- Home

- Packaging Products

- PE Closures Market Size, Future Growth and Forecast 2033

PE Closures Market Size, Future Growth and Forecast 2033

PE Closures Market Segments - by Type (Screw-On, Snap-On), Application (Beverages, Food, Pharmaceuticals, Personal Care, Household), Material (HDPE, LDPE, Others), and End-User (Beverage Industry, Food Industry, Pharmaceutical Industry, Personal Care Industry, Household Products) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

PE Closures Market Outlook

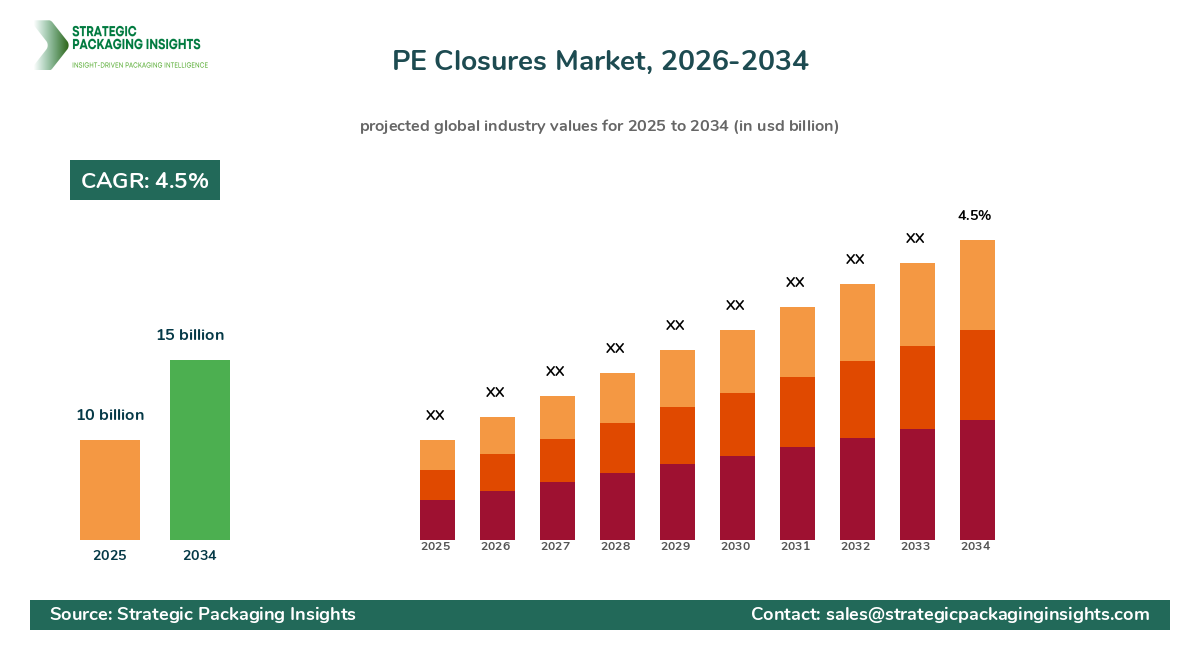

The PE Closures market was valued at $10 billion in 2024 and is projected to reach $15 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025-2033. The market for PE closures is driven by the increasing demand for lightweight and cost-effective packaging solutions across various industries. The beverage industry, in particular, is a significant consumer of PE closures due to their compatibility with a wide range of bottle types and their ability to provide a secure seal. Additionally, the growing trend towards Sustainable Packaging solutions is encouraging manufacturers to adopt PE closures, which are recyclable and environmentally friendly.

However, the market faces challenges such as fluctuating raw material prices and stringent regulations regarding plastic usage. Despite these challenges, the PE closures market holds significant growth potential due to the rising demand for packaged food and beverages, especially in emerging economies. The increasing focus on product differentiation and branding is also driving the demand for customized PE closures, which offer unique shapes, colors, and printing options to enhance product appeal.

Report Scope

| Attributes | Details |

| Report Title | PE Closures Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 243 |

| Type | Screw-On, Snap-On |

| Application | Beverages, Food, Pharmaceuticals, Personal Care, Household |

| Material | HDPE, LDPE, Others |

| End-User | Beverage Industry, Food Industry, Pharmaceutical Industry, Personal Care Industry, Household Products |

| Customization Available | Yes* |

Opportunities & Threats

The PE closures market presents numerous opportunities for growth, particularly in the area of sustainable packaging. As consumers become more environmentally conscious, there is a growing demand for recyclable and eco-friendly packaging solutions. PE closures, being recyclable, are well-positioned to capitalize on this trend. Additionally, advancements in material science are enabling the development of PE closures with enhanced properties such as improved barrier protection and tamper-evidence, further expanding their application scope.

Another significant opportunity lies in the expanding e-commerce sector. With the rise of online shopping, there is an increasing need for secure and reliable packaging solutions that can withstand the rigors of transportation. PE closures, with their robust sealing capabilities, are ideal for E-Commerce Packaging, ensuring product integrity during transit. Furthermore, the growing demand for convenience packaging, driven by busy lifestyles and urbanization, is boosting the adoption of PE closures in single-serve and on-the-go products.

Despite these opportunities, the PE closures market faces certain threats that could hinder its growth. One of the primary challenges is the increasing competition from alternative closure materials such as metal and glass, which offer superior aesthetic appeal and perceived quality. Additionally, the volatility in raw material prices, particularly polyethylene, can impact the profitability of manufacturers. Regulatory pressures to reduce plastic usage and promote biodegradable alternatives also pose a threat to the market, necessitating continuous innovation and adaptation by industry players.

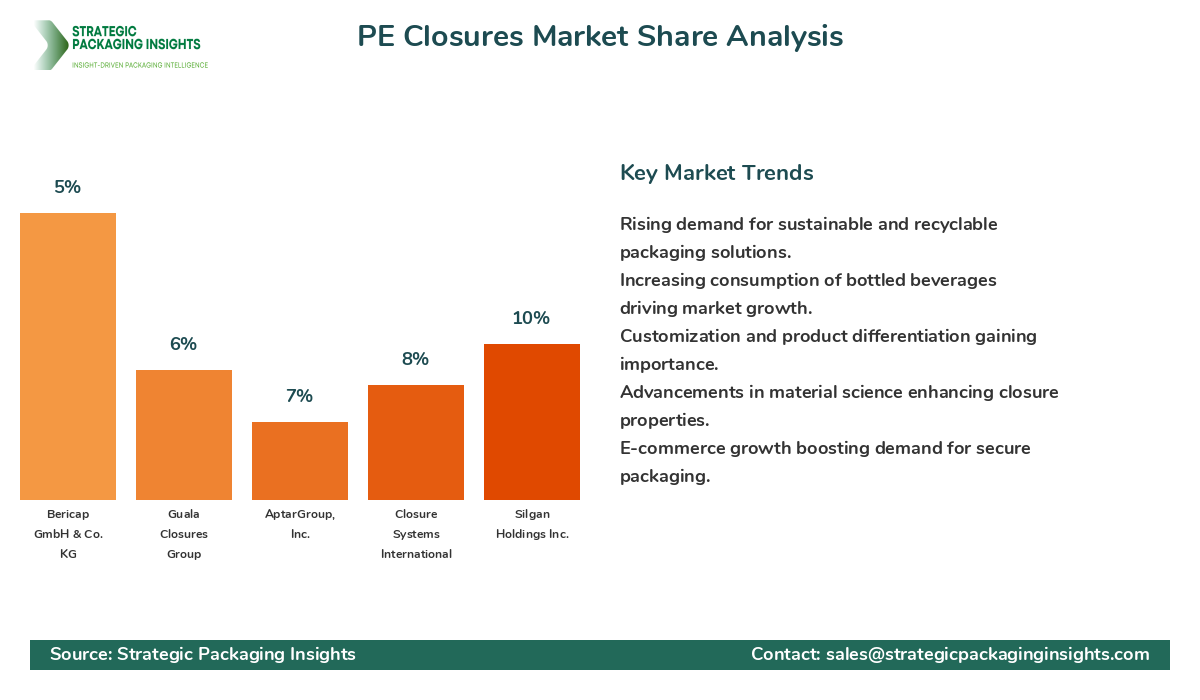

The competitive landscape of the PE closures market is characterized by the presence of several key players who dominate the market with their extensive product portfolios and strong distribution networks. These companies are continuously investing in research and development to introduce innovative products and maintain their competitive edge. The market is moderately consolidated, with a few major players holding a significant share, while numerous small and medium-sized enterprises contribute to the remaining market share.

Amcor Limited, a leading player in the PE closures market, holds a substantial market share due to its wide range of closure solutions and strong presence in the global packaging industry. The company focuses on sustainability and innovation, offering closures that are not only functional but also environmentally friendly. Another major player, Berry Global Inc., is known for its extensive product offerings and strong customer relationships, which have helped it secure a significant market position.

Silgan Holdings Inc. is another prominent player in the PE closures market, known for its focus on product quality and customer satisfaction. The company has a diverse product portfolio catering to various end-use industries, including food, beverage, and personal care. Closure Systems International, a subsidiary of Reynolds Group Holdings, is also a key player, offering a wide range of closure solutions with a focus on innovation and sustainability.

Other notable companies in the PE closures market include AptarGroup, Inc., which is recognized for its innovative dispensing solutions, and Guala Closures Group, known for its premium closure offerings. These companies, along with others such as Bericap GmbH & Co. KG, RPC Group Plc, and Weener Plastics Group, contribute to the competitive dynamics of the market, each striving to enhance their market share through strategic initiatives and product innovations.

Key Highlights PE Closures Market

- The PE closures market is projected to grow at a CAGR of 4.5% from 2025 to 2033.

- Increasing demand for sustainable and recyclable packaging solutions is driving market growth.

- The beverage industry is the largest consumer of PE closures, followed by the food and pharmaceutical industries.

- Advancements in material science are enabling the development of PE closures with enhanced properties.

- The rise of e-commerce is boosting the demand for secure and reliable packaging solutions.

- Customization and product differentiation are key trends in the PE closures market.

- Regulatory pressures to reduce plastic usage pose a challenge to market growth.

- Major players are focusing on innovation and sustainability to maintain their competitive edge.

- The market is moderately consolidated, with a few major players holding a significant share.

- Emerging economies present significant growth opportunities for the PE closures market.

Competitive Intelligence

The PE closures market is highly competitive, with several key players vying for market share through strategic initiatives and product innovations. Amcor Limited, a leader in the market, focuses on sustainability and innovation, offering a wide range of closure solutions that cater to various industries. The company's strong global presence and extensive distribution network give it a competitive advantage, allowing it to capture a significant market share.

Berry Global Inc. is another major player in the PE closures market, known for its comprehensive product portfolio and strong customer relationships. The company emphasizes innovation and customer satisfaction, continuously introducing new products to meet evolving market demands. Berry Global's strategic acquisitions and partnerships have further strengthened its market position, enabling it to expand its geographic reach and enhance its product offerings.

Silgan Holdings Inc. is recognized for its focus on product quality and customer service, offering a diverse range of closure solutions for various end-use industries. The company's commitment to innovation and sustainability has helped it maintain a strong market position, with a significant share in the PE closures market. Closure Systems International, a subsidiary of Reynolds Group Holdings, is also a key player, known for its innovative closure solutions and focus on sustainability.

AptarGroup, Inc. is renowned for its dispensing solutions, offering a wide range of closures that cater to the needs of the food, beverage, and personal care industries. The company's emphasis on innovation and customer-centric solutions has helped it secure a strong market position. Guala Closures Group, known for its premium closure offerings, is another prominent player, focusing on product differentiation and innovation to maintain its competitive edge.

Regional Market Intelligence of PE Closures

The global PE closures market is segmented into several key regions, each exhibiting unique growth patterns and market dynamics. In North America, the market is driven by the high demand for packaged beverages and the presence of major industry players. The region's focus on sustainability and recycling initiatives further supports the growth of the PE closures market. The market in North America was valued at $3 billion in 2024 and is expected to grow at a CAGR of 12% during the forecast period.

In Europe, the PE closures market is characterized by stringent regulations regarding plastic usage and a strong emphasis on sustainability. The region's well-established packaging industry and the presence of leading closure manufacturers contribute to market growth. The European market was valued at $2.5 billion in 2024, with a projected CAGR of 9% from 2025 to 2033.

The Asia-Pacific region is expected to witness the highest growth rate in the PE closures market, driven by the increasing demand for packaged food and beverages in emerging economies such as China and India. The region's growing population and rising disposable incomes further fuel market growth. The Asia-Pacific market was valued at $4 billion in 2024 and is projected to grow at a CAGR of 15% during the forecast period.

In Latin America, the PE closures market is driven by the expanding food and beverage industry and the increasing adoption of sustainable packaging solutions. The region's focus on reducing plastic waste and promoting recycling initiatives supports market growth. The Latin American market was valued at $1 billion in 2024, with a projected CAGR of 7% from 2025 to 2033.

The Middle East & Africa region is experiencing moderate growth in the PE closures market, driven by the increasing demand for packaged products and the growing focus on sustainability. The region's market was valued at $0.5 billion in 2024 and is expected to grow at a CAGR of 5% during the forecast period.

Top Countries Insights in PE Closures

In the United States, the PE closures market is driven by the high demand for packaged beverages and the presence of major industry players. The market was valued at $2 billion in 2024, with a CAGR of 10%. The country's focus on sustainability and recycling initiatives further supports market growth.

In Germany, the market is characterized by stringent regulations regarding plastic usage and a strong emphasis on sustainability. The market was valued at $1.5 billion in 2024, with a CAGR of 8%. Germany's well-established packaging industry and the presence of leading closure manufacturers contribute to market growth.

In China, the PE closures market is expected to witness significant growth, driven by the increasing demand for packaged food and beverages. The market was valued at $3 billion in 2024, with a CAGR of 12%. The country's growing population and rising disposable incomes further fuel market growth.

In Brazil, the market is driven by the expanding food and beverage industry and the increasing adoption of sustainable packaging solutions. The market was valued at $0.8 billion in 2024, with a CAGR of 6%. Brazil's focus on reducing plastic waste and promoting recycling initiatives supports market growth.

In South Africa, the PE closures market is experiencing moderate growth, driven by the increasing demand for packaged products and the growing focus on sustainability. The market was valued at $0.5 billion in 2024, with a CAGR of 5%. The country's market is supported by the expanding food and beverage industry and the increasing adoption of sustainable packaging solutions.

PE Closures Market Segments Insights

Type Analysis

The PE closures market is segmented by type into screw-on and snap-on closures. Screw-on closures are widely used in the beverage industry due to their secure sealing capabilities and ease of use. These closures are designed to provide a tight seal, preventing leakage and ensuring product freshness. The demand for screw-on closures is driven by the increasing consumption of bottled beverages and the growing trend towards convenience packaging. Snap-on closures, on the other hand, are popular in the food and personal care industries, where ease of opening and resealing is a priority. These closures offer a quick and convenient way to access the product, making them ideal for single-serve and on-the-go applications.

The market for screw-on closures is expected to witness significant growth due to the rising demand for bottled water and carbonated soft drinks. The increasing focus on product differentiation and branding is also driving the demand for customized screw-on closures, which offer unique shapes, colors, and printing options to enhance product appeal. Snap-on closures are gaining popularity in the personal care industry, where they are used for products such as shampoos, lotions, and creams. The growing demand for convenient and user-friendly packaging solutions is expected to drive the growth of snap-on closures in the coming years.

Application Analysis

The PE closures market is segmented by application into beverages, food, pharmaceuticals, personal care, and household products. The beverage industry is the largest consumer of PE closures, driven by the high demand for bottled water, carbonated soft drinks, and alcoholic beverages. PE closures are preferred in the beverage industry due to their compatibility with a wide range of bottle types and their ability to provide a secure seal. The food industry is another significant consumer of PE closures, where they are used for packaging products such as sauces, condiments, and dairy products.

The pharmaceutical industry is witnessing increasing adoption of PE closures due to their tamper-evident and child-resistant features, which are essential for ensuring product safety and compliance with regulatory standards. The personal care industry is also a major consumer of PE closures, where they are used for packaging products such as shampoos, lotions, and creams. The growing demand for convenient and user-friendly packaging solutions is driving the adoption of PE closures in the personal care industry. The household products segment is expected to witness moderate growth, driven by the increasing demand for cleaning and hygiene products.

Material Analysis

The PE closures market is segmented by material into HDPE, LDPE, and others. High-density polyethylene (HDPE) is the most commonly used material for PE closures due to its excellent strength, durability, and resistance to chemicals. HDPE closures are widely used in the beverage and food industries, where they provide a secure seal and protect the product from contamination. The demand for HDPE closures is driven by the increasing consumption of bottled beverages and the growing trend towards convenience packaging.

Low-density polyethylene (LDPE) closures are gaining popularity in the personal care and pharmaceutical industries, where flexibility and ease of use are important considerations. LDPE closures offer a softer feel and are easier to open and reseal, making them ideal for products such as shampoos, lotions, and creams. The demand for LDPE closures is expected to grow due to the increasing demand for convenient and user-friendly packaging solutions. Other materials used for PE closures include polypropylene and polyethylene terephthalate, which offer specific properties such as transparency and barrier protection.

End-User Analysis

The PE closures market is segmented by end-user into the beverage industry, food industry, pharmaceutical industry, personal care industry, and household products. The beverage industry is the largest end-user of PE closures, driven by the high demand for bottled water, carbonated soft drinks, and alcoholic beverages. The food industry is another significant end-user, where PE closures are used for packaging products such as sauces, condiments, and dairy products.

The pharmaceutical industry is witnessing increasing adoption of PE closures due to their tamper-evident and child-resistant features, which are essential for ensuring product safety and compliance with regulatory standards. The personal care industry is also a major end-user of PE closures, where they are used for packaging products such as shampoos, lotions, and creams. The growing demand for convenient and user-friendly packaging solutions is driving the adoption of PE closures in the personal care industry. The household products segment is expected to witness moderate growth, driven by the increasing demand for cleaning and hygiene products.

Market Share Analysis

The market share distribution of key players in the PE closures market is influenced by several factors, including product innovation, geographic reach, and customer relationships. Amcor Limited, Berry Global Inc., and Silgan Holdings Inc. are among the leading companies, each holding a significant share of the market. These companies leverage their extensive product portfolios and strong distribution networks to maintain their competitive positions. The market share distribution also affects pricing strategies, with leading players able to command premium prices due to their brand reputation and product quality. Innovation is a key driver of market share, with companies investing in research and development to introduce new and improved closure solutions. Partnerships and collaborations are also common strategies used by companies to expand their market presence and enhance their product offerings.

PE Closures Market Segments

The PE Closures market has been segmented on the basis of

Type

- Screw-On

- Snap-On

Application

- Beverages

- Food

- Pharmaceuticals

- Personal Care

- Household

Material

- HDPE

- LDPE

- Others

End-User

- Beverage Industry

- Food Industry

- Pharmaceutical Industry

- Personal Care Industry

- Household Products

Primary Interview Insights

What are the key drivers of growth in the PE closures market?

How is the market responding to regulatory pressures on plastic usage?

What role does customization play in the PE closures market?

How is the e-commerce sector impacting the PE closures market?

What challenges does the PE closures market face?

Latest Reports

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The RFID-Enabled Shipping Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.2 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The Tracking-Enabled Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025–2033.

The Warehouse-Ready Packaging market was valued at $45 billion in 2024 and is projected to reach $75 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The export packaging market was valued at $150 billion in 2024 and is projected to reach $230 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.