- Home

- Eco-Friendly Packaging

- Global Returnable Packaging Market Size, Future Growth and Forecast 2033

Global Returnable Packaging Market Size, Future Growth and Forecast 2033

Global Returnable Packaging Market Segments - by Material Type (Plastic, Metal, Wood, Others), Product Type (Pallets, Crates, IBCs, Drums & Barrels, Others), End-User Industry (Automotive, Food & Beverage, Consumer Goods, Healthcare, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Global Returnable Packaging Market Outlook

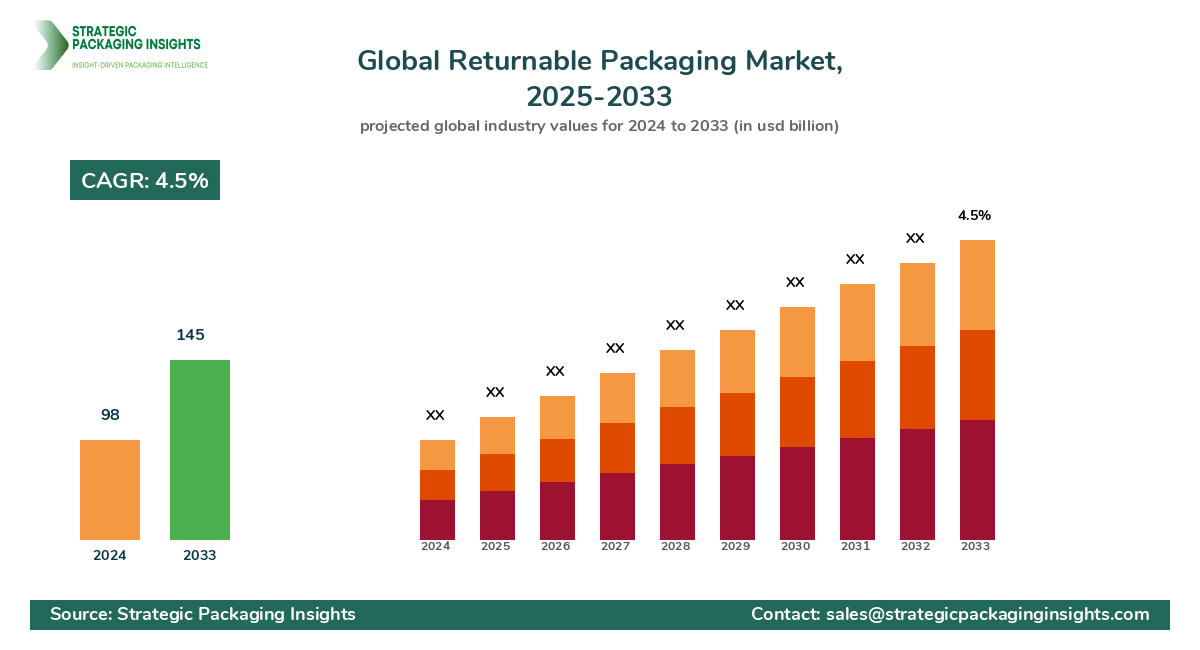

The global returnable packaging market was valued at $98 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033. This market is driven by the increasing demand for sustainable and cost-effective packaging solutions across various industries. Returnable packaging, which includes products like pallets, crates, and intermediate bulk containers (IBCs), is gaining traction due to its ability to reduce waste and lower overall packaging costs. The automotive and food & beverage industries are significant contributors to this market, leveraging returnable packaging to enhance supply chain efficiency and reduce environmental impact. Additionally, the rise in e-commerce and global trade has further fueled the demand for durable and reusable packaging solutions.

However, the market faces challenges such as high initial investment costs and the need for efficient reverse logistics systems. Regulatory frameworks promoting sustainability and waste reduction are expected to bolster market growth, but they also impose compliance costs on manufacturers. Despite these challenges, the market holds significant growth potential, particularly in emerging economies where industrialization and urbanization are driving the need for efficient packaging solutions. Innovations in material technology and design are also expected to create new opportunities for market players, enabling them to offer more durable and cost-effective products.

Report Scope

| Attributes | Details |

| Report Title | Global Returnable Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 197 |

| Material Type | Plastic, Metal, Wood, Others |

| Product Type | Pallets, Crates, IBCs, Drums & Barrels, Others |

| End-User Industry | Automotive, Food & Beverage, Consumer Goods, Healthcare, Others |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The returnable packaging market presents numerous opportunities, particularly in the realm of sustainability and cost efficiency. As companies worldwide strive to reduce their carbon footprint, returnable packaging offers a viable solution by minimizing waste and promoting reuse. This trend is particularly pronounced in industries such as automotive and food & beverage, where the need for durable and reliable packaging is paramount. Additionally, the rise of e-commerce has created a demand for packaging solutions that can withstand multiple shipping cycles, further driving the adoption of returnable packaging. The development of innovative materials and designs that enhance the durability and functionality of returnable packaging is also expected to open new avenues for growth.

Another significant opportunity lies in the expansion of returnable packaging solutions in emerging markets. As these regions undergo rapid industrialization and urbanization, the demand for efficient and sustainable packaging solutions is on the rise. Companies that can offer cost-effective and scalable returnable packaging solutions are well-positioned to capitalize on this growing demand. Furthermore, advancements in tracking and logistics technologies are enabling more efficient management of returnable packaging systems, reducing the complexity and cost associated with reverse logistics.

Despite these opportunities, the market faces several threats that could hinder its growth. One of the primary challenges is the high initial investment required for implementing returnable packaging systems. This includes the cost of purchasing durable packaging materials and establishing efficient reverse logistics networks. Additionally, the market is subject to regulatory pressures aimed at reducing waste and promoting sustainability, which can impose additional compliance costs on manufacturers. The complexity of managing returnable packaging systems, particularly in terms of tracking and logistics, also poses a challenge for companies looking to adopt these solutions.

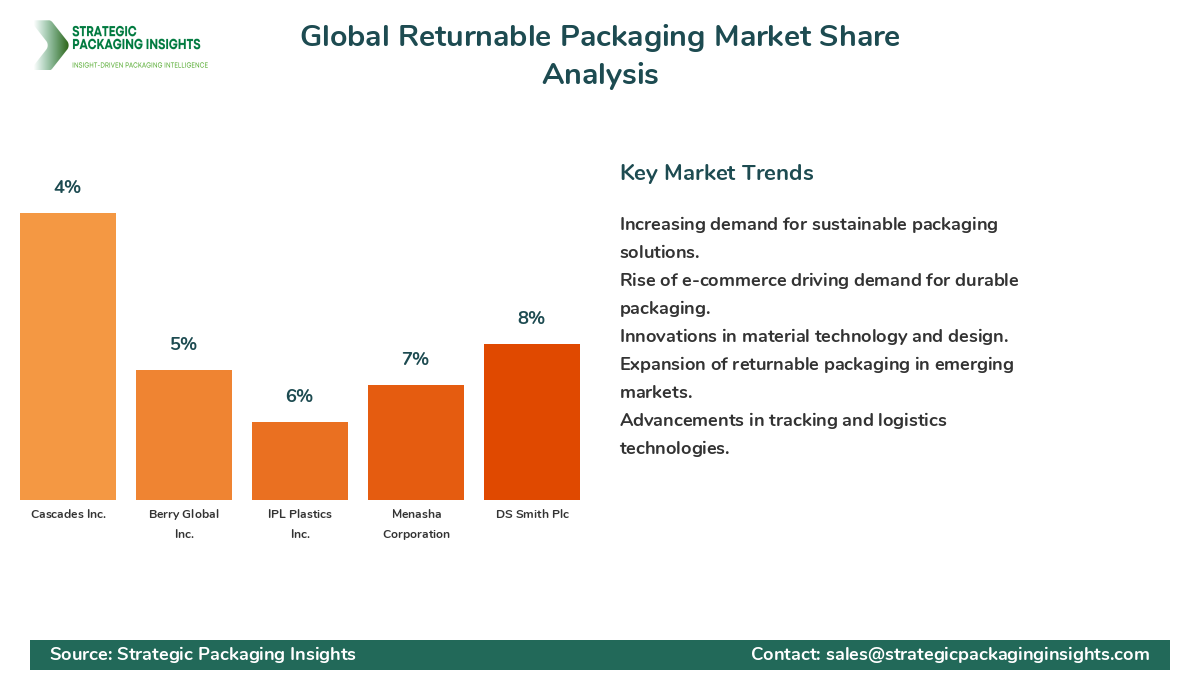

The global returnable packaging market is characterized by a competitive landscape with several key players vying for market share. Companies such as Schoeller Allibert, Brambles Limited, and DS Smith Plc are among the leading players in this market, leveraging their extensive product portfolios and global presence to maintain a competitive edge. These companies are focused on expanding their product offerings and enhancing their supply chain capabilities to meet the growing demand for returnable packaging solutions. Additionally, strategic partnerships and acquisitions are common strategies employed by market players to strengthen their market position and expand their geographical reach.

Schoeller Allibert, for instance, is a prominent player in the returnable packaging market, known for its innovative solutions and commitment to sustainability. The company offers a wide range of products, including pallets, crates, and IBCs, catering to various industries such as automotive, agriculture, and food & beverage. With a strong focus on research and development, Schoeller Allibert continues to introduce new products that enhance the durability and functionality of returnable packaging.

Brambles Limited, another key player, operates through its CHEP brand, providing pooling solutions for pallets and containers. The company's extensive network and expertise in supply chain logistics enable it to offer efficient and cost-effective returnable packaging solutions to its clients. Brambles' commitment to sustainability and innovation has positioned it as a leader in the market, with a strong presence in regions such as North America, Europe, and Asia Pacific.

DS Smith Plc is also a significant player in the returnable packaging market, offering a comprehensive range of packaging solutions that cater to various industries. The company's focus on sustainability and innovation has driven its growth, with a strong emphasis on developing packaging solutions that reduce waste and enhance supply chain efficiency. DS Smith's strategic acquisitions and partnerships have further strengthened its market position, enabling it to expand its product offerings and geographical reach.

Key Highlights Global Returnable Packaging Market

- The global returnable packaging market is projected to reach $145 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033.

- Key drivers include the increasing demand for sustainable packaging solutions and the rise of e-commerce.

- The automotive and food & beverage industries are significant contributors to market growth.

- High initial investment costs and regulatory compliance are major challenges for market players.

- Innovations in material technology and design are expected to create new growth opportunities.

- Emerging markets present significant growth potential due to rapid industrialization and urbanization.

- Advancements in tracking and logistics technologies are enabling more efficient management of returnable packaging systems.

- Strategic partnerships and acquisitions are common strategies employed by market players to strengthen their market position.

- Companies such as Schoeller Allibert, Brambles Limited, and DS Smith Plc are leading players in the market.

- The market is characterized by a competitive landscape with several key players vying for market share.

Top Countries Insights in Global Returnable Packaging

In the United States, the returnable packaging market is valued at approximately $25 billion, with a CAGR of 5%. The country's strong industrial base and emphasis on sustainability are key drivers of market growth. Government regulations promoting waste reduction and recycling are also contributing to the adoption of returnable packaging solutions. However, the high cost of implementing these systems remains a challenge for many companies.

Germany, with a market size of $15 billion and a CAGR of 4%, is a leading player in the European returnable packaging market. The country's robust automotive industry and commitment to sustainability are driving the demand for returnable packaging solutions. Innovations in material technology and design are also contributing to market growth, enabling companies to offer more durable and cost-effective products.

China, with a market size of $20 billion and a CAGR of 6%, is a significant player in the Asia Pacific region. The country's rapid industrialization and urbanization are driving the demand for efficient and sustainable packaging solutions. Government initiatives promoting waste reduction and recycling are also contributing to market growth, although the complexity of managing returnable packaging systems remains a challenge.

In Brazil, the returnable packaging market is valued at $10 billion, with a CAGR of 3%. The country's growing industrial base and emphasis on sustainability are key drivers of market growth. However, the high cost of implementing returnable packaging systems and the complexity of managing reverse logistics remain significant challenges for companies operating in this market.

India, with a market size of $8 billion and a CAGR of 7%, is an emerging player in the global returnable packaging market. The country's rapid industrialization and urbanization are driving the demand for efficient and sustainable packaging solutions. Government initiatives promoting waste reduction and recycling are also contributing to market growth, although the high cost of implementing these systems remains a challenge for many companies.

Value Chain Profitability Analysis

The value chain of the global returnable packaging market involves several key stakeholders, including material suppliers, manufacturers, logistics providers, and end-users. Each stage of the value chain contributes to the overall profitability of the market, with varying profit margins and revenue distribution. Material suppliers, for instance, play a crucial role in providing the raw materials needed for manufacturing returnable packaging products. These suppliers typically operate with moderate profit margins, as they are subject to fluctuations in raw material prices and supply chain disruptions.

Manufacturers, on the other hand, capture a significant share of the market's overall value, as they are responsible for producing the final products. These companies typically operate with higher profit margins, as they can leverage economies of scale and technological advancements to reduce production costs. Logistics providers also play a crucial role in the value chain, as they are responsible for managing the transportation and distribution of returnable packaging products. These companies typically operate with moderate profit margins, as they are subject to fluctuations in fuel prices and transportation costs.

End-users, such as companies in the automotive and food & beverage industries, are the final stakeholders in the value chain. These companies typically operate with lower profit margins, as they are subject to competitive pressures and regulatory compliance costs. However, the adoption of returnable packaging solutions can help these companies reduce their overall packaging costs and enhance supply chain efficiency, thereby improving their profitability.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The global returnable packaging market has undergone significant changes between 2018 and 2024, driven by evolving market dynamics and strategic imperatives. During this period, the market experienced steady growth, with a CAGR of 3.5%, driven by the increasing demand for sustainable packaging solutions and the rise of e-commerce. The automotive and food & beverage industries were significant contributors to market growth, leveraging returnable packaging to enhance supply chain efficiency and reduce environmental impact.

Looking ahead to the forecast period of 2025 to 2033, the market is expected to experience accelerated growth, with a projected CAGR of 4.5%. This growth is driven by several key factors, including advancements in material technology and design, the expansion of returnable packaging solutions in emerging markets, and the increasing adoption of tracking and logistics technologies. These factors are expected to create new opportunities for market players, enabling them to offer more durable and cost-effective products.

In terms of segment distribution, the market is expected to see a shift towards more innovative and sustainable packaging solutions, driven by regulatory pressures and consumer demand for environmentally friendly products. The automotive and food & beverage industries are expected to remain significant contributors to market growth, although other industries such as healthcare and consumer goods are also expected to play an increasingly important role. Additionally, the market is expected to see a shift in regional contributions, with emerging markets such as China and India playing a more prominent role in driving market growth.

Global Returnable Packaging Market Segments Insights

Material Type Analysis

The material type segment of the global returnable packaging market is dominated by plastic, which is widely used due to its durability, lightweight nature, and cost-effectiveness. Plastic returnable packaging solutions, such as pallets and crates, are popular in industries like automotive and food & beverage, where the need for robust and reusable packaging is critical. However, environmental concerns regarding plastic waste have led to increased interest in alternative materials, such as metal and wood. Metal packaging, known for its strength and longevity, is gaining traction in sectors requiring heavy-duty solutions, while wood offers a biodegradable option, appealing to eco-conscious consumers.

In recent years, there has been a growing trend towards the development of biodegradable and recyclable materials in the returnable packaging market. Companies are investing in research and development to create innovative materials that offer the same durability and functionality as traditional options but with a reduced environmental impact. This trend is expected to continue, driven by regulatory pressures and consumer demand for sustainable packaging solutions. As a result, the material type segment is expected to see a shift towards more eco-friendly options, with plastic remaining dominant but facing increasing competition from alternative materials.

Product Type Analysis

The product type segment of the global returnable packaging market includes a variety of solutions, such as pallets, crates, intermediate bulk containers (IBCs), and drums & barrels. Pallets are the most widely used product type, favored for their versatility and ability to facilitate efficient handling and transportation of goods. Crates are also popular, particularly in the food & beverage industry, where they are used to transport perishable items safely. IBCs are gaining popularity in industries such as chemicals and pharmaceuticals, where the need for secure and efficient bulk transportation is critical.

Drums and barrels, traditionally used in the oil and chemical industries, are also seeing increased adoption in other sectors due to their durability and ability to protect contents from contamination. The product type segment is characterized by a high degree of innovation, with companies continuously developing new designs and features to enhance the functionality and efficiency of returnable packaging solutions. This trend is expected to continue, driven by the need for more efficient and cost-effective packaging solutions across various industries.

End-User Industry Analysis

The end-user industry segment of the global returnable packaging market is dominated by the automotive and food & beverage industries, which are significant contributors to market growth. The automotive industry relies heavily on returnable packaging solutions to enhance supply chain efficiency and reduce costs, while the food & beverage industry uses these solutions to ensure the safe and efficient transportation of perishable goods. Other industries, such as consumer goods and healthcare, are also significant users of returnable packaging, leveraging these solutions to enhance supply chain efficiency and reduce environmental impact.

In recent years, there has been a growing trend towards the adoption of returnable packaging solutions in emerging industries, such as e-commerce and retail. These industries are increasingly recognizing the benefits of returnable packaging in terms of cost savings and sustainability, driving demand for these solutions. As a result, the end-user industry segment is expected to see a shift towards more diverse applications, with traditional industries remaining dominant but facing increasing competition from emerging sectors.

Regional Analysis

The regional segment of the global returnable packaging market is characterized by significant variations in market size and growth rates. North America and Europe are the largest markets, driven by strong industrial bases and a high degree of environmental awareness. These regions are characterized by a high degree of innovation and regulatory support, driving the adoption of returnable packaging solutions. The Asia Pacific region is expected to see the highest growth rates, driven by rapid industrialization and urbanization in countries such as China and India.

Latin America and the Middle East & Africa are also significant markets, although they face challenges such as high implementation costs and complex logistics. However, these regions present significant growth potential, driven by increasing demand for efficient and sustainable packaging solutions. As a result, the regional segment is expected to see a shift towards more diverse applications, with traditional markets remaining dominant but facing increasing competition from emerging regions.

Global Returnable Packaging Market Segments

The Global Returnable Packaging market has been segmented on the basis of

Material Type

- Plastic

- Metal

- Wood

- Others

Product Type

- Pallets

- Crates

- IBCs

- Drums & Barrels

- Others

End-User Industry

- Automotive

- Food & Beverage

- Consumer Goods

- Healthcare

- Others

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the returnable packaging market?

What challenges does the returnable packaging market face?

Which industries are the largest users of returnable packaging?

How is the market expected to evolve in the coming years?

What role do emerging markets play in the returnable packaging market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.