- Home

- Eco-Friendly Packaging

- Probiotics Packaging Market Size, Future Growth and Forecast 2033

Probiotics Packaging Market Size, Future Growth and Forecast 2033

Probiotics Packaging Market Segments - by Material (Plastic, Glass, Metal, Paperboard), Application (Food & Beverages, Pharmaceuticals, Dietary Supplements, Animal Feed), Packaging Type (Bottles, Blisters, Sachets, Jars), and End-User (Manufacturers, Retailers, Consumers) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Probiotics Packaging Market Outlook

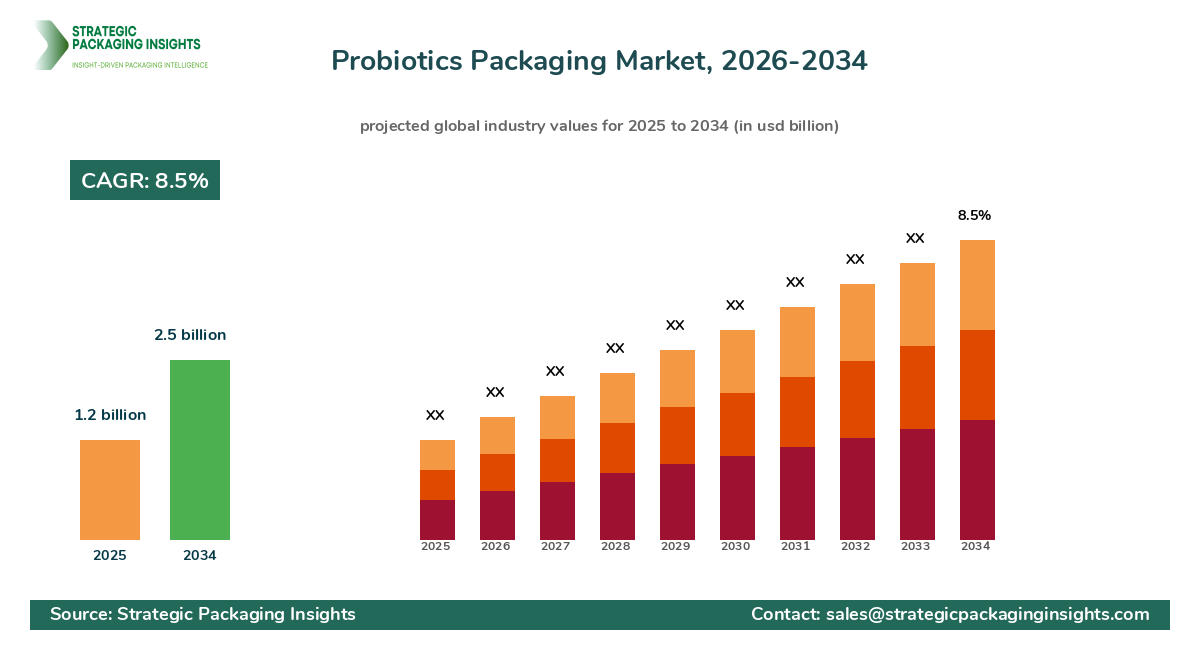

The probiotics packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033. This market is driven by the increasing consumer awareness about gut health and the rising demand for probiotics in various forms such as supplements, food, and beverages. The packaging industry is adapting to these trends by developing innovative and Sustainable Packaging solutions that preserve the efficacy of probiotics while meeting consumer preferences for convenience and eco-friendliness. The growth is further supported by advancements in packaging technologies that enhance the shelf life and stability of probiotic products.

However, the market faces challenges such as stringent regulatory requirements and the high cost of Advanced Packaging materials. Regulatory bodies across different regions have set specific guidelines for the packaging of probiotics to ensure product safety and efficacy, which can increase compliance costs for manufacturers. Despite these challenges, the market holds significant growth potential due to the increasing adoption of probiotics in emerging markets and the development of new probiotic strains that require specialized packaging solutions. The focus on sustainability and the use of biodegradable materials in packaging are also expected to create new opportunities for market players.

Report Scope

| Attributes | Details |

| Report Title | Probiotics Packaging Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 151 |

| Material | Plastic, Glass, Metal, Paperboard |

| Application | Food & Beverages, Pharmaceuticals, Dietary Supplements, Animal Feed |

| Packaging Type | Bottles, Blisters, Sachets, Jars |

| End-User | Manufacturers, Retailers, Consumers |

| Customization Available | Yes* |

Opportunities & Threats

The probiotics packaging market presents numerous opportunities driven by the growing consumer demand for health and wellness products. As consumers become more health-conscious, there is an increasing preference for products that support gut health, leading to a surge in demand for probiotics. This trend is particularly strong in developed regions where consumers are willing to pay a premium for high-quality, effective probiotic products. Packaging companies can capitalize on this trend by offering innovative solutions that enhance the appeal and functionality of probiotic products, such as easy-to-use packaging formats and designs that improve product visibility on retail shelves.

Another significant opportunity lies in the development of sustainable packaging solutions. With the global push towards reducing plastic waste and the environmental impact of packaging, there is a growing demand for eco-friendly packaging materials. Companies that invest in research and development to create biodegradable and recyclable packaging options are likely to gain a competitive edge in the market. Additionally, the use of smart packaging technologies that provide real-time information about product freshness and quality can further enhance consumer trust and drive market growth.

Despite these opportunities, the market faces certain threats that could hinder its growth. One of the primary challenges is the stringent regulatory environment governing the packaging of probiotics. Different regions have varying regulations regarding the labeling, safety, and efficacy of probiotic products, which can complicate the packaging process and increase costs for manufacturers. Additionally, the high cost of Advanced Packaging Materials and technologies can be a barrier for small and medium-sized enterprises looking to enter the market. Companies must navigate these challenges by staying informed about regulatory changes and investing in cost-effective packaging solutions.

The probiotics packaging market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a mix of large multinational corporations and smaller regional players, each offering a range of packaging solutions tailored to the needs of probiotic manufacturers. The competitive environment is driven by factors such as product innovation, sustainability initiatives, and strategic partnerships with probiotic producers.

Among the leading companies in the market, Amcor Limited holds a significant share due to its extensive portfolio of packaging solutions and strong focus on sustainability. The company has invested heavily in developing eco-friendly packaging materials that meet the growing demand for sustainable solutions. Another major player, Berry Global Inc., is known for its innovative packaging designs and commitment to reducing environmental impact through the use of recycled materials.

Sealed Air Corporation is also a prominent player in the probiotics packaging market, offering advanced packaging technologies that enhance product protection and shelf life. The company's focus on research and development has enabled it to introduce cutting-edge solutions that cater to the specific needs of probiotic manufacturers. Similarly, Mondi Group has established itself as a key player by providing Flexible Packaging solutions that offer convenience and functionality to consumers.

Other notable companies in the market include Sonoco Products Company, which offers a range of packaging solutions designed to preserve the integrity of probiotic products, and Huhtamaki Oyj, known for its sustainable packaging initiatives. These companies, along with others such as Smurfit Kappa Group, DS Smith Plc, and WestRock Company, contribute to the dynamic and competitive nature of the probiotics packaging market.

Key Highlights Probiotics Packaging Market

- Increasing consumer demand for health and wellness products is driving market growth.

- Advancements in packaging technologies are enhancing the shelf life of probiotic products.

- Sustainable packaging solutions are gaining traction among consumers and manufacturers.

- Regulatory requirements pose challenges but also ensure product safety and efficacy.

- Emerging markets offer significant growth potential for probiotics packaging.

- Smart packaging technologies are enhancing consumer trust and product appeal.

- Strategic partnerships between packaging companies and probiotic manufacturers are on the rise.

- High cost of advanced packaging materials remains a barrier for some market players.

- Innovation in packaging design is crucial for product differentiation and market success.

Top Countries Insights in Probiotics Packaging

The United States is a leading market for probiotics packaging, with a market size of $400 million and a CAGR of 10%. The country's growth is driven by high consumer awareness of probiotics and a strong demand for health and wellness products. The regulatory environment in the U.S. also supports the development of innovative packaging solutions that meet safety and efficacy standards.

In Europe, Germany is a key market with a market size of $300 million and a CAGR of 8%. The country's focus on sustainability and eco-friendly packaging solutions is a major growth driver. German consumers are increasingly seeking products with minimal environmental impact, prompting packaging companies to develop biodegradable and recyclable options.

China represents a rapidly growing market for probiotics packaging, with a market size of $250 million and a CAGR of 12%. The increasing adoption of probiotics in the country, driven by rising health awareness and disposable incomes, is fueling demand for advanced packaging solutions that ensure product stability and shelf life.

Japan, with a market size of $200 million and a CAGR of 7%, is another significant market for probiotics packaging. The country's aging population and high demand for dietary supplements are key factors driving market growth. Packaging companies are focusing on developing user-friendly and convenient packaging formats to cater to the needs of elderly consumers.

India, with a market size of $150 million and a CAGR of 15%, offers significant growth potential for probiotics packaging. The country's large population and increasing health consciousness are driving demand for probiotics, creating opportunities for packaging companies to introduce innovative and cost-effective solutions.

Value Chain Profitability Analysis

The probiotics packaging market value chain involves several key stakeholders, each contributing to the overall profitability of the industry. The value chain begins with raw material suppliers who provide the necessary materials for packaging production. These suppliers capture a moderate share of the market value, with profit margins typically ranging from 10% to 15%.

Packaging manufacturers are the next link in the value chain, responsible for converting raw materials into finished packaging products. This segment captures a significant share of the market value, with profit margins ranging from 20% to 25%. Manufacturers invest in advanced technologies and sustainable practices to enhance their offerings and meet consumer demands.

Distributors and retailers play a crucial role in the value chain by ensuring the availability of packaged probiotic products to end consumers. This segment captures a smaller share of the market value, with profit margins typically ranging from 5% to 10%. Retailers focus on product placement and marketing strategies to drive sales and increase consumer engagement.

Finally, end-users, including manufacturers, retailers, and consumers, are the ultimate beneficiaries of the probiotics packaging market. The value chain profitability is influenced by factors such as cost structures, pricing models, and the adoption of digital transformation initiatives that enhance efficiency and reduce costs. As the market evolves, stakeholders are increasingly focusing on sustainability and innovation to capture a larger share of the market value.

Evolving Market Dynamics (2018–2024) and Strategic Foresight (2025–2033)

The probiotics packaging market has undergone significant changes between 2018 and 2024, driven by evolving consumer preferences and technological advancements. During this period, the market experienced a steady CAGR of 6%, with a focus on developing sustainable packaging solutions and enhancing product shelf life. The demand for probiotics in various applications, such as food and beverages, pharmaceuticals, and dietary supplements, contributed to the market's growth.

Looking ahead to the period from 2025 to 2033, the market is expected to witness a higher CAGR of 8.5%, driven by increased consumer awareness of gut health and the rising adoption of probiotics in emerging markets. The strategic focus will shift towards developing innovative packaging solutions that cater to the specific needs of different probiotic applications. Companies will also prioritize sustainability initiatives and smart packaging technologies to enhance consumer trust and product appeal.

Regional contributions to the market are expected to shift, with Asia Pacific emerging as a key growth region due to the increasing adoption of probiotics and rising disposable incomes. Technological impact factors, such as advancements in packaging materials and digital transformation initiatives, will play a crucial role in shaping the market dynamics. Companies will need to adapt to these changes by investing in research and development and forming strategic partnerships to remain competitive in the evolving market landscape.

Probiotics Packaging Market Segments Insights

Material Analysis

The material segment of the probiotics packaging market is dominated by plastic, which is widely used due to its versatility and cost-effectiveness. Plastic Packaging offers excellent barrier properties, protecting probiotics from moisture, oxygen, and light, which are critical for maintaining product efficacy. However, the environmental impact of plastic has led to increased demand for alternative materials such as glass and metal. Glass packaging is favored for its premium appeal and recyclability, while metal offers durability and protection against external factors. Paperboard is also gaining traction as a sustainable option, with companies investing in biodegradable and compostable solutions to meet consumer preferences for eco-friendly packaging.

The competition within the material segment is intense, with companies focusing on innovation and sustainability to differentiate their offerings. The trend towards reducing plastic waste and the adoption of circular economy principles are driving the development of new materials and packaging designs. Consumer demand for transparency and traceability in the supply chain is also influencing material choices, with companies prioritizing materials that align with their sustainability goals.

Application Analysis

The application segment of the probiotics packaging market is diverse, encompassing food and beverages, pharmaceuticals, dietary supplements, and animal feed. The food and beverages segment is the largest, driven by the increasing consumption of probiotic-rich products such as yogurt, kefir, and fermented drinks. Packaging solutions for this segment focus on convenience, shelf life, and product safety, with companies investing in technologies that enhance the freshness and quality of probiotic products.

In the pharmaceutical segment, the demand for probiotics is growing due to their health benefits and therapeutic applications. Packaging solutions for pharmaceuticals prioritize protection against contamination and degradation, with a focus on compliance with regulatory standards. The dietary supplements segment is also experiencing significant growth, driven by consumer interest in health and wellness. Packaging solutions for supplements emphasize convenience and portability, with innovative designs that cater to on-the-go consumption.

Packaging Type Analysis

The packaging type segment includes bottles, blisters, sachets, and jars, each offering unique benefits for probiotic products. Bottles are the most common packaging type, providing excellent protection and ease of use for consumers. They are widely used for liquid probiotics and supplements, with companies focusing on designs that enhance product appeal and functionality. Blisters are favored for their ability to protect individual doses from moisture and contamination, making them ideal for pharmaceutical applications.

Sachets are gaining popularity due to their convenience and portability, particularly for single-use probiotic products. They offer a cost-effective packaging solution that appeals to consumers seeking on-the-go options. Jars are commonly used for bulk probiotic products, providing durability and protection against external factors. The competition within the packaging type segment is driven by innovation and consumer preferences, with companies investing in designs that enhance user experience and product differentiation.

End-User Analysis

The end-user segment of the probiotics packaging market includes manufacturers, retailers, and consumers, each with distinct needs and preferences. Manufacturers prioritize packaging solutions that enhance product stability and shelf life, with a focus on compliance with regulatory standards. They seek partnerships with packaging companies that offer innovative and cost-effective solutions to meet their specific requirements.

Retailers focus on packaging designs that enhance product visibility and appeal on store shelves, with an emphasis on sustainability and consumer engagement. They are increasingly seeking packaging solutions that align with their brand values and resonate with environmentally conscious consumers. Consumers, on the other hand, prioritize convenience, functionality, and sustainability in packaging, with a growing preference for eco-friendly options that reduce environmental impact.

Probiotics Packaging Market Segments

The Probiotics Packaging market has been segmented on the basis of

Material

- Plastic

- Glass

- Metal

- Paperboard

Application

- Food & Beverages

- Pharmaceuticals

- Dietary Supplements

- Animal Feed

Packaging Type

- Bottles

- Blisters

- Sachets

- Jars

End-User

- Manufacturers

- Retailers

- Consumers

Primary Interview Insights

What are the key drivers of growth in the probiotics packaging market?

What challenges does the probiotics packaging market face?

How is sustainability impacting the probiotics packaging market?

What role does innovation play in the probiotics packaging market?

Which regions offer the most growth potential for probiotics packaging?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.