- Home

- Packaging Products

- Plastic Granules Market Size, Future Growth and Forecast 2033

Plastic Granules Market Size, Future Growth and Forecast 2033

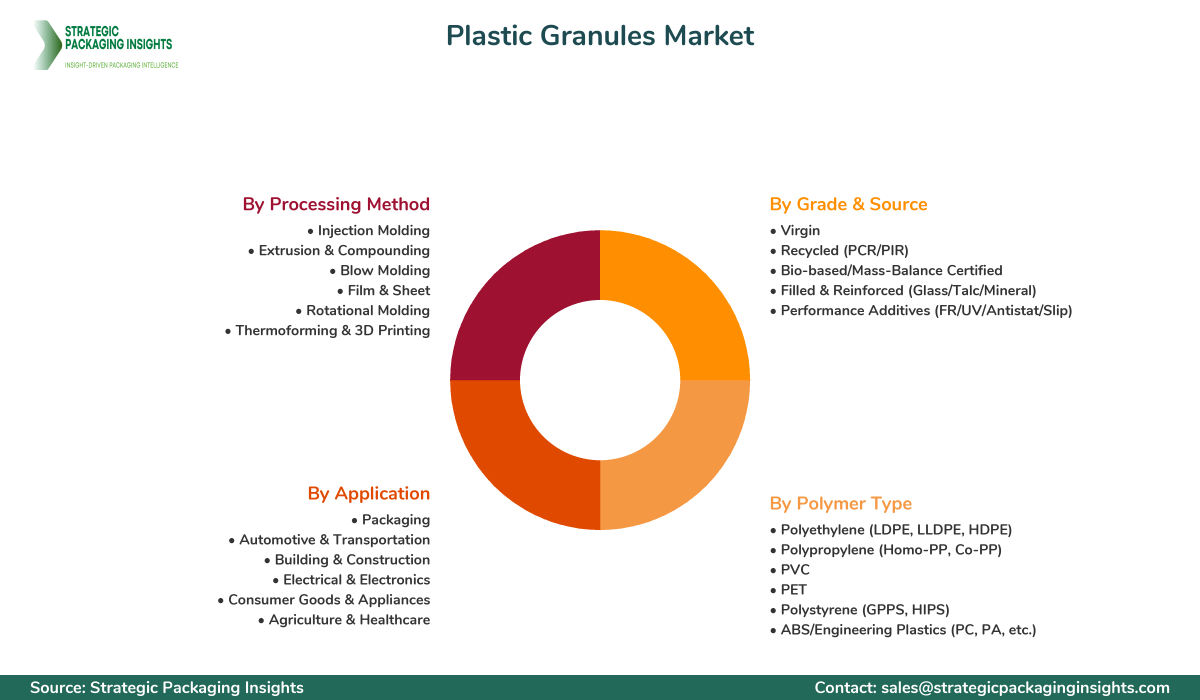

Plastic Granules Market Segments - by Polymer Type (Polyethylene: LDPE, LLDPE, HDPE; Polypropylene: Homo-PP, Co-PP; PVC; PET; Polystyrene: GPPS, HIPS; ABS; Polycarbonate; Polyamide; Engineering Plastics; Others), Application (Packaging, Automotive & Transportation, Building & Construction, Electrical & Electronics, Consumer Goods & Appliances, Agriculture, Healthcare & Medical, Others), Processing Method (Injection Molding, Extrusion & Compounding, Blow Molding, Film & Sheet, Rotational Molding, Thermoforming, Additive Manufacturing/3D Printing), Grade & Source (Virgin, Recycled: PCR/PIR, Bio-based/Bioplastics, Filled & Reinforced: Glass/Talc/Mineral; Performance Additives: FR/UV/Antistat/Slip) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Plastic Granules Market Outlook

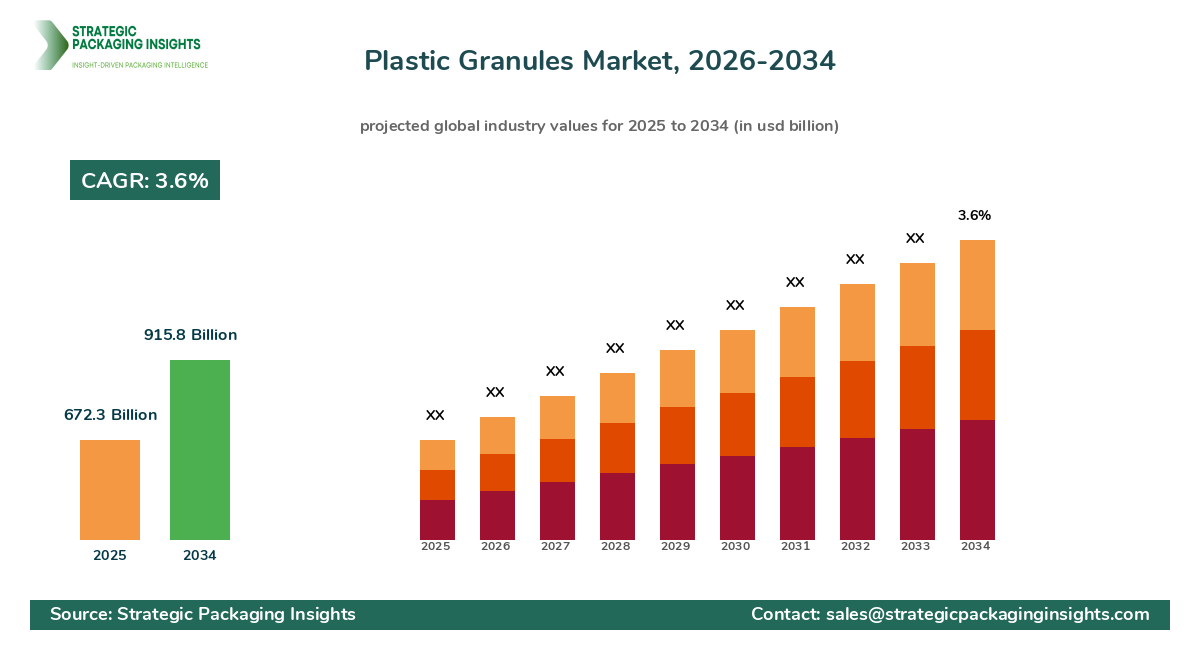

The plastic granules market was valued at $672.3 billion in 2024 and is projected to reach $915.8 billion by 2033, growing at a CAGR of 3.6% during the forecast period 2025–2033. Demand tracks the global consumption of thermoplastic resins supplied as pellets, which feed high-speed conversion routes in packaging, automotive, construction, electricals, and consumer goods. Packaging remains the largest outlet as converters scale film, sheet, and rigid formats for e-commerce, FMCG, and cold-chain, with high-throughput extrusion and injection molding relying on consistent melt flow, narrow moisture windows, and stable additive packages. Automotive and transportation continue to substitute metals with PP, ABS, PA, PC, and composite-filled systems to hit lightweighting and NVH targets, while construction absorbs PE, PVC, and engineered resins for pipes, geomembranes, profiles, and insulation. Rising device density and EV transitions keep engineering plastics in focus for connectors, battery modules, wire insulation, and thermal management. Suppliers are balancing cost, performance, and sustainability by expanding recycled PCR/PIR streams, bio-based options, and mono-material solutions designed for easier recovery, while keeping tight control of rheology, contamination, and odor—factors that directly affect line speed, part aesthetics, and mechanical properties.

Input cost volatility moderated from pandemic extremes, but value chains still face sensitivity to crude, NGLs, and aromatics, as well as regional energy price swings that influence cracking economics and polymer price spreads. Producers with integrated feedstocks, multi-site redundancy, and deep compounding know-how have more room to manage shocks and secure continuity for qualified programs in automotive and healthcare. Regulatory pressure is intensifying around EPR, recycled content mandates, microplastics, and product carbon footprints, creating design constraints and documentation requirements that ripple back to pellet suppliers. The best-positioned players are scaling advanced sorting, decontamination, and solid-state polymerization for high-quality rPET, raising filtration standards for rPO, and ramping bio-attributed mass-balance approaches to present credible decarbonization options. On the demand side, brand owners upgrade specifications for odor, color stability, and stress-crack resistance to support downgauging and circularity without sacrificing shelf impact or operating safety. These shifts reward producers that deliver tight lot-to-lot consistency, robust CoA/CoC packages, and responsive technical support at the press and extruder.

Report Scope

| Attributes | Details |

| Report Title | Plastic Granules Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 191 |

| Polymer Type | Polyethylene (LDPE, LLDPE, HDPE), Polypropylene (Homo-PP, Co-PP), PVC, PET, Polystyrene (GPPS, HIPS), ABS/Engineering Plastics (PC, PA, etc.) |

| Application | Packaging, Automotive & Transportation, Building & Construction, Electrical & Electronics, Consumer Goods & Appliances, Agriculture & Healthcare |

| Processing Method | Injection Molding, Extrusion & Compounding, Blow Molding, Film & Sheet, Rotational Molding, Thermoforming & 3D Printing |

| Grade & Source | Virgin, Recycled (PCR/PIR), Bio-based/Mass-Balance Certified, Filled & Reinforced (Glass/Talc/Mineral), Performance Additives (FR/UV/Antistat/Slip) |

| Customization Available | Yes* |

Opportunities & Threats

Opportunity expands first in packaging, where converters ask for granules that run faster, print cleaner, and seal reliably across wider temperature windows while accommodating recycled content without haze, gels, or neck-in instability. PE and PP grades tuned for cast and blown film, coextrusion, and high-clarity applications enable downgauging and mono-material structures that align with recycling streams, especially for Stand-up Pouches, stretch/shrink film, and closure systems. rPET momentum accelerates in beverages and personal care as brand owners validate food-contact compliance via advanced decontamination and FDA/EFSA approvals. Automotive offers a multi-year runway for PP compounds, PC/ABS, and PA systems in interiors, under-the-hood, and EV-battery componentry, where dimensional stability and flame-retardant performance are mission-critical. Construction keeps PE pressure pipe, PVC profiles, and insulation on a steady course, with energy codes and infrastructure programs supporting volumes. Specialty pockets such as medical disposables, diagnostic consumables, and wearables favor high-purity, gamma-stable, and low-bloom formulations that prove consistent in sterilization and molding cycles.

Second, circularity and low-carbon transitions open high-value niches for recycled, bio-based, and mass-balance certified pellets. Mechanical recycling upgrades—hot-wash, improved optical sorting, deodorization, high-MFI control, and fine filtration—raise rPO quality suitable for films and injection parts beyond non-critical applications. Chemical recycling and solvent purification, while not yet universal, create pathways to near-virgin rMonomers feeding PET, PS, and polyolefin value chains with lower impurity profiles. Bio-based PE, PET, and drop-in monomers increase brand flexibility to meet Scope 3 and PCR targets where collection is immature. Additive packages that stabilize recycled blends against thermal history and color drift help converters protect uptime, while digital passports and traceability tools embedded at resin shipment level give procurement and auditors verifiable recycled content and PCF data. Producers that combine reliable supply of circular grades with field-level processing support will capture premium pricing and long-term offtake contracts.

Restraints are real and differ by region. Feedstock costs can swing quickly, tightening margins for commodity grades where price-based bidding dominates and inventory revaluation hits earnings. Infrastructure for collection, sorting, and recycling is uneven, limiting consistent supply of high-quality PCR, especially food-grade rPET and odor-free rPO for films and caps. Policy asymmetry—differences in EPR timelines, recycled content mandates, or bans—complicates global SKU harmonization and pushes custom formulations that add cost. Technical hurdles like odor removal, IV preservation for rPET, gel control in thin films, and color management in high-regrind blends raise scrap rates if not engineered carefully. Workforce shortages and learning curves at processors may slow adoption of newer circular grades that require tighter drying, residence-time control, or screw design changes. Lastly, public scrutiny over plastic leakage elevates reputational risk, making robust stewardship, pellet loss prevention, and transparent reporting essential to keep brand programs on track.

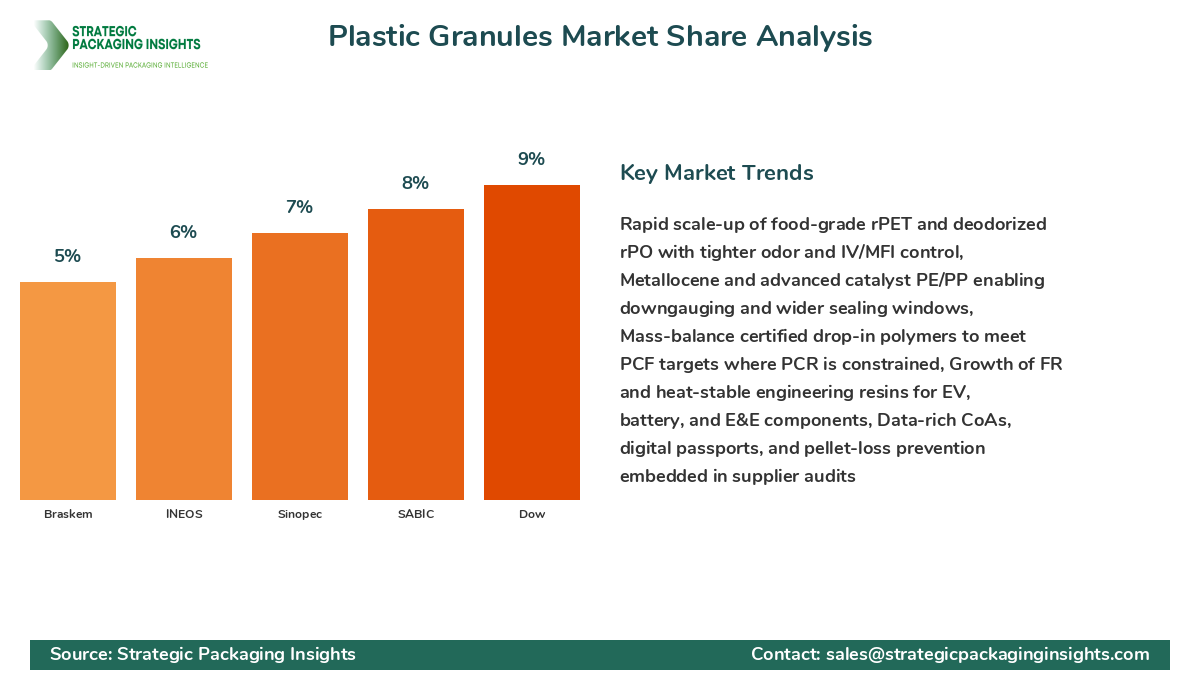

The competitive landscape is anchored by integrated resin majors with global cracker assets and regional champions with strong compounding and application engineering. In 2024, the top dozen suppliers controlled roughly 58–62% of global revenue, reflecting economies of scale in feedstocks, polymerization, logistics, and technical service. LyondellBasell held about 7.8% on the strength of global PE/PP portfolios and licensing reach. Dow maintained roughly 7.5% leveraging advantaged feedstocks, high-performance PE families, and customer intimacy in packaging. ExxonMobil Chemical stood near 7.2% with premium polyolefins for film, hygiene, and molded parts. SABIC captured around 6.9% supported by Middle East integration and expanding specialty platforms. Sinopec recorded approximately 6.3%, backed by extensive capacity and domestic penetration in China. INEOS posted near 5.4% across PE, PP, and styrenics, while Formosa Plastics and Braskem held about 4.1% and 4.5% respectively. Borealis contributed roughly 3.2% with differentiated PP and energy applications, Reliance Industries about 3.6% through India-centric integration, Chevron Phillips Chemical approximately 3.1%, and LG Chem close to 2.9%. A long tail of regional producers and compounders fills specialized niches and price-sensitive demand, particularly in Southeast Asia, India, Africa, and Latin America.

Competition increasingly hinges on differentiated grades, circular offerings, and sharp execution in technical service. Leaders fund pilot lines and customer experience centers to co-develop film structures, mold flow solutions, and additive packages that stabilize recycled blends. Licensing of catalyst systems and process technologies amplifies reach and supports regional joint ventures that secure feedstocks and market access. Supply assurance, product stewardship, and ESG disclosures weigh heavily in qualification for global CPGs and automotive OEMs, where revalidation costs deter frequent supplier switching. While commodity cycles still drive pricing, conversion to higher-value applications—high-clarity LLDPE, metallocene PE, reactor TPOs, FR PC/ABS, transparent impact PP—protects margins and raises stickiness.

Major company dynamics reflect strategic bets. Dow and ExxonMobil push performance polyolefins with metallocene and advanced catalysts tailored for thinner films, lower sealing temperatures, and better optics. LyondellBasell leans into PP leadership and technology licensing while moving on circularity with mechanical and chemical recycling projects. SABIC and Sinopec scale integration and circular initiatives to satisfy local policy goals and multinational brand demands. INEOS and Borealis invest in cracker flexibility, blue hydrogen, and waste-to-chemistry pathways to de-risk carbon exposure. Braskem expands bio-based PE and strengthens Americas distribution, while Reliance deepens India’s polymer value chain with world-scale capacity and downstream compounding. Formosa grows in PVC and polyolefins with a cost-integration edge, and LG Chem broadens engineering plastics and battery materials to catch EV tailwinds.

From a customer lens, procurement teams reward suppliers that combine consistent rheology with global logistics and fast troubleshooting. Field engineers who optimize die design, cooling, and drying for new resin grades help converters unlock speed and scrap reduction. As recycled content targets climb, suppliers ready with odor mitigation, IV control, and white masterbatch compatibility gain repeat business. The net effect is a gradual shift of share toward producers who deliver a credible decarbonization roadmap without trading away mechanical performance, processability, or aesthetics—a balance that separates premium partners from commodity-only vendors.

Company snapshots: Dow integrates advantaged feedstocks and metallocene expertise to deliver high-performance PE that unlocks downgauging in flexible packaging, supported by industry-leading application labs and circularity programs. LyondellBasell blends PP leadership with global licensing and a maturing circular portfolio, positioning well in both automotive compounds and consumer packaging. ExxonMobil Chemical excels in hygiene, stretch, and food packaging with clarity, toughness, and sealing performance that protect line speeds. SABIC’s geographic reach and specialty breadth cover engineering polymers for E&E and healthcare while pushing Trucircle circular solutions. Sinopec’s scale and distribution power dominate China’s polymer flows, with growing export capabilities. INEOS leverages European assets and partnerships to expand circular and low-carbon pathways, while Borealis advances energy and infrastructure PP and PE with strong compounding. Formosa and Reliance emphasize integration and cost discipline, Braskem promotes bio-based and Americas leadership, and LG Chem builds on engineering plastics and battery material synergies.

Key Highlights Plastic Granules Market

- Global plastic granules market reached $672.3 billion in 2024, on track for $915.8 billion by 2033 at a 3.6% CAGR, with packaging as the largest demand center.

- Asia Pacific leads in capacity and consumption, driven by China, India, and Southeast Asia; North America and Europe emphasize high-performance and circular grades.

- Recycled content adoption accelerates, with food-grade rPET and deodorized rPO gaining approvals and stable supply commitments from global brands.

- Performance polyolefins and engineered resins enable downgauging, part consolidation, and lightweighting across film, caps/closures, and automotive interiors.

- Regulatory pressure around EPR, microplastics, and product carbon footprints pushes traceability, mass-balance certification, and solventless/low-odor formulations.

- Technical service and application labs emerge as differentiators, reducing scrap, improving uptime, and enabling faster qualification cycles for converters.

- Digital passports and pellet-loss prevention programs become standard in audits, securing brand compliance and protecting supply contracts.

- Energy and feedstock volatility remain a profitability swing factor; integrated producers with flexible crackers and logistics control show resilience.

Competitive Intelligence

Top players—Dow, LyondellBasell, ExxonMobil Chemical, SABIC, Sinopec, INEOS, Borealis, Formosa Plastics, Braskem, and Reliance Industries—collectively anchor global volume and innovation cadence. Market share momentum favors suppliers pairing performance polyolefins and engineering resins with credible circular paths, such as mechanically recycled rPO with odor control, food-grade rPET with robust IV, and mass-balance certified drop-in PE/PET. Revenue growth trends sit in the low to mid-single digits for commodity portfolios, with double-digit upswings in niches like bio-based PE, high-clarity LLDPE for thin films, FR PC/ABS for E&E, and PP compounds for EV interiors. Geographic reach is truly global for the leaders, each operating multi-continent production and R&D networks; client retention rates are high in auto, healthcare, and regulated packaging due to long validation cycles and tooling investment.

Strategy comparisons reveal nuanced differentiation. Dow and ExxonMobil prioritize metallocene and catalyst innovation for sealability, optics, and toughness, supporting flexible packaging and hygiene. LyondellBasell balances polymer capacity with technology licensing and builds a recycling footprint across Europe and the U.S. SABIC and Sinopec leverage integration and policy alignment to meet national circularity goals and multinational brand specs, including food-contact approvals. INEOS and Borealis pursue low-carbon feedstocks, cracker efficiency, and chemical recycling partnerships to reduce PCF and deliver consistent quality. Formosa and Reliance focus on scale economics and regional service density, while Braskem pushes I’m green bio-based PE and expands recycling investments in the Americas.

Strengths across the top 10 include feedstock integration, broad grade libraries, technical centers, and strong compliance infrastructures (ISO 9001/14001/45001). Weaknesses cluster around exposure to commodity cycles, energy cost volatility in Europe, and limited availability of high-quality PCR streams in emerging markets. Winners are gaining ground by locking multi-year offtakes for PCR, investing in deodorization and advanced filtration for rPO, upgrading SSP for rPET, and publishing LCAs and product carbon footprints that pass customer audits. Those losing ground tend to lag on circular grade availability, face service gaps in fast-growing APAC corridors, or struggle with consistency in high-MFI grades used for thin films and high-cavitation molding.

Who is gaining or losing? Gains are visible for LyondellBasell, Dow, SABIC, and Braskem where circular portfolios and application support align with brand-owner scorecards. Borealis and INEOS capture share in Europe with infrastructure and energy applications supported by circular PP/PE and lower-emission pathways. Slippage shows up among fragmented regional producers in commodity PP/PE who cannot guarantee recycled content quality, odor, or documentation at scale, leading converters to consolidate sourcing with top-tier suppliers.

Regional Market Intelligence of Plastic Granules

North America generated about $149.3 billion in 2024 and is expected to reach $187.9 billion by 2033. Growth centers on advantaged feedstocks, high-performance polyolefins for flexible packaging, and a steady automotive base transitioning to EV platforms. Brand owners prioritize circular grades with robust odor and color control, while infrastructure and building products support demand for PE pressure pipe, PVC, and insulation. Converters invest in automation, faster mold changes, and real-time quality analytics, reinforcing a preference for tight-spec granules that protect uptime and reduce purges. Regulatory momentum on recycled content in packaging nudges demand for rPET and rPO with reliable CoAs and chain-of-custody documentation.

Europe accounted for roughly $160.9 billion in 2024 and is forecast to reach $197.1 billion by 2033. The region places strong emphasis on EPR, eco-design, and PCF reduction, accelerating the use of PCR, mass-balance certified materials, and mono-material structures for easier recycling. Energy price volatility drives efficiency investments and a tilt to higher-value grades to protect margins. Automotive and E&E specifications are exacting, and long qualification cycles advantage suppliers with best-in-class technical documentation and stewardship programs. Food-contact rPET and low-odor rPO are bright spots, while chemical recycling partnerships multiply to address feedstock constraints for circular polymers.

Asia Pacific led the market with approximately $296.0 billion in 2024 and will likely reach $438.5 billion by 2033. Scale, deep manufacturing ecosystems, and expanding middle-class consumption power growth across packaging, appliances, and mobility. China remains the volume anchor across PE/PP/PVC, while India and ASEAN post the fastest growth on the back of e-commerce logistics and infrastructure buildouts. Investments in high-clarity LLDPE, metallocene platforms, and rPET capacity accelerate, with governments promoting waste management and recycled content use. Multinational and regional players expand compounding, color masterbatch, and application centers to serve diverse converters and shorten development cycles.

Latin America reached around $37.8 billion in 2024 and is projected to hit $51.3 billion by 2033. Brazil and Mexico fuel demand for consumer goods, packaging, and automotive parts, and export-oriented agriculture drives film and rigid packaging needs. Currency swings and import dependencies for specialties can introduce volatility, but regional giants invest in bio-based and recycled initiatives, while distributors scale inventories and technical teams to support smaller processors. Policy measures for waste collection and PCR uptake are uneven but improving, boosting interest in deodorized rPO and food-grade rPET for beverages and personal care.

Middle East & Africa recorded about $28.3 billion in 2024 and should advance to $41.0 billion by 2033. New cracker and polymer capacity underpins exports and feeds local conversion clusters serving packaging, building, and consumer durables. Governments are rolling out anti-littering laws, collection pilots, and recycling infrastructure, stirring early-stage demand for PCR and mass-balance offerings. Construction programs and a growing retail base lift polyethylene and PVC, while regional converters seek stable quality to reduce scrap on legacy equipment. Logistics corridors and free zones help distributors improve service levels and shorten lead times.

Top Countries Insights in Plastic Granules

China: Market size stood at $163.0 billion in 2024 with a CAGR of 4% through 2033. Dominant PE/PP/PVC capacity, high internal consumption, and policy support for circular economy initiatives shape supply and demand. Upgrades in rPET and rPO quality target food contact and film markets, while EV growth pulls engineering resins for connectors, housings, and battery components. Challenges include local price competition, variable recycling quality, and stricter export compliance for regulated applications.

United States: Reached approximately $110.5 billion in 2024 with a CAGR of 2%. Advantaged feedstocks and high-performance polyolefin platforms support flexible packaging, hygiene, and caps/closures. Automotive and building products provide steady base load, and brand commitments to PCR elevate demand for deodorized rPO and food-grade rPET. Headwinds revolve around economic cycles and the pace of recycled content mandates at state versus federal levels.

India: Valued near $45.2 billion in 2024 with a CAGR of 6%. E-Commerce Packaging, infrastructure, and consumer durables fuel rapid growth across PE and PP. Government incentives for manufacturing and waste management reform expand the recycling base, although quality consistency and collection logistics remain developmental challenges. International brands’ localization drives demand for certified PCR and mass-balance materials with predictable processing profiles.

Germany: Estimated at $34.6 billion in 2024 with a CAGR of 2%. Precision manufacturing, automotive engineering, and machinery-intensive converters prioritize tight-spec pellets, clean compounding, and circular solutions aligned with EU policy. rPET, rPP compounds, and engineered resins with low VOCs and heat resistance gain traction. Energy costs and regulatory documentation workloads require efficiency and robust stewardship from suppliers.

Japan: Around $30.1 billion in 2024 with a CAGR of 1%. High standards in E&E, automotive, and packaging emphasize consistent rheology, purity, and low odor. Aging demographics elevate automation and demand for stable-running grades that reduce changeovers. Circularity initiatives are growing, with careful attention to quality and traceability in PCR streams for premium applications.

Plastic Granules Market Segments Insights

Polymer Type Analysis

Polymer selection dictates processing windows, mechanical performance, aesthetics, and recyclability, so procurement teams evaluate granules through a multi-criteria lens. Polyethylene (LDPE/LLDPE/HDPE) drives flexible packaging, caps, closures, pipes, and blow-molded containers where sealability, dart impact, ESCR, and clarity matter; metallocene LLDPE unlocks downgauging and broader sealing windows in multilayer films. Polypropylene (homo-PP/co-PP) excels in rigid packaging and automotive interiors, prized for stiffness-to-weight, heat resistance, and hinge properties, with reactor TPOs and mineral-glass filled compounds extending performance. PVC remains vital in construction profiles, pipes, and cable jacketing thanks to flame retardance and cost efficiency, while PET underpins bottles, fibers, and thermoform, with rPET scaling for food-contact under EFSA/FDA approvals. Polystyrene (GPPS/HIPS) continues in foams and appliances; ABS, PC, and PA families serve automotive, E&E, and appliances where impact, heat, and dimensional stability are critical. Engineering plastics and blends fill advanced niches, and additive masterbatches fine-tune UV, slip, antistat, and FR needs without compromising processability.

Innovation centers on enabling circularity while protecting throughput and part quality. Producers advance odor control and filtration in recycled polyolefins, stabilize melt flow for thin films and high-cavitation tools, and strengthen color management for high-PCR blends. In PET, IV retention and decontamination efficiency dictate food-grade acceptance, and SSP lines plus advanced sorting push consistency closer to virgin. For PP, nucleated grades and impact modifiers balance stiffness and toughness in lightweighting programs. Engineering resins adapt to EV and 5G with FR systems that meet stringent flammability and smoke requirements. The winning playbook blends robust grade libraries, credible LCAs/PCFs, and field-level troubleshooting that lowers scrap and changeover time at converters.

Application Analysis

Packaging remains the volume engine, using PE, PP, PET, and PS in films, pouches, rigid containers, closures, and protective wraps. Brand owners pursue mono-material designs for easier recycling, driving demand for high-clarity LLDPE, tough HDPE, and recyclable PP solutions with improved sealing and stiffness. Automotive and transportation consume PP compounds, ABS, PA, and PC/ABS for interiors, exterior trim, under-the-hood parts, and EV battery components, prioritizing weight, noise damping, heat resistance, and flame retardance. Building and construction tap PE and PVC for pipes, geomembranes, profiles, and insulation, with long-life performance and installation efficiency guiding resin choice. Electrical and electronics need engineering resins for connectors, housings, and thermal management, while consumer goods and appliances require color stability, impact performance, and surface quality. Agriculture absorbs film, irrigation pipe, and netting, and healthcare demands clean, sterilization-compatible grades with rigorous documentation.

Shifts in application portfolios align with regulation and consumer behavior. E-commerce pushes stretch and shrink films, cushioning, and protective wraps that must resist puncture and maintain optics after long transits. Food-contact rules and recycled content mandates favor rPET and deodorized rPO with consistent melt flows that run on high-speed lines. EV adoption raises the stakes for dimensional stability and FR compliance in engineering plastics, while construction codes and infrastructure plans underpin PVC and PE pipe. In every segment, processors value pellets that deliver predictable rheology, low volatiles, and additive packages tuned to machine and mold specifics—factors that directly influence uptime, waste, and total cost of ownership.

Processing Method Analysis

Injection molding, extrusion, blow molding, film and sheet, rotational molding, thermoforming, and additive manufacturing each impose distinct demands on granule properties. Injection molding rewards stable melt flow, narrow molecular-weight distribution, and uniform additive dispersion that protect cycle time, dimensional stability, and surface finish in caps, closures, appliance parts, and automotive trim. Extrusion and compounding require consistent viscosity and thermal stability to minimize die build-up and maintain gauge control in pipes, profiles, and compounded pellets. Blow molding needs parison stability and melt strength for container clarity and impact, while film and sheet processes hinge on drawability, sealing windows, optics, and anti-block/slip balances. Rotomolding values ILD consistency and oxidative stability for tanks and large hollow parts, and thermoforming relies on draw uniformity and impact resistance for trays and clamshells. Additive manufacturing is nascent for commodity resins but expanding for engineering plastics and specialty filaments where tight moisture and flow control are essential.

Process optimizations derive from pairing resin and equipment profiles. Metallocene catalysts deliver improved seal initiation for films, while nucleators and impact modifiers fine-tune molding cycles and performance. Recycled content integration demands enhanced drying, filtration, and color management to keep scrap rates low and maintain line speeds. Suppliers that map resin rheology to die geometry, residence time, and cooling systems can unlock material savings through downgauging or part consolidation. Inline analytics, automatic feedback loops, and robust changeover protocols tighten quality windows and boost throughput, turning resin selection into a lever for sustainable cost reduction.

Grade & Source Analysis

Virgin granules remain the backbone of critical applications due to purity, predictable rheology, and broad regulatory clearances. However, recycled streams—PCR and PIR—are climbing as brands lock in content targets and procurement adopts multi-year offtake agreements. Food-grade rPET is the most mature with SSP and decontamination that reach EFSA/FDA thresholds; rPO quality improves via deodorization, high-efficiency filtration, and compatibilizers to stabilize blends. Bio-based and mass-balance certified grades offer drop-in carbon reductions where PCR supply is constrained, and filled/reinforced compounds—glass, talc, mineral—deliver stiffness, heat deflection, and dimensional stability for automotive and appliances. Performance additive packages such as flame retardants, UV stabilizers, anti-block, antistat, and slip align with application demands while aiming to reduce SVHC exposure and VOCs.

Commercial success depends on documentation, consistency, and scale. Buyers ask for chain-of-custody proof, PCF/LCA data, and detailed CoAs covering MFI/IV, density, moisture, ash, and odor benchmarks. Suppliers that can harmonize PCR streams across regions and deliver stable color and rheology win repeat business. Mass-balance certifications (ISCC PLUS, REDcert) ease adoption for drop-in decarbonization. The ability to tailor reinforcement levels and additive packages while maintaining processability makes compounders and integrated majors with compounding assets strategic partners across automotive, E&E, and high-end packaging.

Market Share Analysis

Market share distribution in plastic granules remains top-heavy but fluid. Integrated majors—LyondellBasell, Dow, ExxonMobil Chemical, SABIC, Sinopec, INEOS, Formosa, Braskem, Borealis, Reliance, Chevron Phillips Chemical, and LG Chem—command the bulk of high-volume commodity flows and a wide spectrum of performance grades. Leaders are extending share by securing feedstock flexibility, investing in circular capacity, and offering application support that reduces customer risk and scrap. Mid-tier and regional players gain in localized niches, fast lead times, and cost-sensitive segments but can struggle to match the documentation rigor and consistency required for food-contact packaging, automotive, and healthcare. As recycled content targets rise, players with odor-controlled rPO, food-grade rPET, and mass-balance certified drop-ins hold pricing power and wield influence over converter qualification pipelines, shaping pricing tiers, innovation cadence, and partnership structures across regions.

Plastic Granules Market Segments

The Plastic Granules market has been segmented on the basis of

Polymer Type

- Polyethylene (LDPE, LLDPE, HDPE)

- Polypropylene (Homo-PP, Co-PP)

- PVC

- PET

- Polystyrene (GPPS, HIPS)

- ABS/Engineering Plastics (PC, PA, etc.)

Application

- Packaging

- Automotive & Transportation

- Building & Construction

- Electrical & Electronics

- Consumer Goods & Appliances

- Agriculture & Healthcare

Processing Method

- Injection Molding

- Extrusion & Compounding

- Blow Molding

- Film & Sheet

- Rotational Molding

- Thermoforming & 3D Printing

Grade & Source

- Virgin

- Recycled (PCR/PIR)

- Bio-based/Mass-Balance Certified

- Filled & Reinforced (Glass/Talc/Mineral)

- Performance Additives (FR/UV/Antistat/Slip)

Primary Interview Insights

Which applications are absorbing the most incremental volume in the next 24 months?

What is the biggest technical barrier to higher recycled content in films?

How are buyers evaluating circular materials?

Where are you seeing the strongest price resilience?

What processing changes are common when moving to PCR blends?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.