- Home

- Packaging Products

- Laminated Labels Market Size, Future Growth and Forecast 2033

Laminated Labels Market Size, Future Growth and Forecast 2033

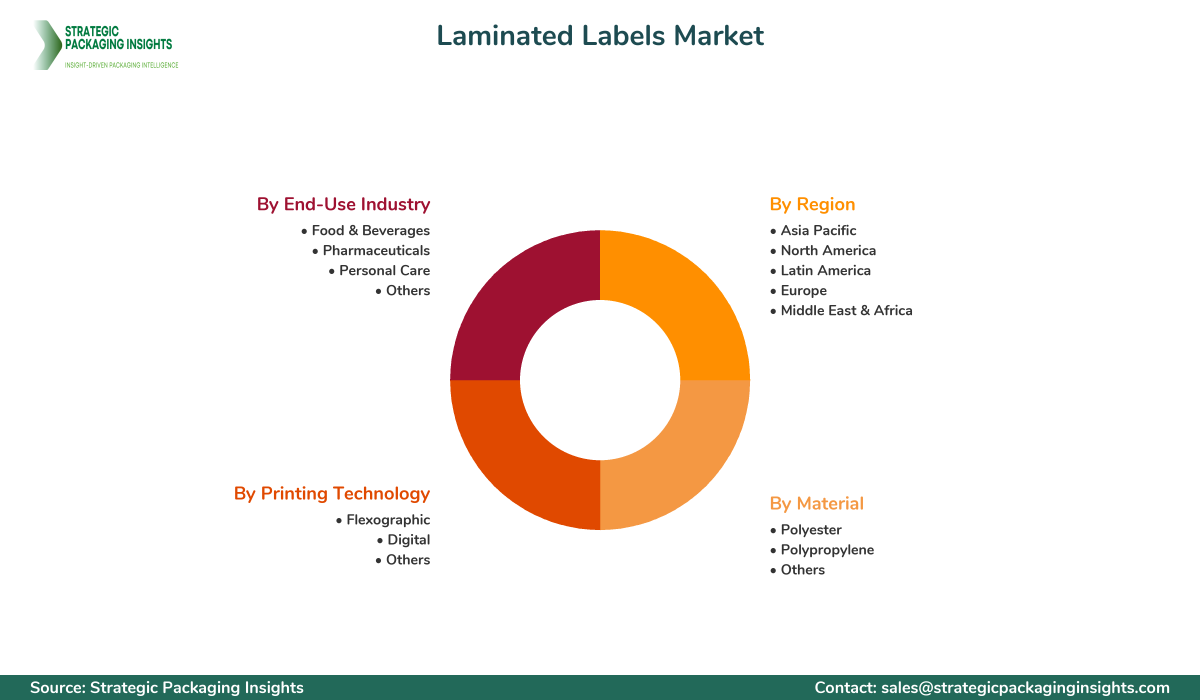

Laminated Labels Market Segments - by Material (Polyester, Polypropylene, Others), Printing Technology (Flexographic, Digital, Others), End-Use Industry (Food & Beverages, Pharmaceuticals, Personal Care, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Laminated Labels Market Outlook

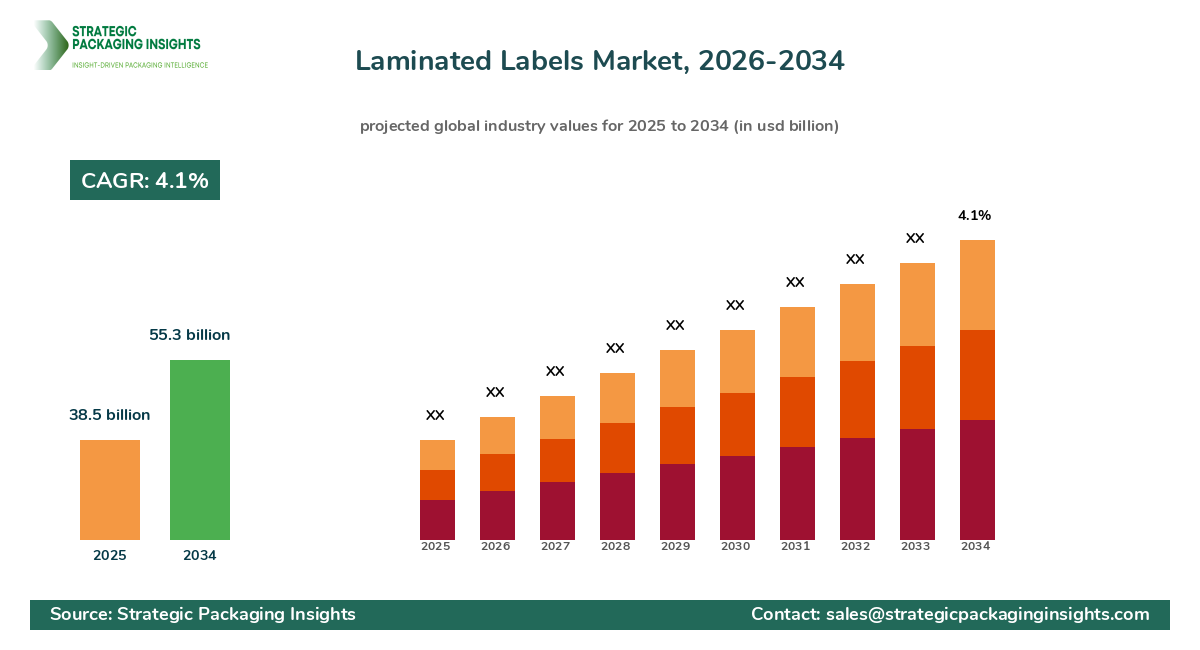

The laminated Labels market was valued at $38.5 billion in 2024 and is projected to reach $55.3 billion by 2033, growing at a CAGR of 4.1% during the forecast period 2025-2033. Laminated labels are increasingly being adopted across various industries due to their durability, aesthetic appeal, and ability to withstand harsh environmental conditions. The demand for laminated labels is driven by the growing need for product differentiation and branding, especially in the food and beverage, pharmaceutical, and personal care sectors. The rise in e-commerce and logistics has further fueled the demand for these labels as they provide essential information and enhance the visual appeal of products.

However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations regarding plastic usage. Despite these challenges, the market holds significant growth potential due to advancements in printing technologies and the increasing adoption of sustainable and eco-friendly labeling solutions. The development of innovative materials and the integration of smart labeling technologies are expected to create new opportunities for market players. Additionally, the growing trend of personalized and customized labels is likely to drive market growth in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Laminated Labels Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 124 |

| Material | Polyester, Polypropylene, Others |

| Printing Technology | Flexographic, Digital, Others |

| End-Use Industry | Food & Beverages, Pharmaceuticals, Personal Care, Others |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The laminated labels market presents numerous opportunities, particularly with the increasing demand for sustainable and eco-friendly labeling solutions. As consumers become more environmentally conscious, there is a growing preference for labels made from recyclable and biodegradable materials. This shift in consumer preference is encouraging manufacturers to invest in research and development to create innovative, sustainable labeling solutions. Additionally, the rise of smart labeling technologies, such as QR codes and NFC tags, offers opportunities for enhanced consumer engagement and product tracking, further driving market growth.

Another significant opportunity lies in the expansion of the e-commerce sector. With the increasing popularity of online shopping, there is a growing need for effective labeling solutions that can withstand the rigors of shipping and handling. Laminated labels, with their durability and resistance to moisture and abrasion, are well-suited for this purpose. Moreover, the demand for personalized and customized labels is on the rise, as brands seek to differentiate themselves in a competitive market. This trend is expected to drive the adoption of digital printing technologies, which offer flexibility and cost-effectiveness for short print runs.

Despite the promising opportunities, the laminated labels market faces certain threats, primarily related to environmental concerns and regulatory challenges. The increasing scrutiny on plastic usage and waste management is pushing manufacturers to explore alternative materials and production processes. Additionally, the volatility in raw material prices, particularly for petroleum-based products, poses a challenge for market players. Companies need to navigate these challenges by adopting sustainable practices and investing in innovative solutions to remain competitive in the market.

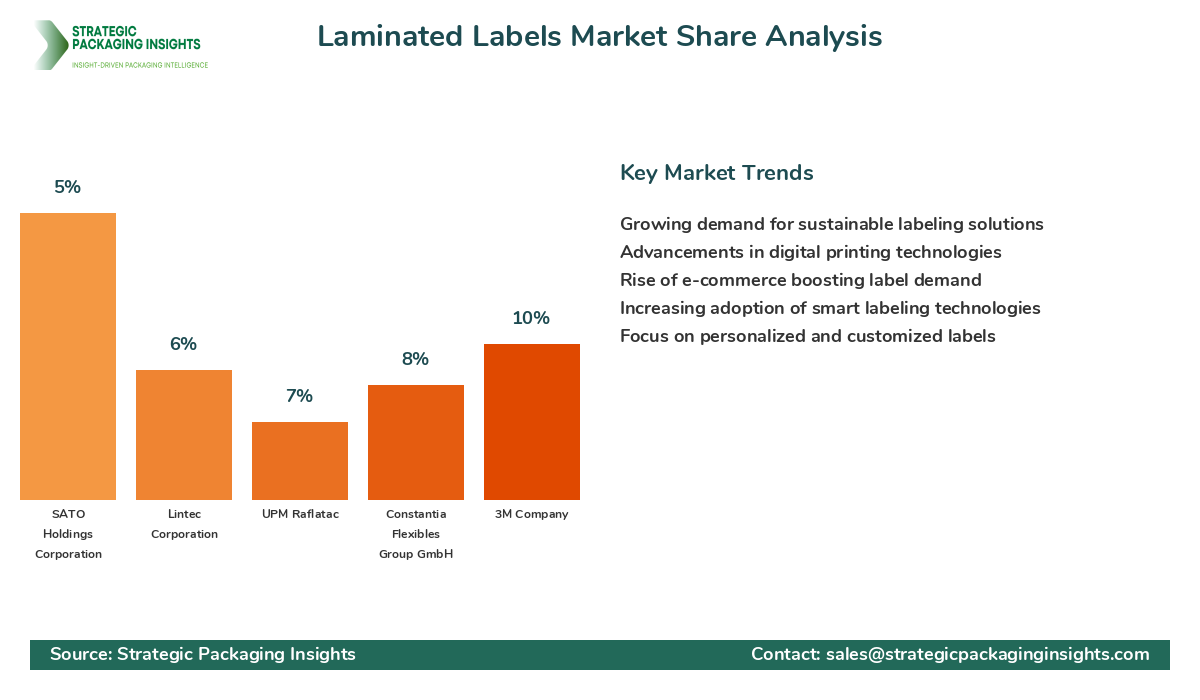

The laminated labels market is characterized by a highly competitive landscape, with numerous players vying for market share. The market is dominated by a few key players who hold significant shares due to their extensive product portfolios, strong distribution networks, and continuous investment in research and development. These companies are focused on expanding their market presence through strategic partnerships, mergers, and acquisitions, as well as by enhancing their product offerings to meet the evolving needs of consumers.

Among the major players in the laminated labels market, Avery Dennison Corporation holds a prominent position, leveraging its extensive experience and innovative product solutions. The company is known for its commitment to sustainability and has been actively investing in eco-friendly labeling technologies. CCL Industries Inc. is another key player, recognized for its diverse range of labeling solutions and strong global presence. The company has been expanding its operations through strategic acquisitions and partnerships, further strengthening its market position.

3M Company is also a significant player in the laminated labels market, known for its innovative product offerings and strong focus on research and development. The company's extensive distribution network and commitment to quality have helped it maintain a competitive edge in the market. Other notable players include Constantia Flexibles Group GmbH, UPM Raflatac, and Lintec Corporation, each contributing to the market's growth through their unique product offerings and strategic initiatives.

In addition to these major players, several regional and local companies are also making significant contributions to the market. These companies often focus on niche segments and offer specialized solutions to cater to specific customer needs. The competitive landscape is further intensified by the presence of numerous small and medium-sized enterprises, which are continuously innovating to capture market share. Overall, the laminated labels market is dynamic and competitive, with companies striving to differentiate themselves through innovation, sustainability, and customer-centric solutions.

Key Highlights Laminated Labels Market

- The laminated labels market is projected to grow at a CAGR of 4.1% from 2025 to 2033.

- Increasing demand for sustainable and eco-friendly labeling solutions is driving market growth.

- Advancements in digital printing technologies are enabling personalized and customized labeling solutions.

- The rise of e-commerce is boosting the demand for durable and resilient labeling solutions.

- Smart labeling technologies, such as QR codes and NFC tags, are enhancing consumer engagement.

- Fluctuating raw material prices pose a challenge for market players.

- Key players are focusing on strategic partnerships and acquisitions to expand their market presence.

- Environmental regulations regarding plastic usage are pushing manufacturers to explore alternative materials.

- Regional and local players are contributing to market growth through niche and specialized solutions.

Premium Insights - Key Investment Analysis

The laminated labels market is witnessing significant investment activity, driven by the growing demand for innovative and sustainable labeling solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and technologically advanced labeling products. The market has seen a surge in mergers and acquisitions, as established players seek to expand their product portfolios and geographic reach. These strategic deals are often aimed at enhancing production capabilities, accessing new markets, and acquiring cutting-edge technologies.

Investment valuations in the laminated labels market are influenced by factors such as the company's market position, product innovation, and sustainability initiatives. Companies with a strong focus on research and development, as well as those with a robust distribution network, tend to attract higher valuations. Return on investment (ROI) expectations are generally high, given the market's growth potential and the increasing demand for differentiated labeling solutions. Emerging investment themes include the development of Smart Labels, the use of biodegradable materials, and the integration of digital printing technologies.

Risk factors in the laminated labels market include regulatory challenges, particularly concerning environmental regulations and plastic usage. Companies need to navigate these challenges by adopting sustainable practices and investing in innovative solutions. The strategic rationale behind major deals often revolves around gaining a competitive edge through product differentiation, expanding market presence, and enhancing operational efficiencies. High-potential investment opportunities are found in segments such as smart labeling technologies, sustainable materials, and digital printing solutions, which are attracting significant investor interest.

Laminated Labels Market Segments Insights

Material Analysis

The laminated labels market is segmented by material into polyester, polypropylene, and others. Polyester is a popular choice due to its excellent durability, clarity, and resistance to moisture and chemicals. It is widely used in applications where labels are exposed to harsh environments, such as in the automotive and industrial sectors. Polypropylene, on the other hand, is favored for its cost-effectiveness and versatility, making it suitable for a wide range of applications, including food and beverage packaging. The demand for eco-friendly materials is also on the rise, with manufacturers exploring biodegradable and recyclable options to meet consumer preferences and regulatory requirements.

Polyester labels are known for their high tensile strength and resistance to tearing, making them ideal for applications that require long-lasting performance. They are often used in outdoor environments and on products that are subject to frequent handling. Polypropylene labels, while less durable than polyester, offer excellent printability and are often used for short-term applications where cost is a significant consideration. The market is witnessing a growing trend towards the use of sustainable materials, with companies investing in research and development to create innovative solutions that meet environmental standards.

Printing Technology Analysis

The laminated labels market is also segmented by printing technology into flexographic, digital, and others. Flexographic printing is a traditional method that is widely used for high-volume production runs due to its cost-effectiveness and ability to print on a variety of substrates. It is particularly popular in the food and beverage industry, where large quantities of labels are required. Digital printing, on the other hand, is gaining traction due to its flexibility, quick turnaround times, and ability to produce high-quality, customized labels. This technology is ideal for short print runs and is increasingly being adopted by companies looking to offer personalized labeling solutions.

Flexographic printing is known for its efficiency and ability to produce consistent, high-quality prints at a low cost. It is often used for applications where large quantities of labels are needed, such as in the packaging of consumer goods. Digital printing, while more expensive on a per-unit basis, offers significant advantages in terms of customization and speed. It allows for the production of labels with variable data, such as barcodes and QR codes, making it ideal for applications that require unique identifiers. The market is seeing a shift towards digital printing as companies seek to differentiate their products and engage consumers through personalized labeling solutions.

End-Use Industry Analysis

The laminated labels market is segmented by end-use industry into food and beverages, pharmaceuticals, personal care, and others. The food and beverage industry is a major consumer of laminated labels, driven by the need for product differentiation and compliance with labeling regulations. Labels in this industry often include nutritional information, branding elements, and promotional content, making them an essential component of packaging. The pharmaceutical industry also relies heavily on laminated labels for product identification, dosage instructions, and safety warnings. These labels must adhere to strict regulatory standards and are often designed to withstand harsh environmental conditions.

In the personal care industry, laminated labels are used to enhance the visual appeal of products and convey brand messaging. They are often designed to withstand exposure to moisture and chemicals, ensuring that they remain intact throughout the product's lifecycle. Other industries, such as automotive and electronics, also utilize laminated labels for product identification and branding purposes. The demand for laminated labels in these industries is driven by the need for durable, high-quality labeling solutions that can withstand challenging environments. Overall, the end-use industry segment is characterized by diverse applications and varying requirements, with companies tailoring their labeling solutions to meet specific industry needs.

Regional Analysis

The laminated labels market is segmented by region into Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. Asia Pacific is the largest market for laminated labels, driven by the rapid growth of the manufacturing and retail sectors in countries such as China and India. The region's expanding middle class and increasing consumer spending are also contributing to the demand for high-quality labeling solutions. North America and Europe are mature markets, characterized by high levels of innovation and a strong focus on sustainability. These regions are witnessing a growing demand for eco-friendly labeling solutions, driven by stringent environmental regulations and consumer preferences.

Latin America and the Middle East & Africa are emerging markets for laminated labels, with significant growth potential. The increasing adoption of modern retail formats and the expansion of the e-commerce sector are driving demand for labeling solutions in these regions. Companies are investing in expanding their operations and distribution networks to capitalize on the growing opportunities in these markets. Overall, the regional segment is characterized by varying levels of market maturity and growth potential, with companies tailoring their strategies to meet the specific needs and preferences of consumers in each region.

Market Share Analysis

The market share distribution of key players in the laminated labels market is influenced by factors such as product innovation, sustainability initiatives, and geographic reach. Companies like Avery Dennison Corporation and CCL Industries Inc. are leading the market, leveraging their extensive product portfolios and strong distribution networks. These companies are gaining market share by focusing on strategic partnerships and acquisitions, as well as by enhancing their product offerings to meet the evolving needs of consumers. Other players, such as 3M Company and Constantia Flexibles Group GmbH, are also making significant contributions to the market, driven by their commitment to innovation and quality.

The competitive positioning of companies in the laminated labels market is influenced by their ability to offer differentiated products and solutions. Companies that invest in research and development to create innovative, sustainable labeling solutions are well-positioned to gain market share. The market share distribution also affects pricing strategies, with leading players often able to command premium prices for their high-quality, innovative products. Partnerships and collaborations are common in the market, as companies seek to expand their reach and enhance their capabilities through strategic alliances. Overall, the market share distribution is dynamic, with companies continuously striving to strengthen their competitive position through innovation and customer-centric solutions.

Top Countries Insights in Laminated Labels

The United States is a leading market for laminated labels, with a current market size of $8.5 billion and a CAGR of 3%. The country's strong manufacturing base and high levels of consumer spending are driving demand for high-quality labeling solutions. The presence of major players and a focus on innovation and sustainability are also contributing to market growth. However, the market faces challenges related to environmental regulations and the need for sustainable materials.

China is another significant market for laminated labels, with a market size of $7.2 billion and a CAGR of 5%. The country's rapid industrialization and expanding middle class are driving demand for consumer goods, leading to increased demand for labeling solutions. The government's focus on environmental sustainability is encouraging manufacturers to adopt eco-friendly practices, further driving market growth.

Germany is a key market in Europe, with a market size of $4.5 billion and a CAGR of 2%. The country's strong focus on quality and innovation is driving demand for high-performance labeling solutions. The presence of major automotive and industrial players is also contributing to market growth, as these industries require durable and reliable labeling solutions.

India is an emerging market for laminated labels, with a market size of $3.8 billion and a CAGR of 6%. The country's growing retail sector and increasing consumer spending are driving demand for labeling solutions. The government's initiatives to promote manufacturing and exports are also contributing to market growth, as companies seek to enhance their product offerings and expand their reach.

Brazil is a growing market for laminated labels, with a market size of $2.5 billion and a CAGR of 4%. The country's expanding e-commerce sector and increasing consumer awareness are driving demand for high-quality labeling solutions. The presence of local manufacturers and a focus on innovation and sustainability are also contributing to market growth.

Laminated Labels Market Segments

The Laminated Labels market has been segmented on the basis of

Material

- Polyester

- Polypropylene

- Others

Printing Technology

- Flexographic

- Digital

- Others

End-Use Industry

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Others

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the laminated labels market?

How are companies addressing environmental concerns in the laminated labels market?

What role does digital printing play in the laminated labels market?

What challenges do companies face in the laminated labels market?

Which regions are experiencing the most growth in the laminated labels market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.