- Home

- Food Packaging

- Plastic Food Preservative Film Market Size, Future Growth and Forecast 2033

Plastic Food Preservative Film Market Size, Future Growth and Forecast 2033

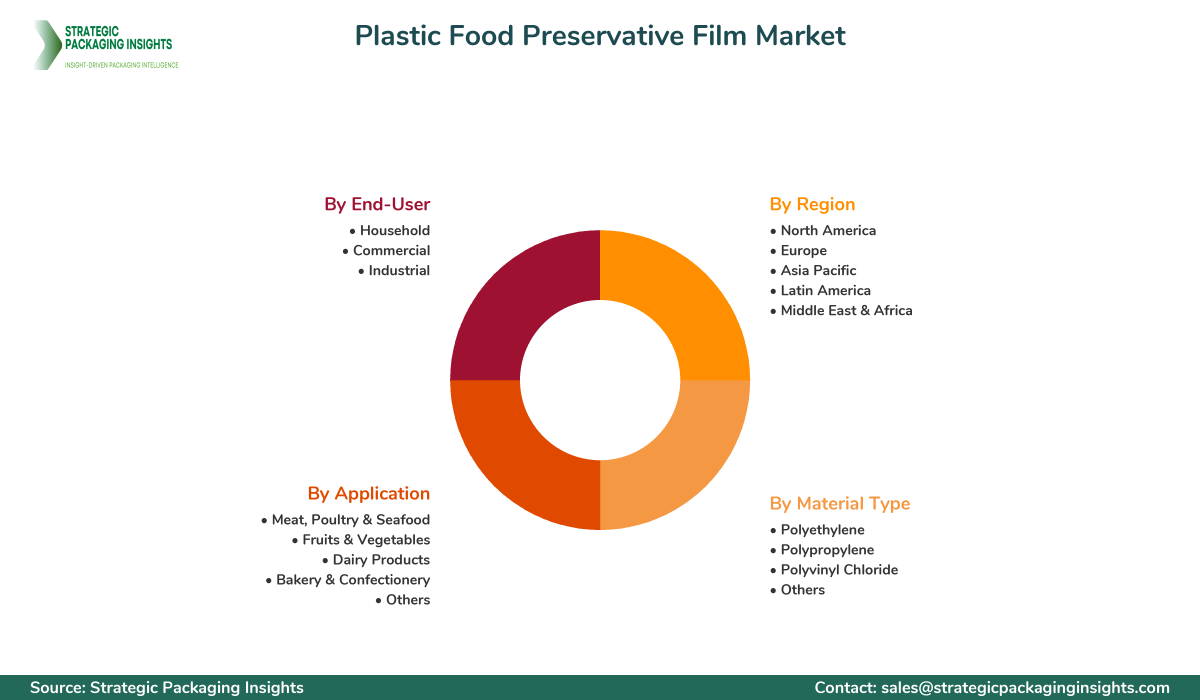

Plastic Food Preservative Film Market Segments - by Material Type (Polyethylene, Polypropylene, Polyvinyl Chloride, Others), Application (Meat, Poultry & Seafood, Fruits & Vegetables, Dairy Products, Bakery & Confectionery, Others), End-User (Household, Commercial, Industrial), and Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Plastic Food Preservative Film Market Outlook

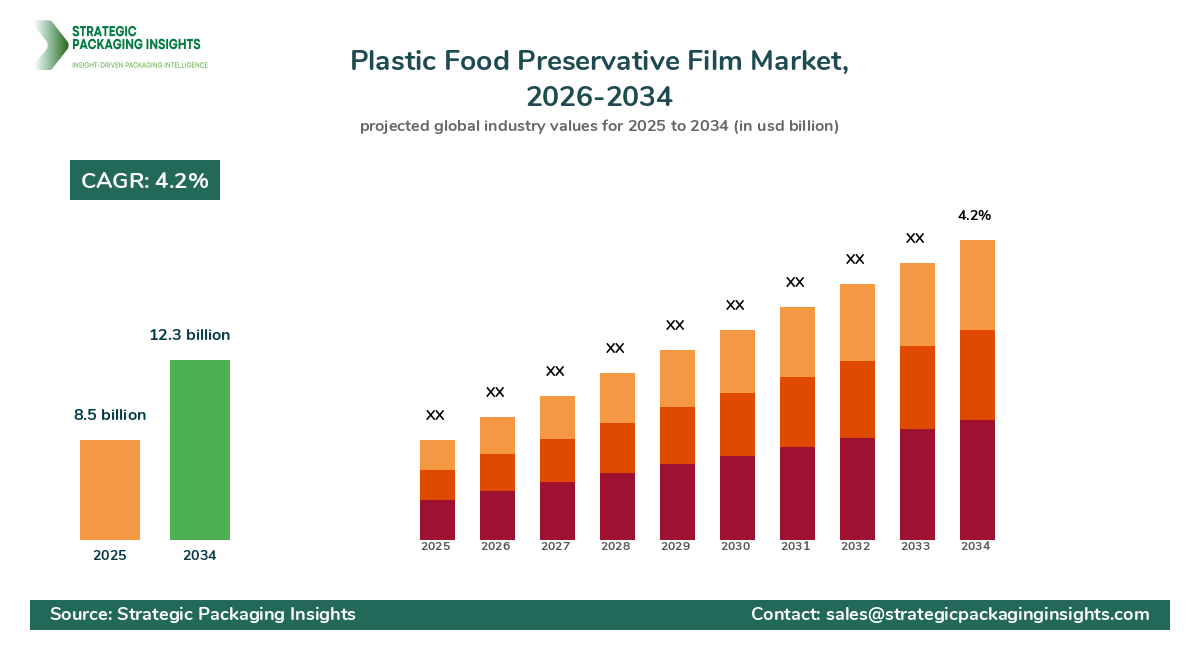

The Plastic Food Preservative Film market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033. This market is driven by the increasing demand for convenient and efficient food packaging solutions that extend the shelf life of perishable goods. The rise in consumer awareness regarding food safety and hygiene has further propelled the demand for plastic food preservative films. Additionally, the growth of the food and beverage industry, coupled with the expansion of retail chains, has significantly contributed to the market's expansion. The versatility and cost-effectiveness of plastic films make them a preferred choice among manufacturers and consumers alike.

However, the market faces challenges due to environmental concerns associated with plastic waste and stringent regulations on plastic usage. The increasing emphasis on Sustainable Packaging solutions and the development of biodegradable films present both challenges and opportunities for market players. Companies are investing in research and development to innovate eco-friendly alternatives that meet regulatory standards and consumer preferences. Despite these challenges, the market holds significant growth potential, driven by technological advancements and the rising demand for packaged food products globally.

Report Scope

| Attributes | Details |

| Report Title | Plastic Food Preservative Film Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 161 |

| Material Type | Polyethylene, Polypropylene, Polyvinyl Chloride, Others |

| Application | Meat, Poultry & Seafood, Fruits & Vegetables, Dairy Products, Bakery & Confectionery, Others |

| End-User | Household, Commercial, Industrial |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The Plastic Food Preservative Film market presents numerous opportunities for growth, primarily driven by the increasing demand for packaged food products. As urbanization and busy lifestyles continue to rise, consumers are seeking convenient food options that require minimal preparation time. This trend has led to a surge in demand for ready-to-eat meals and packaged food items, thereby boosting the need for effective food preservation solutions. Additionally, the growing awareness of food safety and hygiene has prompted consumers to opt for packaging that ensures product integrity and extends shelf life. This shift in consumer preferences presents a lucrative opportunity for manufacturers to innovate and offer advanced preservative films that cater to these evolving needs.

Another significant opportunity lies in the development of sustainable and eco-friendly packaging solutions. With increasing environmental concerns and stringent regulations on plastic usage, there is a growing demand for biodegradable and recyclable films. Companies that invest in research and development to create sustainable alternatives are likely to gain a competitive edge in the market. Furthermore, the expansion of e-commerce and online food delivery services has created a new avenue for growth, as these platforms require efficient packaging solutions to ensure the safe and timely delivery of food products.

Despite the promising opportunities, the market faces certain restrainers that could hinder its growth. One of the primary challenges is the environmental impact of plastic waste, which has led to increased scrutiny and regulatory pressure on Plastic Packaging. Governments and environmental organizations are advocating for reduced plastic usage and promoting the adoption of sustainable alternatives. This has compelled manufacturers to invest in eco-friendly solutions, which may involve higher production costs and affect profit margins. Additionally, the volatility in raw material prices and the availability of alternative packaging materials pose challenges to market growth.

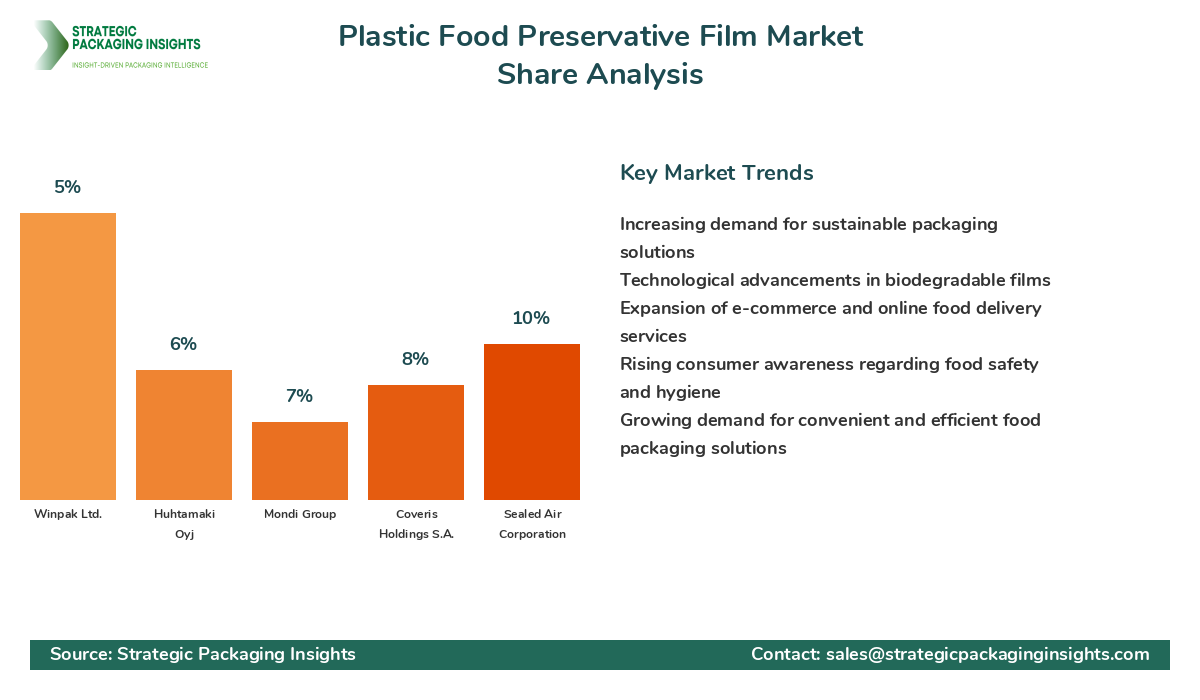

The competitive landscape of the Plastic Food Preservative Film market is characterized by the presence of several key players who dominate the market share. These companies are engaged in strategic initiatives such as mergers and acquisitions, partnerships, and product innovations to strengthen their market position. The market is highly competitive, with players focusing on expanding their product portfolios and enhancing their distribution networks to cater to a wider consumer base. The increasing demand for sustainable packaging solutions has prompted companies to invest in research and development to create eco-friendly alternatives, thereby gaining a competitive edge.

Major companies in the market include Berry Global Inc., Amcor plc, Sealed Air Corporation, and Coveris Holdings S.A. Berry Global Inc. holds a significant market share due to its extensive product portfolio and strong distribution network. The company focuses on innovation and sustainability, offering a range of recyclable and biodegradable films. Amcor plc is another leading player, known for its Advanced Packaging solutions and commitment to sustainability. The company has a strong presence in the global market, with operations in over 40 countries.

Sealed Air Corporation is renowned for its innovative packaging solutions that enhance food safety and extend shelf life. The company's focus on research and development has enabled it to offer a wide range of preservative films that cater to diverse consumer needs. Coveris Holdings S.A. is a prominent player in the market, known for its sustainable packaging solutions and commitment to reducing environmental impact. The company's strategic acquisitions and partnerships have strengthened its market position and expanded its product offerings.

Other notable players in the market include Mondi Group, Huhtamaki Oyj, and Winpak Ltd. Mondi Group is recognized for its sustainable packaging solutions and innovative product offerings. The company's focus on eco-friendly materials and advanced technologies has positioned it as a leader in the market. Huhtamaki Oyj is known for its comprehensive range of packaging solutions, catering to various industries, including food and beverage. Winpak Ltd. is a key player in the North American market, offering high-quality packaging solutions that ensure product safety and integrity.

Key Highlights Plastic Food Preservative Film Market

- The market is projected to grow at a CAGR of 4.2% from 2025 to 2033.

- Increasing demand for packaged food products is driving market growth.

- Environmental concerns and regulatory pressures are influencing market dynamics.

- Technological advancements are leading to the development of eco-friendly films.

- Expansion of e-commerce and online food delivery services is boosting demand.

- Key players are focusing on innovation and sustainability to gain a competitive edge.

- North America and Europe are leading markets due to high consumer awareness.

- Asia Pacific is expected to witness significant growth due to rising urbanization.

- Volatility in raw material prices poses a challenge to market growth.

- Strategic partnerships and acquisitions are shaping the competitive landscape.

Competitive Intelligence

The competitive landscape of the Plastic Food Preservative Film market is shaped by the presence of several key players who are actively engaged in strategic initiatives to strengthen their market position. Berry Global Inc. is a leading player, known for its extensive product portfolio and strong distribution network. The company focuses on innovation and sustainability, offering a range of recyclable and Biodegradable Films. Amcor plc is another prominent player, recognized for its advanced packaging solutions and commitment to sustainability. The company has a strong global presence, with operations in over 40 countries.

Sealed Air Corporation is renowned for its innovative packaging solutions that enhance food safety and extend shelf life. The company's focus on research and development has enabled it to offer a wide range of preservative films that cater to diverse consumer needs. Coveris Holdings S.A. is a key player in the market, known for its sustainable packaging solutions and commitment to reducing environmental impact. The company's strategic acquisitions and partnerships have strengthened its market position and expanded its product offerings.

Mondi Group is recognized for its sustainable packaging solutions and innovative product offerings. The company's focus on eco-friendly materials and advanced technologies has positioned it as a leader in the market. Huhtamaki Oyj is known for its comprehensive range of packaging solutions, catering to various industries, including food and beverage. Winpak Ltd. is a key player in the North American market, offering high-quality packaging solutions that ensure product safety and integrity.

Other notable players in the market include DS Smith Plc, Smurfit Kappa Group, and Sonoco Products Company. DS Smith Plc is known for its innovative packaging solutions and commitment to sustainability. The company's focus on eco-friendly materials and advanced technologies has positioned it as a leader in the market. Smurfit Kappa Group is recognized for its comprehensive range of packaging solutions, catering to various industries, including food and beverage. Sonoco Products Company is a key player in the North American market, offering high-quality packaging solutions that ensure product safety and integrity.

Regional Market Intelligence of Plastic Food Preservative Film

The global Plastic Food Preservative Film market is segmented into major regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by high consumer awareness regarding food safety and hygiene, coupled with the presence of key market players. The region's well-established food and beverage industry further contributes to market growth. Europe is another leading market, characterized by stringent regulations on plastic usage and a strong emphasis on sustainable packaging solutions. The region's focus on environmental conservation has led to the adoption of eco-friendly films.

In the Asia-Pacific region, rapid urbanization and the growing middle-class population are driving the demand for packaged food products, thereby boosting the market for preservative films. The region's expanding retail sector and increasing consumer awareness regarding food safety are further contributing to market growth. Latin America is witnessing moderate growth, driven by the rising demand for convenient food options and the expansion of the food and beverage industry. The region's focus on improving food safety standards is also influencing market dynamics.

The Middle East & Africa region is experiencing steady growth, supported by the increasing demand for packaged food products and the expansion of retail chains. The region's focus on enhancing food safety and hygiene standards is driving the adoption of preservative films. However, the market faces challenges due to economic instability and limited consumer awareness regarding sustainable packaging solutions.

Top Countries Insights in Plastic Food Preservative Film

In the United States, the Plastic Food Preservative Film market is valued at approximately $2.1 billion, with a CAGR of 3%. The country's well-established food and beverage industry, coupled with high consumer awareness regarding food safety, drives market growth. The focus on sustainable packaging solutions and the presence of key market players further contribute to the market's expansion.

In China, the market is valued at around $1.8 billion, with a CAGR of 5%. The country's rapid urbanization and growing middle-class population are driving the demand for packaged food products, thereby boosting the market for preservative films. The government's focus on improving food safety standards and promoting sustainable packaging solutions is also influencing market dynamics.

Germany's market is valued at approximately $1.2 billion, with a CAGR of 4%. The country's stringent regulations on plastic usage and strong emphasis on environmental conservation drive the demand for eco-friendly films. The presence of key market players and the focus on innovation further contribute to market growth.

In India, the market is valued at around $900 million, with a CAGR of 6%. The country's expanding retail sector and increasing consumer awareness regarding food safety are driving the demand for preservative films. The government's initiatives to promote sustainable packaging solutions and improve food safety standards are also influencing market dynamics.

Brazil's market is valued at approximately $700 million, with a CAGR of 4%. The country's rising demand for convenient food options and the expansion of the food and beverage industry drive market growth. The focus on enhancing food safety standards and the presence of key market players further contribute to the market's expansion.

Plastic Food Preservative Film Market Segments Insights

Material Type Analysis

The Plastic Food Preservative Film market is segmented by material type into Polyethylene, Polypropylene, Polyvinyl Chloride, and Others. Polyethylene is the most widely used material due to its versatility, cost-effectiveness, and excellent barrier properties. It is favored for its ability to preserve food freshness and extend shelf life, making it a popular choice among manufacturers. The demand for Polyethylene Films is driven by the increasing consumption of packaged food products and the expansion of the food and beverage industry. Polypropylene films are also gaining traction due to their superior clarity and resistance to moisture and chemicals. These films are preferred for packaging applications that require high transparency and durability.

Polyvinyl Chloride (PVC) films are known for their excellent cling properties and are widely used in food wrapping applications. However, the use of PVC films is declining due to environmental concerns and regulatory restrictions on plasticizers. Manufacturers are focusing on developing alternative materials that offer similar properties without the associated environmental impact. The 'Others' segment includes biodegradable and compostable films, which are gaining popularity due to the increasing emphasis on sustainable packaging solutions. Companies are investing in research and development to create eco-friendly alternatives that meet consumer preferences and regulatory standards.

Application Analysis

The market is segmented by application into Meat, Poultry & Seafood, Fruits & Vegetables, Dairy Products, Bakery & Confectionery, and Others. The Meat, Poultry & Seafood segment holds a significant share of the market due to the high demand for packaging solutions that ensure product safety and extend shelf life. The increasing consumption of meat and seafood products, coupled with the growing focus on food safety, drives the demand for preservative films in this segment. The Fruits & Vegetables segment is also witnessing substantial growth, driven by the rising demand for fresh produce and the need for packaging solutions that preserve freshness and prevent spoilage.

The Dairy Products segment is characterized by the increasing consumption of dairy items and the need for packaging solutions that maintain product integrity and extend shelf life. The Bakery & Confectionery segment is driven by the growing demand for packaged baked goods and confectionery items, which require packaging solutions that prevent moisture loss and maintain product quality. The 'Others' segment includes applications such as ready-to-eat meals and snacks, which are gaining popularity due to the increasing demand for convenient food options. The expansion of e-commerce and online food delivery services further boosts the demand for preservative films in this segment.

End-User Analysis

The market is segmented by end-user into Household, Commercial, and Industrial. The Household segment holds a significant share of the market due to the increasing demand for convenient food packaging solutions that extend shelf life and ensure product safety. The growing consumer awareness regarding food safety and hygiene drives the demand for preservative films in this segment. The Commercial segment is characterized by the increasing demand for packaging solutions in the food service industry, including restaurants, cafes, and catering services. The need for efficient packaging solutions that ensure food safety and quality drives the demand for preservative films in this segment.

The Industrial segment is driven by the increasing demand for packaging solutions in the food processing and manufacturing industries. The need for efficient packaging solutions that ensure product safety and extend shelf life drives the demand for preservative films in this segment. The expansion of the food and beverage industry, coupled with the growing focus on food safety and hygiene, further contributes to the demand for preservative films in the industrial segment. Companies are focusing on developing innovative packaging solutions that cater to the diverse needs of end-users and enhance product safety and quality.

Regional Market Intelligence of Plastic Food Preservative Film

The global Plastic Food Preservative Film market is segmented into major regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by high consumer awareness regarding food safety and hygiene, coupled with the presence of key market players. The region's well-established food and beverage industry further contributes to market growth. Europe is another leading market, characterized by stringent regulations on plastic usage and a strong emphasis on sustainable packaging solutions. The region's focus on environmental conservation has led to the adoption of eco-friendly films.

In the Asia-Pacific region, rapid urbanization and the growing middle-class population are driving the demand for packaged food products, thereby boosting the market for preservative films. The region's expanding retail sector and increasing consumer awareness regarding food safety are further contributing to market growth. Latin America is witnessing moderate growth, driven by the rising demand for convenient food options and the expansion of the food and beverage industry. The region's focus on improving food safety standards is also influencing market dynamics.

The Middle East & Africa region is experiencing steady growth, supported by the increasing demand for packaged food products and the expansion of retail chains. The region's focus on enhancing food safety and hygiene standards is driving the adoption of preservative films. However, the market faces challenges due to economic instability and limited consumer awareness regarding sustainable packaging solutions.

Market Share Analysis

The market share distribution of key players in the Plastic Food Preservative Film market is characterized by the dominance of a few major companies. Berry Global Inc. and Amcor plc are leading the market, with significant shares due to their extensive product portfolios and strong distribution networks. These companies are focusing on innovation and sustainability to maintain their competitive edge. Sealed Air Corporation and Coveris Holdings S.A. are also prominent players, known for their innovative packaging solutions and commitment to sustainability. The market share distribution affects pricing, innovation, and partnerships, as companies strive to differentiate themselves and capture a larger share of the market. The increasing demand for sustainable packaging solutions is driving companies to invest in research and development to create eco-friendly alternatives, thereby influencing market dynamics.

Plastic Food Preservative Film Market Segments

The Plastic Food Preservative Film market has been segmented on the basis of

Material Type

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

Application

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Dairy Products

- Bakery & Confectionery

- Others

End-User

- Household

- Commercial

- Industrial

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers of growth in the Plastic Food Preservative Film market?

What challenges does the market face in terms of sustainability?

How are companies addressing the demand for sustainable packaging solutions?

What role does technology play in the development of preservative films?

Which regions are expected to witness significant growth in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.