- Home

- Eco-Friendly Packaging

- Recovered Paper Pulp Market Size, Future Growth and Forecast 2033

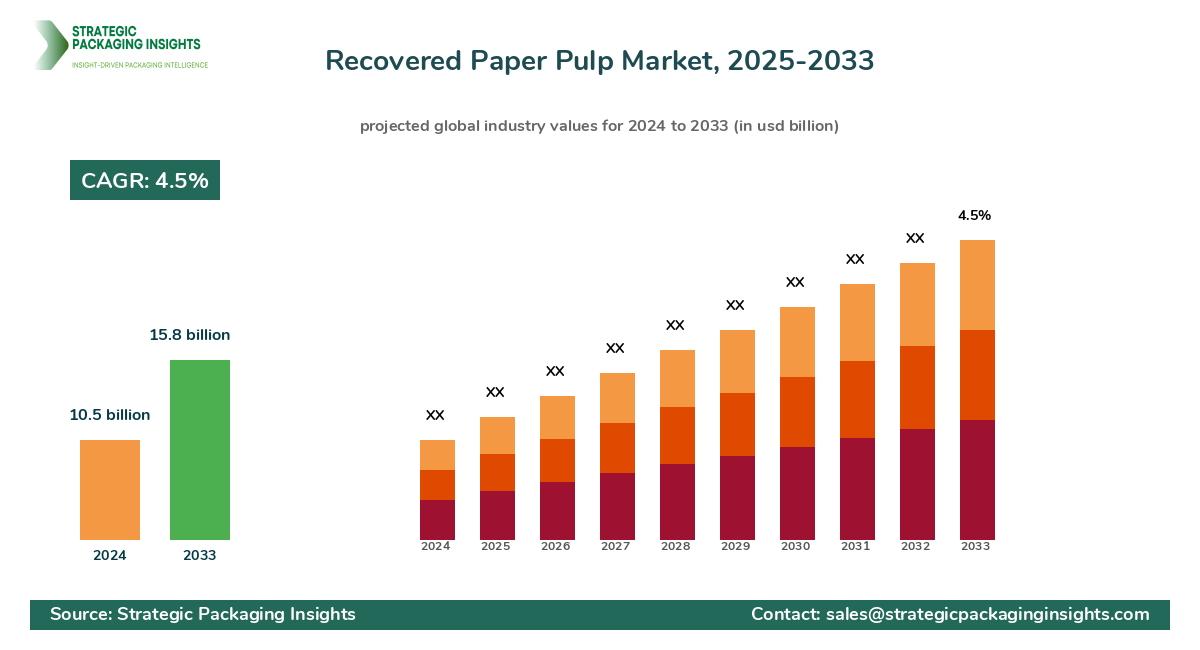

Recovered Paper Pulp Market Size, Future Growth and Forecast 2033

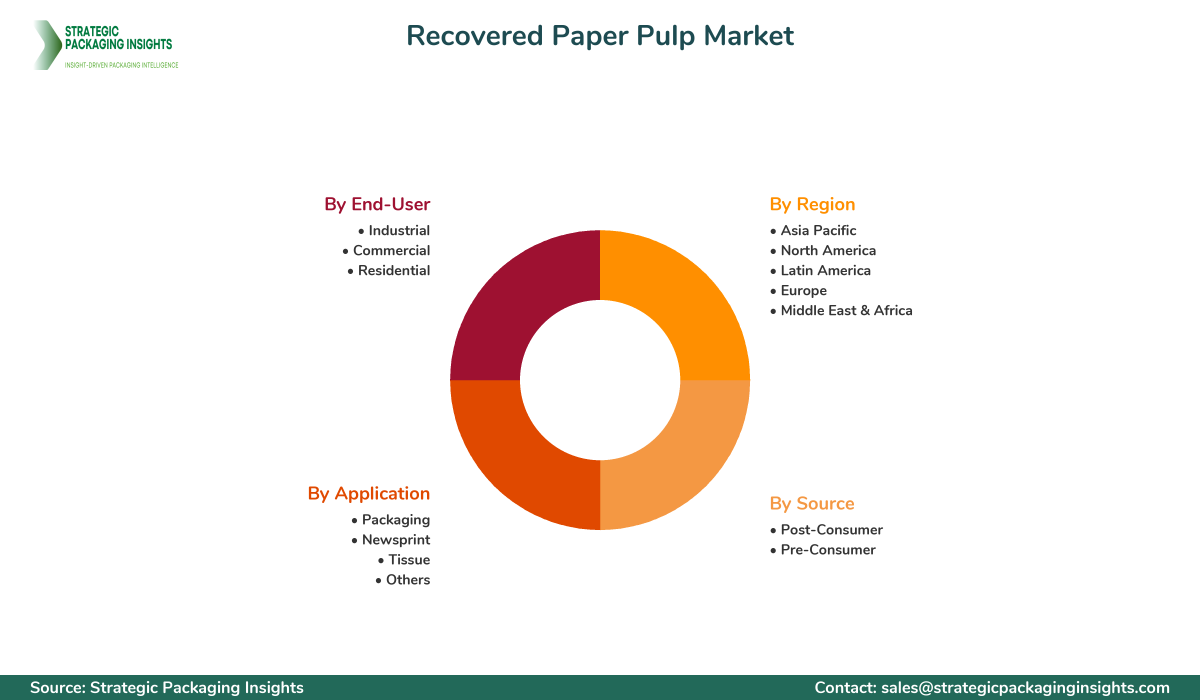

Recovered Paper Pulp Market Segments - by Source (Post-Consumer, Pre-Consumer), Application (Packaging, Newsprint, Tissue, Others), End-User (Industrial, Commercial, Residential), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Recovered Paper Pulp Market Outlook

The recovered paper pulp market was valued at $10.5 billion in 2024 and is projected to reach $15.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025-2033. This market is driven by the increasing demand for sustainable and eco-friendly packaging solutions, as well as the rising awareness of environmental conservation. The shift towards circular economy practices has further propelled the demand for recovered paper pulp, as industries seek to reduce their carbon footprint and enhance resource efficiency. Additionally, the growing e-commerce sector has significantly boosted the demand for packaging materials, thereby driving the market for recovered paper pulp.

Report Scope

| Attributes | Details |

| Report Title | Recovered Paper Pulp Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 160 |

| Source | Post-Consumer, Pre-Consumer |

| Application | Packaging, Newsprint, Tissue, Others |

| End-User | Industrial, Commercial, Residential |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Key Highlights Recovered Paper Pulp Market

- The market is witnessing a significant shift towards post-consumer recovered paper pulp due to stringent environmental regulations.

- Asia-Pacific is the largest market for recovered paper pulp, driven by rapid industrialization and urbanization.

- Technological advancements in recycling processes are enhancing the quality and efficiency of recovered paper pulp production.

- The packaging segment holds the largest share in the application category, driven by the booming e-commerce industry.

- Increasing investments in recycling infrastructure are expected to boost market growth.

- North America is experiencing steady growth due to strong regulatory support for recycling initiatives.

- There is a growing trend towards lightweight and high-strength paper products, driving innovation in the market.

- Collaborations between paper mills and recycling companies are becoming more common to ensure a steady supply of raw materials.

- Government incentives for sustainable practices are encouraging more companies to adopt recovered paper pulp.

- The tissue paper segment is expected to witness significant growth due to rising hygiene awareness.

Competitive Intelligence

The recovered paper pulp market is highly competitive, with key players focusing on expanding their market share through strategic initiatives. International Paper Company, based in the United States, is a leading player with a strong focus on sustainability and innovation. The company has a significant market share due to its extensive product portfolio and global presence. Smurfit Kappa Group, headquartered in Ireland, is another major player known for its innovative packaging solutions and commitment to sustainability. The company has been expanding its operations in emerging markets to capitalize on growth opportunities.

Stora Enso Oyj, a Finnish company, is recognized for its advanced recycling technologies and strong emphasis on R&D. The company has been investing in new facilities to enhance its production capabilities. Nine Dragons Paper Holdings Limited, based in China, is a dominant player in the Asia-Pacific region, leveraging its extensive distribution network and cost-effective production processes. The company is focusing on expanding its product offerings to cater to diverse customer needs.

Other notable players include DS Smith Plc, UPM-Kymmene Corporation, and WestRock Company, each with unique strengths and strategies. DS Smith Plc is known for its innovative packaging designs and strong customer relationships, while UPM-Kymmene Corporation focuses on sustainable forestry practices and efficient resource management. WestRock Company has a robust supply chain and a diverse product portfolio, enabling it to maintain a competitive edge in the market.

Regional Market Intelligence of Recovered Paper Pulp

In North America, the recovered paper pulp market is valued at $2.5 billion and is expected to grow steadily due to strong regulatory support for recycling initiatives and increasing consumer awareness about sustainability. Europe, with a market size of $3 billion, is driven by stringent environmental regulations and a well-established recycling infrastructure. The Asia-Pacific region, the largest market with a value of $4 billion, is experiencing rapid growth due to industrialization, urbanization, and increasing demand for packaging materials.

Latin America, with a market size of $0.8 billion, is witnessing moderate growth, supported by government initiatives to promote recycling and sustainable practices. The Middle East & Africa region, valued at $0.2 billion, is gradually adopting recovered paper pulp due to rising environmental awareness and the need for Sustainable Packaging solutions. Each region presents unique growth opportunities and challenges, influenced by local regulations, consumer preferences, and economic conditions.

Top Countries Insights in Recovered Paper Pulp

In the United States, the recovered paper pulp market is valued at $2 billion, with a CAGR of 3%. The market is driven by strong regulatory support for recycling and increasing demand for sustainable packaging solutions. China, with a market size of $3.5 billion and a CAGR of 5%, is the largest market, driven by rapid industrialization and urbanization. The country is also investing heavily in recycling infrastructure to meet the growing demand.

Germany, with a market size of $1.2 billion and a CAGR of 4%, is a key player in the European market, supported by stringent environmental regulations and a strong focus on sustainability. In Japan, the market is valued at $0.9 billion, with a CAGR of 2%, driven by technological advancements in recycling processes and increasing demand for high-quality paper products. Brazil, with a market size of $0.5 billion and a CAGR of 3%, is experiencing growth due to government initiatives to promote recycling and sustainable practices.

Recovered Paper Pulp Market Segments Insights

Source Analysis

The recovered paper pulp market is segmented by source into post-consumer and pre-consumer categories. The post-consumer segment is gaining traction due to increasing environmental awareness and regulatory pressures to reduce landfill waste. This segment involves the recycling of paper products that have been used by consumers, such as newspapers, magazines, and packaging materials. The growing emphasis on sustainability and circular economy practices is driving the demand for post-consumer recovered paper pulp, as it helps in reducing the carbon footprint and conserving natural resources.

On the other hand, the pre-consumer segment involves the recycling of paper waste generated during the manufacturing process. This includes trimmings, cuttings, and other paper scraps that are collected and recycled before reaching the consumer. The pre-consumer segment is driven by the need to minimize production waste and enhance resource efficiency. Companies are increasingly adopting advanced recycling technologies to improve the quality and yield of pre-consumer recovered paper pulp, thereby boosting its demand in various applications.

Application Analysis

The application segment of the recovered paper pulp market includes packaging, newsprint, tissue, and others. The packaging segment holds the largest share, driven by the booming e-commerce industry and the increasing demand for sustainable packaging solutions. Recovered paper pulp is widely used in the production of Corrugated Boxes, cartons, and other packaging materials due to its cost-effectiveness and eco-friendly nature. The growing trend towards lightweight and high-strength packaging products is further propelling the demand for recovered paper pulp in this segment.

The newsprint segment is experiencing steady growth, supported by the demand for recycled paper in the publishing industry. Despite the digitalization trend, there is still a significant demand for printed newspapers and magazines, particularly in emerging markets. The tissue segment is expected to witness significant growth due to rising hygiene awareness and the increasing demand for tissue paper products. Recovered paper pulp is used in the production of toilet paper, facial tissues, and paper towels, offering a sustainable alternative to virgin pulp.

End-User Analysis

The recovered paper pulp market is segmented by end-user into industrial, commercial, and residential categories. The industrial segment is the largest end-user, driven by the demand for packaging materials in various industries such as food and beverage, electronics, and consumer goods. The increasing focus on sustainability and resource efficiency is encouraging industries to adopt recovered paper pulp for their packaging needs, thereby driving the growth of this segment.

The commercial segment includes businesses such as offices, retail stores, and hospitality establishments that use recovered paper pulp products for various applications. The growing emphasis on corporate social responsibility and sustainable business practices is driving the demand for eco-friendly paper products in the commercial sector. The residential segment is witnessing growth due to the increasing consumer preference for sustainable and recyclable paper products for household use.

Regional Analysis

The regional analysis of the recovered paper pulp market highlights the varying growth patterns and opportunities across different regions. In North America, the market is driven by strong regulatory support for recycling initiatives and increasing consumer awareness about sustainability. Europe is characterized by stringent environmental regulations and a well-established recycling infrastructure, driving the demand for recovered paper pulp.

The Asia-Pacific region is the largest and fastest-growing market, driven by rapid industrialization, urbanization, and increasing demand for packaging materials. Latin America is witnessing moderate growth, supported by government initiatives to promote recycling and sustainable practices. The Middle East & Africa region is gradually adopting recovered paper pulp due to rising environmental awareness and the need for sustainable packaging solutions.

The market share distribution of key players in the recovered paper pulp market is influenced by factors such as product innovation, geographic reach, and strategic partnerships. International Paper Company and Smurfit Kappa Group are among the leading players, with significant market shares due to their extensive product portfolios and global presence. These companies are focusing on expanding their operations in emerging markets to capitalize on growth opportunities.

Stora Enso Oyj and Nine Dragons Paper Holdings Limited are also prominent players, leveraging their advanced recycling technologies and strong distribution networks to maintain a competitive edge. The market share distribution affects pricing strategies, with leading players able to offer competitive prices due to economies of scale. Innovation is a key differentiator, with companies investing in R&D to develop high-quality and Sustainable Paper products. Strategic partnerships and collaborations are also common, enabling companies to enhance their market presence and expand their customer base.

Recovered Paper Pulp Market Segments

The Recovered Paper Pulp market has been segmented on the basis of

Source

- Post-Consumer

- Pre-Consumer

Application

- Packaging

- Newsprint

- Tissue

- Others

End-User

- Industrial

- Commercial

- Residential

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What are the main drivers of growth in the recovered paper pulp market?

How is the competitive landscape evolving in this market?

What are the key challenges faced by the recovered paper pulp market?

Which regions are expected to witness the highest growth?

What role do government policies play in this market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.