- Home

- Packaging Products

- Print & Apply Labeling And Labeling Equipment Market Size, Future Growth and Forecast 2033

Print & Apply Labeling And Labeling Equipment Market Size, Future Growth and Forecast 2033

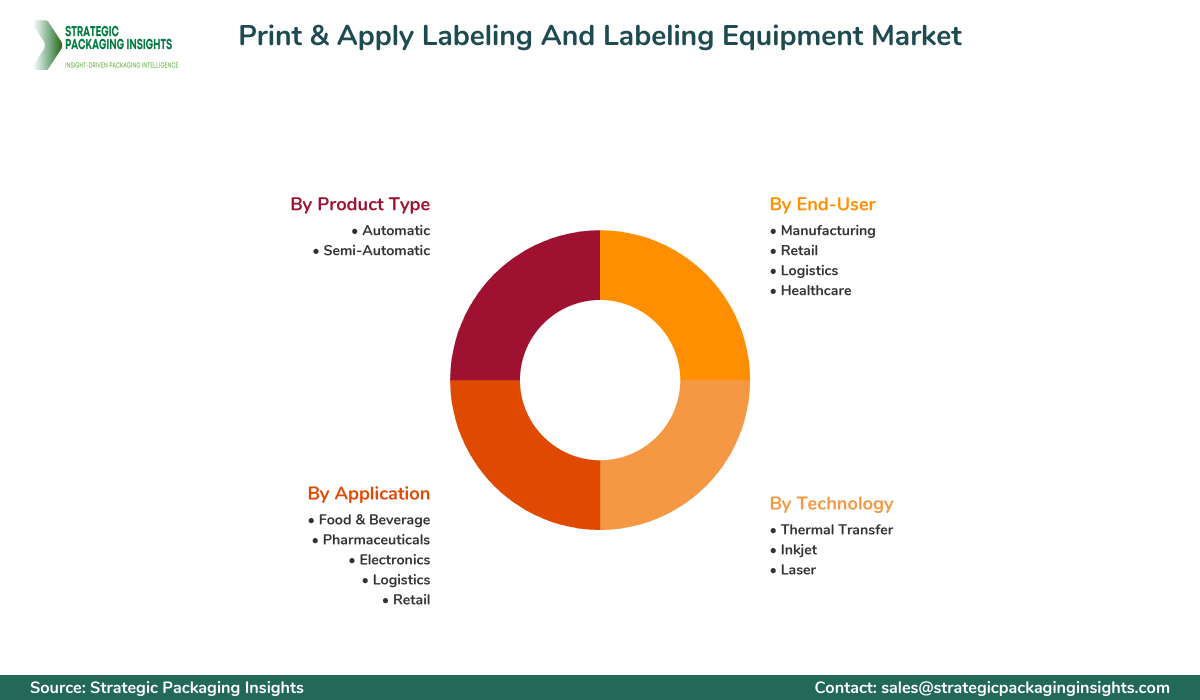

Print & Apply Labeling And Labeling Equipment Market Segments - by Technology (Thermal Transfer, Inkjet, Laser), Application (Food & Beverage, Pharmaceuticals, Electronics, Logistics, Retail), Product Type (Automatic, Semi-Automatic), End-User (Manufacturing, Retail, Logistics, Healthcare), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Print & Apply Labeling And Labeling Equipment Market Outlook

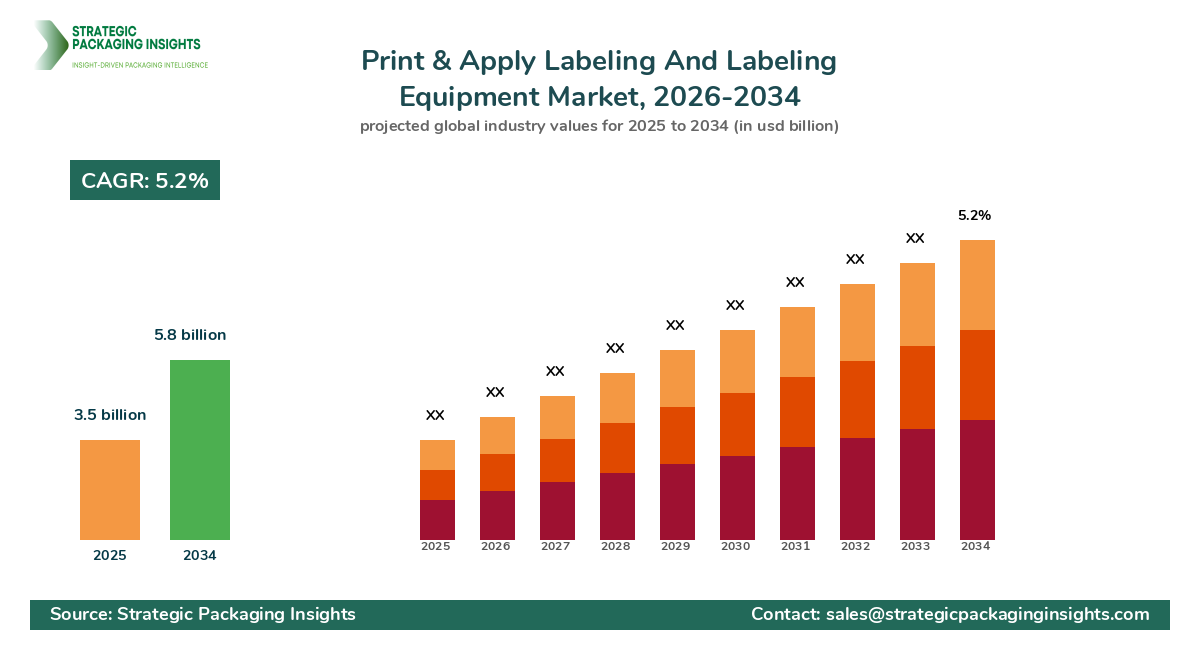

The Print & Apply Labeling and Labeling Equipment market was valued at $3.5 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2025-2033. This market is witnessing significant growth due to the increasing demand for efficient labeling solutions across various industries such as food and beverage, pharmaceuticals, and logistics. The need for accurate and high-speed labeling solutions is driving the adoption of advanced labeling equipment. Additionally, the rise in e-commerce and the need for effective supply chain management are further propelling the market growth. The integration of automation in labeling processes is also a key factor contributing to the market expansion.

Report Scope

| Attributes | Details |

| Report Title | Print & Apply Labeling And Labeling Equipment Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 149 |

| Technology | Thermal Transfer, Inkjet, Laser |

| Application | Food & Beverage, Pharmaceuticals, Electronics, Logistics, Retail |

| Product Type | Automatic, Semi-Automatic |

| End-User | Manufacturing, Retail, Logistics, Healthcare |

| Customization Available | Yes* |

Opportunities & Threats

The Print & Apply Labeling and Labeling Equipment market presents numerous opportunities for growth, primarily driven by technological advancements and the increasing adoption of automation in manufacturing processes. The demand for high-speed and precise labeling solutions is pushing manufacturers to innovate and develop advanced equipment that can cater to the evolving needs of various industries. The growing trend of smart packaging, which involves the use of QR codes and RFID tags, is also creating new avenues for market players to explore. Furthermore, the expansion of the e-commerce sector is leading to an increased demand for efficient labeling solutions to manage the logistics and supply chain operations effectively.

Another significant opportunity lies in the rising demand for sustainable and eco-friendly labeling solutions. With increasing environmental concerns and stringent regulations, companies are focusing on developing labeling equipment that minimizes waste and reduces energy consumption. This shift towards sustainability is encouraging manufacturers to invest in research and development to create innovative solutions that align with the global sustainability goals. Additionally, the growing emphasis on product traceability and authenticity is driving the demand for advanced labeling technologies that can provide detailed product information and enhance consumer trust.

Despite the promising opportunities, the market faces certain challenges that could hinder its growth. One of the primary restrainers is the high initial cost associated with the installation and maintenance of advanced labeling equipment. Small and medium-sized enterprises, in particular, may find it challenging to invest in such technologies due to budget constraints. Moreover, the complexity of integrating new labeling systems with existing production lines can pose a significant challenge for manufacturers. The need for skilled personnel to operate and maintain these advanced systems is another factor that could limit the market growth, especially in regions with a shortage of skilled labor.

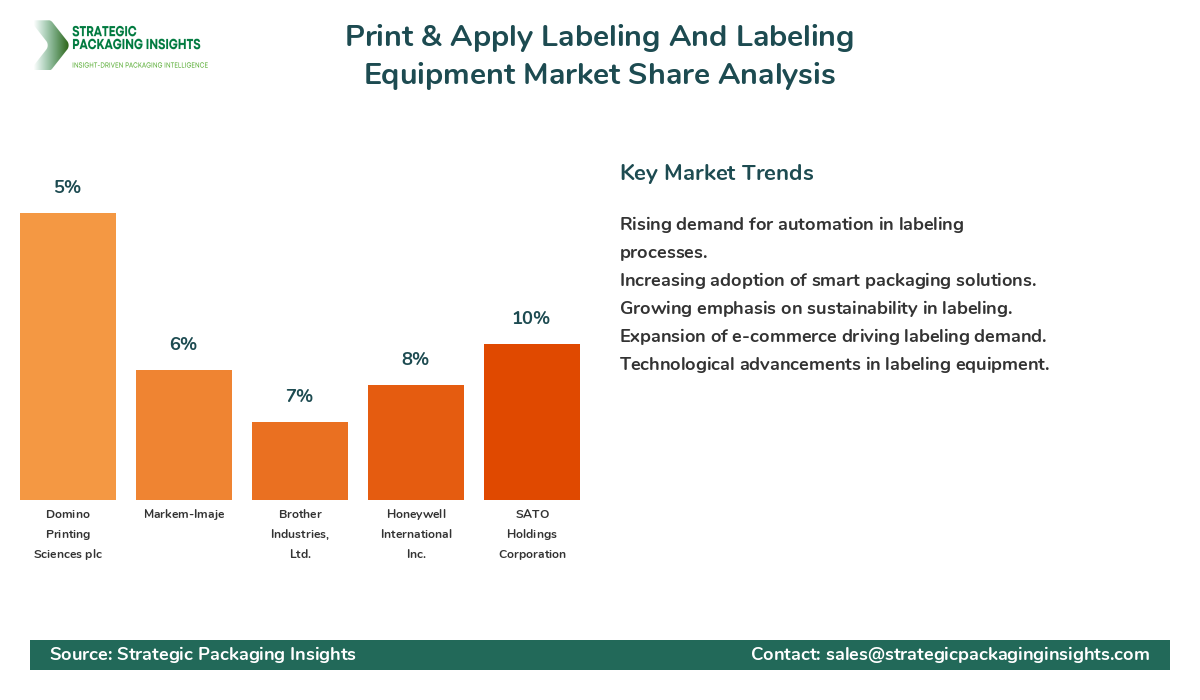

The competitive landscape of the Print & Apply Labeling and Labeling Equipment market is characterized by the presence of several key players who are actively engaged in product innovation and strategic partnerships to strengthen their market position. The market is moderately fragmented, with a mix of global and regional players competing to gain a larger share. Companies are focusing on expanding their product portfolios and enhancing their distribution networks to cater to a wider customer base. The increasing demand for customized labeling solutions is prompting manufacturers to invest in research and development to offer tailored products that meet specific customer requirements.

Major companies in the market include Avery Dennison Corporation, a leader in labeling and packaging materials, known for its innovative solutions and strong global presence. Zebra Technologies Corporation is another key player, renowned for its advanced labeling and printing solutions that cater to various industries. SATO Holdings Corporation, with its extensive product range and focus on sustainability, is also a significant player in the market. Other notable companies include Honeywell International Inc., which offers a wide range of labeling equipment and solutions, and Brother Industries, Ltd., known for its high-quality printing and labeling products.

Avery Dennison Corporation has been at the forefront of the market, leveraging its expertise in materials science to develop innovative labeling solutions that cater to diverse industries. The company's strong focus on sustainability and its commitment to reducing environmental impact have positioned it as a leader in the market. Zebra Technologies Corporation, with its robust product portfolio and emphasis on technological advancements, continues to expand its market presence by offering cutting-edge solutions that enhance operational efficiency and productivity.

SATO Holdings Corporation, a pioneer in the labeling industry, is known for its comprehensive range of products that cater to various applications, including retail, healthcare, and logistics. The company's focus on sustainability and its efforts to develop eco-friendly solutions have earned it a strong reputation in the market. Honeywell International Inc. is another major player, offering a wide array of labeling equipment and solutions that are designed to meet the evolving needs of its customers. The company's commitment to innovation and its strategic partnerships have enabled it to maintain a competitive edge in the market.

Key Highlights Print & Apply Labeling And Labeling Equipment Market

- Increasing demand for automation in labeling processes across various industries.

- Rising adoption of smart packaging solutions, including QR codes and RFID tags.

- Growing emphasis on sustainability and eco-friendly labeling solutions.

- Expansion of the e-commerce sector driving demand for efficient labeling solutions.

- Technological advancements leading to the development of high-speed and precise labeling equipment.

- Increasing focus on product traceability and authenticity enhancing demand for advanced labeling technologies.

- Challenges related to the high initial cost and complexity of integrating new labeling systems.

- Need for skilled personnel to operate and maintain advanced labeling equipment.

- Strategic partnerships and collaborations among key players to strengthen market position.

- Expansion of product portfolios and distribution networks by major companies.

Premium Insights - Key Investment Analysis

The Print & Apply Labeling and Labeling Equipment market is witnessing significant investment activity, driven by the increasing demand for advanced labeling solutions across various industries. Venture capital firms and private equity investors are showing keen interest in this market, recognizing the growth potential and the opportunities for innovation. The focus is primarily on companies that are developing sustainable and eco-friendly labeling solutions, as well as those that are leveraging technology to enhance operational efficiency and productivity.

Investment valuations in the market are on the rise, with companies attracting substantial funding to expand their product offerings and enhance their technological capabilities. The return on investment (ROI) expectations are high, given the growing demand for efficient labeling solutions and the increasing emphasis on sustainability. Emerging investment themes include the development of smart packaging solutions, the integration of automation in labeling processes, and the focus on product traceability and authenticity.

Risk factors in the market include the high initial cost of advanced labeling equipment and the complexity of integrating new systems with existing production lines. However, the strategic rationale behind major deals is centered around the potential for growth and the ability to cater to the evolving needs of various industries. High-potential investment opportunities lie in the development of innovative labeling technologies that align with global sustainability goals and enhance operational efficiency. Sectors attracting the most investor interest include food and beverage, pharmaceuticals, and logistics, where the demand for efficient and precise labeling solutions is particularly high.

Print & Apply Labeling And Labeling Equipment Market Segments Insights

Technology Analysis

The technology segment of the Print & Apply Labeling and Labeling Equipment market is witnessing significant advancements, driven by the need for high-speed and precise labeling solutions. Thermal transfer technology is one of the most widely used methods, known for its durability and ability to produce high-quality Labels. This technology is particularly popular in industries such as food and beverage, pharmaceuticals, and logistics, where the demand for clear and durable labels is high. Inkjet technology is also gaining traction, offering flexibility and the ability to print complex designs and variable data. The growing trend of smart packaging is driving the adoption of laser technology, which provides high-resolution printing and the ability to incorporate QR codes and RFID tags.

Manufacturers are focusing on developing advanced technologies that can cater to the evolving needs of various industries. The integration of automation in labeling processes is a key trend, enabling companies to enhance operational efficiency and reduce labor costs. The demand for eco-friendly labeling solutions is also driving innovation in this segment, with companies investing in research and development to create sustainable technologies that minimize waste and reduce energy consumption. The competitive landscape is characterized by the presence of several key players who are actively engaged in product innovation and strategic partnerships to strengthen their market position.

Application Analysis

The application segment of the Print & Apply Labeling and Labeling Equipment market is diverse, with various industries adopting advanced labeling solutions to enhance their operations. The food and beverage industry is one of the largest consumers of labeling equipment, driven by the need for accurate and high-speed labeling solutions to manage the logistics and supply chain operations effectively. The pharmaceuticals industry is also a significant contributor to the market, with the demand for precise labeling solutions to ensure product traceability and authenticity. The electronics industry is witnessing increasing adoption of labeling equipment, driven by the need for detailed product information and compliance with regulatory requirements.

The logistics and retail sectors are also key applications of labeling equipment, with the growing e-commerce industry driving the demand for efficient labeling solutions. The need for accurate and high-speed labeling solutions is prompting companies to invest in advanced equipment that can cater to the evolving needs of these industries. The competitive landscape is characterized by the presence of several key players who are actively engaged in product innovation and strategic partnerships to strengthen their market position. The demand for customized labeling solutions is prompting manufacturers to invest in research and development to offer tailored products that meet specific customer requirements.

Product Type Analysis

The product type segment of the Print & Apply Labeling and Labeling Equipment market is categorized into automatic and semi-automatic labeling equipment. Automatic labeling equipment is witnessing significant demand, driven by the need for high-speed and precise labeling solutions across various industries. The integration of automation in labeling processes is a key trend, enabling companies to enhance operational efficiency and reduce labor costs. The demand for eco-friendly labeling solutions is also driving innovation in this segment, with companies investing in research and development to create sustainable technologies that minimize waste and reduce energy consumption.

Semi-automatic labeling equipment is also gaining traction, particularly among small and medium-sized enterprises that may not have the budget to invest in fully automated systems. These systems offer flexibility and the ability to handle a wide range of labeling applications, making them an attractive option for companies looking to enhance their operations without incurring significant costs. The competitive landscape is characterized by the presence of several key players who are actively engaged in product innovation and strategic partnerships to strengthen their market position. The demand for customized labeling solutions is prompting manufacturers to invest in research and development to offer tailored products that meet specific customer requirements.

End-User Analysis

The end-user segment of the Print & Apply Labeling and Labeling Equipment market is diverse, with various industries adopting advanced labeling solutions to enhance their operations. The manufacturing industry is one of the largest consumers of labeling equipment, driven by the need for accurate and high-speed labeling solutions to manage the logistics and supply chain operations effectively. The retail industry is also a significant contributor to the market, with the demand for precise labeling solutions to ensure product traceability and authenticity. The logistics industry is witnessing increasing adoption of labeling equipment, driven by the need for detailed product information and compliance with regulatory requirements.

The healthcare industry is also a key end-user of labeling equipment, with the growing emphasis on product traceability and authenticity driving the demand for advanced labeling technologies. The competitive landscape is characterized by the presence of several key players who are actively engaged in product innovation and strategic partnerships to strengthen their market position. The demand for customized labeling solutions is prompting manufacturers to invest in research and development to offer tailored products that meet specific customer requirements. The integration of automation in labeling processes is a key trend, enabling companies to enhance operational efficiency and reduce labor costs.

Market Share Analysis

The market share distribution of key players in the Print & Apply Labeling and Labeling Equipment market is influenced by several factors, including product innovation, strategic partnerships, and the ability to cater to the evolving needs of various industries. Companies that are leading the market are those that have a strong focus on research and development, enabling them to offer advanced and customized labeling solutions. These companies are also expanding their product portfolios and enhancing their distribution networks to cater to a wider customer base. The competitive positioning trends indicate that companies with a strong emphasis on sustainability and eco-friendly solutions are gaining market share, as the demand for sustainable labeling solutions continues to rise.

Top Countries Insights in Print & Apply Labeling And Labeling Equipment

The United States is one of the leading markets for Print & Apply Labeling and Labeling Equipment, with a market size of $1.2 billion and a CAGR of 6%. The growth in this market is driven by the increasing demand for advanced labeling solutions across various industries, including food and beverage, pharmaceuticals, and logistics. The presence of key players and the focus on technological advancements are also contributing to the market growth. The regulatory environment in the United States, which emphasizes product traceability and authenticity, is further driving the demand for advanced labeling technologies.

Germany is another significant market, with a market size of $950 million and a CAGR of 5%. The growth in this market is driven by the strong manufacturing sector and the increasing demand for efficient labeling solutions. The focus on sustainability and the development of eco-friendly labeling technologies are also contributing to the market growth. The presence of key players and the emphasis on research and development are further enhancing the market potential in Germany.

China is witnessing rapid growth in the Print & Apply Labeling and Labeling Equipment market, with a market size of $800 million and a CAGR of 8%. The growth in this market is driven by the expanding manufacturing sector and the increasing demand for advanced labeling solutions. The focus on automation and the integration of smart technologies in labeling processes are also contributing to the market growth. The regulatory environment in China, which emphasizes product safety and compliance, is further driving the demand for advanced labeling technologies.

Japan is another key market, with a market size of $700 million and a CAGR of 4%. The growth in this market is driven by the strong focus on technological advancements and the increasing demand for efficient labeling solutions. The emphasis on sustainability and the development of eco-friendly labeling technologies are also contributing to the market growth. The presence of key players and the focus on research and development are further enhancing the market potential in Japan.

The United Kingdom is also witnessing significant growth in the Print & Apply Labeling and Labeling Equipment market, with a market size of $650 million and a CAGR of 5%. The growth in this market is driven by the increasing demand for advanced labeling solutions across various industries, including food and beverage, pharmaceuticals, and logistics. The focus on sustainability and the development of eco-friendly labeling technologies are also contributing to the market growth. The presence of key players and the emphasis on research and development are further enhancing the market potential in the United Kingdom.

Print & Apply Labeling And Labeling Equipment Market Segments

The Print & Apply Labeling And Labeling Equipment market has been segmented on the basis of

Technology

- Thermal Transfer

- Inkjet

- Laser

Application

- Food & Beverage

- Pharmaceuticals

- Electronics

- Logistics

- Retail

Product Type

- Automatic

- Semi-Automatic

End-User

- Manufacturing

- Retail

- Logistics

- Healthcare

Primary Interview Insights

What are the key drivers of growth in the Print & Apply Labeling and Labeling Equipment market?

What challenges does the market face?

Which industries are the largest consumers of labeling equipment?

How is sustainability influencing the market?

What role does technology play in the market?

Latest Reports

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The pallet wrapping packaging market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025–2033.

The stretch film packaging market was valued at $12.5 billion in 2024 and is projected to reach $20.3 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.