- Home

- Food Packaging

- Frozen Specialty Food Packaging Market Size, Future Growth and Forecast 2033

Frozen Specialty Food Packaging Market Size, Future Growth and Forecast 2033

Frozen Specialty Food Packaging Market Segments - by Material (Plastic, Paper & Paperboard, Metal, Glass), Product Type (Bags, Boxes, Trays, Containers, Films), Application (Fruits & Vegetables, Meat & Poultry, Seafood, Ready Meals, Others), and End-User (Retail, Foodservice, Industrial) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Frozen Specialty Food Packaging Market Outlook

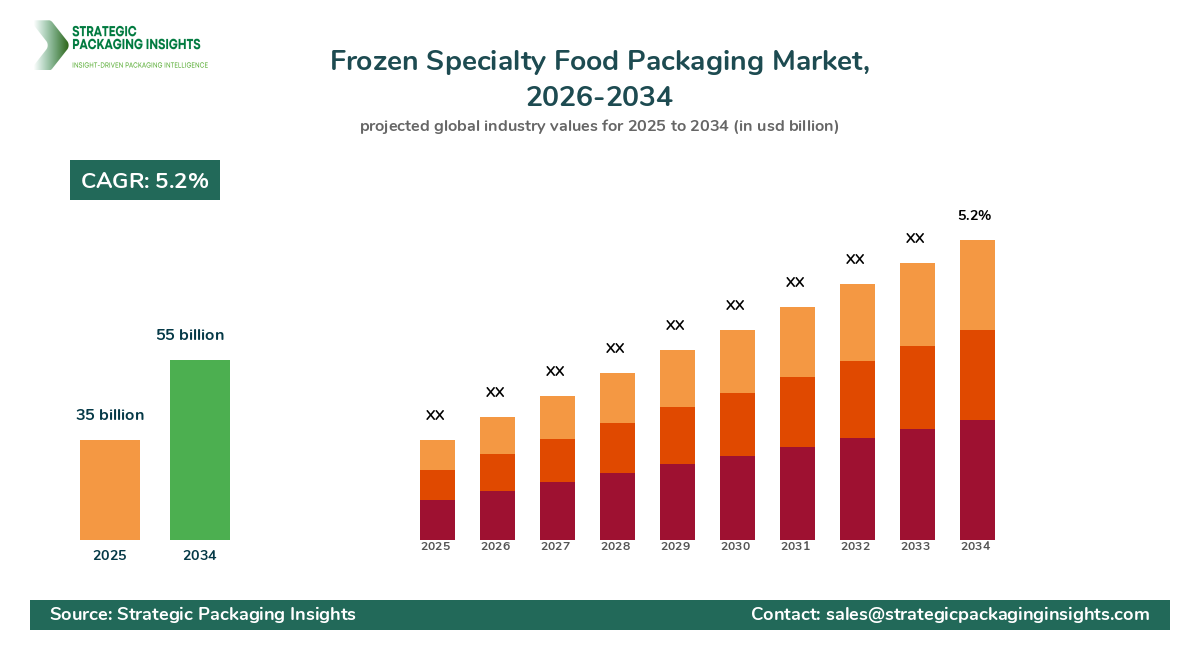

The frozen specialty food packaging market was valued at $35 billion in 2024 and is projected to reach $55 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025-2033. This market is experiencing robust growth due to the increasing demand for convenience foods and the rising popularity of frozen foods among consumers. The shift in consumer preferences towards ready-to-eat meals, driven by hectic lifestyles and the need for quick meal solutions, is a significant driver for this market. Additionally, advancements in packaging technologies that enhance the shelf life and quality of frozen foods are further propelling market growth. The market is also benefiting from the expansion of retail chains and the growing penetration of e-commerce platforms, which are making frozen specialty foods more accessible to consumers worldwide.

However, the market faces challenges such as stringent environmental regulations regarding the use of Plastic Packaging and the need for sustainable packaging solutions. The high cost of Advanced Packaging materials and technologies can also act as a restraint for market growth. Despite these challenges, the market holds significant growth potential due to the increasing focus on sustainable packaging solutions and the development of innovative packaging materials that are both eco-friendly and cost-effective. The growing awareness among consumers about the environmental impact of packaging waste is driving demand for recyclable and biodegradable packaging options, which presents lucrative opportunities for market players.

Report Scope

| Attributes | Details |

| Report Title | Frozen Specialty Food Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 198 |

| Material | Plastic, Paper & Paperboard, Metal, Glass |

| Product Type | Bags, Boxes, Trays, Containers, Films |

| Application | Fruits & Vegetables, Meat & Poultry, Seafood, Ready Meals, Others |

| End-User | Retail, Foodservice, Industrial |

| Customization Available | Yes* |

Key Highlights Frozen Specialty Food Packaging Market

- Increasing demand for convenience foods is driving market growth.

- Advancements in packaging technologies are enhancing product shelf life.

- Expansion of retail chains and e-commerce platforms is boosting market accessibility.

- Stringent environmental regulations are pushing for sustainable packaging solutions.

- High cost of advanced packaging materials poses a challenge.

- Growing consumer awareness about environmental impact is driving demand for eco-friendly packaging.

- Innovative packaging materials are creating new market opportunities.

- Rising popularity of frozen foods among consumers is a key market driver.

- Development of recyclable and biodegradable packaging options is gaining traction.

- Focus on sustainable packaging solutions is a significant market trend.

Competitive Intelligence

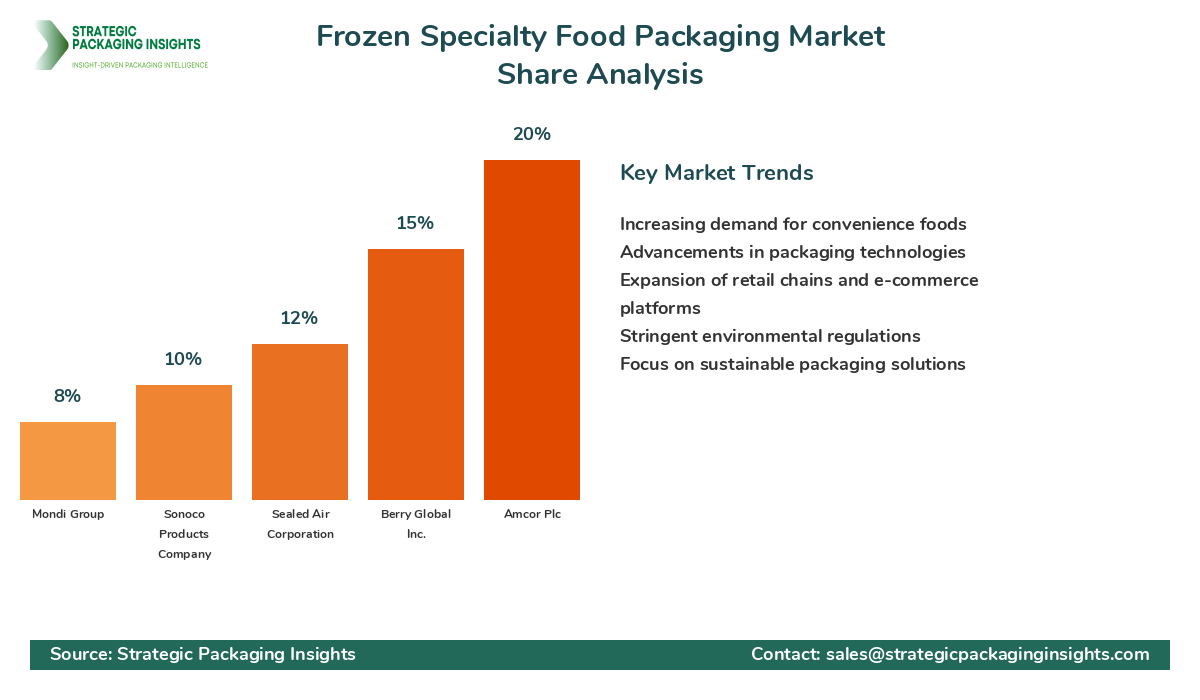

The frozen specialty food packaging market is highly competitive, with several key players vying for market share. Leading companies such as Amcor Plc, Berry Global Inc., Sealed Air Corporation, and Sonoco Products Company are at the forefront of this market. These companies are focusing on expanding their product portfolios and investing in research and development to introduce innovative packaging solutions. Amcor Plc, for instance, is known for its extensive range of Sustainable Packaging solutions, which has helped it maintain a strong market position. Berry Global Inc. is focusing on expanding its geographic reach and enhancing its product offerings to cater to the growing demand for frozen food packaging.

Sealed Air Corporation is leveraging its expertise in packaging technologies to offer solutions that enhance the shelf life and quality of frozen foods. The company is also focusing on sustainability initiatives to reduce its environmental footprint. Sonoco Products Company is known for its innovative packaging solutions and strong customer relationships, which have helped it maintain a competitive edge. Other notable players in the market include Mondi Group, Smurfit Kappa Group, Huhtamaki Oyj, and WestRock Company. These companies are focusing on strategic partnerships, mergers, and acquisitions to strengthen their market positions and expand their product offerings.

Regional Market Intelligence of Frozen Specialty Food Packaging

The global frozen specialty food packaging market is segmented into major regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds a significant share of the market, valued at $10 billion in 2024, and is expected to grow at a CAGR of 12% during the forecast period. The region's growth is driven by the high demand for convenience foods and the presence of major market players. Europe is another key market, with a current value of $8 billion and a forecast CAGR of 9%. The region's growth is attributed to the increasing focus on sustainable packaging solutions and stringent environmental regulations.

Asia-Pacific is the fastest-growing region, with a market size of $12 billion in 2024 and a projected CAGR of 15%. The region's growth is driven by the rising disposable incomes, changing consumer lifestyles, and the growing popularity of frozen foods. Latin America and the Middle East & Africa are also experiencing growth, with market sizes of $3 billion and $2 billion, respectively, and forecast CAGRs of 7% and 5%. The growth in these regions is driven by the increasing urbanization and the expansion of retail chains, which are making frozen specialty foods more accessible to consumers.

Top Countries Insights in Frozen Specialty Food Packaging

The United States is the largest market for frozen specialty food packaging, with a market size of $8 billion and a CAGR of 6%. The country's growth is driven by the high demand for convenience foods and the presence of major market players. China is the fastest-growing market, with a market size of $5 billion and a CAGR of 10%. The country's growth is driven by the rising disposable incomes and the growing popularity of frozen foods. Germany is another key market, with a market size of $4 billion and a CAGR of 5%. The country's growth is attributed to the increasing focus on sustainable packaging solutions and stringent environmental regulations.

India is experiencing significant growth, with a market size of $3 billion and a CAGR of 8%. The country's growth is driven by the changing consumer lifestyles and the growing popularity of frozen foods. Brazil is also a key market, with a market size of $2 billion and a CAGR of 4%. The country's growth is driven by the increasing urbanization and the expansion of retail chains, which are making frozen specialty foods more accessible to consumers.

Frozen Specialty Food Packaging Market Segments Insights

Material Analysis

The frozen specialty food packaging market is segmented by material into plastic, paper & Paperboard, metal, and glass. Plastic is the most widely used material due to its versatility, durability, and cost-effectiveness. It offers excellent barrier properties, which help in preserving the quality and freshness of frozen foods. However, the increasing environmental concerns and stringent regulations regarding plastic usage are driving the demand for alternative materials. Paper & paperboard are gaining popularity as eco-friendly options, offering recyclability and biodegradability. Metal and glass are also used in specific applications where high barrier properties and product visibility are required.

The demand for sustainable packaging materials is driving innovation in this segment, with companies focusing on developing biodegradable and recyclable options. The shift towards eco-friendly materials is also driven by consumer preferences and regulatory pressures. The development of advanced materials that offer similar properties to plastic but with a lower environmental impact is a key trend in this segment. Companies are investing in research and development to create innovative solutions that meet the evolving needs of consumers and comply with environmental regulations.

Product Type Analysis

The product type segment includes bags, boxes, trays, containers, and films. Bags are the most commonly used packaging type due to their convenience and cost-effectiveness. They are widely used for packaging fruits, vegetables, and ready meals. Boxes and trays are preferred for packaging meat, poultry, and seafood, offering excellent protection and product visibility. Containers are used for packaging a variety of frozen foods, providing durability and ease of handling. Films are used for wrapping and sealing products, offering excellent barrier properties and product protection.

The demand for innovative packaging solutions is driving growth in this segment, with companies focusing on developing products that enhance convenience and product protection. The increasing focus on sustainability is also driving demand for recyclable and Biodegradable Packaging options. Companies are investing in research and development to create innovative solutions that meet the evolving needs of consumers and comply with environmental regulations. The development of advanced materials and technologies that enhance product shelf life and quality is a key trend in this segment.

Application Analysis

The application segment includes fruits & vegetables, meat & poultry, seafood, ready meals, and others. The demand for frozen fruits and vegetables is driven by the increasing consumer preference for convenience foods and the need for quick meal solutions. The meat & poultry segment is experiencing growth due to the rising demand for protein-rich foods and the increasing popularity of frozen meat products. The seafood segment is also experiencing growth, driven by the increasing consumer preference for healthy and nutritious foods.

The ready meals segment is the fastest-growing application, driven by the increasing demand for convenience foods and the rising popularity of frozen ready meals among consumers. The development of innovative packaging solutions that enhance product shelf life and quality is driving growth in this segment. Companies are focusing on developing packaging solutions that meet the evolving needs of consumers and comply with environmental regulations. The increasing focus on sustainability is also driving demand for recyclable and biodegradable packaging options.

End-User Analysis

The end-user segment includes retail, foodservice, and industrial. The retail segment is the largest end-user, driven by the increasing demand for convenience foods and the expansion of retail chains. The foodservice segment is experiencing growth due to the rising demand for frozen foods in restaurants and catering services. The industrial segment is also experiencing growth, driven by the increasing demand for frozen foods in the food processing industry.

The demand for innovative packaging solutions is driving growth in this segment, with companies focusing on developing products that enhance convenience and product protection. The increasing focus on sustainability is also driving demand for recyclable and biodegradable packaging options. Companies are investing in research and development to create innovative solutions that meet the evolving needs of consumers and comply with environmental regulations. The development of advanced materials and technologies that enhance product shelf life and quality is a key trend in this segment.

The frozen specialty food packaging market is characterized by the presence of several key players, each vying for market share. Amcor Plc, Berry Global Inc., Sealed Air Corporation, and Sonoco Products Company are among the leading companies in this market. Amcor Plc holds a significant market share due to its extensive range of sustainable packaging solutions and strong market presence. Berry Global Inc. is gaining market share by expanding its geographic reach and enhancing its product offerings. Sealed Air Corporation is leveraging its expertise in packaging technologies to offer solutions that enhance product shelf life and quality. Sonoco Products Company is known for its innovative packaging solutions and strong customer relationships, which have helped it maintain a competitive edge.

The market share distribution is influenced by factors such as pricing, innovation, and strategic partnerships. Companies that focus on developing innovative and sustainable packaging solutions are gaining market share, while those that fail to adapt to changing consumer preferences and regulatory requirements are losing ground. The increasing focus on sustainability is driving demand for eco-friendly packaging solutions, which is influencing market share distribution. Companies that invest in research and development to create innovative solutions that meet the evolving needs of consumers and comply with environmental regulations are well-positioned to gain market share.

Frozen Specialty Food Packaging Market Segments

The Frozen Specialty Food Packaging market has been segmented on the basis of

Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

Product Type

- Bags

- Boxes

- Trays

- Containers

- Films

Application

- Fruits & Vegetables

- Meat & Poultry

- Seafood

- Ready Meals

- Others

End-User

- Retail

- Foodservice

- Industrial

Primary Interview Insights

What are the key drivers for the frozen specialty food packaging market?

What challenges does the market face?

How is the market responding to environmental concerns?

Which region is experiencing the fastest growth?

What are the key trends in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.