- Home

- Food Packaging

- High Barrier Food Containers Market Size, Future Growth and Forecast 2033

High Barrier Food Containers Market Size, Future Growth and Forecast 2033

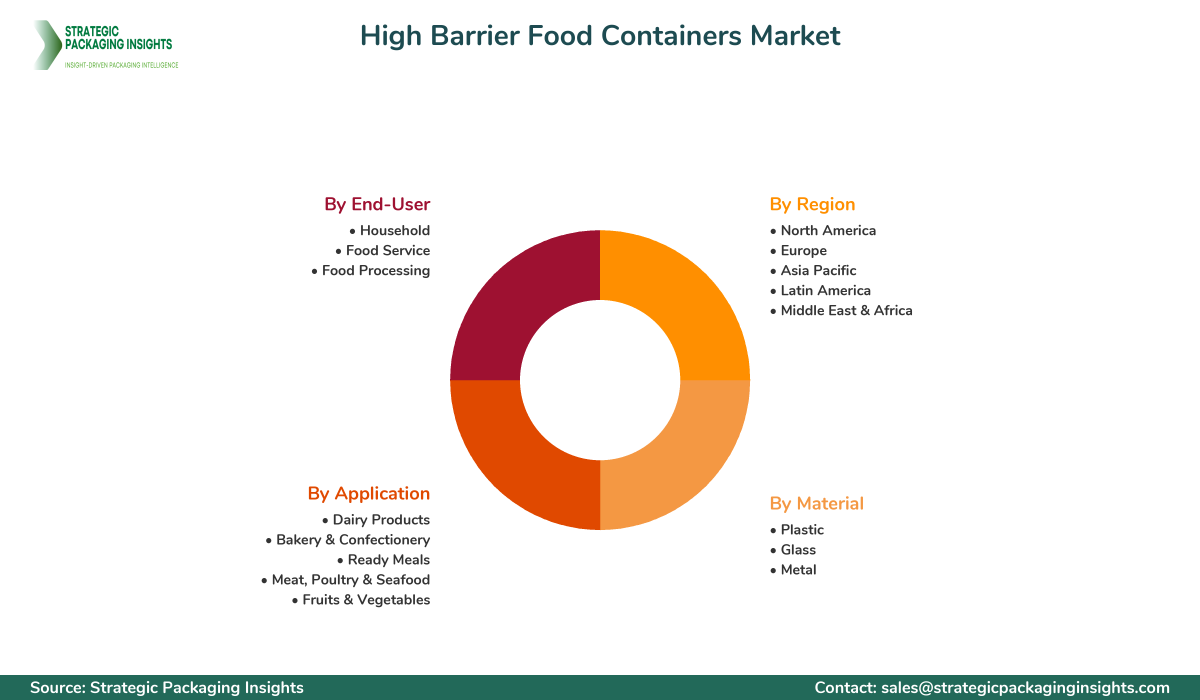

High Barrier Food Containers Market Segments - by Material (Plastic, Glass, Metal), Application (Dairy Products, Bakery & Confectionery, Ready Meals, Meat, Poultry & Seafood, Fruits & Vegetables), End-User (Household, Food Service, Food Processing), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

High Barrier Food Containers Market Outlook

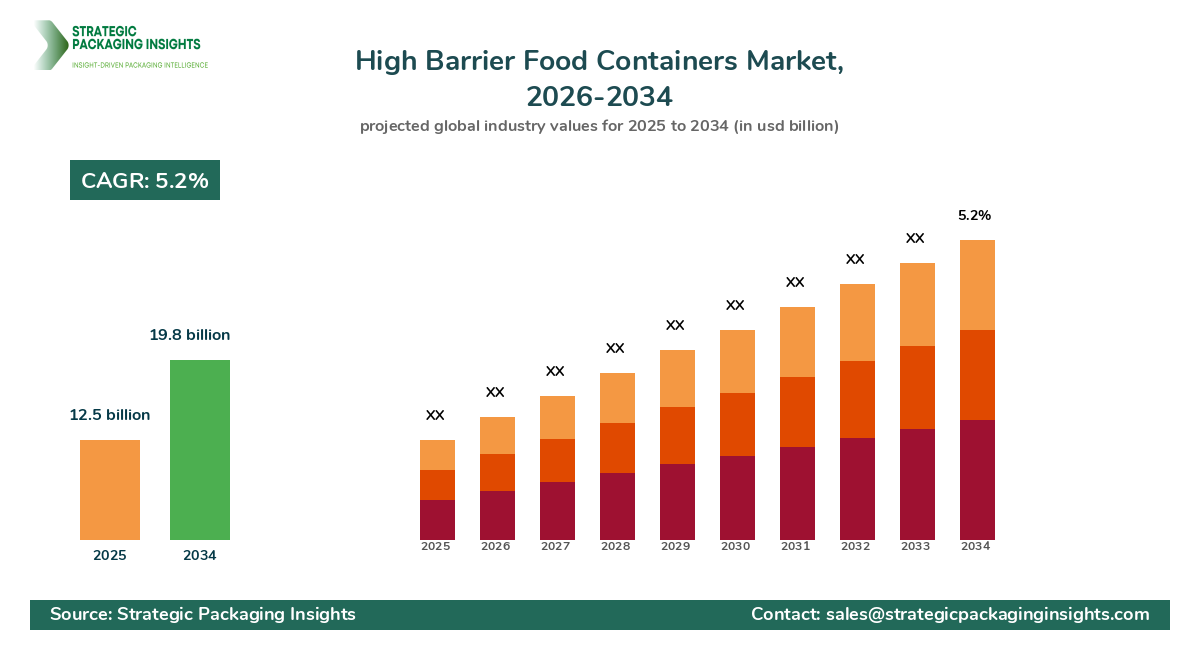

The High Barrier Food Containers market was valued at $12.5 billion in 2024 and is projected to reach $19.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025–2033. This market is driven by the increasing demand for extended shelf life of food products, which is a critical factor for both manufacturers and consumers. The rise in consumer awareness regarding food safety and quality has further propelled the demand for high barrier food containers. These containers are designed to protect food from oxygen, moisture, and other environmental factors that can degrade food quality. The market is also benefiting from technological advancements in packaging materials and designs, which enhance the barrier properties of these containers.

However, the market faces certain restraints, including the high cost of raw materials used in manufacturing high barrier food containers. Regulatory challenges related to food contact materials and environmental concerns regarding plastic waste are also significant hurdles. Despite these challenges, the market holds substantial growth potential due to the increasing adoption of sustainable and eco-friendly packaging solutions. Companies are investing in research and development to create innovative products that meet regulatory standards and consumer expectations. The shift towards recyclable and biodegradable materials is expected to open new avenues for market growth.

Report Scope

| Attributes | Details |

| Report Title | High Barrier Food Containers Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 230 |

| Material | Plastic, Glass, Metal |

| Application | Dairy Products, Bakery & Confectionery, Ready Meals, Meat, Poultry & Seafood, Fruits & Vegetables |

| End-User | Household, Food Service, Food Processing |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The High Barrier Food Containers market presents numerous opportunities, particularly with the growing trend of convenience foods and ready-to-eat meals. As urbanization increases and lifestyles become busier, consumers are seeking packaging solutions that offer convenience without compromising on food quality. High barrier food containers are ideal for preserving the freshness and taste of ready meals, making them a preferred choice for food manufacturers. Additionally, the rise of e-commerce and online food delivery services has further boosted the demand for reliable and durable packaging solutions that can withstand transportation and handling.

Another significant opportunity lies in the development of sustainable packaging solutions. With increasing environmental awareness, consumers and regulatory bodies are pushing for eco-friendly packaging options. This has led to a surge in demand for high barrier food containers made from biodegradable and recyclable materials. Companies that can innovate and offer sustainable solutions are likely to gain a competitive edge in the market. Furthermore, advancements in nanotechnology and smart packaging are expected to enhance the functionality of high barrier food containers, providing additional growth opportunities.

Despite the promising opportunities, the market faces threats from stringent regulations and the high cost of production. Compliance with food safety standards and environmental regulations can be challenging for manufacturers, particularly in regions with strict regulatory frameworks. Additionally, the volatility in raw material prices can impact the profitability of companies operating in this market. To mitigate these threats, companies need to focus on cost-effective production methods and strategic partnerships to ensure a steady supply of raw materials.

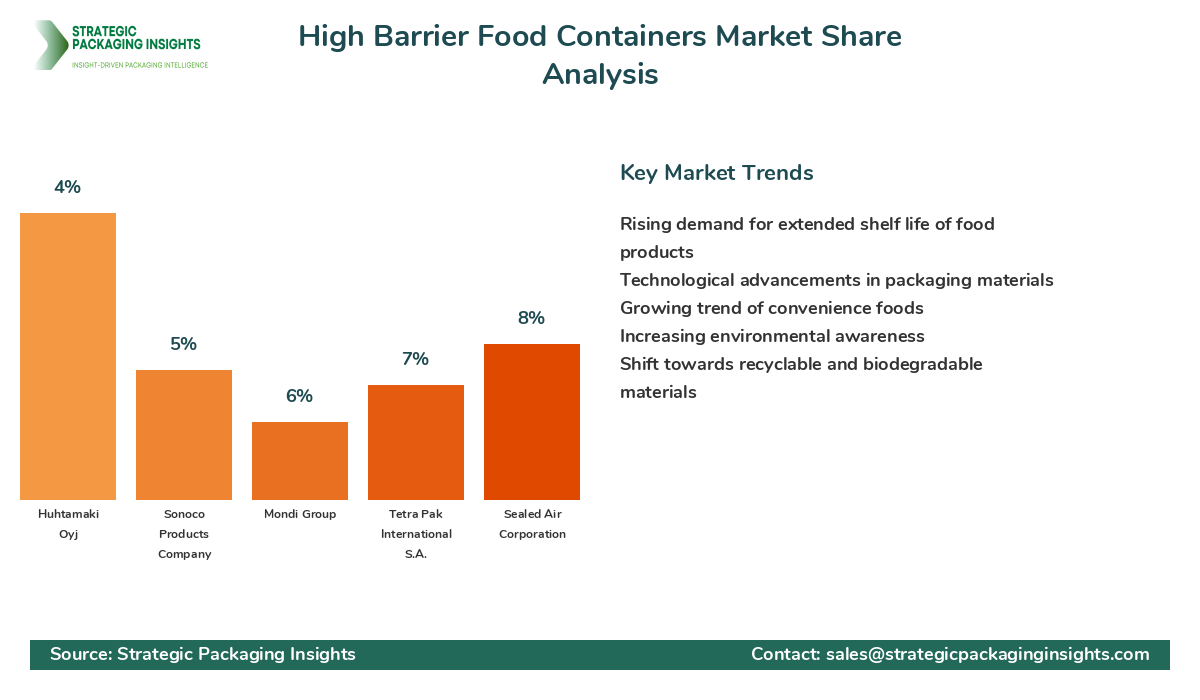

The competitive landscape of the High Barrier Food Containers market is characterized by the presence of several key players who hold significant market shares. These companies are focusing on product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. The market is moderately fragmented, with a mix of global and regional players competing for market share. The leading companies are investing heavily in research and development to introduce advanced packaging solutions that cater to the evolving needs of consumers and regulatory requirements.

Amcor Plc is one of the prominent players in the market, known for its innovative packaging solutions and strong global presence. The company has a diverse product portfolio that includes high barrier food containers made from various materials such as plastic, metal, and glass. Amcor's focus on sustainability and eco-friendly packaging has helped it maintain a competitive edge in the market. Another key player, Berry Global Inc., is recognized for its extensive range of packaging products and commitment to sustainability. The company has been actively expanding its product offerings to include high-performance barrier solutions that meet the demands of the food industry.

Sealed Air Corporation is another major player in the market, offering a wide range of packaging solutions designed to enhance food safety and extend shelf life. The company's innovative Cryovac brand is well-known for its high barrier properties and is widely used in the food processing industry. Tetra Pak International S.A. is also a significant player, with a strong focus on sustainable packaging solutions. The company's commitment to reducing environmental impact and promoting recycling has positioned it as a leader in the high barrier food containers market.

Other notable companies in the market include Mondi Group, Sonoco Products Company, and Huhtamaki Oyj. These companies are leveraging their expertise in packaging technology and materials science to develop high barrier food containers that meet the stringent requirements of the food industry. By focusing on innovation and sustainability, these companies are well-positioned to capitalize on the growing demand for high barrier food containers.

Key Highlights High Barrier Food Containers Market

- Increasing demand for extended shelf life of food products is driving market growth.

- Technological advancements in packaging materials enhance barrier properties.

- Growing trend of convenience foods boosts demand for high barrier containers.

- Rising environmental awareness fuels demand for sustainable packaging solutions.

- Stringent regulations and high production costs pose challenges to market growth.

- Advancements in nanotechnology and smart packaging offer growth opportunities.

- Key players focus on product innovation and strategic partnerships.

- Moderately fragmented market with a mix of global and regional players.

- Shift towards recyclable and biodegradable materials opens new avenues.

- Increasing adoption of e-commerce and online food delivery services drives demand.

Top Countries Insights in High Barrier Food Containers

The United States is a leading market for high barrier food containers, with a market size of $3.5 billion and a CAGR of 6%. The country's strong food processing industry and high consumer demand for convenience foods drive market growth. Additionally, stringent food safety regulations and a focus on sustainable packaging solutions contribute to the market's expansion.

Germany is another significant market, valued at $2.1 billion with a CAGR of 5%. The country's advanced packaging technology and emphasis on quality and safety standards make it a key player in the European market. The growing trend of ready-to-eat meals and increasing environmental awareness further boost demand for high barrier food containers.

China's market for high barrier food containers is rapidly growing, with a market size of $2.8 billion and a CAGR of 8%. The country's expanding middle class and increasing urbanization drive demand for packaged foods, creating opportunities for high barrier packaging solutions. Government initiatives to promote sustainable packaging also support market growth.

Japan, with a market size of $1.9 billion and a CAGR of 4%, is a mature market for high barrier food containers. The country's focus on food safety and quality, along with a strong tradition of packaging innovation, drives demand. The aging population and increasing preference for convenience foods further contribute to market growth.

India is an emerging market, valued at $1.5 billion with a CAGR of 9%. The country's growing population and rising disposable incomes drive demand for packaged foods, creating opportunities for high barrier food containers. The government's push for sustainable packaging solutions and increasing consumer awareness of food safety also support market growth.

Value Chain Profitability Analysis

The value chain of the High Barrier Food Containers market involves several key stakeholders, including raw material suppliers, manufacturers, distributors, and end-users. Raw material suppliers provide essential inputs such as plastics, metals, and glass, which are critical for manufacturing high barrier food containers. Manufacturers play a crucial role in transforming these raw materials into finished products, utilizing advanced technologies and processes to enhance barrier properties and meet regulatory standards.

Distributors and retailers are responsible for ensuring the availability of high barrier food containers to end-users, including households, food service providers, and food processing companies. The profitability of each stakeholder in the value chain varies, with manufacturers capturing a significant share due to their role in product development and innovation. However, the high cost of raw materials and production can impact profit margins.

Digital transformation is reshaping the value chain, with technology platforms and consultancies playing an increasingly important role. These entities provide valuable insights and solutions to optimize production processes, reduce costs, and enhance product quality. As a result, they are capturing a growing share of the overall market value. The shift towards sustainable packaging solutions is also influencing the value chain, with companies investing in eco-friendly materials and processes to meet consumer and regulatory demands.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The High Barrier Food Containers market has undergone significant changes between 2018 and 2024, driven by technological advancements, changing consumer preferences, and regulatory developments. During this period, the market experienced steady growth, with a focus on enhancing barrier properties and developing sustainable packaging solutions. The increasing demand for convenience foods and ready-to-eat meals also contributed to market expansion.

Looking ahead to 2025–2033, the market is expected to continue evolving, with a greater emphasis on sustainability and innovation. Companies are likely to invest in research and development to create advanced packaging solutions that meet the stringent requirements of the food industry. The adoption of digital technologies and smart packaging is expected to enhance product functionality and consumer engagement.

Regional contributions are also expected to shift, with emerging markets such as China and India playing a more prominent role in driving market growth. The focus on reducing environmental impact and promoting recycling will be a key strategic imperative for companies operating in this market. Overall, the High Barrier Food Containers market is poised for continued growth, driven by a combination of technological innovation, changing consumer preferences, and regulatory developments.

High Barrier Food Containers Market Segments Insights

Material Analysis

The material segment of the High Barrier Food Containers market includes plastic, glass, and metal. Plastic is the most widely used material due to its versatility, lightweight nature, and cost-effectiveness. The demand for plastic high barrier containers is driven by their ability to provide excellent barrier properties and extend the shelf life of food products. However, environmental concerns related to plastic waste are prompting manufacturers to explore sustainable alternatives, such as biodegradable and recyclable plastics.

Glass is another important material in the high barrier food containers market, known for its excellent barrier properties and inert nature. Glass containers are preferred for premium food products and beverages, as they do not interact with the contents and preserve the original taste and quality. The demand for glass containers is supported by the growing trend of premiumization and consumer preference for eco-friendly packaging solutions.

Metal containers, particularly those made from aluminum and steel, are also used in the high barrier food containers market. These containers offer superior barrier properties and are ideal for preserving the freshness and quality of food products. The demand for metal containers is driven by their durability and recyclability, making them a popular choice for environmentally conscious consumers. However, the high cost of production and the need for specialized manufacturing processes can be a challenge for manufacturers.

Application Analysis

The application segment of the High Barrier Food Containers market includes dairy products, bakery & confectionery, ready meals, meat, poultry & seafood, and fruits & vegetables. The demand for high barrier containers in the dairy products segment is driven by the need to preserve the freshness and quality of perishable items such as milk, cheese, and yogurt. These containers provide excellent protection against oxygen and moisture, extending the shelf life of dairy products.

In the bakery & confectionery segment, high barrier food containers are used to protect products from moisture and maintain their texture and flavor. The growing demand for packaged bakery products and confectionery items is driving the need for reliable packaging solutions that can preserve product quality. The ready meals segment is also a significant application area, with high barrier containers being used to extend the shelf life of convenience foods and ready-to-eat meals.

The meat, poultry & seafood segment is another key application area for high barrier food containers. These containers provide excellent protection against spoilage and contamination, ensuring the safety and quality of meat products. The demand for high barrier containers in this segment is driven by the increasing consumption of meat and seafood products, as well as the need for safe and hygienic packaging solutions. The fruits & vegetables segment also benefits from high barrier containers, which help preserve the freshness and nutritional value of produce.

End-User Analysis

The end-user segment of the High Barrier Food Containers market includes households, food service providers, and food processing companies. Households are a significant end-user segment, with consumers increasingly seeking packaging solutions that offer convenience and preserve food quality. The demand for high barrier containers in this segment is driven by the growing trend of home cooking and meal preparation.

Food service providers, including restaurants, cafes, and catering companies, are also key end-users of high barrier food containers. These businesses require reliable packaging solutions that can preserve the quality and freshness of food products during transportation and storage. The demand for high barrier containers in this segment is supported by the increasing popularity of food delivery services and takeout meals.

Food processing companies are another important end-user segment, with high barrier food containers being used to package a wide range of processed food products. These companies require packaging solutions that can extend the shelf life of their products and meet regulatory standards for food safety. The demand for high barrier containers in this segment is driven by the growing demand for packaged and processed foods, as well as the need for innovative packaging solutions that enhance product quality and safety.

Regional Analysis

The regional analysis of the High Barrier Food Containers market reveals significant growth opportunities across various regions. North America is a leading market, driven by the strong food processing industry and high consumer demand for convenience foods. The region's focus on sustainability and eco-friendly packaging solutions further supports market growth.

Europe is another key market, with countries such as Germany and the UK leading the way in packaging innovation and sustainability. The region's stringent food safety regulations and emphasis on quality standards drive demand for high barrier food containers. The growing trend of ready-to-eat meals and increasing environmental awareness further boost market growth.

The Asia Pacific region is expected to witness significant growth, driven by the expanding middle class and increasing urbanization in countries such as China and India. The region's growing demand for packaged foods and government initiatives to promote sustainable packaging solutions create opportunities for high barrier food containers. The Middle East & Africa and Latin America regions also offer growth potential, with increasing consumer awareness of food safety and quality driving demand for reliable packaging solutions.

High Barrier Food Containers Market Segments

The High Barrier Food Containers market has been segmented on the basis of

Material

- Plastic

- Glass

- Metal

Application

- Dairy Products

- Bakery & Confectionery

- Ready Meals

- Meat, Poultry & Seafood

- Fruits & Vegetables

End-User

- Household

- Food Service

- Food Processing

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers for the High Barrier Food Containers market?

What challenges does the market face?

How is sustainability impacting the market?

What role does technology play in this market?

Which regions are expected to see significant growth?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.