- Home

- Packaging Products

- High Density Polyethylene (HDPE) Film Market Size, Future Growth and Forecast 2033

High Density Polyethylene (HDPE) Film Market Size, Future Growth and Forecast 2033

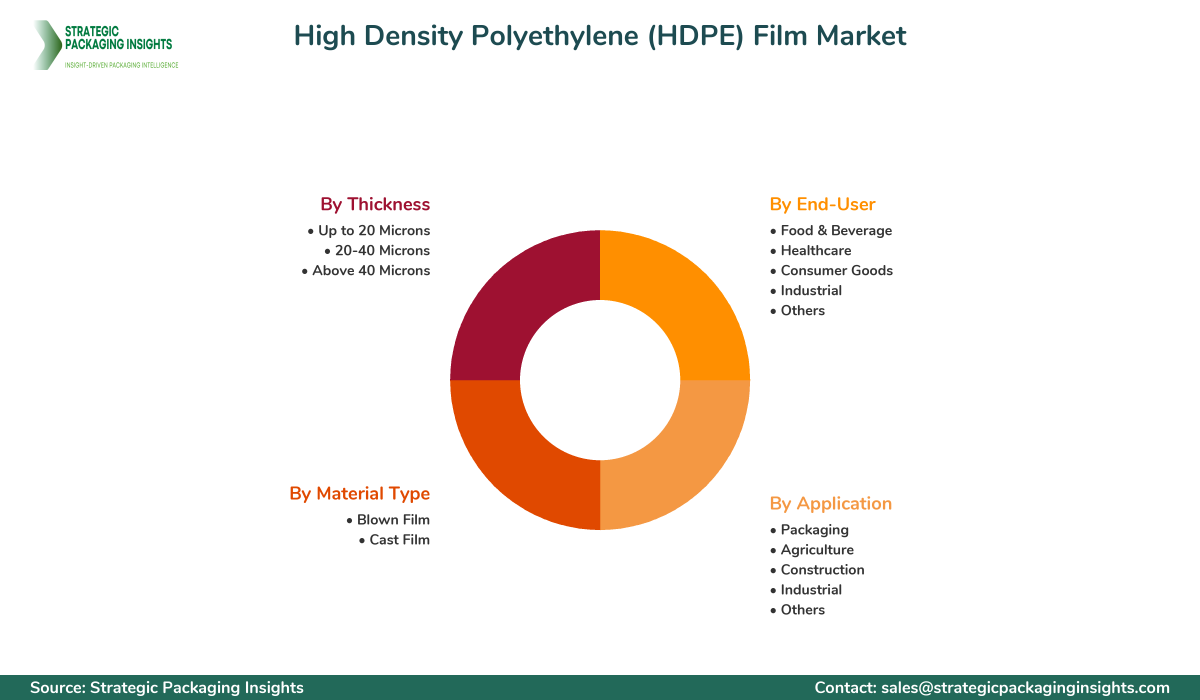

High Density Polyethylene (HDPE) Film Market Segments - by Application (Packaging, Agriculture, Construction, Industrial, Others), Material Type (Blown Film, Cast Film), Thickness (Up to 20 Microns, 20-40 Microns, Above 40 Microns), End-User (Food & Beverage, Healthcare, Consumer Goods, Industrial, Others) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

High Density Polyethylene (HDPE) Film Market Outlook

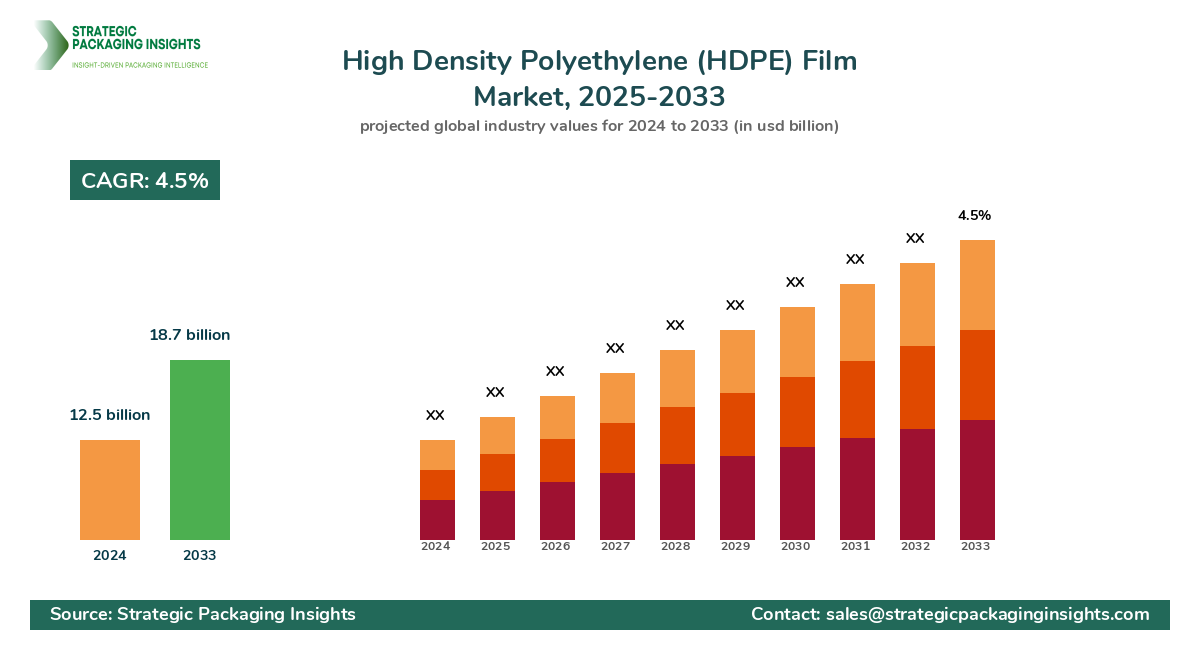

The High Density Polyethylene (HDPE) Film market was valued at $12.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033. This growth is driven by the increasing demand for sustainable and durable packaging solutions across various industries. HDPE films are known for their high tensile strength, resistance to moisture, and chemical stability, making them ideal for packaging applications in food and beverage, healthcare, and consumer goods sectors. The rising awareness about environmental sustainability and the shift towards recyclable materials are further propelling the market growth.

However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations regarding plastic usage. Despite these restraints, the market holds significant growth potential due to technological advancements in film manufacturing processes and the development of bio-based HDPE films. These innovations are expected to open new avenues for market players, enabling them to cater to the evolving consumer preferences and regulatory requirements.

Report Scope

| Attributes | Details |

| Report Title | High Density Polyethylene (HDPE) Film Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 184 |

| Application | Packaging, Agriculture, Construction, Industrial, Others |

| Material Type | Blown Film, Cast Film |

| Thickness | Up to 20 Microns, 20-40 Microns, Above 40 Microns |

| End-User | Food & Beverage, Healthcare, Consumer Goods, Industrial, Others |

| Customization Available | Yes* |

Opportunities & Threats

The HDPE film market presents numerous opportunities, particularly in the realm of eco-friendly packaging solutions. As consumers and businesses become increasingly conscious of their environmental footprint, the demand for recyclable and biodegradable packaging materials is on the rise. HDPE films, being recyclable, are well-positioned to capitalize on this trend. Additionally, advancements in film extrusion technologies are enabling manufacturers to produce thinner films without compromising on strength and durability, thereby reducing material usage and costs. This not only enhances the sustainability quotient of HDPE films but also makes them more economically viable for a broader range of applications.

Another significant opportunity lies in the expanding applications of HDPE films in the agricultural sector. With the global population on the rise, there is an increasing need for efficient agricultural practices to ensure food security. HDPE films are used in mulching, greenhouse coverings, and silage wraps, offering benefits such as improved crop yield, soil moisture retention, and protection against pests. The growing adoption of modern farming techniques and the emphasis on increasing agricultural productivity are expected to drive the demand for HDPE films in this sector.

Despite the promising opportunities, the HDPE film market is not without its challenges. One of the primary restrainers is the volatility in raw material prices, particularly ethylene, which is a key component in HDPE production. Fluctuations in crude oil prices directly impact the cost of ethylene, thereby affecting the overall production costs of HDPE films. Additionally, the market is subject to stringent environmental regulations aimed at reducing plastic waste, which could pose compliance challenges for manufacturers. Companies need to invest in research and development to innovate and produce environmentally friendly HDPE films that meet regulatory standards while maintaining performance and cost-effectiveness.

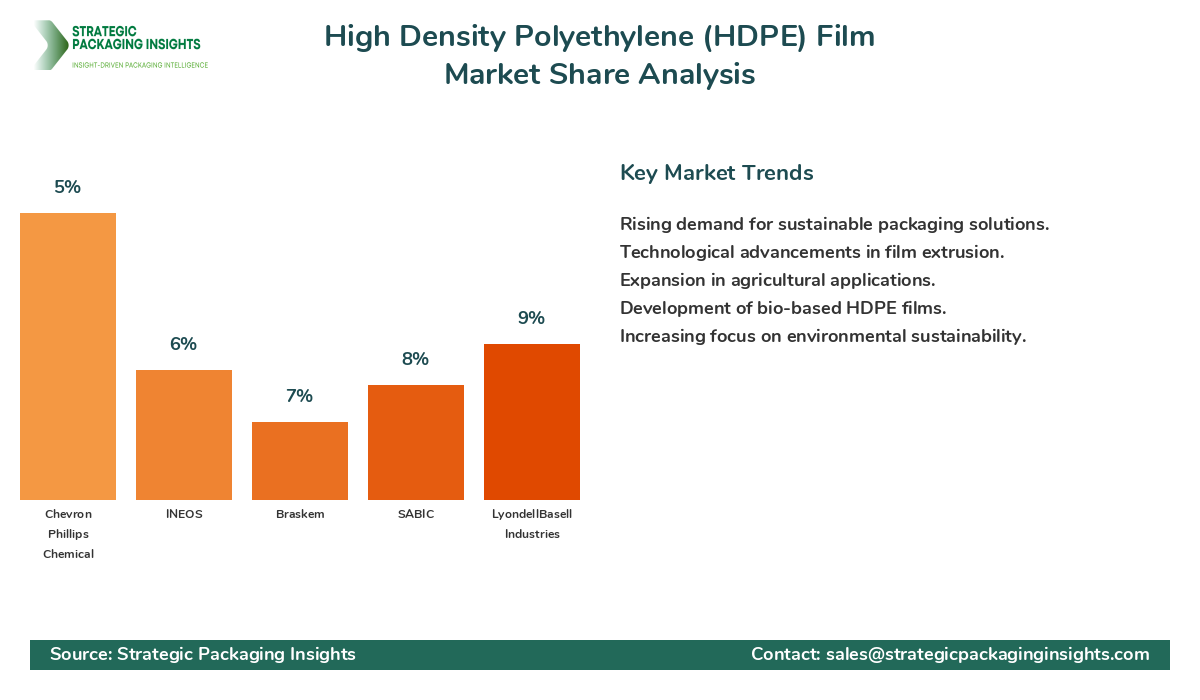

The competitive landscape of the High Density Polyethylene (HDPE) Film market is characterized by the presence of several key players who hold significant market shares. These companies are actively engaged in strategic initiatives such as mergers and acquisitions, product innovations, and capacity expansions to strengthen their market position. The market is moderately fragmented, with a mix of global and regional players competing to capture a larger share of the market. The leading companies are focusing on enhancing their product portfolios and expanding their geographical reach to tap into emerging markets with high growth potential.

Among the major players, ExxonMobil Corporation holds a substantial market share, leveraging its extensive distribution network and advanced manufacturing capabilities. The company is known for its high-quality HDPE films that cater to diverse applications across various industries. Similarly, Dow Inc. is another prominent player, renowned for its innovative product offerings and commitment to sustainability. The company's focus on developing bio-based HDPE films aligns with the growing demand for eco-friendly packaging solutions.

Other notable companies in the HDPE film market include LyondellBasell Industries, SABIC, and Braskem. LyondellBasell Industries is recognized for its robust research and development efforts, which have resulted in the introduction of advanced HDPE film grades with enhanced performance characteristics. SABIC, on the other hand, is a key player in the Middle East, with a strong presence in the global market. The company's strategic partnerships and collaborations have enabled it to expand its product offerings and cater to a wider customer base.

Braskem, a leading producer of thermoplastic resins, is also a significant contributor to the HDPE film market. The company's focus on sustainability and innovation has led to the development of green polyethylene, a bio-based alternative to traditional HDPE. This aligns with the industry's shift towards sustainable materials and positions Braskem as a frontrunner in the market. Other companies such as INEOS, Chevron Phillips Chemical, and Borealis AG are also key players, each contributing to the market's growth through their unique product offerings and strategic initiatives.

Key Highlights High Density Polyethylene (HDPE) Film Market

- Increasing demand for sustainable and recyclable packaging solutions.

- Technological advancements in film extrusion processes.

- Growing applications in the agricultural sector for mulching and greenhouse coverings.

- Rising awareness about environmental sustainability driving market growth.

- Volatility in raw material prices impacting production costs.

- Stringent environmental regulations influencing market dynamics.

- Expansion of product portfolios by key market players.

- Development of bio-based HDPE films as a sustainable alternative.

- Strategic mergers and acquisitions to enhance market presence.

- Focus on emerging markets with high growth potential.

Top Countries Insights in High Density Polyethylene (HDPE) Film

The United States is a leading market for HDPE films, with a market size of $3.5 billion and a CAGR of 5%. The country's robust packaging industry and the increasing demand for sustainable packaging solutions are key growth drivers. Additionally, the presence of major market players and advancements in film manufacturing technologies contribute to the market's expansion.

China, with a market value of $2.8 billion and a CAGR of 6%, is another significant player in the HDPE film market. The country's booming e-commerce sector and the growing emphasis on eco-friendly packaging materials are driving the demand for HDPE films. Government initiatives promoting sustainable practices further bolster market growth.

Germany, with a market size of $1.5 billion and a CAGR of 4%, is a prominent market in Europe. The country's strong focus on environmental sustainability and the adoption of advanced packaging technologies are key factors propelling the market. The presence of leading packaging companies also contributes to the market's growth.

India, with a market value of $1.2 billion and a CAGR of 7%, is an emerging market for HDPE films. The country's expanding retail sector and the increasing demand for packaged food products are driving the market. Additionally, government policies supporting sustainable packaging solutions are expected to boost market growth.

Brazil, with a market size of $0.9 billion and a CAGR of 5%, is a key market in Latin America. The country's growing agricultural sector and the rising demand for efficient packaging solutions are driving the market. The adoption of modern farming techniques and the emphasis on increasing agricultural productivity further support market growth.

Value Chain Profitability Analysis

The value chain of the High Density Polyethylene (HDPE) Film market involves several key stakeholders, each contributing to the overall profitability of the industry. The primary stages in the value chain include raw material suppliers, film manufacturers, distributors, and end-users. Raw material suppliers, primarily ethylene producers, play a crucial role in the value chain, as the cost and availability of ethylene directly impact the production costs of HDPE films. Film manufacturers, on the other hand, add value through the extrusion and processing of HDPE into films, with profit margins varying based on production efficiency and technological capabilities.

Distributors and wholesalers are responsible for the distribution and marketing of HDPE films to various end-users, including packaging companies, agricultural firms, and industrial users. These intermediaries capture a portion of the value chain's profitability through markups and distribution fees. End-users, such as food and beverage companies, healthcare providers, and consumer goods manufacturers, utilize HDPE films for packaging and other applications, deriving value from the films' durability, recyclability, and cost-effectiveness.

In terms of profitability, film manufacturers typically capture the largest share of the value chain, with profit margins ranging from 10% to 20%, depending on production efficiency and market demand. Raw material suppliers also enjoy significant profit margins, particularly during periods of high ethylene prices. Distributors and wholesalers capture smaller margins, typically ranging from 5% to 10%, while end-users benefit from cost savings and enhanced product performance. The ongoing digital transformation in the industry is expected to further redistribute revenue opportunities, with technology platforms and service providers capturing an increasing share of the market value.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The High Density Polyethylene (HDPE) Film market has undergone significant changes between 2018 and 2024, with evolving market dynamics shaping the industry's landscape. During this period, the market experienced steady growth, driven by the increasing demand for sustainable packaging solutions and advancements in film manufacturing technologies. The CAGR for this period was approximately 3.5%, with the market size expanding from $10 billion in 2018 to $12.5 billion in 2024. The segment distribution shifted towards thinner films, with a growing preference for eco-friendly materials.

Looking ahead to the forecast period of 2025–2033, the market is expected to witness accelerated growth, with a projected CAGR of 4.5%. The market size is anticipated to reach $18.7 billion by 2033, driven by the continued emphasis on sustainability and the development of bio-based HDPE films. Regional contributions are expected to shift, with emerging markets in Asia Pacific and Latin America capturing a larger share of the market. Technological advancements, such as the integration of digital technologies in film production, are expected to enhance production efficiency and reduce costs, further driving market growth.

Client demand transformations are also anticipated, with a growing focus on customized and high-performance films that meet specific application requirements. The strategic imperatives for market players will include investing in research and development to innovate and produce environmentally friendly HDPE films, expanding their geographical reach to tap into emerging markets, and forming strategic partnerships to enhance their market presence. Overall, the HDPE film market is poised for significant growth, with evolving market dynamics and strategic foresight shaping the industry's future landscape.

High Density Polyethylene (HDPE) Film Market Segments Insights

Application Analysis

The application segment of the High Density Polyethylene (HDPE) Film market is diverse, encompassing various industries such as packaging, agriculture, construction, and industrial applications. In the packaging sector, HDPE films are widely used due to their excellent barrier properties, durability, and recyclability. The growing demand for sustainable packaging solutions is driving the adoption of HDPE films in food and beverage, healthcare, and consumer goods industries. In agriculture, HDPE films are used for mulching, greenhouse coverings, and silage wraps, offering benefits such as improved crop yield and soil moisture retention.

The construction industry also utilizes HDPE films for applications such as vapor barriers and protective coverings, owing to their resistance to moisture and chemicals. In the industrial sector, HDPE films are used for packaging and protective applications, benefiting from their strength and durability. The increasing focus on sustainability and the development of bio-based HDPE films are expected to drive the growth of the application segment, with manufacturers investing in research and development to innovate and meet evolving consumer preferences.

Material Type Analysis

The material type segment of the HDPE film market is primarily divided into blown film and cast film. Blown films are produced through a process of extrusion and blowing, resulting in films with excellent mechanical properties and uniform thickness. These films are widely used in packaging applications due to their strength and flexibility. Cast films, on the other hand, are produced through a casting process, resulting in films with superior clarity and gloss. These films are preferred for applications where visual appeal is important, such as in retail packaging.

The choice between blown and cast films depends on the specific application requirements, with manufacturers offering a range of options to cater to diverse customer needs. The ongoing advancements in film extrusion technologies are enabling manufacturers to produce high-quality films with enhanced performance characteristics, driving the growth of the material type segment. The development of bio-based HDPE films is also expected to impact the material type segment, with manufacturers focusing on sustainability and environmental responsibility.

Thickness Analysis

The thickness segment of the HDPE film market is categorized into films with thicknesses of up to 20 microns, 20-40 microns, and above 40 microns. Films with thicknesses of up to 20 microns are commonly used in applications where lightweight and cost-effective solutions are required, such as in packaging and agricultural applications. Films with thicknesses of 20-40 microns offer a balance between strength and flexibility, making them suitable for a wide range of applications, including industrial and construction uses.

Films with thicknesses above 40 microns are used in applications where high strength and durability are critical, such as in heavy-duty packaging and protective coverings. The choice of film thickness depends on the specific application requirements, with manufacturers offering a range of options to meet diverse customer needs. The ongoing advancements in film extrusion technologies are enabling manufacturers to produce films with precise thickness control, enhancing the performance and cost-effectiveness of HDPE films.

End-User Analysis

The end-user segment of the HDPE film market includes industries such as food and beverage, healthcare, consumer goods, industrial, and others. The food and beverage industry is a major consumer of HDPE films, utilizing them for packaging applications due to their excellent barrier properties and recyclability. The healthcare industry also uses HDPE films for packaging medical devices and pharmaceuticals, benefiting from their chemical resistance and durability.

The consumer goods industry utilizes HDPE films for packaging a wide range of products, from personal care items to household goods. The industrial sector uses HDPE films for packaging and protective applications, benefiting from their strength and durability. The increasing focus on sustainability and the development of bio-based HDPE films are expected to drive the growth of the end-user segment, with manufacturers investing in research and development to innovate and meet evolving consumer preferences.

High Density Polyethylene (HDPE) Film Market Segments

The High Density Polyethylene (HDPE) Film market has been segmented on the basis of

Application

- Packaging

- Agriculture

- Construction

- Industrial

- Others

Material Type

- Blown Film

- Cast Film

Thickness

- Up to 20 Microns

- 20-40 Microns

- Above 40 Microns

End-User

- Food & Beverage

- Healthcare

- Consumer Goods

- Industrial

- Others

Primary Interview Insights

What are the key drivers for the HDPE film market growth?

What challenges does the HDPE film market face?

How is the market responding to environmental sustainability trends?

Which regions are expected to see the most growth in the HDPE film market?

What role do technological advancements play in the HDPE film market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.