- Home

- Eco-Friendly Packaging

- Non-Toluene Ink For Flexible Packaging Market Size, Future Growth and Forecast 2033

Non-Toluene Ink For Flexible Packaging Market Size, Future Growth and Forecast 2033

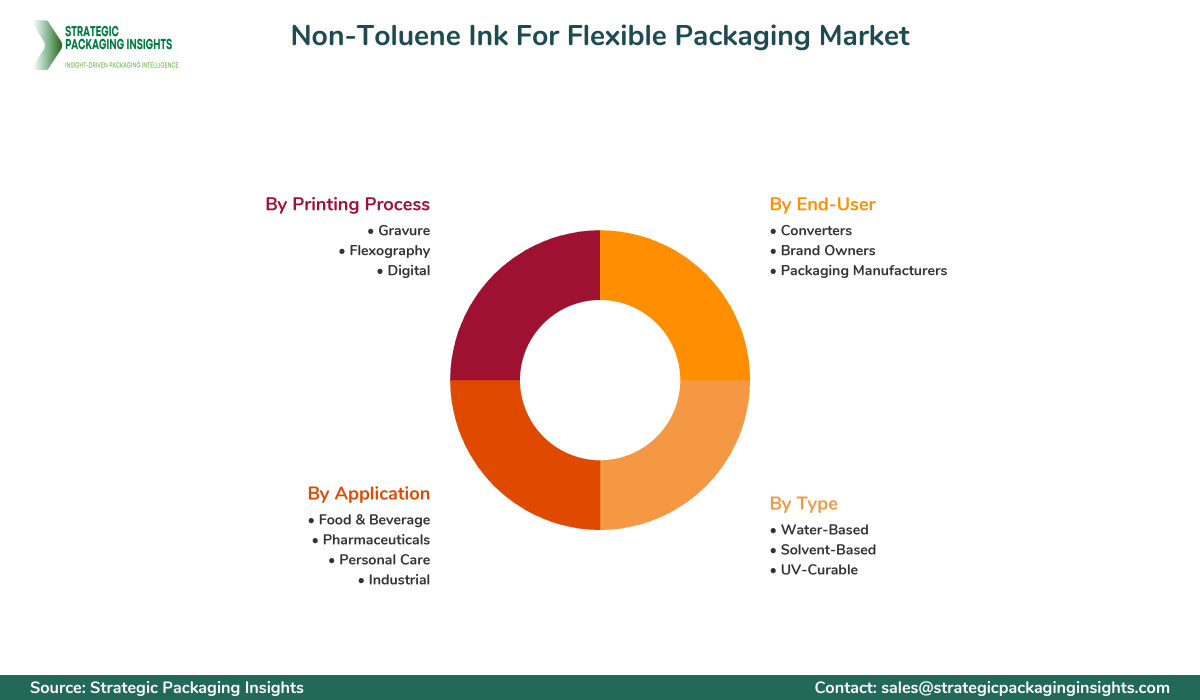

Non-Toluene Ink For Flexible Packaging Market Segments - by Type (Water-Based, Solvent-Based, UV-Curable), Application (Food & Beverage, Pharmaceuticals, Personal Care, Industrial), Printing Process (Gravure, Flexography, Digital), and End-User (Converters, Brand Owners, Packaging Manufacturers) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Non-Toluene Ink For Flexible Packaging Market Outlook

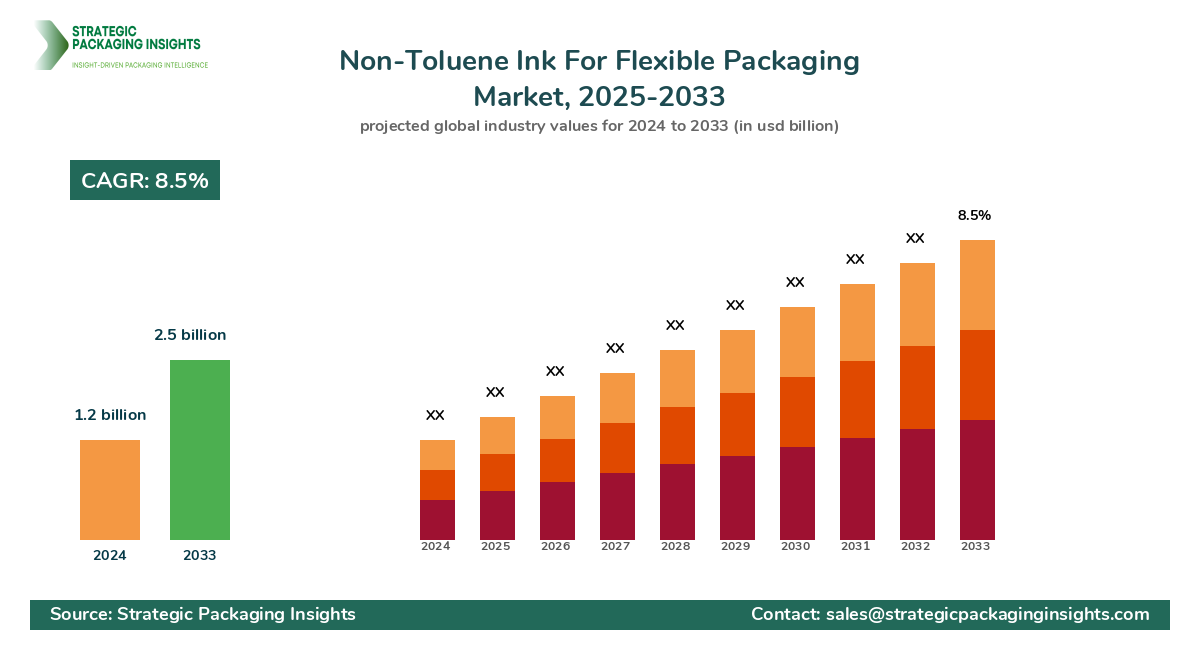

The Non-Toluene Ink for Flexible Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033. This market is witnessing significant growth due to the increasing demand for eco-friendly and sustainable packaging solutions. The shift towards non-toluene inks is driven by stringent environmental regulations and the growing awareness among consumers and manufacturers about the harmful effects of toluene-based inks. The flexible packaging industry is rapidly adopting these inks to meet the rising demand for safe and sustainable packaging, particularly in the food and beverage sector, where safety and compliance are paramount.

Opportunities in this market are abundant, with technological advancements in ink formulations leading to improved performance and cost-effectiveness. The development of water-based and UV-curable inks is particularly noteworthy, as these types offer enhanced print quality and faster drying times, which are crucial for high-speed printing processes. Additionally, the increasing adoption of digital printing technologies in the packaging industry is creating new avenues for market growth. Digital printing allows for greater customization and shorter print runs, which are increasingly in demand as brands seek to differentiate themselves in a competitive market.

Report Scope

| Attributes | Details |

| Report Title | Non-Toluene Ink For Flexible Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 176 |

| Type | Water-Based, Solvent-Based, UV-Curable |

| Application | Food & Beverage, Pharmaceuticals, Personal Care, Industrial |

| Printing Process | Gravure, Flexography, Digital |

| End-User | Converters, Brand Owners, Packaging Manufacturers |

| Customization Available | Yes* |

Opportunities & Threats

The Non-Toluene Ink for Flexible Packaging market presents numerous opportunities, primarily driven by the increasing consumer preference for environmentally friendly products. As consumers become more conscious of the environmental impact of their purchases, there is a growing demand for packaging solutions that are both sustainable and safe. This trend is encouraging manufacturers to invest in the development of non-toluene inks that not only meet regulatory standards but also offer superior performance. Furthermore, the rise of e-commerce and the subsequent increase in demand for flexible packaging solutions provide a significant growth opportunity for non-toluene inks, as they are well-suited for the diverse requirements of online retail packaging.

Another opportunity lies in the expanding applications of flexible packaging across various industries. The food and beverage sector, in particular, is a major driver of demand for non-toluene inks, as these inks ensure that packaging is safe for direct contact with food products. Additionally, the pharmaceutical and personal care industries are increasingly adopting flexible packaging solutions, further boosting the demand for non-toluene inks. The ability of these inks to provide high-quality prints and vibrant colors without compromising safety makes them an attractive choice for brand owners looking to enhance their product appeal.

However, the market also faces certain threats, primarily in the form of high initial costs associated with the transition from toluene-based to non-toluene inks. While the long-term benefits of non-toluene inks are clear, the initial investment required for new equipment and processes can be a barrier for some manufacturers. Additionally, the market is subject to fluctuations in raw material prices, which can impact the overall cost of production. Despite these challenges, the long-term outlook for the Non-Toluene Ink for Flexible Packaging market remains positive, driven by the ongoing shift towards sustainable and safe packaging solutions.

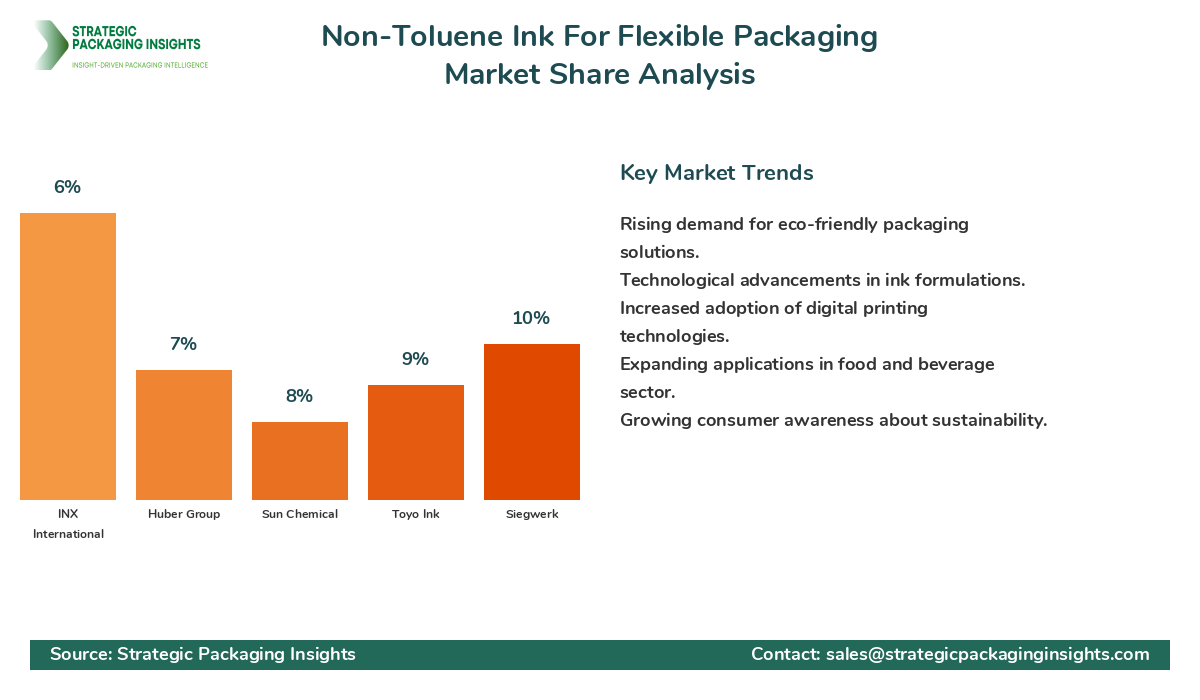

The competitive landscape of the Non-Toluene Ink for Flexible Packaging market is characterized by the presence of several key players who are actively engaged in research and development to enhance their product offerings. The market is moderately fragmented, with a mix of established companies and emerging players striving to gain a foothold. Major companies in this market include DIC Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, Toyo Ink SC Holdings Co., Ltd., and Sun Chemical Corporation. These companies are focusing on expanding their product portfolios and strengthening their distribution networks to cater to the growing demand for non-toluene inks.

DIC Corporation holds a significant market share, leveraging its extensive experience and expertise in the ink industry. The company is known for its innovative ink formulations that meet the stringent requirements of the flexible packaging sector. Similarly, Flint Group is a prominent player, offering a wide range of non-toluene inks that are designed to deliver high performance and sustainability. The company's commitment to research and development has enabled it to introduce cutting-edge products that cater to the evolving needs of the market.

Siegwerk Druckfarben AG & Co. KGaA is another key player, renowned for its focus on sustainability and safety. The company has made significant investments in developing non-toluene inks that comply with global regulatory standards. Toyo Ink SC Holdings Co., Ltd. is also a major contributor to the market, with a strong emphasis on innovation and customer-centric solutions. The company's diverse product range and strategic partnerships have helped it maintain a competitive edge in the market.

Sun Chemical Corporation, a subsidiary of DIC Corporation, is a leading player in the non-toluene ink market, offering a comprehensive portfolio of products that cater to various applications in the flexible packaging industry. The company's focus on sustainability and innovation has positioned it as a preferred choice for many brand owners and packaging manufacturers. Other notable players in the market include Huber Group, INX International Ink Co., and Wikoff Color Corporation, each contributing to the market's growth through their unique offerings and strategic initiatives.

Key Highlights Non-Toluene Ink For Flexible Packaging Market

- Increasing demand for eco-friendly and sustainable packaging solutions.

- Technological advancements in ink formulations enhancing performance.

- Rising adoption of digital printing technologies in packaging.

- Expanding applications of flexible packaging across various industries.

- Significant growth opportunities in the food and beverage sector.

- Challenges related to high initial costs and raw material price fluctuations.

- Strong focus on research and development by key market players.

- Growing consumer awareness about the harmful effects of toluene-based inks.

- Regulatory support for non-toluene inks in major markets.

- Strategic partnerships and collaborations driving market expansion.

Top Countries Insights in Non-Toluene Ink For Flexible Packaging

The United States is a leading market for non-toluene inks, with a current market size of $300 million and a CAGR of 10%. The country's stringent environmental regulations and the growing demand for sustainable packaging solutions are key drivers of market growth. Additionally, the presence of major players and the rapid adoption of digital printing technologies further bolster the market's expansion.

Germany is another significant market, valued at $250 million with a CAGR of 8%. The country's strong focus on sustainability and innovation in the packaging industry drives the demand for non-toluene inks. The German market benefits from a robust manufacturing sector and a well-established regulatory framework that supports the use of eco-friendly inks.

China, with a market size of $200 million and a CAGR of 12%, is experiencing rapid growth in the non-toluene ink market. The country's expanding middle class and increasing consumer awareness about environmental issues are key factors driving demand. Additionally, China's booming e-commerce sector and the growing need for flexible packaging solutions contribute to market growth.

India, with a market size of $150 million and a CAGR of 15%, is emerging as a key market for non-toluene inks. The country's growing population and increasing demand for packaged goods are significant growth drivers. Furthermore, government initiatives promoting sustainable practices and the adoption of digital printing technologies are expected to boost market growth.

Japan, with a market size of $100 million and a CAGR of 7%, is a mature market for non-toluene inks. The country's advanced technology infrastructure and strong emphasis on quality and safety in packaging drive demand. Japan's well-established regulatory framework and the presence of leading ink manufacturers further support market growth.

Value Chain Profitability Analysis

The value chain of the Non-Toluene Ink for Flexible Packaging market involves several key stakeholders, each playing a crucial role in the overall profitability of the industry. The primary stakeholders include raw material suppliers, ink manufacturers, packaging converters, and end-users such as brand owners and retailers. Raw material suppliers provide essential components such as pigments, resins, and solvents, which are critical for ink formulation. These suppliers typically operate on thin margins due to the competitive nature of the market and the volatility of raw material prices.

Ink manufacturers, on the other hand, capture a significant portion of the value chain's profitability. They invest heavily in research and development to create innovative ink formulations that meet the specific requirements of the flexible packaging industry. The ability to offer high-performance, eco-friendly inks allows manufacturers to command premium pricing, thereby enhancing their profit margins. Packaging converters, who transform raw materials into finished packaging products, also play a vital role in the value chain. They benefit from economies of scale and advanced printing technologies, which enable them to optimize production processes and reduce costs.

End-users, including brand owners and retailers, are the final link in the value chain. They drive demand for non-toluene inks by prioritizing sustainability and safety in their packaging choices. While they may face higher initial costs when transitioning to non-toluene inks, the long-term benefits of enhanced brand reputation and compliance with regulatory standards outweigh these expenses. Overall, the value chain of the Non-Toluene Ink for Flexible Packaging market is characterized by a dynamic interplay of cost structures, pricing models, and profit margins, with digital transformation playing a pivotal role in redistributing revenue opportunities across the industry.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The Non-Toluene Ink for Flexible Packaging market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences and regulatory pressures. During this period, the market experienced a steady CAGR of 6.5%, with a notable shift towards sustainable packaging solutions. The adoption of digital printing technologies and the development of advanced ink formulations were key trends that shaped the market landscape. Additionally, the increasing focus on reducing volatile organic compound (VOC) emissions and enhancing print quality contributed to the market's growth.

Looking ahead to the period from 2025 to 2033, the market is expected to witness accelerated growth, with a projected CAGR of 8.5%. This growth will be driven by continued advancements in ink technology and the expanding applications of flexible packaging across various industries. The increasing demand for customized and short-run printing solutions will further fuel the adoption of non-toluene inks. Moreover, strategic partnerships and collaborations among key market players are anticipated to drive innovation and market expansion.

Regionally, the Asia Pacific is expected to emerge as a dominant force in the market, with significant contributions from countries like China and India. The region's rapid industrialization and growing consumer base will be key drivers of market growth. In contrast, mature markets such as North America and Europe will continue to focus on sustainability and regulatory compliance, maintaining steady growth rates. Overall, the Non-Toluene Ink for Flexible Packaging market is poised for dynamic growth, with strategic foresight and innovation playing crucial roles in shaping its future trajectory.

Non-Toluene Ink For Flexible Packaging Market Segments Insights

Type Analysis

The Non-Toluene Ink for Flexible Packaging market is segmented by type into water-based, solvent-based, and UV-curable inks. Water-based inks are gaining popularity due to their eco-friendly nature and low VOC emissions. These inks are particularly favored in regions with stringent environmental regulations, as they offer a safer alternative to traditional solvent-based inks. The demand for water-based inks is driven by their ability to provide high-quality prints and vibrant colors, making them suitable for a wide range of applications in the flexible packaging industry.

Solvent-based inks, while facing challenges due to environmental concerns, continue to hold a significant share of the market. These inks are known for their durability and resistance to harsh conditions, making them ideal for applications that require high-performance packaging solutions. However, the shift towards more sustainable options is prompting manufacturers to innovate and develop solvent-based inks with reduced environmental impact. UV-curable inks are also gaining traction, offering fast curing times and excellent print quality. These inks are particularly suitable for high-speed printing processes, providing a competitive edge in the market.

Application Analysis

The application segment of the Non-Toluene Ink for Flexible Packaging market includes food and beverage, pharmaceuticals, personal care, and industrial applications. The food and beverage sector is a major driver of demand for non-toluene inks, as these inks ensure that packaging is safe for direct contact with food products. The increasing focus on food safety and compliance with regulatory standards is propelling the adoption of non-toluene inks in this sector. Additionally, the growing trend of convenience foods and ready-to-eat meals is further boosting demand for flexible packaging solutions.

In the pharmaceutical industry, non-toluene inks are gaining traction due to their ability to provide high-quality prints and ensure the safety of packaging materials. The need for tamper-evident and secure packaging solutions is driving the adoption of these inks in the pharmaceutical sector. The personal care industry is also witnessing increased demand for non-toluene inks, as brands seek to enhance their product appeal with vibrant and eye-catching packaging designs. The industrial sector, while smaller in comparison, is gradually adopting non-toluene inks for applications that require durable and high-performance packaging solutions.

Printing Process Analysis

The Non-Toluene Ink for Flexible Packaging market is segmented by printing process into gravure, flexography, and digital printing. Gravure printing is a widely used process in the flexible packaging industry, known for its ability to produce high-quality prints with fine details. The demand for gravure printing is driven by its suitability for large-volume production and its ability to deliver consistent print quality. However, the high initial costs associated with gravure printing equipment can be a barrier for some manufacturers.

Flexography is another popular printing process, favored for its versatility and cost-effectiveness. This process is particularly suitable for printing on a variety of substrates, making it ideal for flexible packaging applications. The growing demand for short-run and customized printing solutions is driving the adoption of flexography in the market. Digital printing, while still emerging, is gaining traction due to its ability to offer greater customization and shorter print runs. The increasing demand for personalized packaging solutions is expected to drive the growth of digital printing in the non-toluene ink market.

End-User Analysis

The end-user segment of the Non-Toluene Ink for Flexible Packaging market includes converters, brand owners, and packaging manufacturers. Converters play a crucial role in the market, transforming raw materials into finished packaging products. They are increasingly adopting non-toluene inks to meet the growing demand for sustainable and safe packaging solutions. The ability to offer high-quality prints and vibrant colors is a key factor driving the adoption of these inks among converters.

Brand owners are also significant end-users of non-toluene inks, as they seek to enhance their product appeal and comply with regulatory standards. The growing consumer preference for eco-friendly products is prompting brand owners to invest in sustainable packaging solutions, driving demand for non-toluene inks. Packaging manufacturers, while primarily focused on production efficiency, are also adopting non-toluene inks to meet the evolving needs of their clients. The ability to offer innovative and sustainable packaging solutions is a key competitive advantage for manufacturers in this market.

Non-Toluene Ink For Flexible Packaging Market Segments

The Non-Toluene Ink For Flexible Packaging market has been segmented on the basis of

Type

- Water-Based

- Solvent-Based

- UV-Curable

Application

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Industrial

Printing Process

- Gravure

- Flexography

- Digital

End-User

- Converters

- Brand Owners

- Packaging Manufacturers

Primary Interview Insights

What are the key drivers of growth in the Non-Toluene Ink for Flexible Packaging market?

What challenges does the market face?

How is the competitive landscape evolving?

What opportunities exist for new entrants in this market?

How are regulatory standards impacting the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.