- Home

- Eco-Friendly Packaging

- Recycled White Lined Chipboard Market Size, Future Growth and Forecast 2033

Recycled White Lined Chipboard Market Size, Future Growth and Forecast 2033

Recycled White Lined Chipboard Market Segments - by Application (Packaging, Printing, Others), Material Type (Recycled Fiber, Virgin Fiber), End-User (Food and Beverage, Personal Care, Pharmaceuticals, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Recycled White Lined Chipboard Market Outlook

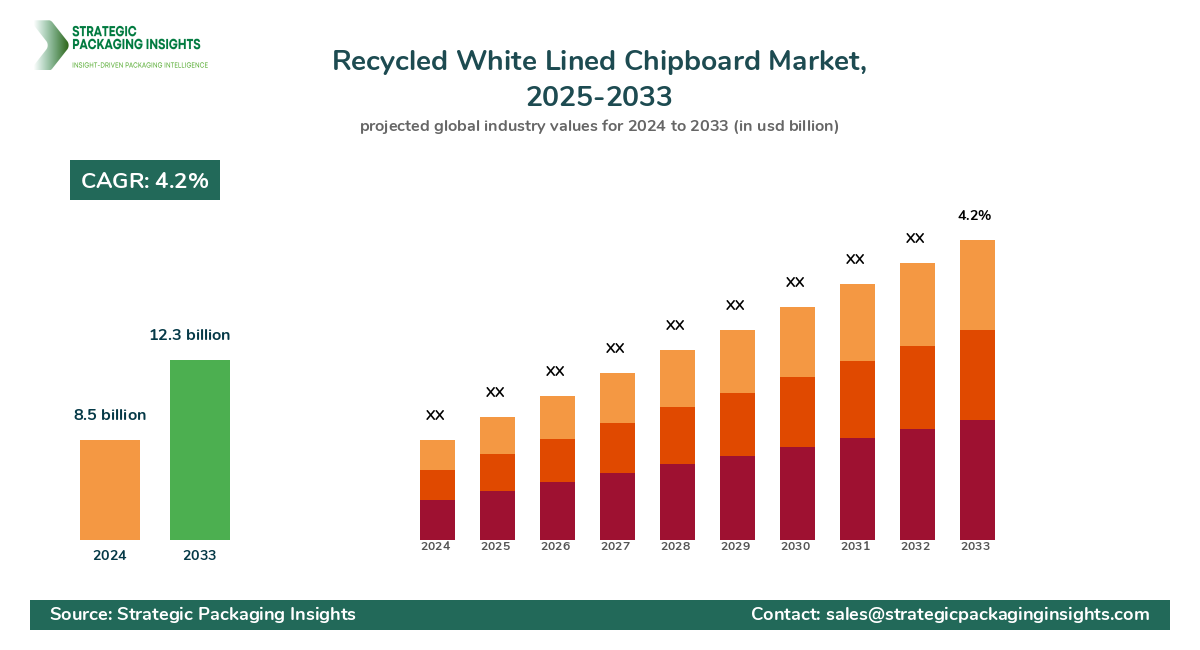

The Recycled White Lined Chipboard market was valued at $8.5 billion in 2024 and is projected to reach $12.3 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2025-2033. This growth trajectory is driven by increasing demand for sustainable packaging solutions across various industries. The shift towards eco-friendly materials is gaining momentum as consumers and businesses alike become more environmentally conscious. Recycled white lined chipboard, known for its versatility and cost-effectiveness, is increasingly being adopted in packaging applications, particularly in the food and beverage sector. The market is also benefiting from advancements in recycling technologies, which enhance the quality and performance of recycled materials, making them more competitive with virgin materials.

Despite the positive outlook, the market faces several challenges that could hinder its growth. Regulatory restrictions on waste management and recycling processes in certain regions pose significant hurdles. Additionally, the fluctuating prices of raw materials and the high cost of recycling infrastructure can impact profitability. However, the potential for growth remains substantial, particularly in emerging markets where the demand for sustainable packaging is on the rise. Companies are investing in research and development to improve the quality and performance of recycled chipboard, which could open new avenues for growth. The market's expansion is also supported by government initiatives promoting recycling and the use of sustainable materials.

Report Scope

| Attributes | Details |

| Report Title | Recycled White Lined Chipboard Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 188 |

| Application | Packaging, Printing |

| Material Type | Recycled Fiber, Virgin Fiber |

| End-User | Food and Beverage, Personal Care, Pharmaceuticals |

| Region | Asia Pacific, North America, Latin America, Europe, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The Recycled White Lined Chipboard market presents numerous opportunities for growth, primarily driven by the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for products that minimize environmental impact. This trend is particularly evident in the food and beverage industry, where packaging plays a crucial role in product presentation and preservation. The versatility of recycled white lined chipboard makes it an ideal choice for a wide range of packaging applications, from food containers to retail packaging. Additionally, advancements in recycling technologies are enhancing the quality and performance of recycled materials, making them more competitive with traditional materials.

Another significant opportunity lies in the expansion of the market in emerging economies. As these regions experience economic growth, there is an increasing demand for packaged goods, which in turn drives the demand for packaging materials. The adoption of recycled white lined chipboard in these markets is supported by government initiatives promoting sustainable practices and the use of eco-friendly materials. Furthermore, the development of new applications for recycled chipboard, such as in the printing industry, presents additional growth prospects. Companies that can innovate and adapt to changing consumer preferences are likely to gain a competitive edge in this evolving market.

However, the market also faces several threats that could impact its growth. One of the primary challenges is the regulatory environment surrounding waste management and recycling processes. In some regions, stringent regulations can increase the cost of recycling and limit the availability of raw materials. Additionally, the fluctuating prices of raw materials and the high cost of recycling infrastructure can impact profitability. Companies must navigate these challenges by investing in efficient recycling processes and developing cost-effective solutions. The competitive landscape is also intensifying, with new entrants and existing players vying for market share. To succeed, companies must focus on innovation, quality, and sustainability to differentiate themselves in the market.

The competitive landscape of the Recycled White Lined Chipboard market is characterized by the presence of several key players, each striving to enhance their market position through strategic initiatives. The market is moderately fragmented, with a mix of established companies and emerging players. Leading companies are focusing on expanding their production capacities and investing in research and development to improve the quality and performance of their products. Additionally, partnerships and collaborations are common strategies employed by companies to strengthen their market presence and expand their customer base.

Some of the major companies operating in the Recycled White Lined Chipboard market include Smurfit Kappa Group, Mondi Group, DS Smith Plc, Stora Enso Oyj, and International Paper Company. Smurfit Kappa Group is a leading player in the market, known for its innovative packaging solutions and commitment to sustainability. The company has a strong presence in Europe and is expanding its operations in emerging markets. Mondi Group is another key player, offering a wide range of packaging and paper products. The company is focused on enhancing its product portfolio through strategic acquisitions and investments in sustainable technologies.

DS Smith Plc is a prominent player in the recycled packaging market, with a strong focus on innovation and sustainability. The company has a significant presence in Europe and is expanding its operations in North America and Asia. Stora Enso Oyj is a leading provider of renewable solutions in packaging, biomaterials, and wooden constructions. The company is committed to sustainability and is investing in research and development to enhance its product offerings. International Paper Company is a global leader in the paper and packaging industry, with a strong focus on sustainability and innovation. The company is expanding its operations in emerging markets to capitalize on the growing demand for sustainable packaging solutions.

Other notable players in the market include WestRock Company, Nine Dragons Paper Holdings Limited, and Pratt Industries, Inc. WestRock Company is a leading provider of paper and packaging solutions, with a strong focus on innovation and sustainability. The company is expanding its operations in emerging markets to capitalize on the growing demand for sustainable packaging solutions. Nine Dragons Paper Holdings Limited is a leading producer of Containerboard products, with a strong presence in China and expanding operations in North America. Pratt Industries, Inc. is a leading provider of sustainable packaging solutions, with a strong focus on innovation and sustainability. The company is expanding its operations in North America and Europe to capitalize on the growing demand for sustainable packaging solutions.

Key Highlights Recycled White Lined Chipboard Market

- Increasing demand for sustainable packaging solutions is driving market growth.

- Advancements in recycling technologies are enhancing the quality of recycled materials.

- Emerging markets present significant growth opportunities for the market.

- Regulatory restrictions on waste management pose challenges to market growth.

- Fluctuating raw material prices impact profitability in the market.

- Companies are investing in research and development to improve product quality.

- Partnerships and collaborations are common strategies among market players.

- Innovation and sustainability are key differentiators in the competitive landscape.

- Expansion of production capacities is a focus for leading companies.

- Government initiatives promoting recycling support market growth.

Competitive Intelligence

The Recycled White Lined Chipboard market is highly competitive, with several key players striving to enhance their market position through strategic initiatives. Smurfit Kappa Group, a leading player in the market, is known for its innovative packaging solutions and commitment to sustainability. The company has a strong presence in Europe and is expanding its operations in emerging markets. Mondi Group, another key player, offers a wide range of packaging and paper products and is focused on enhancing its product portfolio through strategic acquisitions and investments in sustainable technologies.

DS Smith Plc is a prominent player in the recycled packaging market, with a strong focus on innovation and sustainability. The company has a significant presence in Europe and is expanding its operations in North America and Asia. Stora Enso Oyj is a leading provider of renewable solutions in packaging, biomaterials, and wooden constructions. The company is committed to sustainability and is investing in research and development to enhance its product offerings. International Paper Company is a global leader in the paper and packaging industry, with a strong focus on sustainability and innovation. The company is expanding its operations in emerging markets to capitalize on the growing demand for sustainable packaging solutions.

Other notable players in the market include WestRock Company, Nine Dragons Paper Holdings Limited, and Pratt Industries, Inc. WestRock Company is a leading provider of paper and packaging solutions, with a strong focus on innovation and sustainability. The company is expanding its operations in emerging markets to capitalize on the growing demand for sustainable packaging solutions. Nine Dragons Paper Holdings Limited is a leading producer of containerboard products, with a strong presence in China and expanding operations in North America. Pratt Industries, Inc. is a leading provider of sustainable packaging solutions, with a strong focus on innovation and sustainability. The company is expanding its operations in North America and Europe to capitalize on the growing demand for sustainable packaging solutions.

Regional Market Intelligence of Recycled White Lined Chipboard

The global Recycled White Lined Chipboard market is segmented into major regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of major players in the region. The market is expected to grow at a steady pace, supported by government initiatives promoting recycling and the use of eco-friendly materials.

In Europe, the market is characterized by the presence of several key players and a strong focus on sustainability. The region is a major hub for recycled packaging solutions, with companies investing in research and development to enhance product quality and performance. The market is expected to grow at a moderate pace, driven by the increasing demand for sustainable packaging solutions and advancements in recycling technologies.

The Asia-Pacific region is expected to witness significant growth in the Recycled White Lined Chipboard market, driven by the increasing demand for packaged goods and the adoption of sustainable packaging solutions. Emerging economies in the region, such as China and India, present significant growth opportunities for the market. The market is supported by government initiatives promoting recycling and the use of eco-friendly materials.

In Latin America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of major players in the region. The market is expected to grow at a steady pace, supported by government initiatives promoting recycling and the use of eco-friendly materials. The Middle East & Africa region is expected to witness moderate growth in the Recycled White Lined Chipboard market, driven by the increasing demand for sustainable packaging solutions and the adoption of eco-friendly materials.

Top Countries Insights in Recycled White Lined Chipboard

The Recycled White Lined Chipboard market is witnessing significant growth in several key countries. In the United States, the market is driven by the increasing demand for sustainable packaging solutions and the presence of major players in the region. The market is expected to grow at a CAGR of 5%, supported by government initiatives promoting recycling and the use of eco-friendly materials.

In Germany, the market is characterized by the presence of several key players and a strong focus on sustainability. The market is expected to grow at a CAGR of 4%, driven by the increasing demand for sustainable packaging solutions and advancements in recycling technologies. The United Kingdom is another key market for recycled white lined chipboard, with a strong focus on sustainability and innovation. The market is expected to grow at a CAGR of 3%, supported by government initiatives promoting recycling and the use of eco-friendly materials.

In China, the market is expected to witness significant growth, driven by the increasing demand for packaged goods and the adoption of sustainable packaging solutions. The market is expected to grow at a CAGR of 6%, supported by government initiatives promoting recycling and the use of eco-friendly materials. India is another key market for recycled white lined chipboard, with a strong focus on sustainability and innovation. The market is expected to grow at a CAGR of 7%, supported by government initiatives promoting recycling and the use of eco-friendly materials.

Recycled White Lined Chipboard Market Segments Insights

Application Analysis

The application segment of the Recycled White Lined Chipboard market is primarily driven by the increasing demand for sustainable packaging solutions. The packaging industry is the largest consumer of recycled white lined chipboard, with applications ranging from food containers to retail packaging. The versatility of the material makes it an ideal choice for a wide range of packaging applications, particularly in the food and beverage sector. The printing industry is another significant consumer of recycled white lined chipboard, with applications in book covers, brochures, and other printed materials. The development of new applications for recycled chipboard presents additional growth prospects for the market.

The demand for recycled white lined chipboard in the packaging industry is driven by the increasing preference for eco-friendly materials. Consumers are becoming more environmentally conscious, and there is a growing demand for products that minimize environmental impact. The food and beverage industry is a major driver of demand for recycled white lined chipboard, with applications in food containers, beverage cartons, and other packaging solutions. The printing industry is another significant consumer of recycled white lined chipboard, with applications in book covers, brochures, and other printed materials. The development of new applications for recycled chipboard presents additional growth prospects for the market.

Material Type Analysis

The material type segment of the Recycled White Lined Chipboard market is divided into recycled fiber and virgin fiber. Recycled fiber is the most commonly used material in the production of white lined chipboard, accounting for the majority of the market share. The use of recycled fiber is driven by the increasing demand for sustainable packaging solutions and the availability of raw materials. The production of recycled white lined chipboard from recycled fiber is a cost-effective and environmentally friendly process, making it an ideal choice for a wide range of applications.

Virgin fiber is another material used in the production of white lined chipboard, although it accounts for a smaller share of the market. The use of virgin fiber is driven by the demand for high-quality packaging solutions, particularly in the food and beverage industry. The production of white lined chipboard from virgin fiber is a more expensive process, but it offers superior quality and performance compared to recycled fiber. The demand for virgin fiber is expected to grow at a moderate pace, driven by the increasing demand for high-quality packaging solutions in the food and beverage industry.

End-User Analysis

The end-user segment of the Recycled White Lined Chipboard market is divided into food and beverage, personal care, pharmaceuticals, and others. The food and beverage industry is the largest consumer of recycled white lined chipboard, accounting for the majority of the market share. The demand for recycled white lined chipboard in the food and beverage industry is driven by the increasing preference for eco-friendly materials and the need for sustainable packaging solutions. The personal care industry is another significant consumer of recycled white lined chipboard, with applications in packaging for cosmetics, toiletries, and other personal care products.

The pharmaceuticals industry is another significant consumer of recycled white lined chipboard, with applications in packaging for medicines, supplements, and other pharmaceutical products. The demand for recycled white lined chipboard in the pharmaceuticals industry is driven by the need for sustainable packaging solutions and the increasing preference for eco-friendly materials. The demand for recycled white lined chipboard in the personal care industry is driven by the increasing preference for eco-friendly materials and the need for sustainable packaging solutions. The development of new applications for recycled chipboard presents additional growth prospects for the market.

Regional Analysis

The regional segment of the Recycled White Lined Chipboard market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is the largest market for recycled white lined chipboard, accounting for the majority of the market share. The demand for recycled white lined chipboard in North America is driven by the increasing preference for eco-friendly materials and the need for sustainable packaging solutions. The market is expected to grow at a steady pace, supported by government initiatives promoting recycling and the use of eco-friendly materials.

Europe is another significant market for recycled white lined chipboard, with a strong focus on sustainability and innovation. The demand for recycled white lined chipboard in Europe is driven by the increasing preference for eco-friendly materials and the need for sustainable packaging solutions. The market is expected to grow at a moderate pace, driven by the increasing demand for sustainable packaging solutions and advancements in recycling technologies. The Asia-Pacific region is expected to witness significant growth in the Recycled White Lined Chipboard market, driven by the increasing demand for packaged goods and the adoption of sustainable packaging solutions.

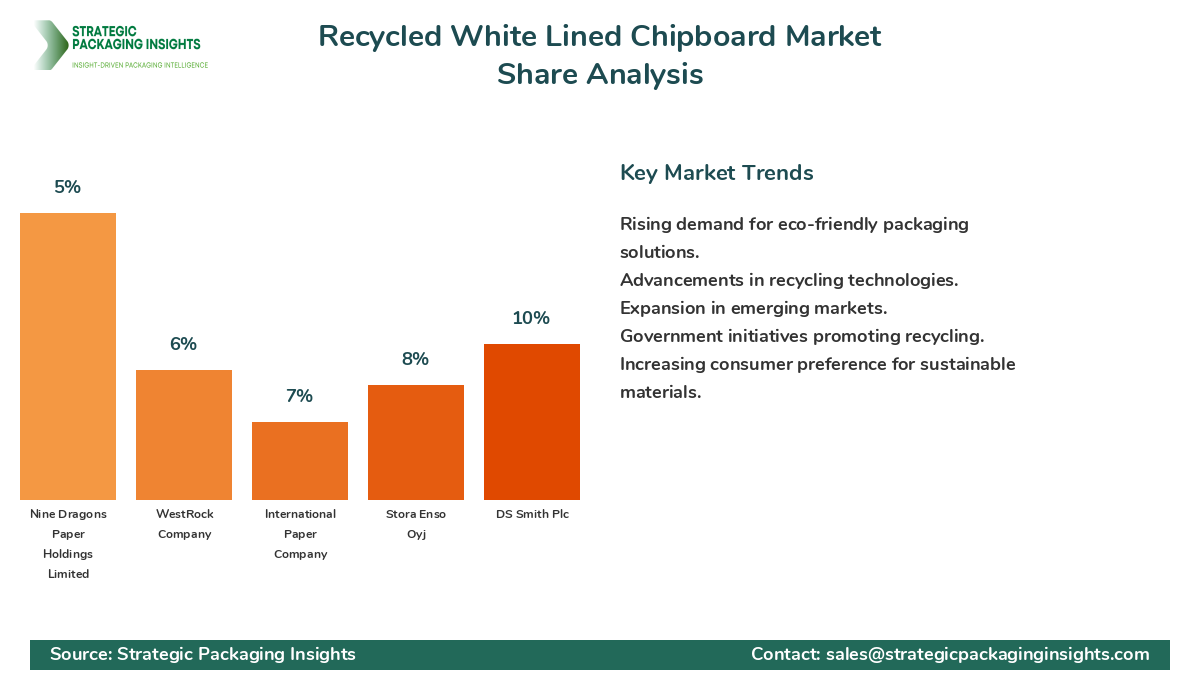

Market Share Analysis

The market share distribution of key players in the Recycled White Lined Chipboard market is characterized by a mix of established companies and emerging players. Leading companies such as Smurfit Kappa Group, Mondi Group, and DS Smith Plc hold significant market shares, driven by their strong focus on innovation and sustainability. These companies are investing in research and development to improve the quality and performance of their products, which is helping them maintain their competitive edge. The market share distribution is also influenced by the presence of regional players who are expanding their operations to capture a larger share of the market.

The competitive positioning of companies in the market is influenced by factors such as product quality, innovation, and sustainability. Companies that can differentiate themselves through these factors are likely to gain a competitive edge in the market. The market share distribution also affects pricing, with leading companies able to command premium prices for their products. Partnerships and collaborations are common strategies among market players, allowing them to expand their customer base and strengthen their market presence. The market share distribution is expected to evolve as new players enter the market and existing players expand their operations.

Recycled White Lined Chipboard Market Segments

The Recycled White Lined Chipboard market has been segmented on the basis of

Application

- Packaging

- Printing

Material Type

- Recycled Fiber

- Virgin Fiber

End-User

- Food and Beverage

- Personal Care

- Pharmaceuticals

Region

- Asia Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

Primary Interview Insights

What is driving the growth of the Recycled White Lined Chipboard market?

What challenges does the market face?

Which regions are expected to witness significant growth?

How are companies differentiating themselves in the market?

What role do government initiatives play in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.