- Home

- Food Packaging

- Fresh Beef Packaging Market Size, Future Growth and Forecast 2033

Fresh Beef Packaging Market Size, Future Growth and Forecast 2033

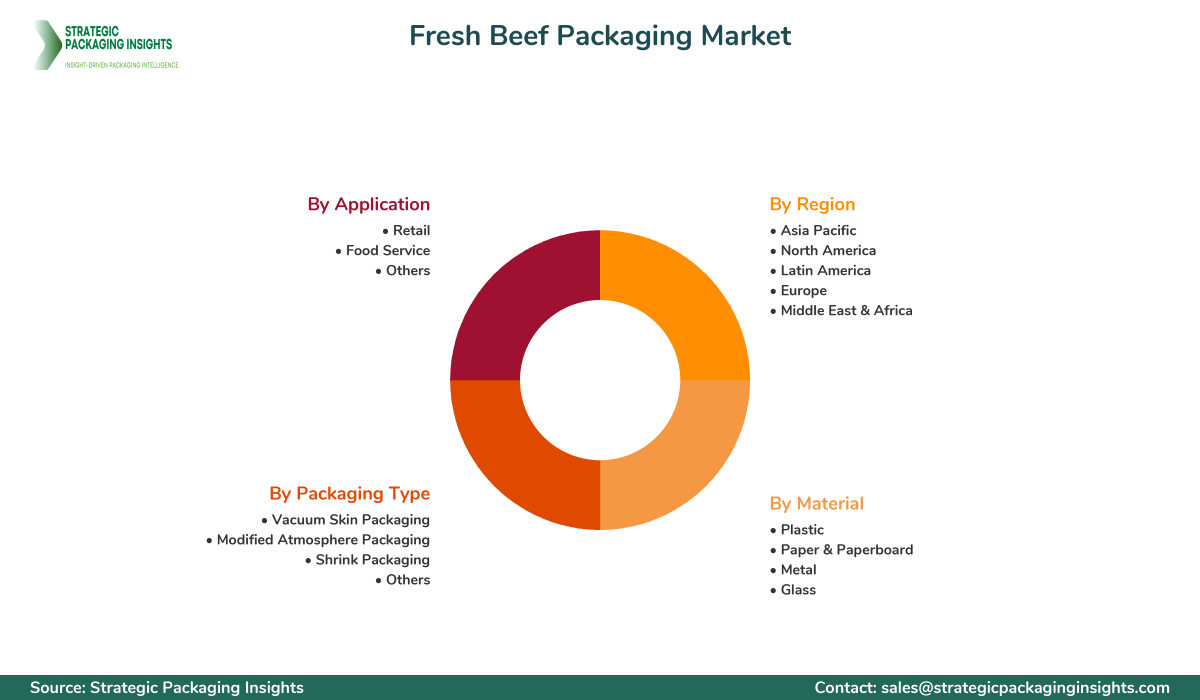

Fresh Beef Packaging Market Segments - by Material (Plastic, Paper & Paperboard, Metal, Glass), Packaging Type (Vacuum Skin Packaging, Modified Atmosphere Packaging, Shrink Packaging, Others), Application (Retail, Food Service, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Fresh Beef Packaging Market Outlook

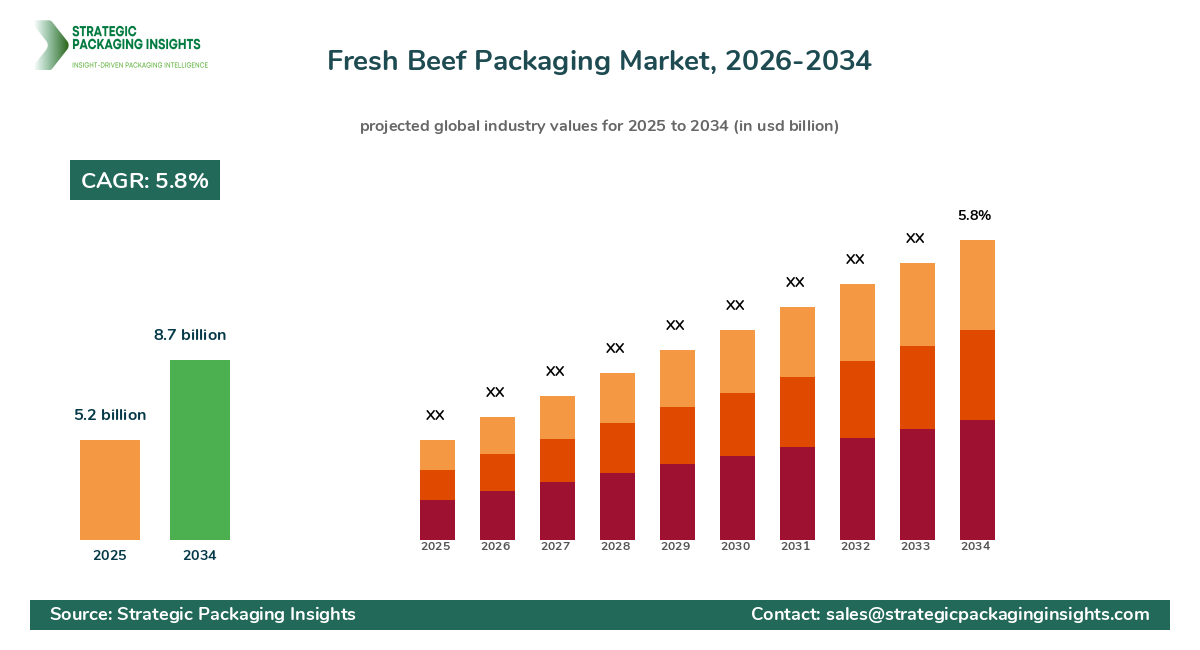

The Fresh Beef Packaging market was valued at $5.2 billion in 2024 and is projected to reach $8.7 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033. This market is driven by the increasing demand for fresh beef products, which necessitates effective packaging solutions to maintain quality and extend shelf life. The rise in consumer preference for fresh and minimally processed meat products is a significant driver, as is the growing trend of urbanization, which increases the demand for convenient and ready-to-cook meat products. Additionally, advancements in packaging technologies, such as vacuum skin packaging and Modified Atmosphere packaging, are enhancing the preservation of beef products, thereby boosting market growth.

However, the market faces challenges such as stringent regulatory requirements regarding food safety and packaging materials, which can increase production costs and limit market expansion. Environmental concerns related to plastic packaging waste are also a significant restraint, prompting manufacturers to explore sustainable and eco-friendly packaging alternatives. Despite these challenges, the market holds substantial growth potential due to the increasing adoption of innovative packaging solutions that enhance product visibility and consumer appeal. The shift towards sustainable packaging materials and the integration of smart packaging technologies are expected to create lucrative opportunities for market players in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Fresh Beef Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 215 |

| Material | Plastic, Paper & Paperboard, Metal, Glass |

| Packaging Type | Vacuum Skin Packaging, Modified Atmosphere Packaging, Shrink Packaging, Others |

| Application | Retail, Food Service, Others |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The Fresh Beef Packaging market presents numerous opportunities, particularly with the increasing consumer demand for sustainable and eco-friendly packaging solutions. As environmental awareness grows, consumers are becoming more conscious of the packaging materials used in their food products. This shift in consumer preference is driving manufacturers to innovate and develop packaging solutions that are not only effective in preserving the quality of fresh beef but also environmentally sustainable. The adoption of biodegradable and recyclable materials is gaining traction, offering significant growth opportunities for companies that can successfully integrate these materials into their packaging solutions.

Another opportunity lies in the technological advancements in packaging methods. Innovations such as vacuum Skin Packaging and modified atmosphere packaging are enhancing the shelf life and quality of fresh beef products, making them more appealing to consumers. These technologies help maintain the freshness and nutritional value of beef, reducing food waste and increasing consumer satisfaction. Companies that invest in research and development to improve these technologies and make them more cost-effective are likely to gain a competitive edge in the market.

Despite these opportunities, the market faces threats from stringent regulatory requirements and environmental concerns. Regulations regarding food safety and packaging materials can increase production costs and pose challenges for manufacturers. Additionally, the environmental impact of plastic packaging waste is a significant concern, prompting regulatory bodies to impose stricter guidelines on packaging materials. Companies must navigate these challenges by investing in sustainable packaging solutions and ensuring compliance with regulatory standards to maintain their market position.

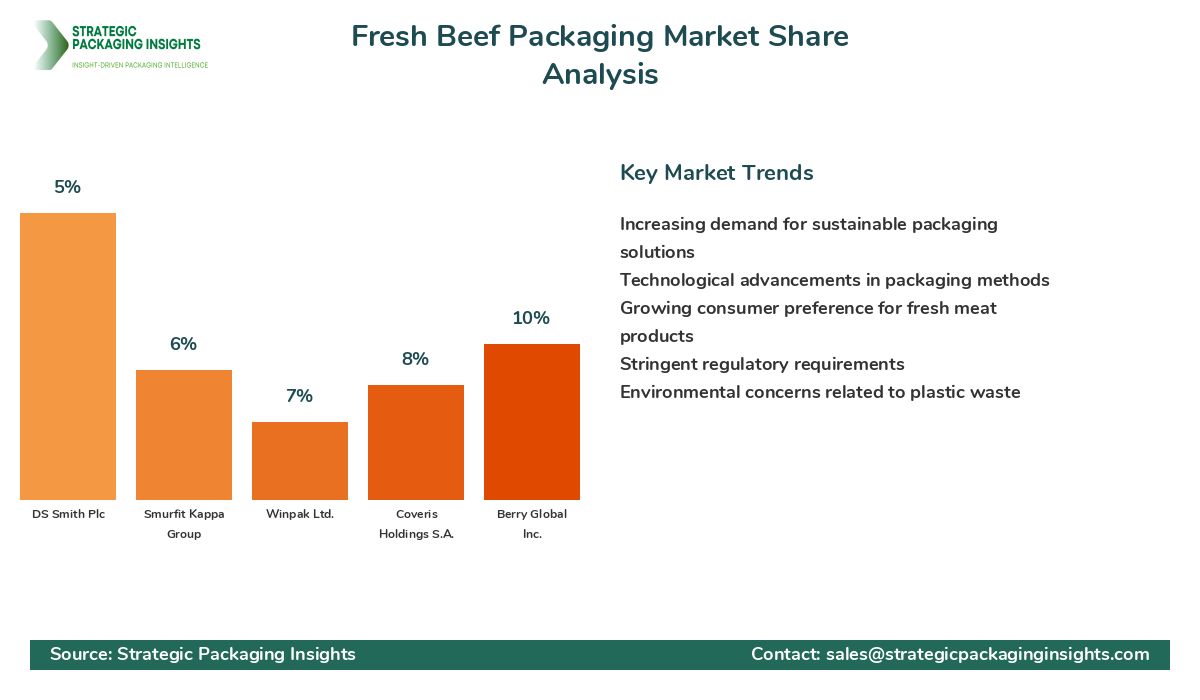

The Fresh Beef Packaging market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of established companies and emerging players, each striving to innovate and offer superior packaging solutions. The competitive dynamics are influenced by factors such as product quality, technological advancements, pricing strategies, and brand reputation. Companies are focusing on expanding their product portfolios and enhancing their distribution networks to strengthen their market presence.

Major players in the market include Amcor Plc, Sealed Air Corporation, Berry Global Inc., and Coveris Holdings S.A. These companies hold significant market shares due to their extensive product offerings and strong global presence. Amcor Plc, for instance, is known for its innovative packaging solutions and commitment to sustainability, which has helped it maintain a leading position in the market. Sealed Air Corporation is another key player, renowned for its advanced packaging technologies that enhance product safety and extend shelf life.

Berry Global Inc. is a prominent player with a diverse range of packaging solutions catering to various industries, including fresh beef packaging. The company's focus on sustainability and innovation has enabled it to capture a substantial market share. Coveris Holdings S.A. is also a significant player, offering a wide array of packaging solutions that meet the evolving needs of the fresh beef packaging market. The company's emphasis on quality and customer satisfaction has contributed to its strong market position.

Other notable companies in the market include Winpak Ltd., Smurfit Kappa Group, DS Smith Plc, and Mondi Group. These companies are actively investing in research and development to enhance their product offerings and meet the growing demand for sustainable packaging solutions. The competitive landscape is further shaped by strategic partnerships, mergers, and acquisitions, as companies seek to expand their market reach and strengthen their competitive position.

Key Highlights Fresh Beef Packaging Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Technological advancements in packaging methods, such as vacuum skin packaging and modified atmosphere packaging.

- Growing consumer preference for fresh and minimally processed meat products.

- Stringent regulatory requirements regarding food safety and packaging materials.

- Environmental concerns related to plastic packaging waste.

- Rising urbanization and demand for convenient and ready-to-cook meat products.

- Integration of smart packaging technologies to enhance product visibility and consumer appeal.

- Expansion of product portfolios and distribution networks by key market players.

- Strategic partnerships, mergers, and acquisitions to strengthen market position.

- Focus on research and development to improve packaging technologies and sustainability.

Top Countries Insights in Fresh Beef Packaging

The United States is a leading market for fresh beef packaging, with a market size of $1.5 billion and a CAGR of 6%. The country's robust beef industry and high consumer demand for fresh meat products drive the market. Innovations in packaging technologies and a strong focus on sustainability are key growth drivers. However, regulatory challenges and environmental concerns related to packaging waste pose challenges for market players.

In China, the fresh beef packaging market is valued at $1.2 billion, with a CAGR of 8%. The growing middle class and increasing consumer preference for high-quality meat products are driving market growth. The government's focus on food safety and quality standards is also a significant growth driver. However, the market faces challenges related to supply chain inefficiencies and regulatory compliance.

Germany's fresh beef packaging market is valued at $900 million, with a CAGR of 5%. The country's strong meat processing industry and consumer demand for fresh and minimally processed meat products drive the market. The focus on sustainability and eco-friendly packaging solutions is a key growth driver. However, stringent regulatory requirements and environmental concerns pose challenges for market players.

Brazil's fresh beef packaging market is valued at $800 million, with a CAGR of 7%. The country's large beef industry and growing consumer demand for fresh meat products drive the market. Innovations in packaging technologies and a focus on sustainability are key growth drivers. However, regulatory challenges and environmental concerns related to packaging waste pose challenges for market players.

In India, the fresh beef packaging market is valued at $700 million, with a CAGR of 9%. The country's growing middle class and increasing consumer preference for high-quality meat products are driving market growth. The government's focus on food safety and quality standards is also a significant growth driver. However, the market faces challenges related to supply chain inefficiencies and regulatory compliance.

Value Chain Profitability Analysis

The value chain of the Fresh Beef Packaging market involves several key stakeholders, each contributing to the overall profitability of the industry. The primary stakeholders include raw material suppliers, packaging manufacturers, distributors, and retailers. Raw material suppliers provide the essential materials required for packaging production, such as plastics, paper, and metal. These suppliers capture a significant portion of the value chain, with profit margins ranging from 10% to 15%.

Packaging manufacturers play a crucial role in the value chain, transforming raw materials into finished packaging products. These manufacturers capture a substantial share of the market value, with profit margins ranging from 15% to 20%. The adoption of advanced packaging technologies and sustainable materials is enhancing the profitability of this segment. Distributors and retailers are responsible for delivering the packaged products to end consumers. These stakeholders capture a smaller share of the market value, with profit margins ranging from 5% to 10%.

Digital transformation is reshaping the value chain, with technology platforms and service providers capturing an increasing share of the market value. The integration of smart packaging technologies and data analytics is enhancing the efficiency and profitability of the value chain. As a result, companies that invest in digital transformation and innovation are likely to capture a larger share of the market value in the coming years.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The Fresh Beef Packaging market has undergone significant changes between 2018 and 2024, with evolving consumer preferences and technological advancements driving market dynamics. During this period, the market experienced a steady growth rate, with a CAGR of 4.5%. The increasing demand for fresh and minimally processed meat products, coupled with advancements in packaging technologies, contributed to market growth. The focus on sustainability and eco-friendly packaging solutions also gained prominence, influencing market dynamics.

Looking ahead to the forecast period of 2025–2033, the market is expected to experience accelerated growth, with a projected CAGR of 5.8%. The adoption of innovative packaging solutions, such as vacuum skin packaging and modified atmosphere packaging, is expected to drive market growth. The integration of smart packaging technologies and the shift towards sustainable materials will further enhance market dynamics. Companies that invest in research and development to improve packaging technologies and sustainability are likely to gain a competitive edge in the market.

Regional contributions to the market are also expected to shift, with Asia Pacific emerging as a key growth region. The increasing consumer demand for high-quality meat products and the focus on food safety and quality standards are driving market growth in this region. North America and Europe are expected to maintain their strong market positions, driven by technological advancements and a focus on sustainability. However, regulatory challenges and environmental concerns related to packaging waste will continue to pose challenges for market players.

Fresh Beef Packaging Market Segments Insights

Material Analysis

The material segment of the Fresh Beef Packaging market is dominated by plastic, which is widely used due to its durability, flexibility, and cost-effectiveness. However, environmental concerns related to plastic waste are driving the demand for alternative materials such as paper and paperboard. These materials are gaining traction due to their biodegradability and recyclability, aligning with the growing consumer preference for sustainable packaging solutions. Metal and glass are also used in niche applications, offering superior protection and preservation of fresh beef products.

The competition in the material segment is intense, with companies focusing on developing innovative and sustainable packaging solutions. The demand for eco-friendly materials is driving research and development efforts, with companies investing in biodegradable and recyclable materials. The shift towards sustainable materials is expected to create significant growth opportunities for market players, as consumers increasingly prioritize environmental sustainability in their purchasing decisions.

Packaging Type Analysis

The packaging type segment is characterized by the dominance of vacuum skin packaging and modified atmosphere packaging, which are widely used due to their ability to extend the shelf life of fresh beef products. These packaging types are gaining popularity due to their effectiveness in preserving the quality and freshness of meat products, reducing food waste, and enhancing consumer satisfaction. Shrink packaging and other packaging types are also used, offering cost-effective solutions for various applications.

The demand for advanced packaging types is driven by the increasing consumer preference for fresh and minimally processed meat products. Companies are focusing on developing innovative packaging solutions that enhance product visibility and consumer appeal. The integration of smart packaging technologies, such as QR codes and sensors, is also gaining traction, offering consumers additional information about the product and enhancing their purchasing experience.

Application Analysis

The application segment of the Fresh Beef Packaging market is dominated by the retail sector, which accounts for a significant share of the market. The increasing consumer demand for fresh and high-quality meat products is driving the growth of this segment. The food service sector is also a key application area, with restaurants and catering services requiring effective packaging solutions to maintain the quality and freshness of their meat products.

The demand for fresh beef packaging solutions in the retail sector is driven by the growing trend of urbanization and the increasing consumer preference for convenient and ready-to-cook meat products. Companies are focusing on developing packaging solutions that enhance product visibility and consumer appeal, offering a competitive edge in the market. The food service sector is also experiencing growth, with companies investing in innovative packaging solutions to meet the evolving needs of their customers.

Region Analysis

The regional segment of the Fresh Beef Packaging market is characterized by the dominance of North America and Europe, which account for a significant share of the market. These regions are driven by technological advancements and a strong focus on sustainability, with companies investing in innovative packaging solutions to meet the growing demand for fresh and high-quality meat products. Asia Pacific is emerging as a key growth region, driven by the increasing consumer demand for high-quality meat products and the focus on food safety and quality standards.

The competition in the regional segment is intense, with companies focusing on expanding their product portfolios and enhancing their distribution networks to strengthen their market presence. The shift towards sustainable packaging solutions is also gaining traction, with companies investing in biodegradable and recyclable materials to meet the growing consumer demand for environmentally sustainable products. The regional dynamics are expected to evolve, with Asia Pacific emerging as a key growth region in the coming years.

Fresh Beef Packaging Market Segments

The Fresh Beef Packaging market has been segmented on the basis of

Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

Packaging Type

- Vacuum Skin Packaging

- Modified Atmosphere Packaging

- Shrink Packaging

- Others

Application

- Retail

- Food Service

- Others

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the Fresh Beef Packaging market?

What challenges does the Fresh Beef Packaging market face?

How is technology impacting the Fresh Beef Packaging market?

What opportunities exist for companies in the Fresh Beef Packaging market?

Which regions are expected to see the most growth in the Fresh Beef Packaging market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.