- Home

- Packaging Products

- PET Containers Market Size, Future Growth and Forecast 2033

PET Containers Market Size, Future Growth and Forecast 2033

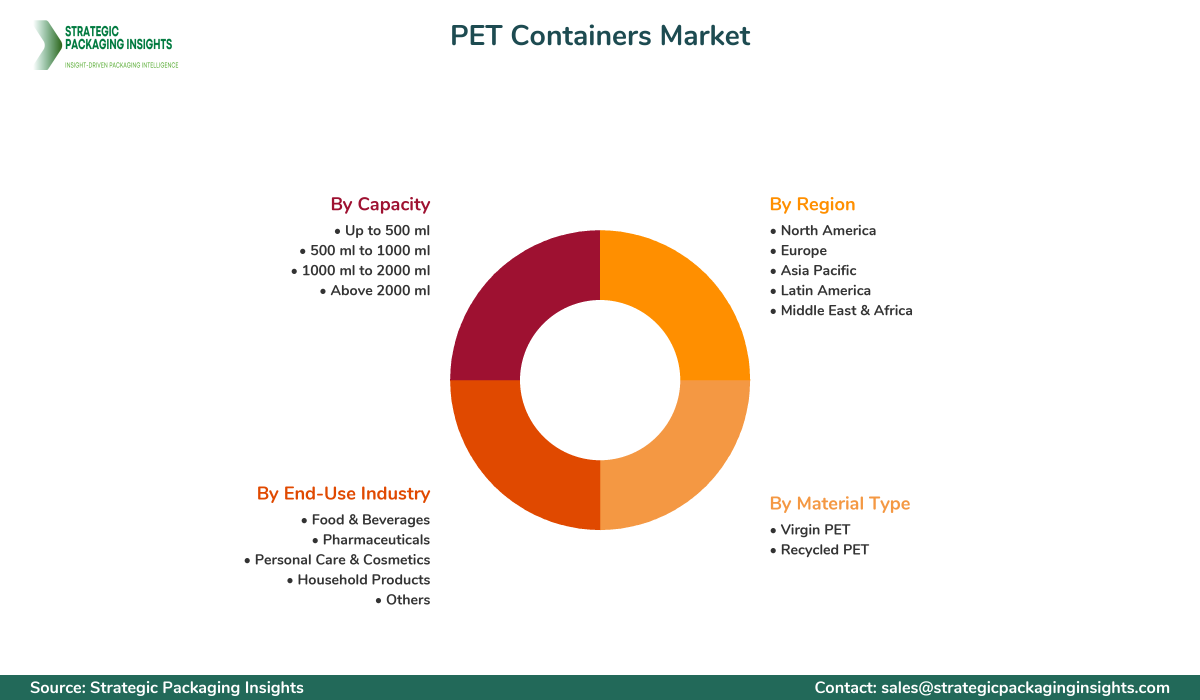

PET Containers Market Segments - by Material Type (Virgin PET, Recycled PET), End-Use Industry (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Household Products, Others), Capacity (Up to 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 ml, Above 2000 ml), and Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

PET Containers Market Outlook

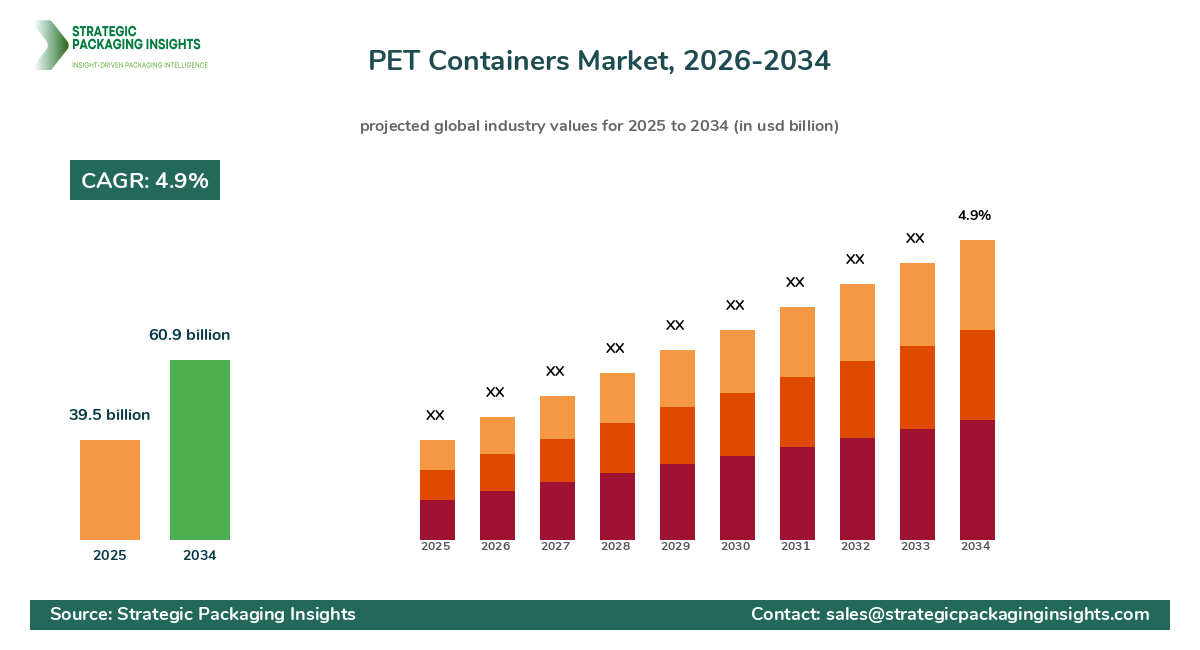

The PET containers market was valued at $39.5 billion in 2024 and is projected to reach $60.9 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2025-2033. This growth is driven by the increasing demand for lightweight, durable, and recyclable packaging solutions across various industries. PET containers are favored for their versatility and cost-effectiveness, making them a popular choice in the food and beverage sector, which is the largest end-user segment. The rising consumer preference for Sustainable Packaging and the expansion of the e-commerce industry further bolster the market's growth prospects. Additionally, advancements in PET recycling technologies are expected to enhance the market's appeal by addressing environmental concerns and promoting circular economy practices.

Report Scope

| Attributes | Details |

| Report Title | PET Containers Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 173 |

| Material Type | Virgin PET, Recycled PET |

| End-Use Industry | Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Household Products, Others |

| Capacity | Up to 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 ml, Above 2000 ml |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Key Highlights PET Containers Market

- The food and beverage industry remains the largest consumer of PET containers, accounting for over 50% of the market share.

- Recycled PET is gaining traction, with an expected CAGR of 6.2% during the forecast period.

- Asia Pacific is the fastest-growing region, driven by rapid industrialization and urbanization.

- Technological advancements in PET recycling are enhancing the sustainability of PET containers.

- Increasing consumer awareness about eco-friendly packaging is boosting demand for PET containers.

- Innovations in lightweight and durable PET containers are expanding their application in various industries.

- Stringent regulations on plastic usage are encouraging the adoption of recyclable PET containers.

- The rise of e-commerce is significantly driving the demand for PET containers for packaging and shipping.

- North America holds a significant market share due to high consumption of packaged goods.

- Collaborations between PET manufacturers and recycling companies are fostering market growth.

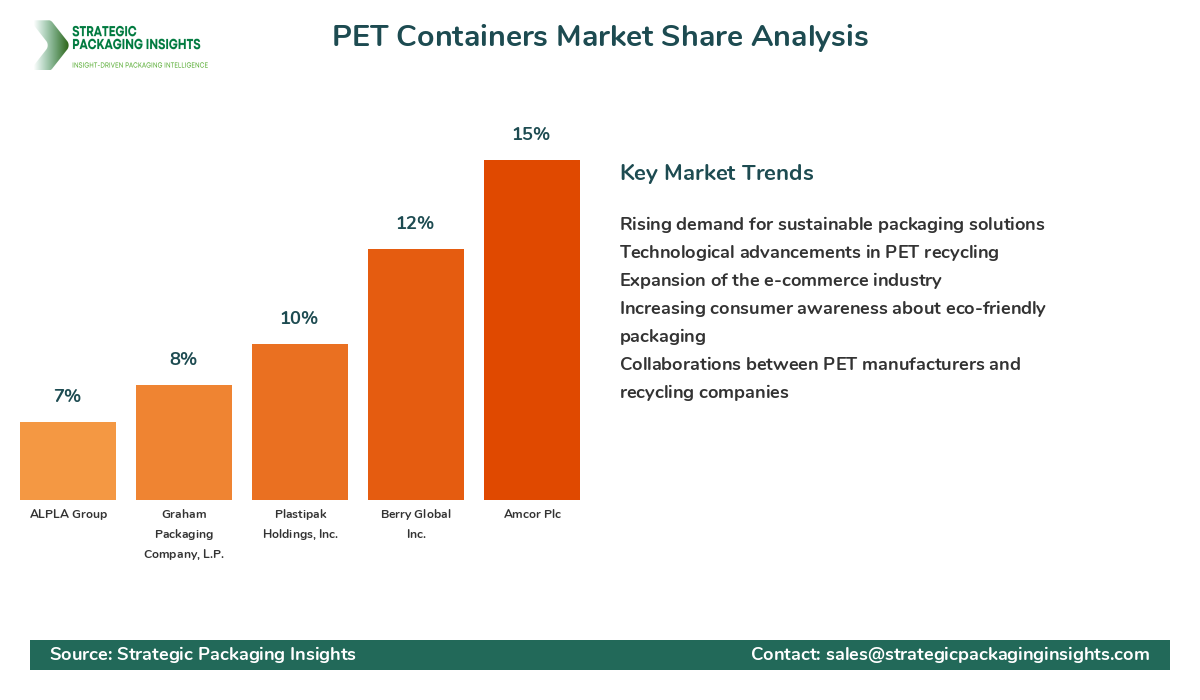

Competitive Intelligence

The PET containers market is highly competitive, with key players focusing on innovation, sustainability, and strategic partnerships to maintain their market positions. Amcor Plc, a leading player, is known for its extensive product portfolio and strong focus on sustainable packaging solutions. The company has a significant market share and is expanding its geographic reach through acquisitions and collaborations. Berry Global Inc. is another major player, emphasizing innovation and customer-centric solutions. The company is investing in advanced manufacturing technologies to enhance product quality and reduce environmental impact.

Plastipak Holdings, Inc. is recognized for its strong R&D capabilities and focus on developing lightweight and recyclable PET containers. The company is expanding its presence in emerging markets to capitalize on growth opportunities. Graham Packaging Company, L.P. is known for its innovative packaging solutions and strong customer relationships. The company is focusing on expanding its product offerings and enhancing its production capabilities.

ALPLA Group is a global leader in the PET containers market, with a strong focus on sustainability and innovation. The company is investing in recycling technologies to enhance its product offerings and reduce its environmental footprint. Gerresheimer AG is another key player, known for its high-quality packaging solutions and strong customer base. The company is expanding its geographic reach and product portfolio to strengthen its market position.

Silgan Holdings Inc. is focusing on strategic acquisitions and partnerships to enhance its market presence and product offerings. The company is investing in advanced manufacturing technologies to improve product quality and reduce costs. Resilux NV is recognized for its strong focus on sustainability and innovation, with a significant market share in Europe. The company is expanding its presence in emerging markets to capitalize on growth opportunities.

Logoplaste is known for its innovative packaging solutions and strong customer relationships. The company is focusing on expanding its product offerings and enhancing its production capabilities. The competitive landscape is characterized by intense competition, with companies focusing on innovation, sustainability, and strategic partnerships to maintain their market positions.

Regional Market Intelligence of PET Containers

In North America, the PET containers market is valued at $10.5 billion and is expected to grow steadily due to high consumption of packaged goods and increasing demand for sustainable packaging solutions. The region's focus on recycling and environmental sustainability is driving the adoption of PET containers. Europe, with a market size of $9.2 billion, is witnessing growth driven by stringent regulations on plastic usage and increasing consumer awareness about eco-friendly packaging. The region's strong focus on sustainability and recycling is fostering market growth.

Asia Pacific is the fastest-growing region, with a market size of $12.8 billion, driven by rapid industrialization, urbanization, and increasing demand for packaged goods. The region's expanding middle-class population and rising consumer awareness about sustainable packaging are boosting the demand for PET containers. Latin America, with a market size of $4.5 billion, is experiencing growth due to increasing demand for packaged food and beverages and rising consumer awareness about eco-friendly packaging.

The Middle East & Africa, with a market size of $2.5 billion, is witnessing growth driven by increasing demand for packaged goods and rising consumer awareness about sustainable packaging solutions. The region's focus on recycling and environmental sustainability is driving the adoption of PET containers. Overall, the global PET containers market is witnessing significant growth across all regions, driven by increasing demand for sustainable packaging solutions and rising consumer awareness about environmental sustainability.

Top Countries Insights in PET Containers

The United States, with a market size of $8.5 billion and a CAGR of 4%, is a leading market for PET containers, driven by high consumption of packaged goods and increasing demand for sustainable packaging solutions. The country's focus on recycling and environmental sustainability is fostering market growth. China, with a market size of $7.2 billion and a CAGR of 6%, is experiencing rapid growth due to increasing demand for packaged goods and rising consumer awareness about sustainable packaging.

Germany, with a market size of $5.5 billion and a CAGR of 3%, is witnessing growth driven by stringent regulations on plastic usage and increasing consumer awareness about eco-friendly packaging. The country's strong focus on sustainability and recycling is fostering market growth. India, with a market size of $4.8 billion and a CAGR of 7%, is experiencing rapid growth due to increasing demand for packaged goods and rising consumer awareness about sustainable packaging.

Brazil, with a market size of $3.2 billion and a CAGR of 5%, is witnessing growth driven by increasing demand for packaged food and beverages and rising consumer awareness about eco-friendly packaging. The country's focus on recycling and environmental sustainability is fostering market growth. Overall, the top countries in the PET containers market are witnessing significant growth driven by increasing demand for sustainable packaging solutions and rising consumer awareness about environmental sustainability.

PET Containers Market Segments Insights

Material Type Analysis

The PET containers market is segmented by material type into virgin PET and recycled PET. Virgin PET remains the dominant segment due to its widespread availability and cost-effectiveness. However, recycled PET is gaining significant traction as environmental concerns and regulatory pressures mount. The shift towards a circular economy is driving demand for recycled PET, with companies investing in advanced recycling technologies to enhance product quality and reduce environmental impact. The increasing consumer preference for sustainable packaging solutions is further boosting the demand for recycled PET.

Recycled PET is expected to witness the highest growth rate during the forecast period, driven by increasing consumer awareness about environmental sustainability and stringent regulations on plastic usage. The segment's growth is also supported by technological advancements in recycling processes, which are enhancing the quality and performance of recycled PET containers. As companies focus on sustainability and reducing their carbon footprint, the demand for recycled PET is expected to continue to rise.

End-Use Industry Analysis

The PET containers market is segmented by end-use industry into food & beverages, pharmaceuticals, personal care & cosmetics, household products, and others. The food & beverages segment is the largest consumer of PET containers, accounting for over 50% of the market share. The segment's growth is driven by the increasing demand for lightweight, durable, and Recyclable Packaging solutions. The rising consumer preference for sustainable packaging and the expansion of the e-commerce industry are further bolstering the segment's growth prospects.

The pharmaceuticals segment is expected to witness significant growth during the forecast period, driven by the increasing demand for safe and secure packaging solutions. The segment's growth is also supported by the rising consumer awareness about the benefits of PET containers, such as their lightweight, durability, and recyclability. The personal care & cosmetics segment is also witnessing growth, driven by the increasing demand for aesthetically appealing and sustainable packaging solutions.

Capacity Analysis

The PET containers market is segmented by capacity into up to 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 ml, and above 2000 ml. The up to 500 ml segment is the largest, driven by the increasing demand for small-sized packaging solutions in the food & beverages and personal care & cosmetics industries. The segment's growth is also supported by the rising consumer preference for convenient and portable packaging solutions.

The 500 ml to 1000 ml segment is expected to witness significant growth during the forecast period, driven by the increasing demand for medium-sized packaging solutions in the food & beverages and pharmaceuticals industries. The segment's growth is also supported by the rising consumer awareness about the benefits of PET containers, such as their lightweight, durability, and recyclability. The above 2000 ml segment is also witnessing growth, driven by the increasing demand for large-sized packaging solutions in the household products and industrial sectors.

Regional Analysis

The PET containers market is segmented by region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America is the largest market for PET containers, driven by high consumption of packaged goods and increasing demand for sustainable packaging solutions. The region's focus on recycling and environmental sustainability is driving the adoption of PET containers.

Europe is witnessing growth driven by stringent regulations on plastic usage and increasing consumer awareness about eco-friendly packaging. The region's strong focus on sustainability and recycling is fostering market growth. Asia Pacific is the fastest-growing region, driven by rapid industrialization, urbanization, and increasing demand for packaged goods. The region's expanding middle-class population and rising consumer awareness about sustainable packaging are boosting the demand for PET containers.

The PET containers market is characterized by a competitive landscape with several key players holding significant market shares. Amcor Plc and Berry Global Inc. are among the leading companies, leveraging their extensive product portfolios and strong focus on sustainability to maintain their market positions. These companies are investing in advanced manufacturing technologies and strategic partnerships to enhance their market presence and product offerings.

Plastipak Holdings, Inc. and Graham Packaging Company, L.P. are also key players, focusing on innovation and customer-centric solutions to gain a competitive edge. These companies are expanding their geographic reach and product portfolios to capitalize on growth opportunities. ALPLA Group and Gerresheimer AG are recognized for their strong focus on sustainability and innovation, with significant market shares in Europe and North America.

The competitive landscape is characterized by intense competition, with companies focusing on innovation, sustainability, and strategic partnerships to maintain their market positions. The market share distribution affects pricing, innovation, and partnerships, with leading companies leveraging their strengths to gain a competitive edge. As the market continues to evolve, companies are expected to focus on sustainability and innovation to maintain their market positions and capitalize on growth opportunities.

PET Containers Market Segments

The PET Containers market has been segmented on the basis of

Material Type

- Virgin PET

- Recycled PET

End-Use Industry

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Household Products

- Others

Capacity

- Up to 500 ml

- 500 ml to 1000 ml

- 1000 ml to 2000 ml

- Above 2000 ml

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What is driving the growth of the PET containers market?

How is the market responding to environmental concerns?

What role does innovation play in the PET containers market?

How are companies addressing regulatory pressures on plastic usage?

What are the key challenges facing the PET containers market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.