- Home

- Food Packaging

- Meat, Poultry, and Seafood Packaging Market Size, Future Growth and Forecast 2033

Meat, Poultry, and Seafood Packaging Market Size, Future Growth and Forecast 2033

Meat, Poultry, and Seafood Packaging Market Segments - by Material (Plastic, Paper & Paperboard, Metal, Glass), Packaging Type (Rigid, Flexible), Application (Fresh & Frozen Products, Processed Products, Ready-to-Eat Products), and End-User (Retail, Foodservice, Institutional) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Meat, Poultry, and Seafood Packaging Market Outlook

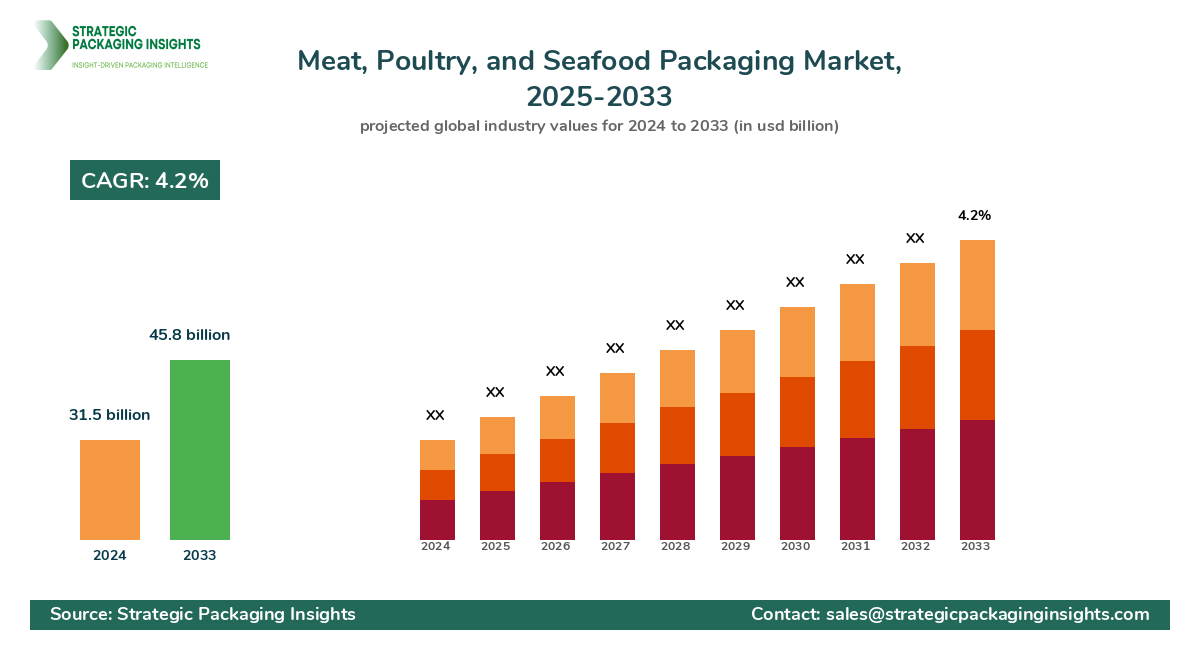

The meat, poultry, and seafood packaging market was valued at $31.5 billion in 2024 and is projected to reach $45.8 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033. This market is driven by the increasing demand for convenient and sustainable packaging solutions that extend the shelf life of perishable goods. The rise in global consumption of meat, poultry, and seafood, coupled with the growing trend of ready-to-eat and processed food products, is significantly contributing to the market's expansion. Additionally, advancements in packaging technologies, such as vacuum skin packaging and Modified Atmosphere packaging, are enhancing product safety and quality, further propelling market growth.

However, the market faces challenges such as stringent regulatory requirements regarding food safety and packaging waste management. The increasing focus on reducing plastic usage and promoting eco-friendly packaging solutions is pushing manufacturers to innovate and adapt. Despite these challenges, the market holds substantial growth potential due to the rising consumer preference for packaged food products and the expansion of retail and foodservice sectors globally. The ongoing developments in biodegradable and recyclable packaging materials are expected to create lucrative opportunities for market players in the coming years.

Report Scope

| Attributes | Details |

| Report Title | Meat, Poultry, and Seafood Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 169 |

| Material | Plastic, Paper & Paperboard, Metal, Glass |

| Packaging Type | Rigid, Flexible |

| Application | Fresh & Frozen Products, Processed Products, Ready-to-Eat Products |

| End-User | Retail, Foodservice, Institutional |

| Customization Available | Yes* |

Opportunities & Threats

The meat, poultry, and seafood packaging market presents numerous opportunities, primarily driven by the increasing demand for sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are biodegradable and recyclable. This shift is encouraging manufacturers to invest in research and development to create innovative packaging solutions that meet these demands. Additionally, the rise in e-commerce and online grocery shopping is boosting the demand for efficient and durable packaging that can withstand the rigors of transportation and handling. This trend is expected to open new avenues for growth in the market.

Another significant opportunity lies in the technological advancements in packaging methods. Innovations such as vacuum Skin Packaging, modified atmosphere packaging, and active packaging are gaining traction due to their ability to extend the shelf life of products and maintain their freshness. These technologies are particularly beneficial for meat, poultry, and seafood products, which are highly perishable. As a result, companies that invest in these advanced packaging solutions are likely to gain a competitive edge in the market. Furthermore, the increasing focus on food safety and hygiene is driving the demand for packaging solutions that offer enhanced protection against contamination and spoilage.

Despite the promising opportunities, the market faces certain threats that could hinder its growth. One of the primary challenges is the stringent regulatory landscape governing food packaging. Compliance with food safety standards and regulations can be complex and costly for manufacturers, particularly for small and medium-sized enterprises. Additionally, the rising cost of raw materials, such as plastics and paper, can impact profit margins and pose a challenge for market players. The growing pressure to reduce plastic waste and adopt sustainable packaging practices also requires significant investment in new technologies and materials, which may not be feasible for all companies.

The competitive landscape of the meat, poultry, and seafood packaging market is characterized by the presence of several key players who are actively engaged in product innovation and strategic partnerships to strengthen their market position. The market is moderately fragmented, with a mix of global and regional players competing for market share. Companies are focusing on expanding their product portfolios and enhancing their production capabilities to cater to the growing demand for sustainable and efficient packaging solutions. The increasing emphasis on food safety and hygiene is also driving companies to invest in advanced packaging technologies that offer superior protection and preservation of products.

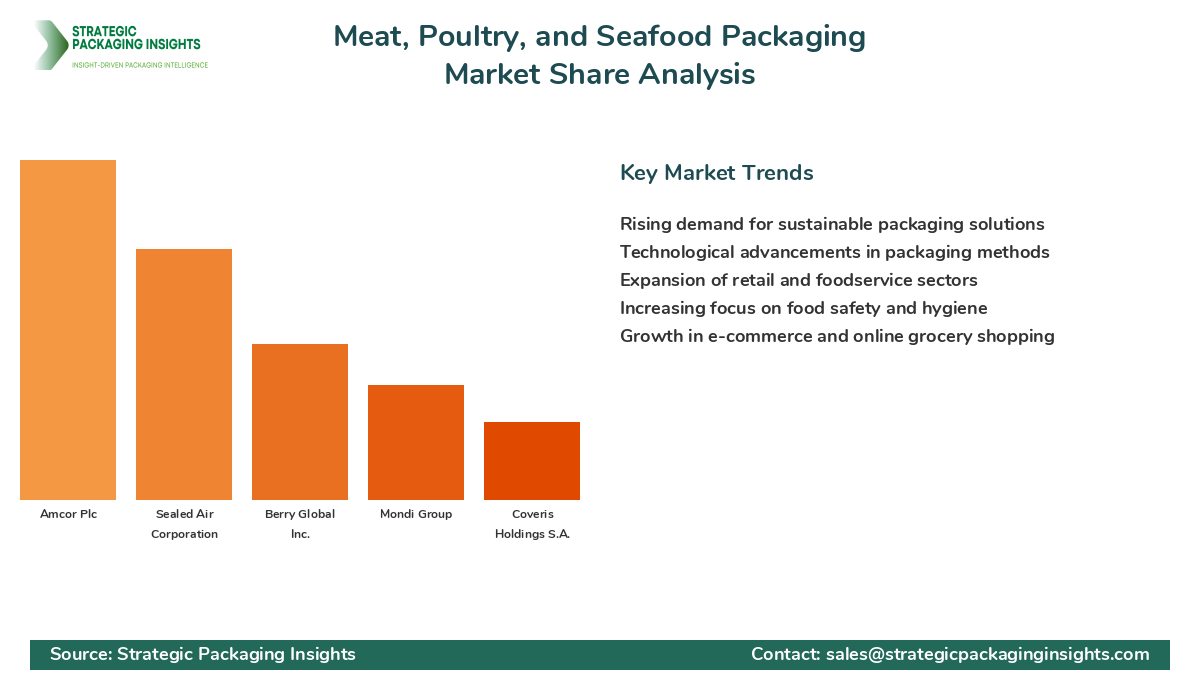

Amcor Plc is a leading player in the market, known for its innovative packaging solutions and commitment to sustainability. The company offers a wide range of packaging products for the meat, poultry, and seafood industry, including vacuum skin packaging and modified atmosphere packaging. Amcor's strong focus on research and development and its extensive global presence have helped it maintain a significant market share. Similarly, Sealed Air Corporation is another major player, renowned for its Cryovac brand, which provides high-performance packaging solutions that enhance product safety and extend shelf life.

Berry Global Inc. is a prominent player in the market, offering a diverse range of packaging solutions for the food industry. The company's focus on sustainability and innovation has enabled it to capture a substantial share of the market. Berry Global's extensive product portfolio includes flexible and rigid packaging options that cater to the specific needs of the meat, poultry, and seafood industry. Additionally, Mondi Group is a key player known for its sustainable packaging solutions and commitment to reducing environmental impact. The company's focus on developing eco-friendly packaging materials has positioned it as a leader in the market.

Other notable players in the market include Coveris Holdings S.A., Smurfit Kappa Group, and DS Smith Plc, all of which are actively investing in research and development to enhance their product offerings and expand their market presence. These companies are leveraging strategic partnerships and acquisitions to strengthen their position in the market and capitalize on emerging opportunities. The competitive landscape is expected to remain dynamic, with companies focusing on innovation and sustainability to gain a competitive edge.

Key Highlights Meat, Poultry, and Seafood Packaging Market

- Increasing demand for sustainable and eco-friendly packaging solutions.

- Technological advancements in packaging methods, such as vacuum skin packaging and modified atmosphere packaging.

- Rising consumer preference for packaged food products.

- Expansion of retail and foodservice sectors globally.

- Growing focus on food safety and hygiene.

- Stringent regulatory requirements regarding food safety and packaging waste management.

- Rising cost of raw materials impacting profit margins.

- Opportunities for growth in e-commerce and online grocery shopping.

- Investment in research and development for innovative packaging solutions.

- Increasing emphasis on reducing plastic waste and adopting sustainable packaging practices.

Premium Insights - Key Investment Analysis

The meat, poultry, and seafood packaging market is witnessing significant investment activity, driven by the growing demand for sustainable and innovative packaging solutions. Venture capital firms and private equity investors are increasingly focusing on companies that offer eco-friendly and technologically advanced packaging products. The market is also seeing a rise in mergers and acquisitions as companies seek to expand their product portfolios and enhance their market presence. Strategic investments in research and development are crucial for companies to stay competitive and meet the evolving demands of consumers and regulatory bodies.

Investment valuations in the market are influenced by factors such as the company's technological capabilities, product innovation, and sustainability initiatives. Companies that demonstrate a strong commitment to reducing environmental impact and enhancing product safety are attracting significant investor interest. The return on investment (ROI) expectations in the market are high, given the increasing consumer preference for packaged food products and the expansion of the retail and foodservice sectors. Emerging investment themes include the development of biodegradable and recyclable packaging materials, as well as the adoption of advanced packaging technologies that extend product shelf life.

Risk factors in the market include the volatility of raw material prices, regulatory compliance costs, and the competitive landscape. Companies that can effectively manage these risks and capitalize on emerging opportunities are likely to achieve substantial growth. The strategic rationale behind major deals in the market often revolves around enhancing product offerings, expanding geographic reach, and strengthening market position. High-potential investment opportunities exist in regions with growing demand for packaged food products, such as Asia Pacific and Latin America, where rising disposable incomes and changing consumer lifestyles are driving market growth.

Meat, Poultry, and Seafood Packaging Market Segments Insights

Material Analysis

The material segment of the meat, poultry, and seafood packaging market is dominated by plastic, which is widely used due to its versatility, durability, and cost-effectiveness. However, the increasing environmental concerns and regulatory pressures to reduce plastic waste are driving the demand for alternative materials such as paper & paperboard, metal, and glass. Paper & paperboard are gaining popularity due to their recyclability and biodegradability, making them an attractive option for eco-conscious consumers. Metal and glass, although less commonly used, offer excellent barrier properties and are preferred for premium and specialty products.

The competition in the material segment is intense, with companies focusing on developing innovative and sustainable packaging solutions to meet the evolving consumer demands. The trend towards lightweight and flexible packaging is also influencing material choices, as manufacturers seek to reduce transportation costs and environmental impact. The demand for high-performance materials that offer superior protection and preservation of products is driving research and development efforts in the industry. As a result, companies that can offer a diverse range of materials and adapt to changing market trends are likely to gain a competitive advantage.

Packaging Type Analysis

The packaging type segment is divided into rigid and flexible packaging, each offering distinct advantages and catering to different consumer preferences. Rigid packaging, which includes containers, trays, and cartons, is favored for its strength and protection, making it ideal for transporting and storing meat, poultry, and seafood products. However, the growing demand for convenience and portability is driving the popularity of flexible packaging, which includes pouches, bags, and films. Flexible packaging is lightweight, easy to handle, and offers excellent barrier properties, making it a preferred choice for many consumers.

The trend towards flexible packaging is supported by advancements in packaging technologies that enhance product safety and extend shelf life. Companies are investing in innovative solutions such as vacuum skin packaging and modified atmosphere packaging to meet the demand for fresh and high-quality products. The competition in the packaging type segment is fierce, with manufacturers focusing on product differentiation and sustainability to capture market share. As consumer preferences continue to evolve, companies that can offer a wide range of packaging options and adapt to changing trends are likely to succeed in the market.

Application Analysis

The application segment of the market is categorized into fresh & frozen products, processed products, and ready-to-eat products. The demand for fresh & frozen products is driven by the increasing consumer preference for fresh and minimally processed foods. Packaging solutions that offer superior protection and preservation of freshness are in high demand in this segment. Processed products, which include cured, smoked, and canned meats, require packaging that ensures product safety and extends shelf life. The growing trend of convenience foods is boosting the demand for ready-to-eat products, which require packaging that is easy to open and use.

The competition in the application segment is influenced by consumer preferences and lifestyle changes. Companies are focusing on developing packaging solutions that cater to the specific needs of each application, such as resealable and microwaveable packaging for ready-to-eat products. The demand for packaging that offers convenience, safety, and sustainability is driving innovation in the industry. As a result, companies that can offer tailored solutions for different applications and adapt to changing consumer demands are likely to gain a competitive edge in the market.

End-User Analysis

The end-user segment is divided into retail, foodservice, and institutional sectors, each with unique packaging requirements. The retail sector, which includes supermarkets and grocery stores, is the largest end-user of meat, poultry, and seafood packaging. The demand for attractive and informative packaging that enhances product visibility and appeal is high in this sector. The foodservice sector, which includes restaurants and catering services, requires packaging that ensures product safety and convenience. The institutional sector, which includes schools, hospitals, and other institutions, demands packaging that is cost-effective and easy to handle.

The competition in the end-user segment is driven by the need for customized packaging solutions that meet the specific requirements of each sector. Companies are focusing on developing packaging that offers convenience, safety, and sustainability to capture market share. The trend towards online grocery shopping and home delivery is also influencing packaging choices, as companies seek to offer packaging that is durable and efficient for transportation. As the demand for packaged food products continues to grow, companies that can offer innovative and tailored solutions for different end-users are likely to succeed in the market.

Market Share Analysis

The market share distribution of key players in the meat, poultry, and seafood packaging market is influenced by factors such as product innovation, sustainability initiatives, and strategic partnerships. Leading companies like Amcor Plc, Sealed Air Corporation, and Berry Global Inc. are at the forefront of the market, leveraging their extensive product portfolios and global presence to maintain a competitive edge. These companies are investing heavily in research and development to create innovative packaging solutions that meet the evolving demands of consumers and regulatory bodies.

Companies that are gaining market share are those that focus on sustainability and eco-friendly packaging solutions. The growing consumer preference for sustainable packaging is driving companies to adopt environmentally friendly practices and materials. This trend is influencing pricing strategies, as companies seek to offer competitive pricing while maintaining profitability. The market share distribution is also affected by strategic partnerships and collaborations, as companies seek to expand their product offerings and geographic reach. As the market continues to evolve, companies that can effectively navigate these trends and adapt to changing consumer demands are likely to succeed.

Top Countries Insights in Meat, Poultry, and Seafood Packaging

The United States is a leading market for meat, poultry, and seafood packaging, with a market size of $8.5 billion and a CAGR of 4%. The demand for convenient and sustainable packaging solutions is driving market growth, supported by the expansion of the retail and foodservice sectors. The increasing focus on food safety and hygiene is also influencing packaging choices, as consumers seek products that offer superior protection and preservation.

China is another significant market, with a market size of $6.2 billion and a CAGR of 5%. The rising disposable incomes and changing consumer lifestyles are driving the demand for packaged food products, particularly in urban areas. The government's focus on food safety and environmental sustainability is also influencing packaging trends, as companies seek to comply with regulatory requirements and meet consumer expectations.

Germany is a key market in Europe, with a market size of $4.1 billion and a CAGR of 3%. The demand for sustainable and eco-friendly packaging solutions is high, driven by the increasing environmental awareness among consumers. The expansion of the retail sector and the growing trend of convenience foods are also contributing to market growth.

Brazil is an emerging market, with a market size of $3.5 billion and a CAGR of 4%. The rising demand for packaged food products, supported by the expansion of the retail and foodservice sectors, is driving market growth. The focus on food safety and hygiene is also influencing packaging choices, as consumers seek products that offer superior protection and preservation.

India is a rapidly growing market, with a market size of $2.8 billion and a CAGR of 6%. The increasing disposable incomes and changing consumer preferences are driving the demand for packaged food products. The government's focus on food safety and environmental sustainability is also influencing packaging trends, as companies seek to comply with regulatory requirements and meet consumer expectations.

Meat, Poultry, and Seafood Packaging Market Segments

The Meat, Poultry, and Seafood Packaging market has been segmented on the basis of

Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

Packaging Type

- Rigid

- Flexible

Application

- Fresh & Frozen Products

- Processed Products

- Ready-to-Eat Products

End-User

- Retail

- Foodservice

- Institutional

Primary Interview Insights

What are the key drivers of growth in the meat, poultry, and seafood packaging market?

What challenges does the market face?

How are companies responding to the demand for sustainable packaging?

What opportunities exist in the market?

Which regions offer the most growth potential?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.