- Home

- Food Packaging

- Metal Food Container Market Size, Future Growth and Forecast 2033

Metal Food Container Market Size, Future Growth and Forecast 2033

Metal Food Container Market Segments - by Material (Aluminum, Steel, Tin), Application (Canned Food, Beverages, Pet Food, Others), End-User (Household, Commercial, Industrial), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Metal Food Container Market Outlook

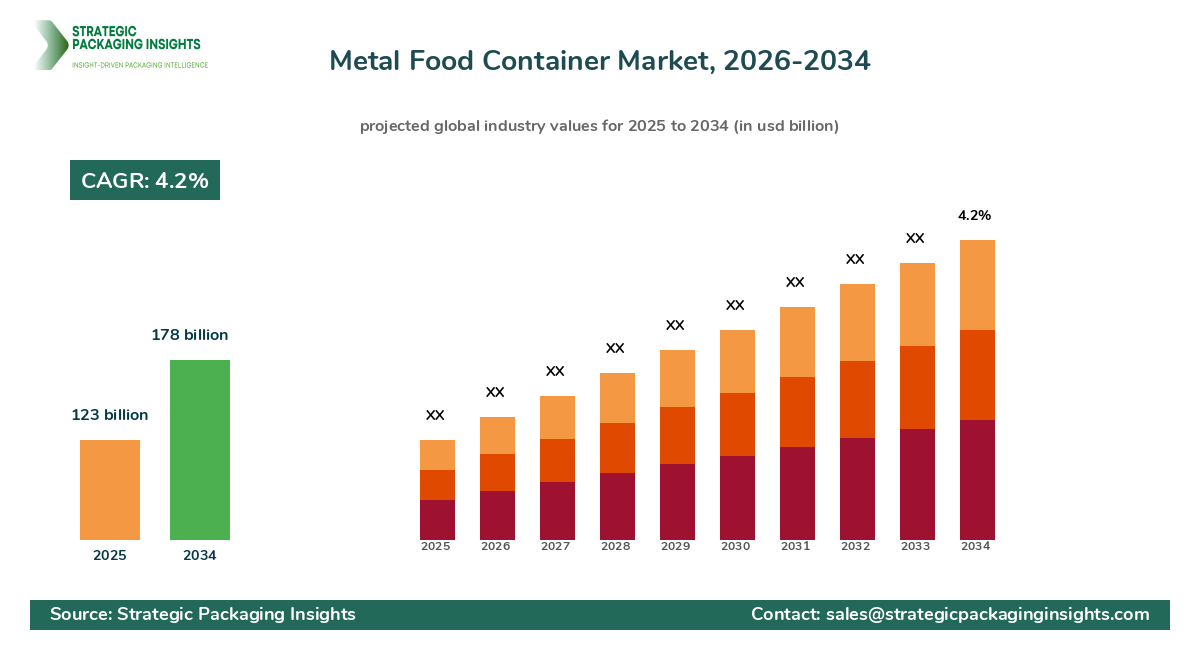

The metal food container market was valued at $123 billion in 2024 and is projected to reach $178 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033. This growth is driven by increasing consumer demand for sustainable and Recyclable Packaging solutions, as well as the rising popularity of canned foods and beverages. Metal containers offer superior protection against external factors such as light, oxygen, and moisture, which helps in preserving the quality and shelf life of food products. The market is also benefiting from technological advancements in metal packaging, which enhance the aesthetic appeal and functionality of containers.

However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations regarding metal production and recycling processes. Despite these challenges, the market holds significant growth potential due to the increasing adoption of metal packaging in emerging economies and the development of innovative packaging designs that cater to consumer preferences for convenience and portability. The market is also witnessing a shift towards lightweight and easy-to-open metal containers, which are gaining popularity among consumers.

Report Scope

| Attributes | Details |

| Report Title | Metal Food Container Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 228 |

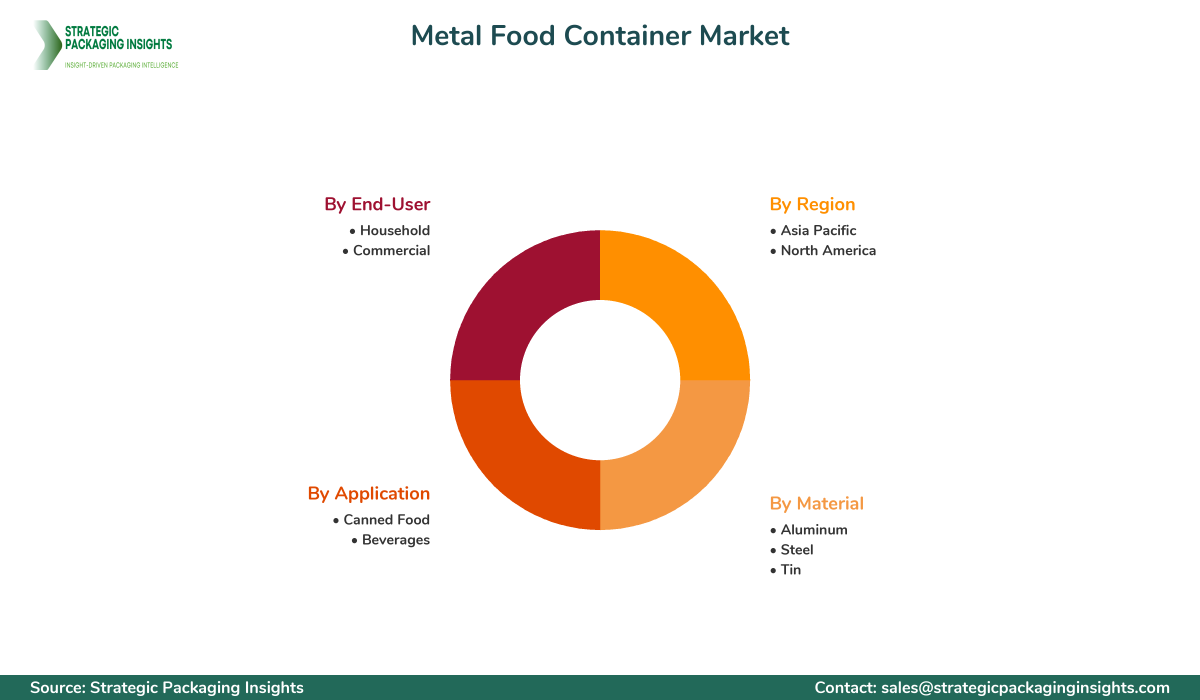

| Material | Aluminum, Steel, Tin |

| Application | Canned Food, Beverages |

| End-User | Household, Commercial |

| Region | Asia Pacific, North America |

| Customization Available | Yes* |

Opportunities & Threats

The metal food container market presents numerous opportunities for growth, primarily driven by the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for recyclable and Reusable Packaging materials. Metal containers, being 100% recyclable, are well-positioned to capitalize on this trend. Additionally, the rise in urbanization and changing lifestyles have led to an increased demand for convenient and ready-to-eat food products, further boosting the demand for metal food containers. The market also benefits from the growing popularity of canned beverages, particularly in the alcoholic and non-alcoholic segments, which require durable and tamper-proof packaging solutions.

Another significant opportunity lies in the development of innovative packaging designs that enhance the functionality and aesthetic appeal of metal containers. Manufacturers are increasingly focusing on creating lightweight and easy-to-open containers that cater to consumer preferences for convenience and portability. The integration of advanced printing technologies and digitalization in packaging design also offers opportunities for customization and personalization, which can help brands differentiate themselves in a competitive market. Furthermore, the expansion of e-commerce and online food delivery services is driving the demand for durable and Protective Packaging solutions, providing additional growth opportunities for the metal food container market.

Despite the numerous opportunities, the metal food container market faces certain threats that could hinder its growth. One of the primary challenges is the fluctuating prices of raw materials, such as aluminum and steel, which can impact the overall cost of production and affect profit margins. Additionally, stringent environmental regulations regarding metal production and recycling processes pose a challenge for manufacturers, as they need to invest in sustainable practices and technologies to comply with these regulations. The market also faces competition from alternative packaging materials, such as plastic and glass, which offer different advantages and may appeal to certain consumer segments.

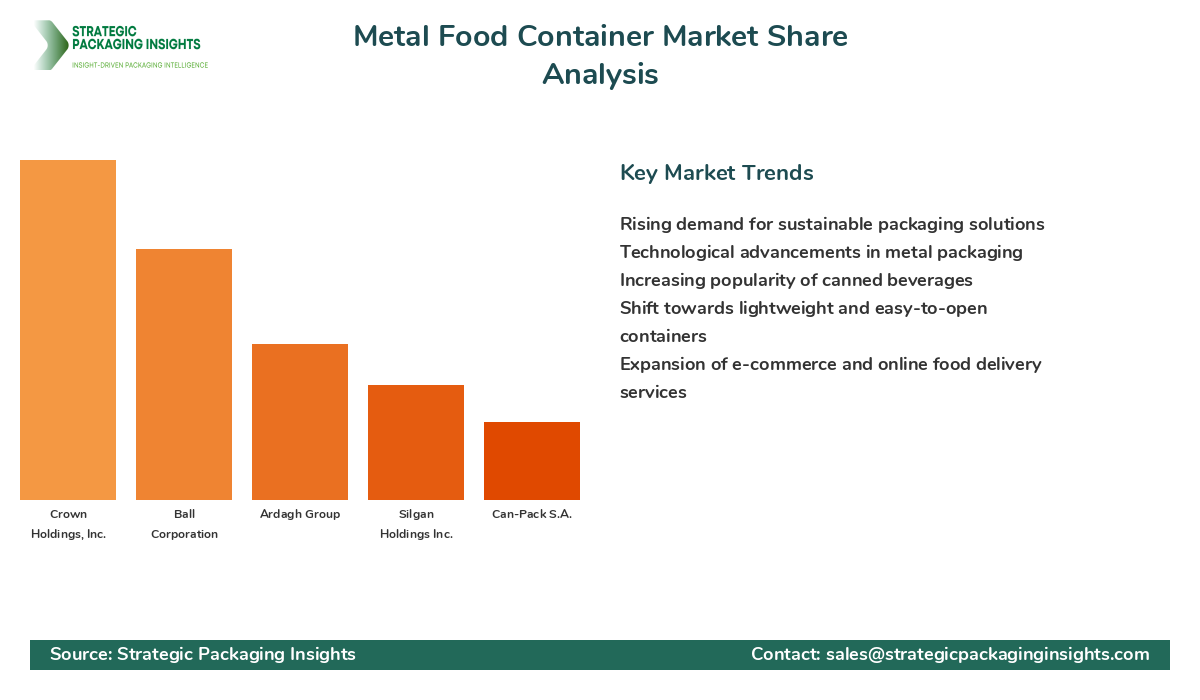

The metal food container market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a few major companies, each holding a significant share of the market. These companies are focused on expanding their product portfolios, enhancing their production capabilities, and investing in research and development to maintain their competitive edge. The market is also witnessing strategic collaborations and partnerships among key players to strengthen their market position and expand their geographical presence.

One of the leading companies in the metal food container market is Crown Holdings, Inc., which holds a substantial market share. The company is known for its innovative packaging solutions and has a strong presence in both developed and emerging markets. Another major player is Ball Corporation, which is renowned for its Sustainable Packaging solutions and has a significant market share in the beverage can segment. Ardagh Group is also a key player in the market, offering a wide range of metal packaging solutions for food and beverage products.

Silgan Holdings Inc. is another prominent company in the metal food container market, known for its extensive product portfolio and strong customer base. The company focuses on providing high-quality and sustainable packaging solutions to meet the evolving needs of consumers. Can-Pack S.A. is also a significant player in the market, with a strong presence in Europe and a growing footprint in other regions. The company is committed to innovation and sustainability, which has helped it maintain a competitive edge in the market.

Other notable companies in the metal food container market include Toyo Seikan Group Holdings, Ltd., which is known for its Advanced Packaging technologies and strong market presence in Asia. Silgan Containers LLC, a subsidiary of Silgan Holdings Inc., is also a key player, offering a wide range of metal packaging solutions for food and beverage products. The market is also witnessing the entry of new players, particularly in emerging markets, which is intensifying the competition and driving innovation in the industry.

Key Highlights Metal Food Container Market

- Increasing demand for sustainable and recyclable packaging solutions.

- Rising popularity of canned foods and beverages.

- Technological advancements in metal packaging enhancing functionality and aesthetics.

- Growing preference for lightweight and easy-to-open metal containers.

- Expansion of e-commerce and online food delivery services driving demand for durable packaging.

- Fluctuating raw material prices impacting production costs.

- Stringent environmental regulations posing challenges for manufacturers.

- Competition from alternative packaging materials such as plastic and glass.

- Strategic collaborations and partnerships among key players to strengthen market position.

- Entry of new players in emerging markets intensifying competition.

Top Countries Insights in Metal Food Container

The United States is one of the leading markets for metal food containers, with a market size of approximately $35 billion and a CAGR of 3%. The country's demand is driven by the high consumption of canned foods and beverages, coupled with a strong focus on sustainability and recycling initiatives. The presence of major players and advanced manufacturing capabilities further bolster the market's growth in the region.

China is another significant market for metal food containers, with a market size of around $28 billion and a CAGR of 5%. The country's rapid urbanization and changing consumer lifestyles have led to an increased demand for convenient and ready-to-eat food products, driving the growth of the metal food container market. Additionally, government initiatives promoting sustainable packaging solutions are supporting market expansion.

Germany is a key market in Europe, with a market size of approximately $15 billion and a CAGR of 4%. The country's strong focus on sustainability and recycling, along with a well-established food and beverage industry, drives the demand for metal food containers. The presence of leading packaging companies and technological advancements in metal packaging further contribute to market growth.

India is an emerging market for metal food containers, with a market size of about $10 billion and a CAGR of 6%. The country's growing middle-class population and increasing disposable incomes are driving the demand for packaged food products, including canned foods and beverages. The government's emphasis on sustainable packaging solutions and initiatives to reduce plastic waste are also supporting market growth.

Brazil is a notable market in Latin America, with a market size of approximately $8 billion and a CAGR of 4%. The country's demand for metal food containers is driven by the growing consumption of canned beverages and the increasing popularity of ready-to-eat food products. The presence of local manufacturers and the expansion of e-commerce and online food delivery services further contribute to market growth.

Value Chain Profitability Analysis

The value chain of the metal food container market involves several key stakeholders, including raw material suppliers, manufacturers, distributors, and retailers. Each stage of the value chain plays a crucial role in determining the overall profitability and revenue distribution within the market. Raw material suppliers, such as aluminum and steel producers, capture a significant share of the market value due to the high cost of raw materials. However, fluctuations in raw material prices can impact their profit margins.

Manufacturers of metal food containers are responsible for converting raw materials into finished products. They invest in advanced manufacturing technologies and processes to enhance production efficiency and reduce costs. Manufacturers capture a substantial share of the market value, with profit margins ranging from 10% to 15%. The integration of digital technologies and automation in manufacturing processes is helping manufacturers optimize production and improve profitability.

Distributors and retailers play a critical role in the value chain by ensuring the availability of metal food containers to end-users. They capture a smaller share of the market value, with profit margins typically ranging from 5% to 10%. The expansion of e-commerce and online retail channels is providing new revenue opportunities for distributors and retailers, as consumers increasingly prefer to purchase packaged food products online.

The value chain is also witnessing a shift towards more sustainable and eco-friendly practices, driven by consumer demand and regulatory requirements. This shift is creating opportunities for stakeholders to capture additional value by offering innovative and sustainable packaging solutions. Overall, the value chain of the metal food container market is evolving, with digital transformation and sustainability initiatives playing a key role in redistributing revenue opportunities across the industry.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The metal food container market has undergone significant changes between 2018 and 2024, with a focus on sustainability and technological advancements. During this period, the market experienced a steady growth rate, driven by the increasing demand for recyclable and eco-friendly packaging solutions. The market size expanded from $100 billion in 2018 to $123 billion in 2024, with a CAGR of 3.5%. The segment distribution shifted towards lightweight and easy-to-open containers, catering to consumer preferences for convenience and portability.

In terms of regional contribution, North America and Europe remained dominant markets, accounting for a significant share of the market value. However, the Asia Pacific region witnessed the highest growth rate, driven by rapid urbanization and changing consumer lifestyles. Technological advancements, such as digital printing and automation in manufacturing processes, played a crucial role in enhancing the functionality and aesthetic appeal of metal containers.

Looking ahead to the forecast period of 2025–2033, the metal food container market is expected to continue its growth trajectory, with a projected CAGR of 4.2%. The market size is anticipated to reach $178 billion by 2033, driven by the increasing adoption of sustainable packaging solutions and the expansion of e-commerce and online food delivery services. The segment distribution is expected to further shift towards innovative and customizable packaging designs, offering opportunities for brands to differentiate themselves in a competitive market.

Regionally, the Asia Pacific region is expected to continue its rapid growth, driven by the rising demand for convenient and ready-to-eat food products. North America and Europe are also expected to maintain their strong market positions, supported by advanced manufacturing capabilities and a focus on sustainability. The market is likely to witness increased competition from alternative packaging materials, such as plastic and glass, which may impact the growth of the metal food container market.

Metal Food Container Market Segments Insights

Material Analysis

The metal food container market is segmented by material into aluminum, steel, and tin. Aluminum is the most widely used material due to its lightweight, corrosion-resistant properties, and excellent recyclability. The demand for Aluminum Containers is driven by the increasing preference for sustainable packaging solutions and the rising popularity of canned beverages. Steel containers are also popular, particularly for packaging canned foods, due to their strength and durability. Tin containers, although less common, are used for specific applications where a high level of protection is required.

Manufacturers are focusing on developing innovative material solutions that enhance the functionality and aesthetic appeal of metal containers. The integration of advanced coating technologies and digital printing is enabling manufacturers to offer customized and visually appealing packaging solutions. The market is also witnessing a shift towards lightweight and easy-to-open containers, which cater to consumer preferences for convenience and portability. Overall, the material segment of the metal food container market is evolving, with a focus on sustainability and innovation.

Application Analysis

The metal food container market is segmented by application into canned food, beverages, pet food, and others. The canned food segment holds a significant share of the market, driven by the increasing demand for convenient and ready-to-eat food products. The rising popularity of canned fruits, vegetables, and meats is contributing to the growth of this segment. The beverage segment is also a major contributor to the market, with a growing demand for canned alcoholic and non-alcoholic beverages.

The pet food segment is experiencing steady growth, driven by the increasing adoption of pets and the rising demand for premium pet food products. Metal containers offer superior protection and preservation of pet food, making them a preferred choice among pet owners. The market is also witnessing the development of innovative packaging solutions for niche applications, such as baby food and nutritional supplements. Overall, the application segment of the metal food container market is characterized by diverse and evolving consumer preferences.

End-User Analysis

The metal food container market is segmented by end-user into household, commercial, and industrial. The household segment holds a significant share of the market, driven by the increasing consumption of canned foods and beverages. The convenience and portability of metal containers make them a popular choice among consumers for home use. The commercial segment, which includes restaurants, cafes, and catering services, is also a major contributor to the market, driven by the demand for durable and tamper-proof packaging solutions.

The industrial segment, although smaller, is experiencing growth due to the increasing use of metal containers in food processing and manufacturing industries. Metal containers offer superior protection and preservation of food products, making them a preferred choice for industrial applications. The market is also witnessing the development of customized packaging solutions for specific industrial applications, such as bulk storage and transportation. Overall, the end-user segment of the metal food container market is characterized by diverse and evolving demand patterns.

Regional Analysis

The metal food container market is segmented by region into Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. North America and Europe are the dominant markets, driven by the high consumption of canned foods and beverages and a strong focus on sustainability and recycling initiatives. The presence of major players and advanced manufacturing capabilities further bolster the market's growth in these regions.

The Asia Pacific region is experiencing rapid growth, driven by the increasing demand for convenient and ready-to-eat food products. The region's rapid urbanization and changing consumer lifestyles are contributing to the growth of the metal food container market. Latin America and the Middle East & Africa are also witnessing growth, driven by the increasing consumption of canned beverages and the expansion of e-commerce and online food delivery services. Overall, the regional segment of the metal food container market is characterized by diverse and evolving growth patterns.

Metal Food Container Market Segments

The Metal Food Container market has been segmented on the basis of

Material

- Aluminum

- Steel

- Tin

Application

- Canned Food

- Beverages

End-User

- Household

- Commercial

Region

- Asia Pacific

- North America

Primary Interview Insights

What are the key drivers for the metal food container market?

What challenges does the metal food container market face?

How is the market expected to evolve in the coming years?

Which regions are expected to witness significant growth?

What opportunities exist for new entrants in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.