- Home

- Food Packaging

- Lidding Foil For Food Market Size, Future Growth and Forecast 2033

Lidding Foil For Food Market Size, Future Growth and Forecast 2033

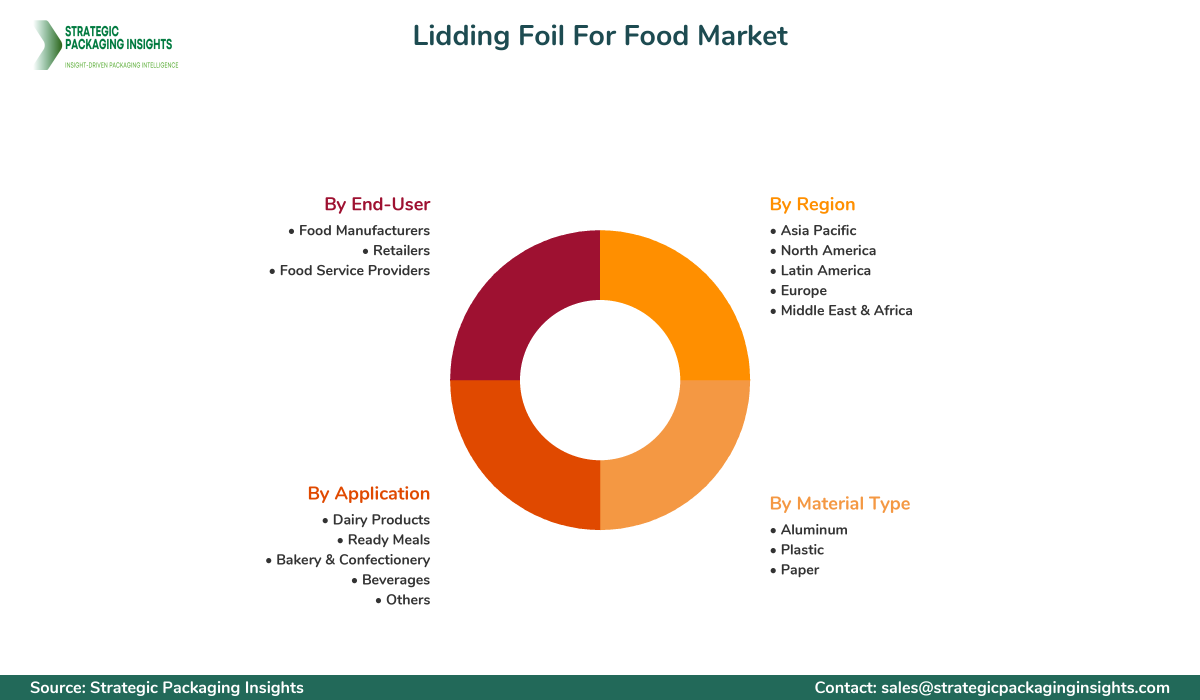

Lidding Foil For Food Market Segments - by Material Type (Aluminum, Plastic, Paper), Application (Dairy Products, Ready Meals, Bakery & Confectionery, Beverages, Others), End-User (Food Manufacturers, Retailers, Food Service Providers), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Lidding Foil For Food Market Outlook

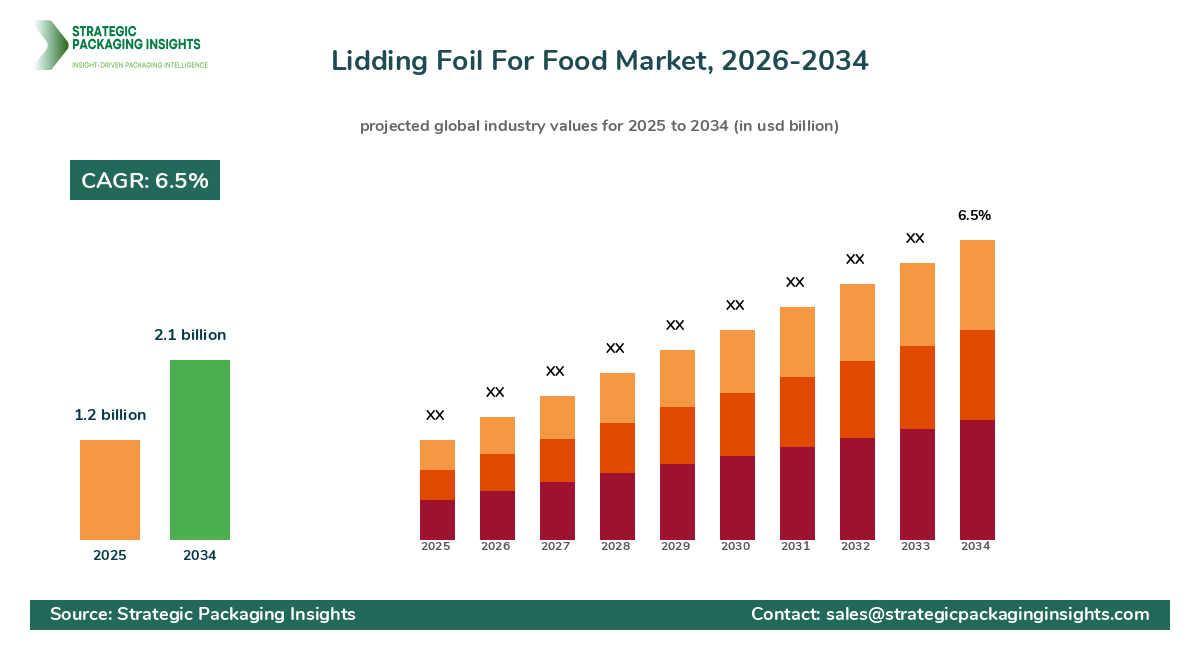

The lidding foil for food market was valued at $1.2 billion in 2024 and is projected to reach $2.1 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033. This market is driven by the increasing demand for convenient and Sustainable Packaging solutions in the food industry. The rising consumer preference for ready-to-eat meals and packaged food products is significantly contributing to the growth of the lidding foil market. Additionally, the growing awareness regarding food safety and hygiene is propelling the demand for effective packaging solutions, further boosting the market growth.

However, the market faces challenges such as stringent environmental regulations and the high cost of raw materials, which may hinder its growth. Despite these challenges, the market holds significant growth potential due to the increasing adoption of eco-friendly and Recyclable Packaging materials. The development of innovative packaging solutions that enhance product shelf life and reduce food wastage is expected to create lucrative opportunities for market players in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Lidding Foil For Food Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 170 |

| Material Type | Aluminum, Plastic, Paper |

| Application | Dairy Products, Ready Meals, Bakery & Confectionery, Beverages, Others |

| End-User | Food Manufacturers, Retailers, Food Service Providers |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The Lidding Foil for food market presents numerous opportunities for growth, primarily driven by the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are recyclable and have a lower carbon footprint. This trend is encouraging manufacturers to develop innovative lidding foil solutions that meet these sustainability criteria. Additionally, the rise in e-commerce and online food delivery services is boosting the demand for effective packaging solutions that ensure product safety and quality during transit.

Another significant opportunity lies in the technological advancements in packaging materials. The development of high-barrier lidding foils that offer superior protection against moisture, oxygen, and light is gaining traction in the market. These advanced materials not only enhance the shelf life of food products but also improve their visual appeal, making them more attractive to consumers. Furthermore, the increasing focus on reducing food wastage is driving the demand for packaging solutions that can extend the freshness of perishable goods, thereby creating new growth avenues for market players.

Despite the promising opportunities, the market faces certain restrainers that could impede its growth. One of the primary challenges is the fluctuating prices of raw materials, particularly aluminum, which is a key component of lidding foils. The volatility in raw material prices can significantly impact the production costs and profit margins of manufacturers. Additionally, the stringent regulations regarding food packaging materials, particularly in developed regions, pose a challenge for market players. Compliance with these regulations requires significant investment in research and development, which can be a barrier for small and medium-sized enterprises.

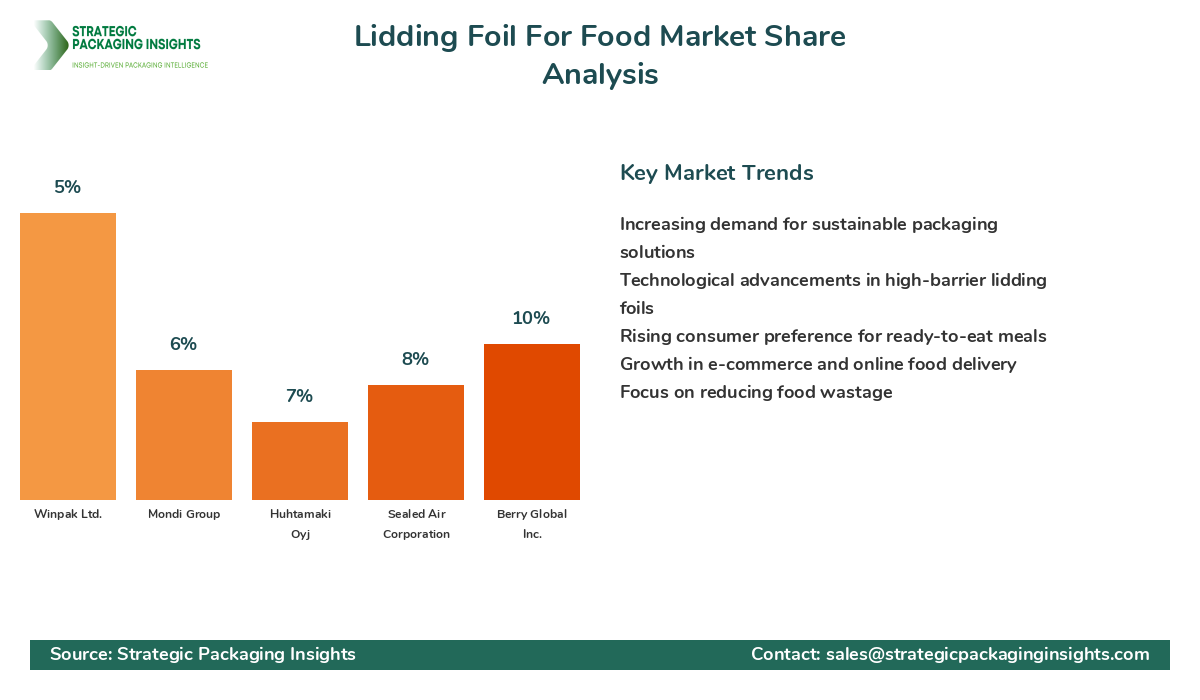

The competitive landscape of the lidding foil for food market is characterized by the presence of several key players who hold significant market shares. These companies are focusing on strategic initiatives such as mergers and acquisitions, product innovations, and collaborations to strengthen their market position. The market is moderately fragmented, with a mix of global and regional players competing to capture a larger share of the market. The leading companies are investing heavily in research and development to introduce innovative and sustainable packaging solutions that cater to the evolving consumer preferences.

Amcor Plc is one of the prominent players in the market, known for its extensive range of packaging solutions, including lidding foils. The company has a strong global presence and is continuously expanding its product portfolio to meet the diverse needs of its customers. Constantia Flexibles Group GmbH is another major player, offering a wide range of Flexible Packaging solutions, including high-barrier lidding foils that provide excellent protection for food products.

Berry Global Inc. is a key player in the market, known for its innovative packaging solutions that focus on sustainability and recyclability. The company has a strong focus on research and development, which enables it to introduce cutting-edge packaging solutions that meet the changing demands of the food industry. Sealed Air Corporation is also a significant player, offering a comprehensive range of packaging solutions that enhance food safety and extend shelf life.

Huhtamaki Oyj is a leading provider of sustainable packaging solutions, including lidding foils, with a strong emphasis on environmental responsibility. The company is committed to reducing its carbon footprint and is actively involved in developing eco-friendly packaging materials. Mondi Group is another key player, offering a wide range of packaging solutions that cater to various industries, including food and beverages. The company is focused on innovation and sustainability, which are key drivers of its growth strategy.

Key Highlights Lidding Foil For Food Market

- Increasing demand for sustainable and recyclable packaging solutions.

- Technological advancements in high-barrier lidding foils.

- Rising consumer preference for ready-to-eat and packaged food products.

- Growth in e-commerce and online food delivery services.

- Stringent regulations regarding food packaging materials.

- Volatility in raw material prices impacting production costs.

- Focus on reducing food wastage through innovative packaging solutions.

- Expansion of product portfolios by key market players.

- Growing awareness regarding food safety and hygiene.

- Development of eco-friendly packaging materials.

Top Countries Insights in Lidding Foil For Food

The United States is one of the leading markets for lidding foil for food, with a market size of $300 million and a CAGR of 5%. The country's strong focus on food safety and hygiene, coupled with the growing demand for convenient packaging solutions, is driving the market growth. Additionally, the presence of major food manufacturers and retailers in the country is contributing to the increasing demand for lidding foils.

Germany is another significant market, with a market size of $250 million and a CAGR of 4%. The country's stringent regulations regarding food packaging materials and the growing emphasis on sustainability are key drivers of the market. The demand for high-barrier lidding foils that offer superior protection for food products is particularly strong in Germany.

China is experiencing rapid growth in the lidding foil for food market, with a market size of $200 million and a CAGR of 7%. The country's expanding middle class and increasing disposable income are driving the demand for packaged food products, thereby boosting the market for lidding foils. Additionally, the growth of e-commerce and online food delivery services is contributing to the market expansion.

India is also witnessing significant growth, with a market size of $150 million and a CAGR of 8%. The country's large population and increasing urbanization are driving the demand for convenient and sustainable packaging solutions. The government's initiatives to promote food safety and reduce food wastage are further supporting the market growth.

Brazil is a key market in Latin America, with a market size of $100 million and a CAGR of 6%. The country's growing food and beverage industry, coupled with the increasing demand for packaged food products, is driving the market for lidding foils. The focus on sustainability and eco-friendly packaging solutions is also contributing to the market growth in Brazil.

Value Chain Profitability Analysis

The value chain of the lidding foil for food market involves several key stakeholders, including raw material suppliers, manufacturers, distributors, and end-users. Each stage of the value chain plays a crucial role in determining the overall profitability of the market. Raw material suppliers provide essential components such as aluminum and plastic, which are critical for the production of lidding foils. The cost of these raw materials significantly impacts the production costs and profit margins of manufacturers.

Manufacturers are responsible for converting raw materials into finished lidding foils, which are then distributed to various end-users, including food manufacturers, retailers, and food service providers. The pricing models and profit margins at each stage of the value chain vary depending on factors such as production costs, demand, and competition. Manufacturers typically capture a significant share of the market value, as they are responsible for the production and innovation of lidding foils.

Distributors play a crucial role in ensuring the availability of lidding foils to end-users. They are responsible for managing the logistics and supply chain operations, which can impact the overall profitability of the market. End-users, such as food manufacturers and retailers, are the final consumers of lidding foils and play a vital role in driving demand. The increasing focus on sustainability and eco-friendly packaging solutions is reshaping the value chain, with manufacturers and distributors investing in innovative technologies to meet the evolving consumer preferences.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The lidding foil for food market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences and technological advancements. During this period, the market experienced a steady growth rate, with a CAGR of 4.5%. The increasing demand for convenient and sustainable packaging solutions was a key driver of market growth. The focus on food safety and hygiene also played a crucial role in shaping the market dynamics.

Looking ahead to the forecast period of 2025–2033, the market is expected to witness accelerated growth, with a projected CAGR of 6.5%. The increasing adoption of eco-friendly and recyclable packaging materials is expected to be a major growth driver. Technological advancements in high-barrier lidding foils and the growing demand for ready-to-eat and packaged food products are also expected to contribute to the market expansion. The strategic focus on reducing food wastage and enhancing product shelf life is likely to create new growth opportunities for market players.

Regional contribution changes are also expected during the forecast period, with Asia Pacific emerging as a key growth region. The rapid urbanization and increasing disposable income in countries such as China and India are driving the demand for lidding foils. The growth of e-commerce and online food delivery services is also expected to boost the market in this region. In contrast, the market in Europe and North America is expected to experience moderate growth, driven by the increasing focus on sustainability and stringent regulations regarding food packaging materials.

Lidding Foil For Food Market Segments Insights

Material Type Analysis

The material type segment of the lidding foil for food market is primarily categorized into aluminum, plastic, and paper. Aluminum lidding foils are widely used due to their excellent barrier properties, which protect food products from moisture, oxygen, and light. The demand for aluminum lidding foils is driven by their ability to extend the shelf life of food products and enhance their visual appeal. However, the high cost of aluminum and environmental concerns related to its production are driving the demand for alternative materials.

Plastic lidding foils are gaining popularity due to their cost-effectiveness and versatility. They are available in various forms, including polyethylene, polypropylene, and polyester, each offering unique properties that cater to different packaging needs. The demand for plastic lidding foils is driven by their lightweight nature and ability to be easily molded into various shapes and sizes. However, the growing environmental concerns regarding plastic waste are encouraging manufacturers to develop recyclable and biodegradable plastic lidding foils.

Paper lidding foils are emerging as a sustainable alternative to traditional materials. They are made from renewable resources and are easily recyclable, making them an attractive option for environmentally conscious consumers. The demand for paper lidding foils is driven by the increasing focus on sustainability and the growing preference for eco-friendly packaging solutions. However, the limited barrier properties of paper compared to aluminum and plastic may restrict its use in certain applications.

Application Analysis

The application segment of the lidding foil for food market includes dairy products, ready meals, bakery & confectionery, beverages, and others. The demand for lidding foils in the dairy products segment is driven by the need for effective packaging solutions that ensure product safety and extend shelf life. The growing consumption of dairy products, particularly in emerging markets, is contributing to the demand for lidding foils in this segment.

The ready meals segment is experiencing significant growth due to the increasing consumer preference for convenient and time-saving food options. Lidding foils play a crucial role in preserving the freshness and quality of ready meals, making them an essential component of the packaging process. The demand for lidding foils in the bakery & confectionery segment is driven by the need for packaging solutions that protect products from moisture and contamination.

The beverages segment is also witnessing growth, driven by the increasing demand for packaged drinks and the need for effective sealing solutions. Lidding foils are used to seal beverage containers, ensuring product safety and preventing leakage. The demand for lidding foils in other applications, such as snacks and frozen foods, is driven by the need for packaging solutions that enhance product shelf life and maintain quality.

End-User Analysis

The end-user segment of the lidding foil for food market includes food manufacturers, retailers, and food service providers. Food manufacturers are the primary consumers of lidding foils, using them to package a wide range of products, including dairy, ready meals, and bakery items. The demand for lidding foils in this segment is driven by the need for packaging solutions that ensure product safety and extend shelf life.

Retailers also play a significant role in the demand for lidding foils, as they require effective packaging solutions to maintain the quality and freshness of products on store shelves. The growing trend of private label products is contributing to the demand for lidding foils in the retail segment. Food service providers, including restaurants and catering services, use lidding foils to package and transport food products, ensuring their safety and quality during transit.

The demand for lidding foils in the end-user segment is driven by the increasing focus on sustainability and the need for packaging solutions that reduce food wastage. The growing awareness regarding food safety and hygiene is also contributing to the demand for lidding foils in this segment. Manufacturers are focusing on developing innovative and eco-friendly packaging solutions to meet the evolving needs of end-users.

Lidding Foil For Food Market Segments

The Lidding Foil For Food market has been segmented on the basis of

Material Type

- Aluminum

- Plastic

- Paper

Application

- Dairy Products

- Ready Meals

- Bakery & Confectionery

- Beverages

- Others

End-User

- Food Manufacturers

- Retailers

- Food Service Providers

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the lidding foil for food market?

What challenges does the lidding foil for food market face?

How is the market expected to evolve in the coming years?

Which regions are expected to see the most growth?

What role do end-users play in the demand for lidding foils?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.