- Home

- Food Packaging

- Food Grade Packaging Paper Market Size, Future Growth and Forecast 2033

Food Grade Packaging Paper Market Size, Future Growth and Forecast 2033

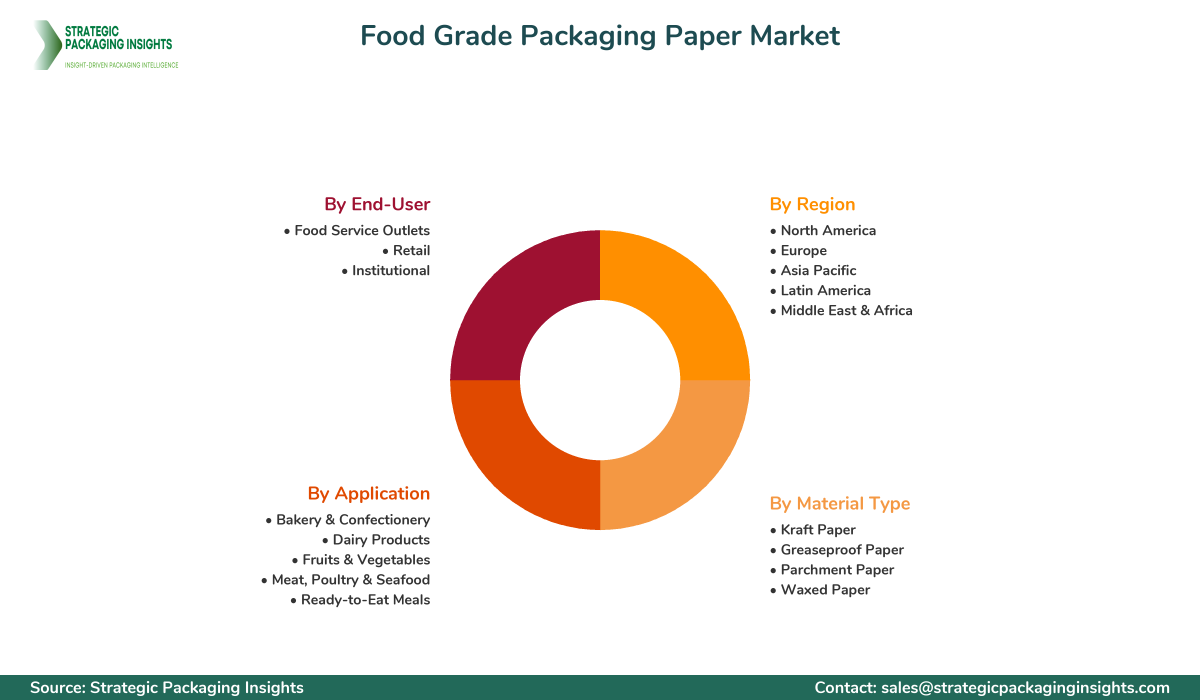

Food Grade Packaging Paper Market Segments - by Material Type (Kraft Paper, Greaseproof Paper, Parchment Paper, Waxed Paper), Application (Bakery & Confectionery, Dairy Products, Fruits & Vegetables, Meat, Poultry & Seafood, Ready-to-Eat Meals), End-User (Food Service Outlets, Retail, Institutional), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Food Grade Packaging Paper Market Outlook

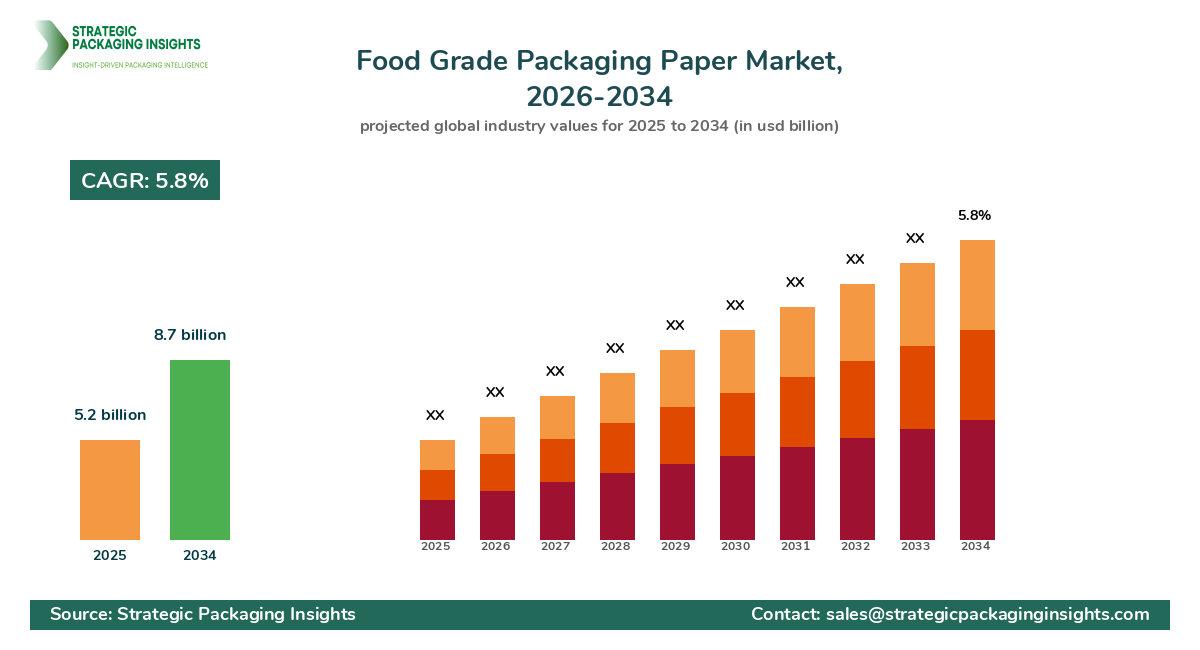

The food grade packaging paper market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033. This market is driven by the increasing demand for sustainable and eco-friendly packaging solutions, as consumers and businesses alike are becoming more environmentally conscious. The rise in packaged food consumption, driven by urbanization and changing lifestyles, is also a significant factor propelling market growth. Additionally, advancements in packaging technology that enhance the shelf life and safety of food products are contributing to the market's expansion.

However, the market faces challenges such as stringent regulations regarding food safety and packaging materials, which can increase production costs and limit market entry for new players. Despite these challenges, the market holds significant growth potential due to the increasing trend of using biodegradable and recyclable materials in packaging. The growing awareness about the environmental impact of plastic packaging is pushing manufacturers to innovate and develop new products that meet both consumer demands and regulatory standards.

Report Scope

| Attributes | Details |

| Report Title | Food Grade Packaging Paper Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 104 |

| Material Type | Kraft Paper, Greaseproof Paper, Parchment Paper, Waxed Paper |

| Application | Bakery & Confectionery, Dairy Products, Fruits & Vegetables, Meat, Poultry & Seafood, Ready-to-Eat Meals |

| End-User | Food Service Outlets, Retail, Institutional |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The food grade packaging paper market presents numerous opportunities for growth, primarily driven by the increasing consumer preference for sustainable packaging solutions. As environmental concerns continue to rise, there is a growing demand for packaging materials that are not only safe for food contact but also environmentally friendly. This shift in consumer behavior is encouraging manufacturers to invest in research and development to create innovative packaging solutions that meet these criteria. Additionally, the expansion of the food and beverage industry, particularly in emerging markets, is creating new opportunities for market players to expand their reach and increase their market share.

Another significant opportunity lies in the technological advancements in packaging materials. Innovations such as moisture-resistant and greaseproof papers are gaining popularity, as they offer enhanced protection for food products while maintaining their eco-friendly attributes. These advancements are opening up new avenues for manufacturers to differentiate their products and cater to a broader range of applications, from bakery and confectionery to ready-to-eat meals. Furthermore, the increasing trend of online food delivery services is driving the demand for efficient and sustainable packaging solutions, providing additional growth opportunities for the market.

Despite the promising opportunities, the market is not without its challenges. One of the primary restrainers is the stringent regulatory environment governing food packaging materials. Compliance with food safety standards and regulations can be costly and time-consuming, posing a barrier to entry for new players and limiting the flexibility of existing manufacturers. Additionally, the high cost of raw materials and the need for continuous innovation to meet changing consumer preferences can strain resources and impact profitability. These factors highlight the need for strategic planning and investment in research and development to overcome these challenges and capitalize on the market's growth potential.

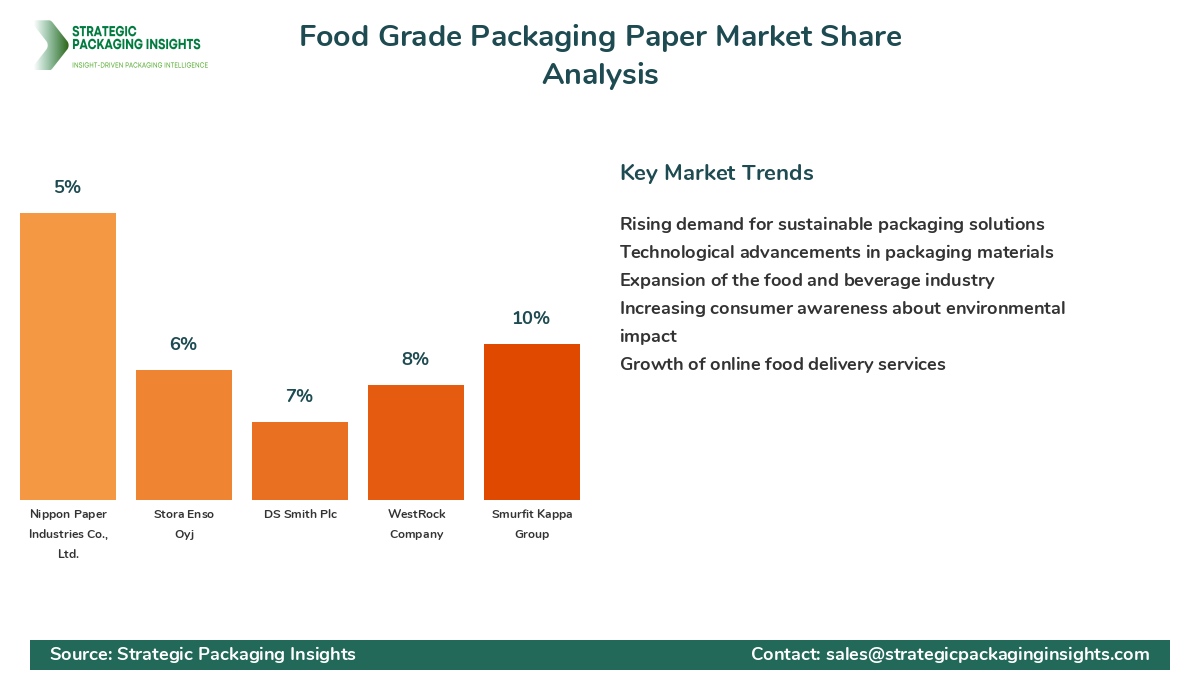

The competitive landscape of the food grade packaging paper market is characterized by the presence of several key players who dominate the market with their extensive product portfolios and strong distribution networks. These companies are continuously investing in research and development to innovate and offer sustainable packaging solutions that meet the evolving needs of consumers and regulatory standards. The market is highly competitive, with players focusing on strategic partnerships, mergers, and acquisitions to expand their market presence and enhance their product offerings.

Among the major companies in the market, International Paper Company holds a significant share due to its extensive range of packaging solutions and strong global presence. The company is known for its commitment to sustainability and innovation, which has helped it maintain a competitive edge in the market. Similarly, Mondi Group is another key player, recognized for its comprehensive portfolio of eco-friendly packaging solutions and its focus on reducing environmental impact through sustainable practices.

Smurfit Kappa Group is also a prominent player in the market, known for its innovative packaging solutions and strong emphasis on sustainability. The company's extensive research and development efforts have enabled it to offer a wide range of products that cater to various applications in the food industry. Additionally, WestRock Company is a major player, with a strong focus on customer-centric solutions and a commitment to sustainability, which has helped it maintain a competitive position in the market.

Other notable companies in the market include DS Smith Plc, known for its innovative and sustainable packaging solutions, and Stora Enso Oyj, which focuses on renewable materials and sustainable practices. These companies, along with others such as Nippon Paper Industries Co., Ltd., and Georgia-Pacific LLC, are continuously striving to enhance their product offerings and expand their market presence through strategic initiatives and collaborations.

Key Highlights Food Grade Packaging Paper Market

- The market is projected to grow at a CAGR of 5.8% from 2025 to 2033.

- Increasing demand for sustainable and eco-friendly packaging solutions is a major driver.

- Technological advancements in packaging materials are opening new growth avenues.

- Stringent regulatory standards pose challenges for market players.

- Expansion of the food and beverage industry in emerging markets offers significant opportunities.

- Online food delivery services are driving demand for efficient packaging solutions.

- Key players are focusing on strategic partnerships and acquisitions to enhance market presence.

- Innovations such as moisture-resistant and greaseproof papers are gaining popularity.

- High cost of raw materials is a restraining factor for market growth.

- Consumer preference for biodegradable and recyclable materials is increasing.

Competitive Intelligence

The competitive landscape of the food grade packaging paper market is shaped by the strategies and innovations of the top companies operating in this space. International Paper Company, with its strong global presence and commitment to sustainability, leads the market with a significant share. The company's focus on innovation and eco-friendly solutions has helped it maintain a competitive edge. Mondi Group follows closely, known for its comprehensive portfolio of sustainable packaging solutions and its efforts to reduce environmental impact.

Smurfit Kappa Group is another key player, recognized for its innovative packaging solutions and strong emphasis on sustainability. The company's extensive research and development efforts have enabled it to offer a wide range of products that cater to various applications in the food industry. WestRock Company, with its customer-centric approach and commitment to sustainability, also holds a significant share in the market.

DS Smith Plc and Stora Enso Oyj are notable players, known for their focus on renewable materials and sustainable practices. These companies, along with Nippon Paper Industries Co., Ltd., and Georgia-Pacific LLC, are continuously striving to enhance their product offerings and expand their market presence through strategic initiatives and collaborations. The competitive landscape is further enriched by the presence of companies like Oji Holdings Corporation and Sappi Limited, which are known for their innovative solutions and strong market presence.

Overall, the market is characterized by intense competition, with companies focusing on strategic partnerships, mergers, and acquisitions to expand their market presence and enhance their product offerings. The emphasis on sustainability and innovation is a common theme among the top players, as they strive to meet the evolving needs of consumers and regulatory standards. The competitive landscape is dynamic, with companies continuously adapting their strategies to maintain a competitive edge and capitalize on the market's growth potential.

Regional Market Intelligence of Food Grade Packaging Paper

The global food grade packaging paper market is segmented into several key regions, each with its unique market dynamics and growth drivers. In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of major food and beverage companies. The region's focus on reducing environmental impact and adhering to stringent regulatory standards is also contributing to market growth. The market in North America was valued at $1.5 billion in 2024 and is expected to grow at a CAGR of 12% during the forecast period.

In Europe, the market is characterized by a strong emphasis on sustainability and innovation. The region's stringent regulations regarding food safety and packaging materials are driving manufacturers to invest in research and development to create eco-friendly solutions. The market in Europe was valued at $1.2 billion in 2024 and is projected to grow at a CAGR of 9% during the forecast period.

The Asia-Pacific region is experiencing rapid growth, driven by the expanding food and beverage industry and increasing consumer awareness about sustainable packaging. The region's large population and rising disposable incomes are also contributing to market growth. The market in Asia-Pacific was valued at $2.0 billion in 2024 and is expected to grow at a CAGR of 15% during the forecast period.

In Latin America, the market is driven by the growing demand for packaged food products and the increasing focus on sustainability. The region's expanding middle class and urbanization are also contributing to market growth. The market in Latin America was valued at $0.8 billion in 2024 and is projected to grow at a CAGR of 7% during the forecast period.

The Middle East & Africa region is experiencing moderate growth, driven by the increasing demand for sustainable packaging solutions and the expansion of the food and beverage industry. The market in this region was valued at $0.7 billion in 2024 and is expected to grow at a CAGR of 5% during the forecast period.

Top Countries Insights in Food Grade Packaging Paper

In the United States, the food grade packaging paper market is driven by the increasing demand for sustainable packaging solutions and the presence of major food and beverage companies. The market was valued at $1.2 billion in 2024, with a CAGR of 6%. The country's focus on reducing environmental impact and adhering to stringent regulatory standards is also contributing to market growth.

In Germany, the market is characterized by a strong emphasis on sustainability and innovation. The country's stringent regulations regarding food safety and packaging materials are driving manufacturers to invest in research and development to create eco-friendly solutions. The market was valued at $0.9 billion in 2024, with a CAGR of 5%.

In China, the market is experiencing rapid growth, driven by the expanding food and beverage industry and increasing consumer awareness about sustainable packaging. The country's large population and rising disposable incomes are also contributing to market growth. The market was valued at $1.5 billion in 2024, with a CAGR of 8%.

In Brazil, the market is driven by the growing demand for packaged food products and the increasing focus on sustainability. The country's expanding middle class and urbanization are also contributing to market growth. The market was valued at $0.6 billion in 2024, with a CAGR of 4%.

In South Africa, the market is experiencing moderate growth, driven by the increasing demand for sustainable packaging solutions and the expansion of the food and beverage industry. The market was valued at $0.5 billion in 2024, with a CAGR of 3%.

Food Grade Packaging Paper Market Segments Insights

Material Type Analysis

The material type segment of the food grade packaging paper market is dominated by kraft paper, which is widely used due to its strength and durability. Kraft paper is favored for its eco-friendly properties and ability to be recycled, making it a popular choice among manufacturers and consumers alike. The demand for greaseproof paper is also on the rise, driven by its ability to resist oil and moisture, making it ideal for packaging greasy or oily foods. Parchment paper is another key material, known for its non-stick properties and versatility in various food applications. Waxed paper, although less popular, is used for its moisture-resistant properties, particularly in the packaging of dairy products and baked goods.

The market for these materials is driven by the increasing demand for sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are biodegradable and recyclable. This trend is encouraging manufacturers to invest in research and development to create innovative materials that meet these criteria. Additionally, the expansion of the food and beverage industry, particularly in emerging markets, is creating new opportunities for market players to expand their reach and increase their market share.

Application Analysis

The application segment of the food grade packaging paper market is diverse, with bakery and confectionery being one of the largest segments. The demand for packaging solutions in this segment is driven by the increasing consumption of baked goods and confectionery products, particularly in urban areas. Dairy products are another significant application, with packaging solutions designed to maintain the freshness and quality of products such as cheese, butter, and yogurt. The fruits and vegetables segment is also growing, driven by the increasing demand for fresh produce and the need for packaging solutions that extend shelf life and reduce spoilage.

Meat, poultry, and seafood are other key applications, with packaging solutions designed to ensure the safety and quality of these products. The ready-to-eat meals segment is also expanding, driven by the increasing demand for convenient and quick meal options. The growth of online food delivery services is further driving demand for efficient and sustainable packaging solutions in this segment. Overall, the application segment is characterized by a diverse range of products and solutions, with manufacturers focusing on innovation and sustainability to meet the evolving needs of consumers and regulatory standards.

End-User Analysis

The end-user segment of the food grade packaging paper market is dominated by food service outlets, which account for a significant share of the market. The demand for packaging solutions in this segment is driven by the increasing consumption of takeout and delivery meals, particularly in urban areas. Retail is another key end-user, with packaging solutions designed to enhance the shelf appeal and safety of food products. The institutional segment, which includes schools, hospitals, and other large-scale food service providers, is also a significant end-user, with demand driven by the need for efficient and sustainable packaging solutions.

The growth of these end-user segments is driven by the increasing demand for convenient and sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are biodegradable and recyclable. This trend is encouraging manufacturers to invest in research and development to create innovative solutions that meet these criteria. Additionally, the expansion of the food and beverage industry, particularly in emerging markets, is creating new opportunities for market players to expand their reach and increase their market share.

Regional Analysis

The regional segment of the food grade packaging paper market is characterized by diverse market dynamics and growth drivers. In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of major food and beverage companies. The region's focus on reducing environmental impact and adhering to stringent regulatory standards is also contributing to market growth. In Europe, the market is characterized by a strong emphasis on sustainability and innovation, with manufacturers investing in research and development to create eco-friendly solutions.

The Asia-Pacific region is experiencing rapid growth, driven by the expanding food and beverage industry and increasing consumer awareness about sustainable packaging. The region's large population and rising disposable incomes are also contributing to market growth. In Latin America, the market is driven by the growing demand for packaged food products and the increasing focus on sustainability. The Middle East & Africa region is experiencing moderate growth, driven by the increasing demand for sustainable packaging solutions and the expansion of the food and beverage industry.

Market Share Analysis

The market share distribution of key players in the food grade packaging paper market is characterized by the dominance of a few major companies, with International Paper Company, Mondi Group, and Smurfit Kappa Group leading the market. These companies have established themselves as leaders through their extensive product portfolios, strong distribution networks, and commitment to sustainability. The competitive positioning of these companies is further strengthened by their focus on innovation and strategic partnerships, which enable them to maintain a competitive edge and capitalize on the market's growth potential.

The market share distribution also affects pricing, with leading companies able to leverage their economies of scale to offer competitive pricing and enhance their market presence. Additionally, the emphasis on innovation and sustainability is driving partnerships and collaborations among market players, as they seek to enhance their product offerings and expand their market reach. Overall, the market share distribution is dynamic, with companies continuously adapting their strategies to maintain a competitive edge and capitalize on the market's growth potential.

Food Grade Packaging Paper Market Segments

The Food Grade Packaging Paper market has been segmented on the basis of

Material Type

- Kraft Paper

- Greaseproof Paper

- Parchment Paper

- Waxed Paper

Application

- Bakery & Confectionery

- Dairy Products

- Fruits & Vegetables

- Meat, Poultry & Seafood

- Ready-to-Eat Meals

End-User

- Food Service Outlets

- Retail

- Institutional

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the food grade packaging paper market?

What challenges do companies face in this market?

How are companies addressing the demand for eco-friendly packaging?

What role does innovation play in this market?

How is the market expected to evolve in the coming years?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.