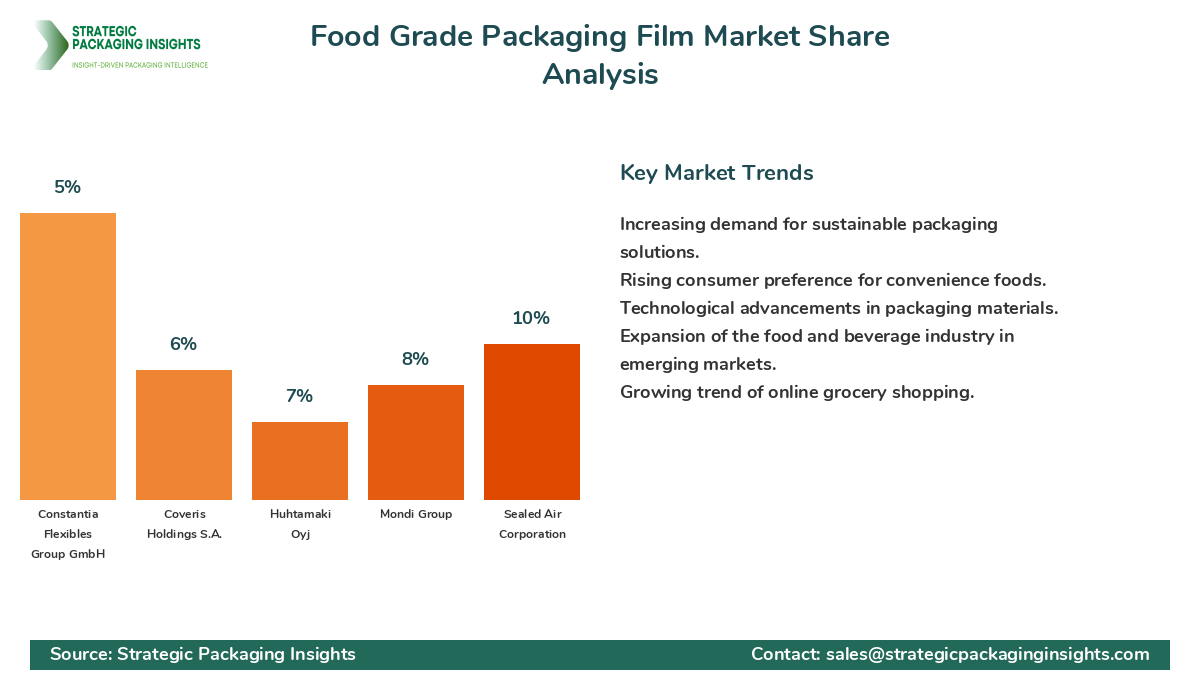

Other notable players in the market include Coveris Holdings S.A., Constantia Flexibles Group GmbH, and Sonoco Products Company. These companies are investing in research and development to create innovative packaging solutions that address the evolving needs of consumers and businesses. The competitive landscape is characterized by a focus on sustainability, innovation, and strategic partnerships, with companies striving to gain a competitive edge through product differentiation and customer engagement.

Regional Market Intelligence of Food Grade Packaging Film

The global food grade packaging film market is segmented into several key regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by the increasing demand for convenience foods and the presence of major food and beverage companies. The region's focus on sustainability and innovation is also contributing to market growth. Europe is witnessing significant growth due to stringent regulations on food safety and packaging, driving the demand for high-quality packaging films.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes are boosting the demand for packaged food products, driving market growth. The region's expanding retail sector and increasing focus on sustainability are also contributing to the growth of the food grade packaging film market. Latin America is experiencing growth due to the increasing demand for packaged food products and the expansion of the food and beverage industry. The region's focus on sustainability and innovation is also driving market growth.

In the Middle East & Africa, the market is driven by the increasing demand for convenience foods and the expansion of the food and beverage industry. The region's focus on sustainability and innovation is also contributing to market growth. The market is characterized by a focus on sustainability, innovation, and strategic partnerships, with companies striving to gain a competitive edge through product differentiation and customer engagement.

Top Countries Insights in Food Grade Packaging Film

The food grade packaging film market is witnessing significant growth in several key countries. In the United States, the market is driven by the increasing demand for convenience foods and the presence of major food and beverage companies. The country's focus on sustainability and innovation is also contributing to market growth. The market size in the United States is currently valued at $3 billion, with a CAGR of 5%.

In China, rapid urbanization and rising disposable incomes are boosting the demand for packaged food products, driving market growth. The country's expanding retail sector and increasing focus on sustainability are also contributing to the growth of the food grade packaging film market. The market size in China is currently valued at $2.5 billion, with a CAGR of 6%.

In India, the market is driven by the increasing demand for convenience foods and the expansion of the food and beverage industry. The country's focus on sustainability and innovation is also contributing to market growth. The market size in India is currently valued at $1.5 billion, with a CAGR of 7%.

In Germany, the market is witnessing significant growth due to stringent regulations on food safety and packaging, driving the demand for high-quality packaging films. The country's focus on sustainability and innovation is also contributing to market growth. The market size in Germany is currently valued at $1 billion, with a CAGR of 4%.

In Brazil, the market is experiencing growth due to the increasing demand for packaged food products and the expansion of the food and beverage industry. The country's focus on sustainability and innovation is also driving market growth. The market size in Brazil is currently valued at $0.8 billion, with a CAGR of 5%.

Food Grade Packaging Film Market Segments Insights

Material Type Analysis

The food grade packaging film market is segmented by material type into plastic, paper, aluminum, and others. Plastic films dominate the market due to their versatility, cost-effectiveness, and excellent barrier properties. However, the increasing environmental concerns and regulatory pressures are driving the demand for alternative materials such as paper and aluminum. Paper-based films are gaining popularity due to their biodegradability and recyclability, making them an attractive option for environmentally conscious consumers. Aluminum films, known for their superior barrier properties, are widely used in applications requiring extended shelf life and protection against moisture and light.

The competition among material types is intensifying as manufacturers strive to develop innovative solutions that meet the evolving needs of consumers and businesses. The demand for sustainable and eco-friendly packaging materials is driving companies to invest in research and development to create new products that offer the same functionality as traditional materials while reducing environmental impact. The shift towards biodegradable and recyclable materials is expected to drive significant growth in the paper and aluminum segments, as companies seek to align with consumer preferences and regulatory requirements.

Application Analysis

The food grade packaging film market is segmented by application into bakery & confectionery, dairy products, fruits & vegetables, meat, poultry & seafood, and others. The bakery & confectionery segment is a major contributor to market growth, driven by the increasing demand for packaged baked goods and confectionery products. The need for packaging films that preserve freshness and extend shelf life is driving innovation in this segment. The dairy products segment is also witnessing significant growth, as packaging films play a crucial role in maintaining the quality and safety of dairy products.

The fruits & vegetables segment is experiencing growth due to the increasing demand for fresh produce and the need for packaging solutions that extend shelf life and reduce food waste. The meat, poultry & seafood segment is driven by the need for packaging films that provide superior barrier properties and ensure food safety. The competition among application segments is intensifying as manufacturers strive to develop innovative solutions that meet the specific needs of each segment. The increasing focus on sustainability and food safety is driving companies to invest in research and development to create packaging films that address these concerns.

End-User Analysis

The food grade packaging film market is segmented by end-user into retail, food service, and industrial. The retail segment is a major contributor to market growth, driven by the increasing demand for packaged food products and the expansion of the retail sector. The need for packaging films that enhance product visibility and appeal is driving innovation in this segment. The food service segment is also witnessing significant growth, as packaging films play a crucial role in ensuring the safe and efficient delivery of food products.

The industrial segment is driven by the need for packaging films that provide superior barrier properties and ensure food safety. The competition among end-user segments is intensifying as manufacturers strive to develop innovative solutions that meet the specific needs of each segment. The increasing focus on sustainability and food safety is driving companies to invest in research and development to create packaging films that address these concerns. The shift towards eco-friendly and recyclable materials is expected to drive significant growth in the retail and food service segments, as companies seek to align with consumer preferences and regulatory requirements.

Regional Analysis

The food grade packaging film market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is a major contributor to market growth, driven by the increasing demand for convenience foods and the presence of major food and beverage companies. The region's focus on sustainability and innovation is also contributing to market growth. Europe is witnessing significant growth due to stringent regulations on food safety and packaging, driving the demand for high-quality packaging films.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes are boosting the demand for packaged food products, driving market growth. The region's expanding retail sector and increasing focus on sustainability are also contributing to the growth of the food grade packaging film market. Latin America is experiencing growth due to the increasing demand for packaged food products and the expansion of the food and beverage industry. The region's focus on sustainability and innovation is also driving market growth. In the Middle East & Africa, the market is driven by the increasing demand for convenience foods and the expansion of the food and beverage industry. The region's focus on sustainability and innovation is also contributing to market growth.

Market Share Analysis

The food grade packaging film market is characterized by a diverse range of players, each vying for a share of the growing market. Leading companies such as Amcor plc, Berry Global Inc., and Sealed Air Corporation dominate the market with their extensive product portfolios and strong focus on innovation and sustainability. These companies are leveraging their global presence and advanced technologies to maintain a competitive edge. However, the market is also witnessing the emergence of regional players who are gaining traction by offering cost-effective and customized solutions tailored to local market needs.

The market share distribution is influenced by several factors, including product innovation, pricing strategies, and strategic partnerships. Companies that invest in research and development to create innovative and sustainable packaging solutions are gaining a competitive advantage. The increasing focus on eco-friendly materials and recyclable packaging is driving companies to explore new technologies and materials, which is reshaping the competitive landscape. Additionally, strategic partnerships and collaborations are enabling companies to expand their market reach and enhance their product offerings, further influencing market share distribution.

Food Grade Packaging Film Market Segments

The Food Grade Packaging Film market has been segmented on the basis of

Material Type

- Plastic

- Paper

- Aluminum

- Others

Application

- Bakery & Confectionery

- Dairy Products

- Fruits & Vegetables

- Meat, Poultry & Seafood

- Others

End-User

- Retail

- Food Service

- Industrial

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the food grade packaging film market?

What challenges does the food grade packaging film market face?

How are companies addressing sustainability in the food grade packaging film market?

What role does innovation play in the food grade packaging film market?

Which regions are experiencing the most growth in the food grade packaging film market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.