- Home

- Food Packaging

- Frozen Meat Packaging Film Market Size, Future Growth and Forecast 2033

Frozen Meat Packaging Film Market Size, Future Growth and Forecast 2033

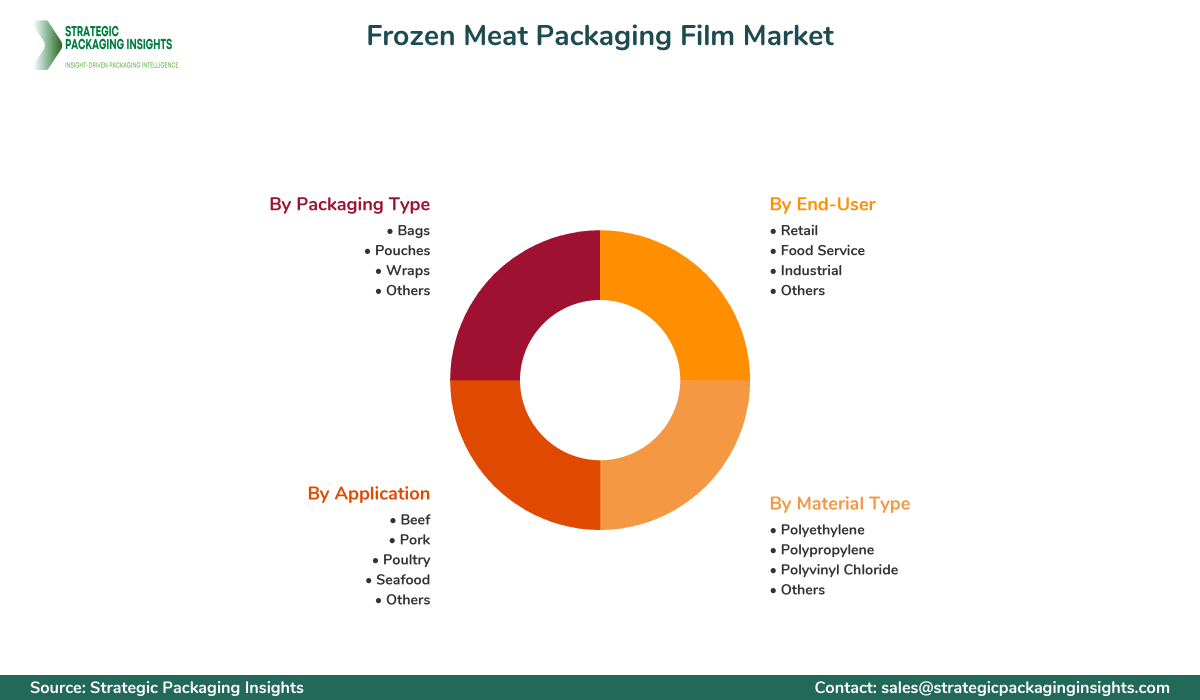

Frozen Meat Packaging Film Market Segments - by Material Type (Polyethylene, Polypropylene, Polyvinyl Chloride, Others), Application (Beef, Pork, Poultry, Seafood, Others), Packaging Type (Bags, Pouches, Wraps, Others), End-User (Retail, Food Service, Industrial, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Frozen Meat Packaging Film Market Outlook

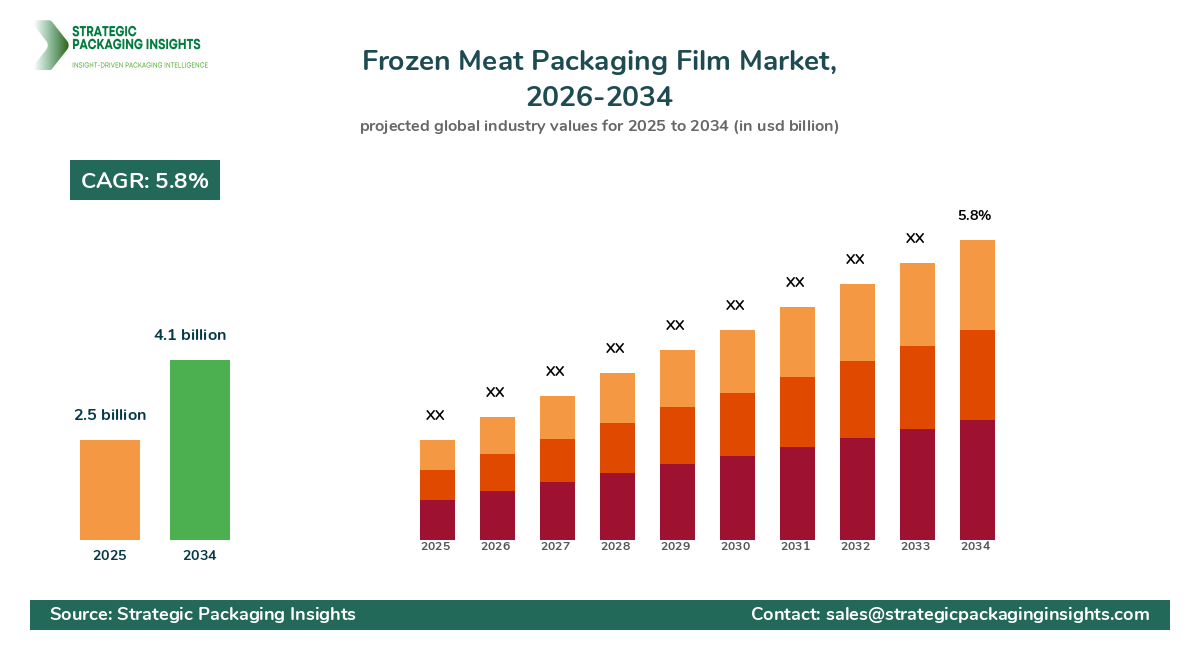

The frozen meat Packaging Film market was valued at $2.5 billion in 2024 and is projected to reach $4.1 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033. This market is driven by the increasing demand for convenient and long-lasting packaging solutions that preserve the quality and safety of frozen meat products. The rise in global meat consumption, coupled with the expansion of cold chain logistics, has significantly contributed to the growth of this market. Additionally, advancements in packaging technologies, such as the development of biodegradable and recyclable films, are expected to further propel market growth.

Report Scope

| Attributes | Details |

| Report Title | Frozen Meat Packaging Film Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 134 |

| Material Type | Polyethylene, Polypropylene, Polyvinyl Chloride, Others |

| Application | Beef, Pork, Poultry, Seafood, Others |

| Packaging Type | Bags, Pouches, Wraps, Others |

| End-User | Retail, Food Service, Industrial, Others |

| Customization Available | Yes* |

Opportunities & Threats

One of the key opportunities in the frozen meat packaging film market is the growing consumer preference for Sustainable Packaging solutions. As environmental concerns continue to rise, consumers are increasingly seeking packaging options that minimize environmental impact. This trend has led to the development of eco-friendly packaging films made from biodegradable materials, which not only reduce waste but also appeal to environmentally conscious consumers. Companies that invest in sustainable packaging innovations are likely to gain a competitive edge and capture a larger market share.

Another opportunity lies in the expanding e-commerce sector, which has revolutionized the way consumers purchase Frozen Meat products. The convenience of online shopping, coupled with the increasing availability of home delivery services, has boosted the demand for efficient and reliable packaging solutions that ensure product integrity during transit. Packaging films that offer superior barrier properties and temperature resistance are essential for maintaining the quality of frozen meat products in the e-commerce supply chain.

However, the market faces certain restraints, such as the volatility in raw material prices. The production of Packaging Films relies heavily on petrochemical derivatives, which are subject to price fluctuations due to changes in crude oil prices. This volatility can impact the profitability of packaging film manufacturers and pose challenges in maintaining competitive pricing. Additionally, stringent regulations regarding food safety and packaging materials can increase compliance costs for manufacturers, potentially hindering market growth.

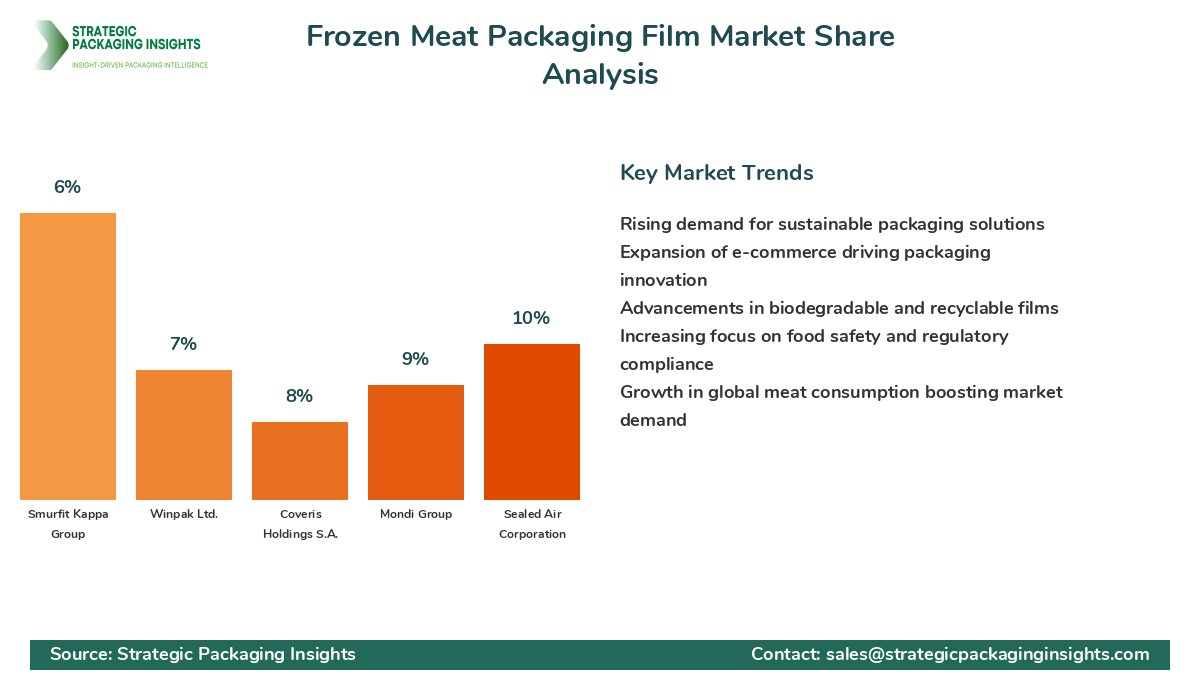

The frozen meat packaging film market is characterized by a competitive landscape with several key players vying for market share. Companies such as Amcor Plc, Berry Global Inc., Sealed Air Corporation, and Mondi Group are prominent players in this market, each holding a significant share. Amcor Plc, for instance, is known for its innovative packaging solutions and strong focus on sustainability, which has helped it maintain a leading position in the market. Berry Global Inc. is another major player, offering a wide range of packaging films with advanced barrier properties to cater to diverse customer needs.

Sealed Air Corporation is renowned for its Cryovac brand, which provides high-performance packaging solutions for the food industry. The company's emphasis on research and development has enabled it to introduce cutting-edge packaging technologies that enhance product shelf life and reduce food waste. Mondi Group, with its extensive global presence, offers a comprehensive portfolio of packaging films that cater to various applications, including frozen meat packaging. The company's commitment to sustainability and innovation has positioned it as a key player in the market.

Other notable companies in the market include Coveris Holdings S.A., Winpak Ltd., and Smurfit Kappa Group. Coveris Holdings S.A. is known for its Flexible Packaging solutions that offer excellent protection and convenience for frozen meat products. Winpak Ltd. specializes in high-quality packaging materials that ensure product safety and freshness. Smurfit Kappa Group, a leader in paper-based packaging, has expanded its offerings to include sustainable packaging films for the frozen food industry.

Overall, the competitive landscape of the frozen meat packaging film market is shaped by the continuous pursuit of innovation and sustainability. Companies that prioritize research and development, along with strategic partnerships and acquisitions, are likely to strengthen their market position and capitalize on emerging opportunities. As consumer preferences evolve and regulatory requirements become more stringent, the ability to adapt and innovate will be crucial for companies to maintain a competitive edge.

Key Highlights Frozen Meat Packaging Film Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Expansion of e-commerce and home delivery services driving packaging innovation.

- Advancements in packaging technologies enhancing product shelf life.

- Volatility in raw material prices impacting profitability.

- Stringent regulations on food safety and packaging materials.

- Growing consumer preference for convenient and long-lasting packaging.

- Rising global meat consumption boosting market growth.

- Development of biodegradable and recyclable packaging films.

- Strategic partnerships and acquisitions shaping competitive landscape.

- Focus on research and development to drive innovation.

Top Countries Insights in Frozen Meat Packaging Film

The United States is a leading market for frozen meat packaging films, with a market size of $1.2 billion and a CAGR of 6%. The country's robust cold chain infrastructure and high meat consumption levels drive demand for efficient packaging solutions. Additionally, the growing trend of online grocery shopping has further fueled the need for reliable packaging films that ensure product quality during transit.

China, with a market size of $900 million and a CAGR of 8%, is another significant player in the frozen meat packaging film market. The country's expanding middle class and increasing disposable income levels have led to a surge in meat consumption, driving demand for packaging solutions that preserve product freshness and safety. Government initiatives to improve food safety standards also contribute to market growth.

Germany, with a market size of $700 million and a CAGR of 5%, is a key market in Europe. The country's strong focus on sustainability and environmental protection has led to the adoption of eco-friendly packaging films. Additionally, the presence of leading packaging manufacturers and technological advancements in packaging materials support market growth.

Brazil, with a market size of $500 million and a CAGR of 7%, is a growing market for frozen meat packaging films. The country's large meat production industry and increasing exports drive demand for packaging solutions that ensure product integrity during transportation. The rise of modern retail formats and e-commerce also contribute to market expansion.

India, with a market size of $400 million and a CAGR of 9%, is an emerging market with significant growth potential. The country's increasing urbanization and changing dietary preferences have led to a rise in meat consumption, boosting demand for packaging films that offer convenience and extended shelf life. Government initiatives to improve cold chain infrastructure further support market growth.

Value Chain Profitability Analysis

The value chain of the frozen meat packaging film market involves several key stakeholders, each contributing to the overall profitability of the industry. Raw material suppliers, primarily petrochemical companies, provide the essential inputs for packaging film production. These suppliers capture a significant share of the market value due to the high cost of raw materials. Packaging film manufacturers, such as Amcor Plc and Berry Global Inc., play a crucial role in converting raw materials into finished products. These companies invest heavily in research and development to create innovative packaging solutions that meet consumer demands and regulatory requirements.

Distributors and wholesalers are responsible for the efficient distribution of packaging films to various end-users, including retailers, food service providers, and industrial clients. These intermediaries capture a moderate share of the market value, as they facilitate the movement of products through the supply chain. Retailers and food service providers, as end-users, utilize packaging films to ensure the quality and safety of frozen meat products. These stakeholders capture a smaller share of the market value, as they focus on delivering the final product to consumers.

Digital transformation is reshaping the value chain by enabling greater transparency and efficiency. Technology platforms and consultancies are increasingly involved in optimizing supply chain operations, reducing costs, and enhancing profitability. As digital solutions become more prevalent, stakeholders across the value chain are capturing increasing shares of the overall market value. The integration of digital technologies, such as IoT and blockchain, is expected to further redistribute revenue opportunities and drive profitability in the frozen meat packaging film market.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The frozen meat packaging film market has undergone significant changes between 2018 and 2024, with a focus on sustainability and technological advancements. During this period, the market experienced a CAGR of 4.5%, driven by increasing consumer awareness of environmental issues and the demand for eco-friendly packaging solutions. The introduction of biodegradable and recyclable films gained traction, as companies sought to reduce their environmental footprint and comply with stringent regulations.

Looking ahead to 2025–2033, the market is expected to grow at a CAGR of 5.8%, with a continued emphasis on sustainability and innovation. The development of Advanced Packaging technologies, such as smart packaging and active packaging, is anticipated to enhance product shelf life and improve consumer convenience. Additionally, the expansion of e-commerce and the rise of online grocery shopping will drive demand for packaging films that ensure product integrity during transit.

Regional contributions to the market are also expected to shift, with Asia Pacific emerging as a key growth region. The increasing middle-class population and rising disposable income levels in countries like China and India will drive demand for frozen meat products and packaging solutions. Technological impact factors, such as the adoption of digital solutions and automation in packaging processes, will further influence market dynamics and strategic imperatives.

Frozen Meat Packaging Film Market Segments Insights

Material Type Analysis

Polyethylene is the most widely used material in the frozen meat packaging film market, owing to its excellent barrier properties and cost-effectiveness. The material's versatility and ability to withstand low temperatures make it ideal for packaging frozen meat products. Polypropylene is another popular material, known for its high clarity and resistance to moisture and chemicals. The demand for polyvinyl chloride (PVC) films is driven by their durability and flexibility, although environmental concerns have led to a shift towards more sustainable alternatives.

The market is witnessing a growing trend towards the use of biodegradable and recyclable materials, as consumers and manufacturers prioritize sustainability. Companies are investing in research and development to create innovative materials that offer the same performance characteristics as traditional plastics while minimizing environmental impact. The competition among material suppliers is intense, with companies striving to develop new formulations that meet regulatory requirements and consumer preferences.

Application Analysis

The application of frozen meat packaging films is diverse, with beef, pork, poultry, and seafood being the primary segments. The beef segment holds the largest market share, driven by the high consumption of beef products globally. Packaging films for beef products require superior barrier properties to prevent spoilage and maintain freshness. The pork segment is also significant, with demand driven by the popularity of pork products in various cuisines.

Poultry and seafood segments are experiencing rapid growth, as consumers increasingly seek convenient and healthy protein options. Packaging films for these segments must offer excellent moisture resistance and temperature stability to ensure product quality. The competition among packaging film manufacturers is fierce, with companies focusing on developing specialized films that cater to the unique requirements of each application segment.

Packaging Type Analysis

Bags, pouches, and wraps are the primary packaging types used in the frozen meat packaging film market. Bags are the most common packaging type, offering convenience and ease of use for both consumers and manufacturers. Pouches are gaining popularity due to their versatility and ability to provide a high level of protection for frozen meat products. Wraps are used for bulk packaging and offer excellent barrier properties to prevent contamination and spoilage.

The market is witnessing a shift towards innovative packaging types that enhance consumer convenience and product presentation. Resealable and easy-open packaging options are becoming increasingly popular, as they offer added convenience for consumers. The competition among packaging manufacturers is intense, with companies striving to develop new packaging formats that meet evolving consumer preferences and regulatory requirements.

End-User Analysis

The end-user segment of the frozen meat packaging film market includes retail, food service, industrial, and others. The retail segment holds the largest market share, driven by the increasing demand for packaged frozen meat products in supermarkets and grocery stores. Packaging films for the retail segment must offer excellent shelf appeal and protection to attract consumers and ensure product quality.

The food service segment is also significant, with demand driven by the growing popularity of ready-to-eat and convenience foods. Packaging films for this segment must offer superior barrier properties and temperature resistance to maintain product integrity during storage and transportation. The industrial segment includes meat processing companies that require packaging films for bulk packaging and distribution. The competition among end-users is intense, with companies focusing on developing packaging solutions that meet the specific needs of each segment.

Frozen Meat Packaging Film Market Segments

The Frozen Meat Packaging Film market has been segmented on the basis of

Material Type

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

Application

- Beef

- Pork

- Poultry

- Seafood

- Others

Packaging Type

- Bags

- Pouches

- Wraps

- Others

End-User

- Retail

- Food Service

- Industrial

- Others

Primary Interview Insights

What are the key drivers of growth in the frozen meat packaging film market?

How is the market addressing environmental concerns?

What challenges do manufacturers face in this market?

Which regions are expected to see the most growth?

What role does technology play in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.