- Home

- Packaging Products

- Metalized Coiled Bopet Film Market Size, Future Growth and Forecast 2033

Metalized Coiled Bopet Film Market Size, Future Growth and Forecast 2033

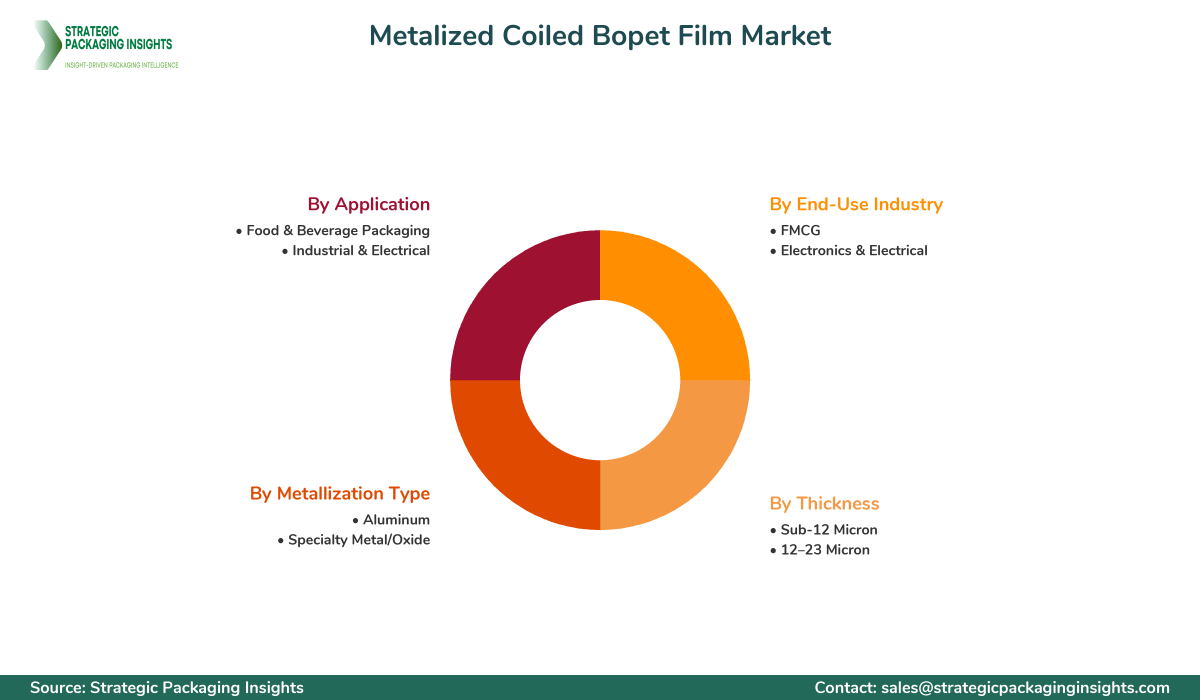

Metalized Coiled BOPET Film Market Segments - by Thickness (Sub-12 Micron, 12–23 Micron), Metallization Type (Aluminum, Specialty Metal/Oxide), Application (Food & Beverage Packaging, Industrial & Electrical), End-Use Industry (FMCG, Electronics & Electrical) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Metalized Coiled BOPET Film Market Outlook

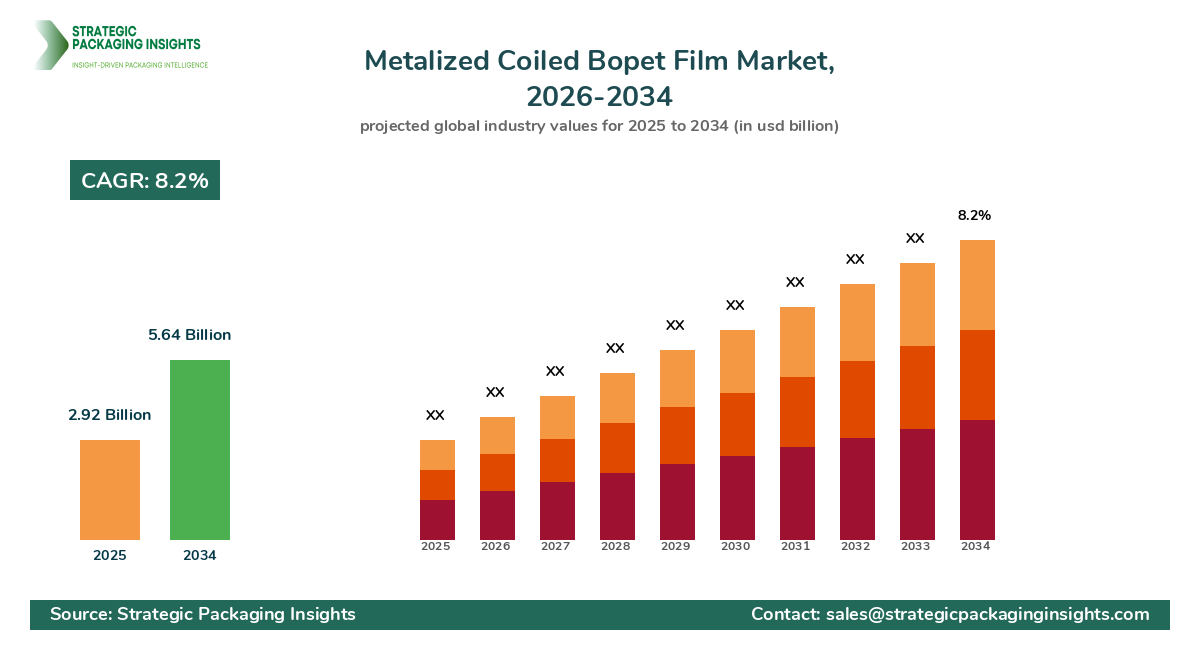

The Metalized Coiled BOPET Film market was valued at $2.92 billion in 2024 and is projected to reach $5.64 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033. Demand accelerates as brand owners push for downgauging without sacrificing barrier performance, converters seek cost-effective alternatives to aluminum foil, and retailers expand private label SKUs that require premium shelf appeal. Metalized BOPET delivers a high oxygen and moisture barrier, glossy metallic aesthetics, and strong machinability for high-speed converting lines across snacks, confectionery, dried foods, coffee, and ready meals. Electrical and industrial users adopt metallized PET for motor insulation, cable tapes, capacitors, reflective insulation, and solar control films, where thermal stability and dielectric strength matter. Sustainability targets are reshaping specifications toward mono-material PET laminates that can be detected and separated more reliably in modern recycling streams, while metallization advances tighten coating adhesion and reduce pinholes at thinner gauges. Global capacity additions in Asia, wider adoption of plasma-assisted metallization, and improved surface treatments are compressing lead times and bringing new specialty formats into mainstream packaging.

Pricing remains sensitive to upstream PET resin volatility and aluminum ingot trends, but technical differentiation is rising as converters ask for tighter COF windows, improved heat-seal initiation, and printable metallized surfaces compatible with solventless adhesives and electron beam curing systems. Regulatory pressure on multi-material laminates and extended producer responsibility (EPR) schemes are nudging buyers toward recyclable-ready PET structures, including clear-on-metal barrier designs with enhanced sortability. At the same time, food contact compliance in the EU and U.S., plus rigorous capacitor-grade film specifications, elevate qualification cycles and favor vendors with robust quality systems. While substitutes like metallized OPP and AlOx/SiOx coated films compete in certain niches, metalized BOPET’s stiffness, temperature resistance, and stable barrier under humidity give it an edge in premium flexible packaging and high-reliability industrial uses. Emerging opportunities include digital-ready metallic effects, anti-counterfeit layers embedded in the metalized stack, and low-metal deposition formats optimized for circularity without compromising shelf life. Together, these shifts create a balanced growth runway anchored by value-added applications rather than pure commodity volumes.

Report Scope

| Attributes | Details |

| Report Title | Metalized Coiled Bopet Film Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 147 |

| Thickness | Sub-12 Micron, 12–23 Micron |

| Metallization Type | Aluminum, Specialty Metal/Oxide |

| Application | Food & Beverage Packaging, Industrial & Electrical |

| End-Use Industry | FMCG, Electronics & Electrical |

| Customization Available | Yes* |

Opportunities & Threats

Opportunities across the Metalized Coiled BOPET Film value chain center on barrier innovation, downgauging, and circularity-ready structures that hit brand-owner sustainability targets. The migration from multi-material foil laminates to mono-PET barrier stacks opens premium pricing for films that pair aluminum metallization with specialty primers, heat-seal layers, and topcoats designed for print fidelity and robust lamination bonds. Food and beverage categories, especially salty snacks, confectionery, powdered beverages, and ready-to-eat meals, are upgrading to metallized PET for its combination of gloss, stiffness, and high barrier uniformity at line speeds over 300 m/min. In industrial and electrical segments, demand rises for high-dielectric, heat-resistant metallized PET used in capacitors, cable wraps, reflective insulation, and EMI shielding. Converters seek tighter gauge control at 8–12 microns, advanced metallization with reduced pinholes, and plasma or high-vacuum treatments that enhance adhesion and reduce metal cracking in flexing. With e-commerce expanding secondary demand for protective and decorative films, metalized PET’s scuff resistance and premium branding effect add value. Large retailers’ private label growth also drives custom metallized designs, shorter runs, and quick changeovers that suppliers can monetize with agile coating lines and digital workflow integration.

Another sizable opportunity comes from regionalization of supply and risk diversification. Brand owners are dual-qualifying suppliers across Asia, Europe, and North America to reduce geopolitical and logistics exposure, opening doors for players with multi-plant footprints and consistent global specifications. Specialty niches such as reclosable pouches, retortable lidding, and oxygen-scavenging laminates invite co-development partnerships between film producers, ink makers, and adhesive formulators. Additionally, the push for recyclability is catalyzing low-metal deposition films that still achieve target OTR and WVTR, and clear-on-metal constructions that can be recognized by NIR sorting. Sustainability-linked R&D grants in the EU and tax incentives in North America for advanced manufacturing are improving ROI on new metallizers, inline inspection systems, and energy-efficient vacuum chambers. Suppliers that bundle application engineering, shelf-life modeling, and lifecycle assessments (LCAs) are winning specifications with top CPGs, while those offering certified food-contact compliance (FDA, EU 10/2011) and stringent quality controls (ISO 9001, ISO 22000, BRCGS Packaging) secure long-term contracts. These factors collectively underpin steady premiumization and help vendors move beyond commodity pricing pressures.

Key threats include resin price volatility, aluminum price swings, and competition from metallized OPP and growing adoption of AlOx/SiOx coated clear Barrier Films where metal-look aesthetics are not required. Energy costs affect metallization economics, particularly for high-vacuum processes, which can compress margins when buyers push for low-cost bids. Regulatory momentum around recyclability and EPR fees can penalize non-sortable, multi-material laminates, requiring redesigns that may not replicate legacy barrier levels at the same thickness or cost. In food packaging, continuous migration testing and new chemical disclosure requirements increase compliance overhead. In electronics, capacitor and insulation customers demand tight tolerances and defect-free surfaces; any variability in adhesion, pinhole frequency, or thermal shrinkage can trigger requalification and supply shifts. Consolidation among converters and CPGs adds bargaining power on price and rebates, while logistics risks—from freight rate spikes to port congestion—can erode service levels. Finally, substitution risk rises in niche cases where clear high-barrier coatings or foil-based structures outperform on extreme barrier or retort conditions, making technical sales and application support essential to defend share.

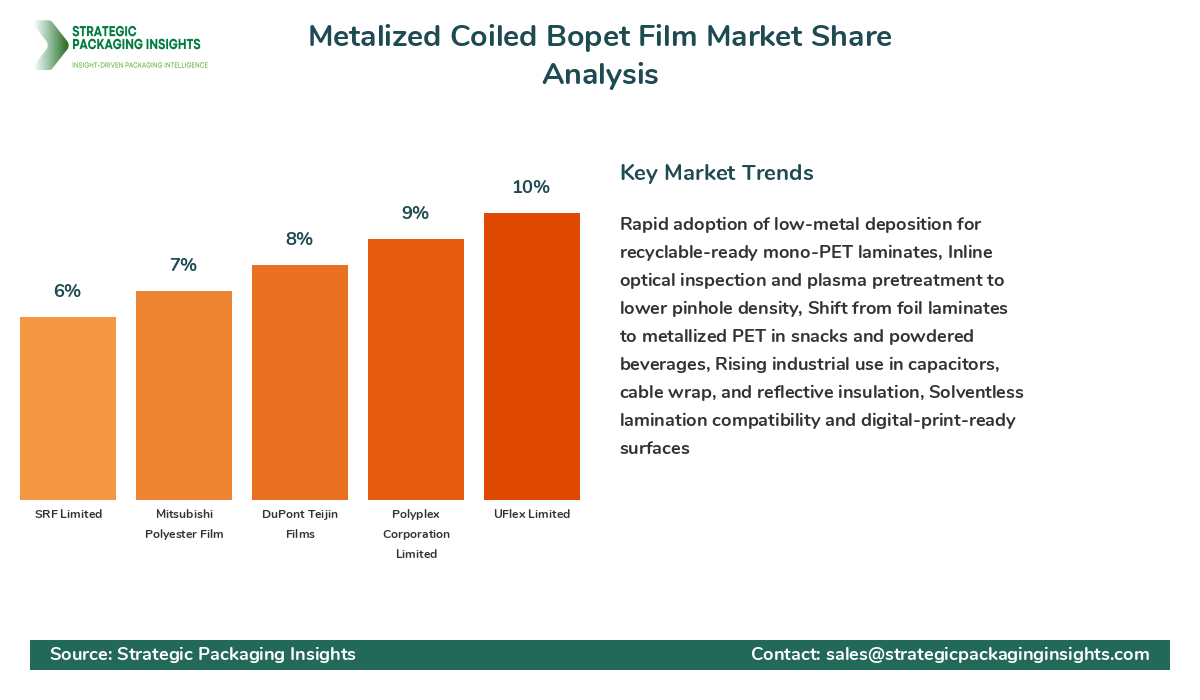

The competitive landscape is moderately consolidated at the top with a long tail of regional specialists focused on niche thicknesses, custom coatings, or short-run decorative work. Global leaders such as Toray Industries, Jindal Poly Films, UFlex (Flex Films), Polyplex, DuPont Teijin Films, Mitsubishi Polyester Film, SRF, Vacmet India, Garware Hi-Tech Films, and Jiangsu Shuangxing New Materials collectively account for over half of global metalized coiled BOPET revenue. Larger players maintain integrated assets across base BOPET lines, metallizers, and downstream coating and slitting, allowing better control of quality, faster changeovers, and optimized cost per square meter. They also run multi-continent footprints that shorten lead times and enable dual sourcing for strategic accounts, which strengthens stickiness with global CPGs and tier-1 converters. In contrast, smaller companies compete on agility, localized technical service, and quick-ship custom runs that large firms may not prioritize, carving profitable niches in specialty Labels, holographic and decorative films, or regional snack categories.

Market share varies by application and geography. In Asia, where capacity expansions continue, producers like Jindal Poly Films, Polyplex, SRF, Vacmet India, and Jiangsu Shuangxing benefit from proximity to resin, skilled labor pools, and rapid capex deployment. In North America and Europe, Toray, DuPont Teijin Films, and Mitsubishi Polyester Film retain strong shares with premium grades, stringent QA, and deep relationships with multinational converters and OEMs. UFlex’s Flex Films division leverages a global network, tapping both packaging and industrial demand with an expanding catalog of specialty metallized grades. Garware Hi-Tech Films has reinforced its presence in high-value niches, including specialty coatings for insulation and solar control, where consistency and performance under heat cycles are critical. These dynamics create a competitive rhythm where innovation pipelines and service models often trump scale alone in securing long-term supply positions.

Technology differentiation remains a central lever. Vendors investing in plasma treatment for improved metal adhesion, real-time optical inspection to cut pinhole counts, and low-metal deposition techniques geared for recyclability are winning high-spec bids. Several leaders now offer barrier-tuned metallized films engineered for solventless lamination and digital printing inks, plus sealant-compatible surfaces that boost line efficiency. Certifications underpin share capture: FDA and EU food-contact compliance, BRCGS Packaging, ISO 9001 and ISO 14001, and in some cases ISO 22000 for food safety management. With sustainability now embedded in procurement scorecards, suppliers that provide recyclability playbooks, LCA data, and design-for-recycling toolkits are moving from supplier to solution partner, translating into higher retention and multi-year agreements across regions. This emphasis on engineered performance and compliance is visible in share gains among technology-forward producers relative to commodity-first rivals.

From a commercial standpoint, the top ten players use tiered pricing structures aligned to barrier metrics (OTR/WVTR), optical quality (gloss/haze), gauge tolerance, and printability specifications. Strategic accounts often negotiate supply across multiple plants and currencies to hedge risk, while spot buyers face wider price swings linked to PET resin and aluminum markets. Value-added services—like predictive lead-time tools, co-development pilots, and on-site lamination trials—are increasingly integrated into offers to defend margins. As consolidation continues among converters and CPGs, the bargaining power asymmetry pushes film suppliers to differentiate through reliability, technical depth, and sustainability leadership, shaping the current market share distribution and determining who expands footprint and who remains regional.

Across key participants, recent estimates point to Toray Industries (Company Name, Market Share ~12%), Jindal Poly Films (~11%), UFlex/Flex Films (~10%), Polyplex (~9%), DuPont Teijin Films (~8%), Mitsubishi Polyester Film (~7%), SRF (~6%), Vacmet India (~5%), Garware Hi-Tech Films (~4%), and Jiangsu Shuangxing New Materials (~4%), with the remainder distributed among regional players and specialty coaters. Shares shift by submarket: in capacitor-grade or high-dielectric films, Japanese and European producers over-index, while snack packaging-oriented grades show stronger Indian and Chinese participation. Continuous investments in wider metallizers, energy-efficient vacuum systems, and automated inspection are likely to re-rank contenders over the next cycle as buyers reward barrier stability, sustainable design options, and consistent on-time performance.

Key Highlights Metalized Coiled BOPET Film Market

- Shift from foil-based laminates to mono-PET barrier stacks accelerates, boosting demand for recyclable-ready metallized PET structures.

- Downgauging to 8–12 micron gauges with improved pinhole control sustains premium barrier at lower material usage and cost per pack.

- Capacitor, cable wrap, and reflective insulation applications expand the industrial share with high dielectric and thermal stability needs.

- Aluminum price and PET resin volatility influence quarterly pricing, reinforcing multi-sourcing and hedging strategies among major buyers.

- Investments in plasma-assisted metallization and inline optical inspection reduce defect rates and raise acceptance yields at converters.

- Regulatory momentum around EPR and recyclability pushes low-metal deposition and clear-on-metal designs optimized for NIR sorting.

- Growth strongest in Asia-Pacific on capacity additions, private label expansion, and rising packaged snack penetration.

- Converters prioritize films compatible with solventless lamination, digital inks, and fast seal initiation to maximize line speeds.

- Premium metallic aesthetics remain a differentiator for confectionery and beverage brands seeking on-shelf pop without foil.

- Supplier certifications (FDA, EU 10/2011, BRCGS, ISO 9001/14001) increasingly gate large CPG and industrial qualification.

Competitive Intelligence

Toray Industries maintains leadership with a balanced portfolio spanning packaging and industrial grades, leveraging multi-continental plants and a strong R&D engine focused on adhesion science and barrier optimization. The company’s market share is supported by high client retention in premium categories and steady revenue growth in capacitor and specialty insulation films. Jindal Poly Films competes aggressively on capacity, cost position, and a broad catalog of metallized structures tailored for snacks, confectionery, and powdered beverages. UFlex (Flex Films) emphasizes innovation speed and global reach, winning with customized grades, quick changeovers, and value-added coatings that improve print receptivity and lamination bonds. Polyplex differentiates through process control, export depth, and reliable supply, consistently expanding geographic reach and sustaining double-digit growth in several APAC corridors. DuPont Teijin Films and Mitsubishi Polyester Film anchor the high-spec segment in Europe and North America with tight tolerances, strong QA frameworks, and deep technical partnerships with converters and OEMs.

SRF and Vacmet India show robust innovation focus in metallization and downstream coatings, driving strong adoption for both packaging and industrial conversion. Garware Hi-Tech Films captures share in reflective, solar control, and high-performance coated PET, translating to solid margins and stable demand across construction and automotive aftermarket channels. Jiangsu Shuangxing New Materials expands its APAC footprint with modern metallizers and competitive pricing, increasing penetration in regional snack packaging and decorative film markets. Across these top ten, geographic reach varies: while Toray, UFlex, and DuPont Teijin Films operate with full global footprints, others run strong regional hubs feeding export markets. Revenue growth favors firms adding specialty lines and energy-efficient vacuum chambers, while companies with older assets and limited coating options face margin erosion.

Strategy comparisons highlight three clusters. Innovation leaders (Toray, DuPont Teijin Films, Mitsubishi Polyester Film) push advanced surface chemistries, low-metal deposition for recyclability, and metrology-driven quality, commanding premium pricing and high retention among multinational accounts. Volume-cost champions (Jindal Poly Films, Polyplex, SRF, Jiangsu Shuangxing) lean on scale, networked logistics, and competitive cost structures to win large tenders. Hybrid specialists (UFlex, Vacmet India, Garware Hi-Tech Films) pair strong application support with diversified product lines, enabling share gains in fast-moving consumer categories and industrial niches. Firms gaining ground combine sustainability roadmaps with customer engineering; those losing ground typically underinvest in coating diversity, line automation, or certifications demanded by global CPGs.

Strengths and weaknesses track investment cycles. Strengths include multi-plant redundancy, advanced metallizers with plasma modules, comprehensive certification stacks, and end-to-end service models. Weaknesses often involve limited specialty SKUs, narrower geographic reach, or dependence on a few large accounts susceptible to re-bidding. Differentiation stems from barrier reliability under humidity, surface energy stability for high-speed printing, and proven performance in solventless lamination—a rising procurement requirement. Companies signaling the fastest momentum are those publishing recyclability design guides, piloting mono-PET laminates with tier-1 brands, and retrofitting lines for energy reduction, which not only cuts cost but also improves ESG scores in customer scorecards.

Regional Market Intelligence of Metalized Coiled BOPET Film

North America: Current market size is approximately $0.64 billion with a forecast reaching about $1.18 billion by 2033. Growth stems from snack and Pet Food packaging upgrades, digital print migration, and strong quality requirements in capacitor and insulation segments. Brand-owner sustainability commitments push mono-PET trials and low-metal deposition options compatible with MRF sorting. The region values consistent COF, stable gloss, and food-contact compliance. Supply security drives dual sourcing from U.S., Mexico, and imports from Europe and Asia, while incentives for advanced manufacturing in the U.S. support capex in efficient metallizers and real-time inspection technologies. Converters emphasize solventless lamination, pushing suppliers to deliver surface energy stability and fast cure performance.

Europe: The market stands near $0.61 billion and is expected to reach around $1.07 billion by 2033. EU packaging directives, EPR fees, and recyclability targets are reshaping specifications, favoring recyclable-ready PET structures and low-metal barrier designs. Premium confectionery and coffee packaging sustain metallized aesthetics demand, while industrial users require high-dielectric films for electrical applications across Germany and Italy. Energy costs remain a factor in production economics, pushing investments in energy-efficient vacuum systems and automation. Buyers prioritize certifications (EU 10/2011, BRCGS, ISO 14001), and many suppliers partner with recyclers for design-for-recycling pilots. Cross-border logistics and currency dynamics influence pricing, prompting framework agreements and buffer inventories to protect service levels.

Asia Pacific: As the largest regional market at roughly $1.31 billion, Asia Pacific is projected to reach about $2.82 billion by 2033, supported by rapid packaged food penetration, private label growth, and continued capacity additions in India and China. Producers leverage cost advantages, skilled labor, and modern metallizers with plasma pretreatments to deliver tighter barrier specs at thin gauges. Application growth spans snacks, noodles, spice blends, and decorative films, while capacitor and cable wrap demand rises with electrification and infrastructure programs. Regional suppliers export heavily, with competitive lead times and agile customization. Sustainability programs are gaining pace, with major players publishing recyclability roadmaps and trialing mono-PET structures with large FMCG accounts.

Latin America: The market is about $0.20 billion today and is expected to approach $0.34 billion by 2033. Growth comes from snack and confectionery expansions, especially in Mexico and Brazil, and a steady shift from foil to metallized PET in mid-tier brands seeking premium shelf presence. Local conversion capacity is growing, though high-spec grades still rely on imports. Currency volatility and logistics can affect quarterly pricing, prompting larger buyers to secure long-term supply contracts. Sustainability programs are emerging, with leading retailers and CPGs piloting recyclable-ready PET laminates. Industrial uses, including cable tapes and reflective insulation, are expanding with infrastructure projects and housing growth.

Middle East & Africa: Estimated at $0.15 billion, the region is forecast to reach about $0.23 billion by 2033. Demand concentrates in GCC countries and South Africa, with rising packaged food consumption and investments in local converting lines. Metallized PET plays in dry foods, powdered beverages, and decorative labels, while industrial applications include insulation and protective wraps. Import dependence remains notable, but new regional assets are under evaluation to shorten lead times. Governments support packaging and manufacturing diversification, while sustainability expectations among premium retailers begin to influence specifications toward mono-material solutions.

Top Countries Insights in Metalized Coiled BOPET Film

United States: Market size near $0.55 billion with a CAGR of 7. Key drivers include brand-owner sustainability targets, switchovers to mono-PET barrier structures, and the rise of digital printing in flexible packaging. The U.S. also benefits from a robust industrial base using metallized PET for insulation and capacitor applications, plus a mature private label segment in grocery driving customized metallic aesthetics. Regulatory compliance on food contact and chemical disclosure is stringent, which lengthens qualification cycles but locks in suppliers with consistent QA and documentation. Challenges include labor constraints, resin and aluminum cost swings, and consolidation among converters that heightens pricing pressure. Incentives for advanced manufacturing support new metallizers and energy-reduction retrofits.

China: Market size around $0.75 billion with a CAGR of 11. Growth is propelled by high packaged snack consumption, e-commerce-ready packs, and scale advantages in film manufacturing. Chinese producers deploy modern metallizers and inline inspection, enabling competitive export offers. Local regulations are elevating recyclability expectations, accelerating trials for low-metal deposition and clear-on-metal options. The country also leans into industrial demand, including electrical insulation and reflective films for building and automotive. Challenges include periodic power constraints, environmental compliance costs, and ongoing competition with domestic peers and regional exporters. Nevertheless, strong capital investment and fast product development cycles sustain momentum.

India: Market size about $0.28 billion with a CAGR of 13. India’s growth comes from rapid urbanization, snack and confectionery category expansion, and rising private label penetration. Indian manufacturers, with cost-efficient operations and new metallizers, address both domestic demand and exports to the Middle East, Africa, and Europe. Government initiatives supporting manufacturing and logistics infrastructure improve reliability. Recyclability and EPR discussions are intensifying, nudging trials of mono-PET laminates. Challenges include currency fluctuations, energy costs, and aligning recycling infrastructure with emerging design-for-recycling standards. Even so, strong converter relationships and agile customization enable swift wins in new SKUs.

Germany: Market size near $0.24 billion with a CAGR of 6. Germany’s market reflects high-spec demand in both packaging and electrical applications. Tight regulatory frameworks and strong retailer sustainability policies favor recyclable-ready structures and high-quality documentation. Industrial uses—capacitor films, cable wraps, and reflective insulations—benefit from engineering-intensive OEMs. Challenges include energy costs, workforce availability, and a premium placed on defect-free surfaces and narrow gauge tolerances. Suppliers with strong local technical service and robust certifications hold an edge, while imports complement supply during peak demand.

Brazil: Market size roughly $0.12 billion with a CAGR of 8. Growth stems from expanding snack and beverage categories, rising modern retail, and the appeal of metallic aesthetics for mid-tier brands upgrading packaging. Local converting capacity is developing, though specialized grades still rely on imports. Currency volatility and logistics costs create quarterly swings in procurement. Sustainability interest is rising, with pilots for mono-material PET laminates and shelf-life modeling to cut food waste. Industrial applications are steady, tied to construction and electrical segments, with room for penetration as standards mature.

Metalized Coiled BOPET Film Market Segments Insights

Thickness Analysis: Demand concentrates in sub-12 micron and 12–23 micron gauges, as buyers balance downgauging with barrier and machinability targets. In sub-12 micron, converters push for tighter gauge control, reduced pinholes, and adhesion stability to maintain barrier under flexing and lamination. Snack and confectionery brands adopt these thin gauges to cut material usage and logistics costs without sacrificing shelf life. In 12–23 micron, industrial and heavy-duty packaging applications value higher stiffness and handling ease on high-speed lines, especially for larger pouch formats and structures requiring robust crease resistance. Suppliers differentiate with plasma-assisted adhesion layers, tailored surface energies for solventless lamination, and controlled COF for trouble-free FFS operations. As sustainability programs expand, both thickness bands see momentum toward recyclable-ready PET stacks, with low-metal deposition strategies and clear-on-metal variants that maintain detection in MRFs.

Competition pivots on delivering consistent OTR/WVTR, optical gloss, and print receptivity across thickness ranges. Leaders invest in inline metrology and AI-enabled defect mapping to minimize pinholes, streaks, and metal cracking while maintaining high vacuum line speeds. Pricing stratifies by barrier and optical quality, with premium paid for films meeting tight COF windows and stable seal performance under different adhesive systems. Industrial buyers add dielectric and thermal criteria, making 12–23 micron grades a stronghold for capacitor and insulation uses. Meanwhile, sub-12 micron remains the growth engine for single-serve snacks, beverages, and portion packs, where downgauging combines cost efficiency with sustainability goals.

Metallization Type Analysis: Aluminum remains the dominant metallization due to its favorable barrier-to-cost ratio, optical brilliance, and well-understood process controls. Suppliers focus on improving metal adhesion, reducing pinholes, and enabling low-metal deposition that meets recyclability requirements while holding barrier levels. Specialty metal or oxide-based approaches, including hybrid stacks and engineered primers, gain traction where clear-on-metal or specific optical effects are needed. Plasma pretreatments and advanced vacuum chamber designs allow tighter control of deposition uniformity, which reduces variation in barrier and reflectivity critical for premium packaging and decorative films.

In high-performance niches, customers demand metallized stacks optimized for solventless lamination and compatibility with both solvent and water-based inks. Specialty formulations target anti-corrosion for aggressive fillings and adhesion enhancement for multi-pass printing. Electrical and industrial segments may prefer metallization tailored for dielectric performance and heat resistance, where process stability and low defect density are decisive. As EPR frameworks evolve, oxide-assisted and low-metal strategies will broaden, particularly in Europe, to improve detection and sortability without losing shelf-life performance. Suppliers that combine metallization expertise with surface engineering and coatings integration are best positioned to capture growth.

Application Analysis: Food & beverage packaging leads demand, driven by snacks, confectionery, powdered beverages, coffee, and ready meals seeking high gloss aesthetics and oxygen/moisture barrier stability. Metalized BOPET provides stiffness for Stand-up Pouches, crisp tactile feel, and consistent machinability on high-speed VFFS and HFFS lines. In industrial and electrical applications, metallized PET serves as capacitor film, cable wrap, motor insulation, reflective insulation, and EMI shielding due to dielectric strength, heat tolerance, and dimensional stability. Converters value consistent COF, primer compatibility with solventless adhesives, and ink adhesion that enables vivid designs while retaining barrier integrity after converting steps.

Growth in E-Commerce Packaging also benefits metallized PET for secondary decorative films and protective wraps, enhancing unboxing aesthetics and scuff resistance. As brands chase recyclability, mono-PET laminates with metallized barrier cores gain favor, supported by low-metal deposition and surface treatments aiding delamination control in recycling trials. Shelf-life modeling and packaging lightweighting reinforce the case for metallized PET versus foil, particularly where flex-cracking risk or cost is a concern. Overall, application-specific engineering and technical service win specifications more reliably than price-only bids.

End-Use Industry Analysis: FMCG dominates with demand from global and regional CPGs in snacks, confectionery, dairy, coffee, and pet food. Buyers prioritize films that balance gloss, barrier, sealability, and print quality, while meeting evolving sustainability scorecards. Electronics & electrical users require tight dielectric properties and heat resistance for capacitors, motors, and cable tapes, where qualification cycles are strict and vendor consistency is rewarded with multi-year contracts. The interplay between packaging aesthetics, operational efficiency, and recyclability aspirations defines FMCG uptake, while robust QA, traceability, and technical support define industrial adoption.

As retailers expand private labels, metallized PET becomes a tool for premiumization at competitive price points, driving SKU proliferation and shorter production runs. Suppliers that offer rapid prototyping, flexible MOQs, and localized technical teams convert this opportunity into sticky relationships. In electronics and electrical, investments in energy and grid infrastructure, EVs, and smart devices widen the addressable market for high-reliability metallized PET. End users increasingly ask for documentation packages—compliance statements, test data, and LCAs—integrated into procurement portals, raising the bar for suppliers and creating a competitive moat for certification-heavy players.

Market Share Analysis

The market share distribution features a top tier of globally integrated film producers steadily expanding through specialty grades and sustainability-forward solutions, while a competitive middle tier focuses on regional strength and application depth. Toray leads with premium grades and global QA alignment, followed closely by Jindal Poly Films and UFlex, which leverage scale and breadth to secure large packaging programs. Polyplex and DuPont Teijin Films hold strong positions through process discipline and technical partnerships, and Mitsubishi Polyester Film retains influence in high-spec European and North American segments. SRF, Vacmet India, Garware Hi-Tech Films, and Jiangsu Shuangxing New Materials are gaining share in Asia and select export markets on the back of modern metallizers and agile customization. As shares concentrate around innovation leaders, pricing power shifts toward performance-based contracts tied to barrier metrics and sustainability KPIs, stimulating co-development agreements and selective M&A. Companies that lag on certifications, recyclability roadmaps, or inline inspection capabilities are losing ground, facing tighter RFQ filters, and greater price pressure, which in turn limits their R&D budgets and innovation cadence.

Metalized Coiled Bopet Film Market Segments

The Metalized Coiled Bopet Film market has been segmented on the basis of

Thickness

- Sub-12 Micron

- 12–23 Micron

Metallization Type

- Aluminum

- Specialty Metal/Oxide

Application

- Food & Beverage Packaging

- Industrial & Electrical

End-Use Industry

- FMCG

- Electronics & Electrical

Primary Interview Insights

What specifications are top converters prioritizing for metallized PET in 2025?

How are recyclability targets changing film selection?

Which applications show the fastest growth?

Where do buyers see the biggest supply risks?

What differentiates winning suppliers?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.