- Home

- Food Packaging

- Frozen Fresh Meat Packaging Market Size, Future Growth and Forecast 2033

Frozen Fresh Meat Packaging Market Size, Future Growth and Forecast 2033

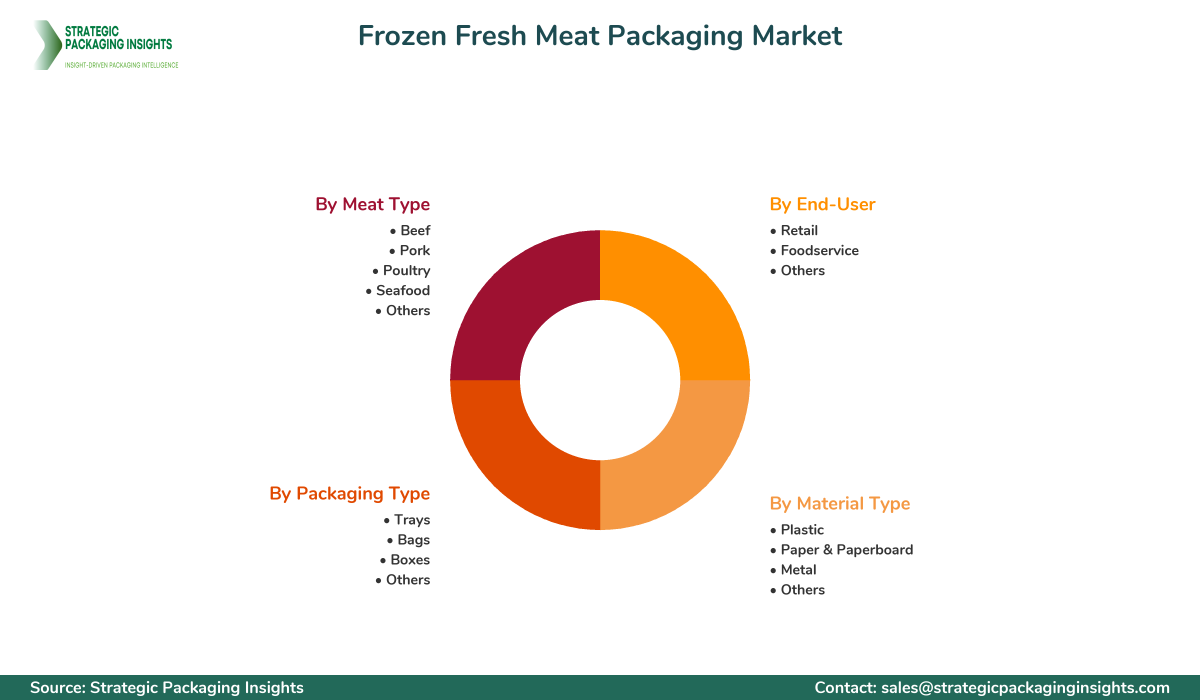

Frozen Fresh Meat Packaging Market Segments - by Material Type (Plastic, Paper & Paperboard, Metal, Others), Packaging Type (Trays, Bags, Boxes, Others), Meat Type (Beef, Pork, Poultry, Seafood, Others), End-User (Retail, Foodservice, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Frozen Fresh Meat Packaging Market Outlook

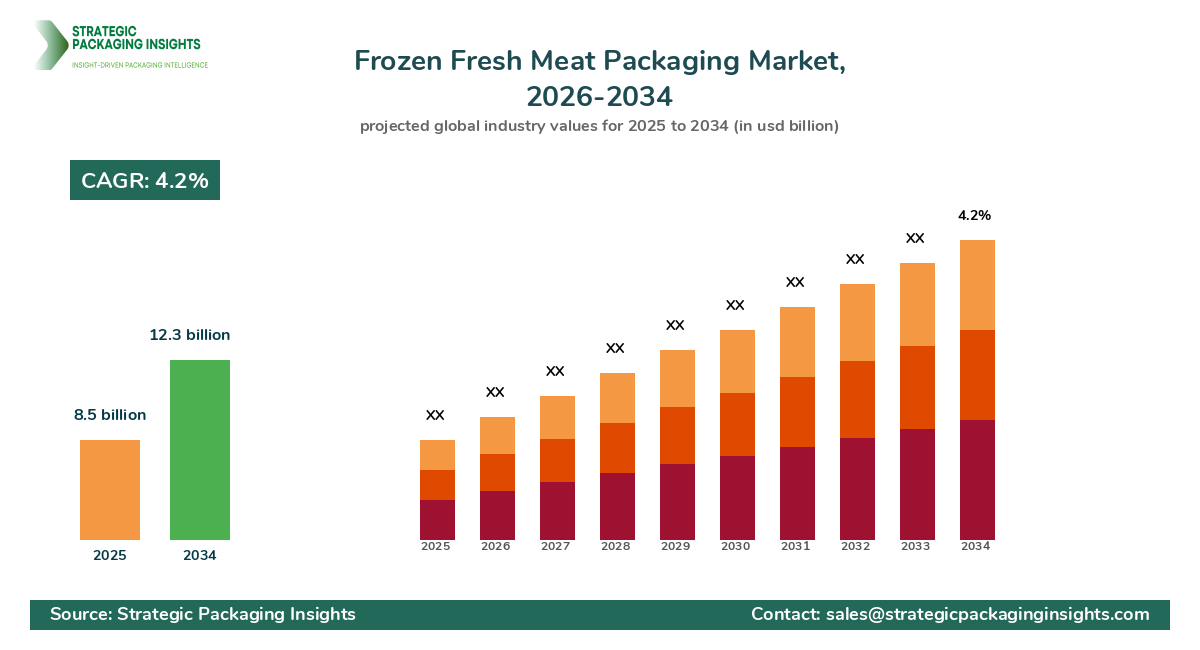

The frozen fresh meat packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033. This market is driven by the increasing demand for convenient and long-lasting meat products, which has led to innovations in packaging technologies that enhance shelf life and maintain product quality. The rise in consumer preference for Frozen Meat due to its ease of storage and preparation is also a significant factor propelling market growth. Additionally, the expansion of retail chains and the growing trend of online grocery shopping are contributing to the increased demand for effective packaging solutions that ensure product safety and quality during transportation and storage.

However, the market faces challenges such as stringent environmental regulations regarding plastic usage, which is a predominant material in meat packaging. The need for sustainable and eco-friendly packaging solutions is becoming more pressing, pushing manufacturers to innovate and adopt biodegradable materials. Despite these challenges, the market holds substantial growth potential due to the increasing global meat consumption and the rising demand for high-quality packaging solutions that cater to the evolving consumer preferences. The development of smart packaging technologies that offer features like temperature monitoring and spoilage detection is expected to open new avenues for market expansion.

Report Scope

| Attributes | Details |

| Report Title | Frozen Fresh Meat Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 236 |

| Material Type | Plastic, Paper & Paperboard, Metal, Others |

| Packaging Type | Trays, Bags, Boxes, Others |

| Meat Type | Beef, Pork, Poultry, Seafood, Others |

| End-User | Retail, Foodservice, Others |

| Customization Available | Yes* |

Opportunities & Threats

The frozen fresh meat packaging market presents numerous opportunities, particularly in the realm of technological advancements. The integration of smart packaging solutions, such as RFID tags and QR codes, allows for better tracking and monitoring of meat products throughout the supply chain. This not only enhances transparency but also improves inventory management and reduces food waste. Additionally, the growing consumer awareness regarding food safety and quality is driving demand for packaging solutions that offer extended shelf life and protection against contamination. Companies that invest in research and development to create innovative packaging materials and designs are likely to gain a competitive edge in the market.

Another significant opportunity lies in the expansion of e-commerce and online grocery shopping. As more consumers turn to online platforms for their grocery needs, the demand for reliable and efficient packaging solutions that ensure the safe delivery of frozen meat products is on the rise. This trend is particularly prominent in urban areas where convenience and time-saving are key factors influencing purchasing decisions. Packaging companies that can offer solutions tailored to the specific requirements of online retail, such as insulation and temperature control, are well-positioned to capitalize on this growing market segment.

Despite the promising opportunities, the market is not without its challenges. One of the primary restrainers is the increasing regulatory pressure to reduce plastic waste and promote sustainable packaging solutions. Governments and environmental organizations worldwide are implementing stricter regulations to curb plastic pollution, which poses a significant challenge for packaging manufacturers heavily reliant on plastic materials. Companies must navigate these regulatory landscapes and invest in the development of eco-friendly alternatives to remain compliant and competitive. Additionally, the high cost of sustainable packaging materials can be a barrier for small and medium-sized enterprises looking to enter the market.

The frozen fresh meat packaging market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of established companies and emerging players, each striving to innovate and offer superior packaging solutions. The competitive dynamics are influenced by factors such as product quality, pricing strategies, and technological advancements. Companies that can effectively balance these elements are likely to maintain or increase their market share.

Major companies in the market include Amcor Plc, Sealed Air Corporation, Berry Global Inc., and Mondi Group, among others. Amcor Plc is known for its extensive range of packaging solutions that cater to various segments of the food industry, including frozen meat. The company's focus on sustainability and innovation has helped it maintain a strong market position. Sealed Air Corporation, with its Cryovac brand, is a leader in providing packaging solutions that enhance food safety and extend shelf life. The company's commitment to reducing food waste through innovative packaging technologies has been a key driver of its success.

Berry Global Inc. is another prominent player, offering a wide array of packaging products that emphasize durability and environmental sustainability. The company's strategic acquisitions and investments in research and development have bolstered its market presence. Mondi Group, with its focus on sustainable packaging solutions, has been at the forefront of developing eco-friendly materials that meet the evolving needs of consumers and regulatory bodies. The company's global reach and strong customer relationships have been instrumental in its growth.

Other notable players include Smurfit Kappa Group, DS Smith Plc, and Coveris Holdings S.A. Smurfit Kappa Group is renowned for its innovative paper-based packaging solutions that offer both functionality and sustainability. DS Smith Plc has made significant strides in the development of recyclable and biodegradable packaging materials, aligning with the growing demand for eco-friendly solutions. Coveris Holdings S.A. focuses on providing flexible packaging solutions that cater to the specific needs of the frozen meat industry, emphasizing product protection and shelf appeal.

Key Highlights Frozen Fresh Meat Packaging Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Technological advancements in smart packaging for enhanced product tracking.

- Growth in online grocery shopping driving demand for efficient packaging.

- Regulatory pressures to reduce plastic usage and promote sustainability.

- Expansion of retail chains boosting demand for frozen meat packaging.

- Rising consumer awareness regarding food safety and quality.

- Development of biodegradable and recyclable packaging materials.

- Innovations in packaging designs to extend product shelf life.

- Growing global meat consumption fueling market growth.

- Strategic partnerships and acquisitions among key market players.

Premium Insights - Key Investment Analysis

The frozen fresh meat packaging market is witnessing significant investment activity, driven by the need for innovative and sustainable packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and technologically advanced packaging products. The growing consumer demand for sustainable packaging is prompting investors to allocate capital towards companies that prioritize environmental responsibility and innovation.

Merger and acquisition (M&A) activity is also on the rise, with larger companies acquiring smaller firms to expand their product portfolios and enhance their market presence. These strategic acquisitions are often aimed at gaining access to new technologies and expanding into emerging markets. The trend of consolidation in the packaging industry is expected to continue as companies seek to strengthen their competitive positions and capitalize on growth opportunities.

Investment valuations in the frozen fresh meat packaging market are influenced by factors such as the company's technological capabilities, market reach, and sustainability initiatives. Companies that demonstrate strong growth potential and a commitment to innovation are attracting higher valuations. Investors are also keen on companies that can offer a high return on investment (ROI) through cost-effective and efficient packaging solutions.

Emerging investment themes in the market include the development of smart packaging technologies, such as temperature-sensitive Labels and spoilage indicators, which enhance product safety and reduce food waste. Additionally, the shift towards biodegradable and recyclable materials is gaining traction, with investors showing interest in companies that can deliver sustainable solutions without compromising on quality or performance.

Frozen Fresh Meat Packaging Market Segments Insights

Material Type Analysis

The material type segment in the frozen fresh meat packaging market is dominated by plastic, which is favored for its durability, flexibility, and cost-effectiveness. However, the increasing environmental concerns and regulatory pressures are driving the demand for alternative materials such as paper & paperboard and metal. Companies are investing in research and development to create biodegradable and recyclable plastic alternatives that meet the sustainability criteria without compromising on performance. The shift towards eco-friendly materials is expected to gain momentum, with paper & paperboard emerging as a viable option due to its recyclability and biodegradability.

Metal Packaging, although less common, is gaining traction due to its superior barrier properties and ability to withstand extreme temperatures. This makes it an ideal choice for packaging frozen meat products that require extended shelf life and protection against contamination. The demand for metal packaging is particularly strong in regions with stringent food safety regulations, where maintaining product integrity is of utmost importance. As consumer preferences continue to evolve, the material type segment is likely to witness significant innovations aimed at enhancing sustainability and functionality.

Packaging Type Analysis

The packaging type segment is characterized by a variety of options, including trays, bags, boxes, and others. Trays are widely used due to their ability to provide excellent product visibility and protection. They are particularly popular in retail settings where product presentation plays a crucial role in influencing consumer purchasing decisions. The demand for trays is expected to remain strong, driven by the growing trend of ready-to-cook and ready-to-eat meat products that require convenient and attractive packaging solutions.

Bags, on the other hand, offer flexibility and cost-effectiveness, making them a preferred choice for bulk packaging and transportation. The demand for bags is anticipated to grow, supported by the expansion of online grocery shopping and the need for efficient packaging solutions that ensure product safety during transit. Boxes, although less common, are gaining popularity for their ability to provide superior protection and insulation, particularly for high-value meat products that require extended shelf life and temperature control.

Meat Type Analysis

The meat type segment includes beef, pork, poultry, seafood, and others. Poultry is the largest segment, driven by its affordability, versatility, and widespread consumption across various regions. The demand for poultry packaging is expected to grow, supported by the increasing consumer preference for lean protein sources and the rising popularity of ready-to-cook poultry products. Beef, although more expensive, is also witnessing strong demand, particularly in regions with high disposable incomes and a preference for premium meat products.

Seafood packaging is gaining traction due to the growing consumer awareness regarding the health benefits of seafood consumption. The demand for seafood packaging is expected to rise, driven by the increasing popularity of frozen seafood products that offer convenience and extended shelf life. Pork, although less popular than poultry and beef, is also witnessing steady demand, supported by its affordability and versatility in various culinary applications. As consumer preferences continue to evolve, the meat type segment is likely to witness significant innovations aimed at enhancing product quality and shelf life.

End-User Analysis

The end-user segment includes retail, foodservice, and others. The retail segment is the largest, driven by the expansion of supermarkets, hypermarkets, and online grocery platforms. The demand for frozen fresh meat packaging in the retail sector is expected to grow, supported by the increasing consumer preference for convenient and ready-to-cook meat products. The foodservice segment, although smaller, is also witnessing strong demand, driven by the growing trend of dining out and the increasing popularity of quick-service restaurants that require efficient and reliable packaging solutions.

The demand for frozen fresh meat packaging in the foodservice sector is expected to rise, supported by the expansion of the hospitality industry and the growing trend of home delivery services. As consumer preferences continue to evolve, the end-user segment is likely to witness significant innovations aimed at enhancing convenience, product quality, and sustainability. Companies that can offer tailored packaging solutions that meet the specific needs of different end-users are well-positioned to capitalize on the growing demand for frozen fresh meat packaging.

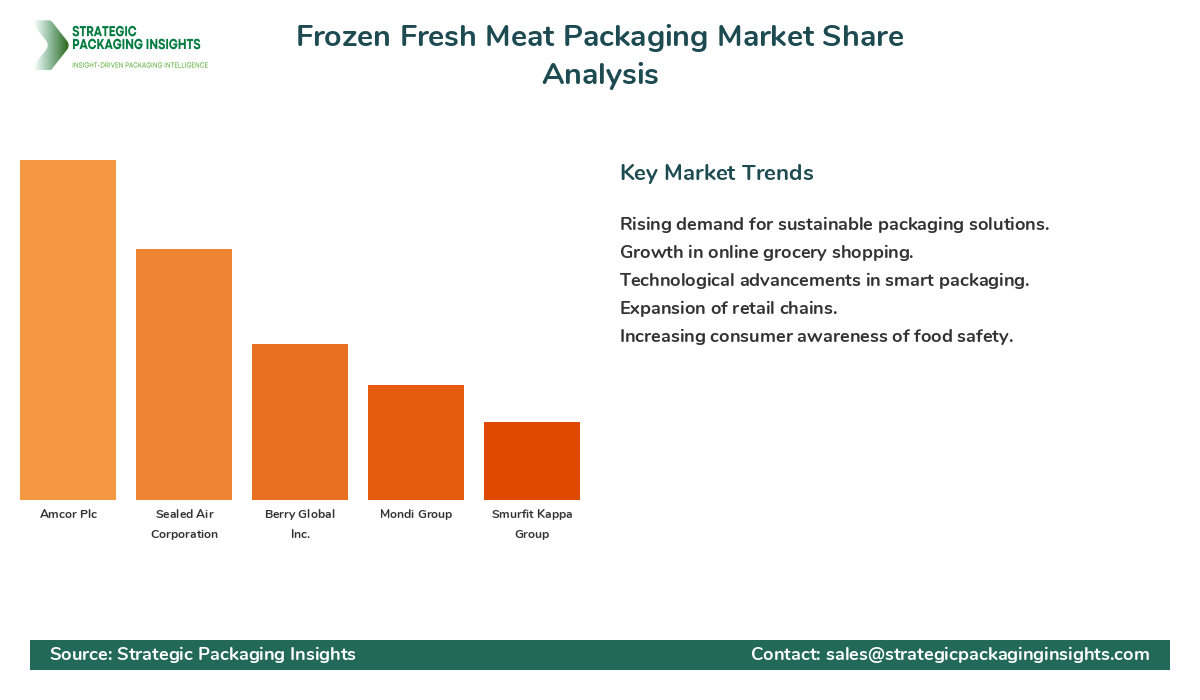

Market Share Analysis

The market share distribution in the frozen fresh meat packaging industry is influenced by several key players who are leading the charge in innovation and sustainability. Companies like Amcor Plc and Sealed Air Corporation are at the forefront, leveraging their extensive product portfolios and technological advancements to capture significant market share. These companies are known for their commitment to sustainability, offering eco-friendly packaging solutions that align with the growing consumer demand for environmentally responsible products.

Berry Global Inc. and Mondi Group are also prominent players, with a strong focus on developing innovative packaging materials that enhance product safety and shelf life. These companies are investing heavily in research and development to create packaging solutions that meet the evolving needs of consumers and regulatory bodies. The competitive positioning of these companies is further strengthened by their strategic partnerships and acquisitions, which enable them to expand their market reach and enhance their product offerings.

Other notable players in the market include Smurfit Kappa Group, DS Smith Plc, and Coveris Holdings S.A., each of which is making significant strides in the development of sustainable packaging solutions. These companies are leveraging their expertise in packaging design and material science to create products that offer both functionality and sustainability. The market share distribution is expected to continue evolving as companies invest in new technologies and expand their product portfolios to meet the growing demand for frozen fresh meat packaging.

Top Countries Insights in Frozen Fresh Meat Packaging

The United States is a leading market for frozen fresh meat packaging, with a market size of $2.5 billion and a CAGR of 4%. The country's robust retail infrastructure and high consumer demand for convenient meat products are key growth drivers. Additionally, the increasing focus on sustainability and the adoption of eco-friendly packaging solutions are shaping the market dynamics.

China, with a market size of $1.8 billion and a CAGR of 5%, is witnessing significant growth due to the rising disposable incomes and changing dietary preferences. The demand for frozen meat products is on the rise, driven by the increasing urbanization and the growing popularity of Western-style diets. The government's focus on food safety and quality is also contributing to the market's expansion.

Germany, with a market size of $1.2 billion and a CAGR of 3%, is a key market in Europe. The country's strong emphasis on sustainability and the growing consumer preference for organic and eco-friendly products are driving the demand for innovative packaging solutions. The expansion of retail chains and the increasing popularity of online grocery shopping are also contributing to market growth.

Brazil, with a market size of $900 million and a CAGR of 4%, is experiencing growth due to the increasing meat consumption and the expansion of the retail sector. The demand for frozen meat packaging is supported by the growing middle class and the rising popularity of ready-to-cook meat products. The government's focus on improving food safety standards is also shaping the market dynamics.

India, with a market size of $700 million and a CAGR of 6%, is witnessing rapid growth due to the increasing urbanization and the rising disposable incomes. The demand for frozen meat products is driven by the growing consumer preference for convenience and the expanding retail infrastructure. The government's initiatives to promote food safety and quality are also contributing to the market's expansion.

Frozen Fresh Meat Packaging Market Segments

The Frozen Fresh Meat Packaging market has been segmented on the basis of

Material Type

- Plastic

- Paper & Paperboard

- Metal

- Others

Packaging Type

- Trays

- Bags

- Boxes

- Others

Meat Type

- Beef

- Pork

- Poultry

- Seafood

- Others

End-User

- Retail

- Foodservice

- Others

Primary Interview Insights

What are the key drivers of growth in the frozen fresh meat packaging market?

How are companies addressing the challenge of plastic waste in packaging?

What role does e-commerce play in the frozen fresh meat packaging market?

How is consumer awareness impacting the frozen fresh meat packaging market?

What are the emerging investment themes in the frozen fresh meat packaging market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.