- Home

- Eco-Friendly Packaging

- Rotary Pulp Molding Machine Market Size, Future Growth and Forecast 2033

Rotary Pulp Molding Machine Market Size, Future Growth and Forecast 2033

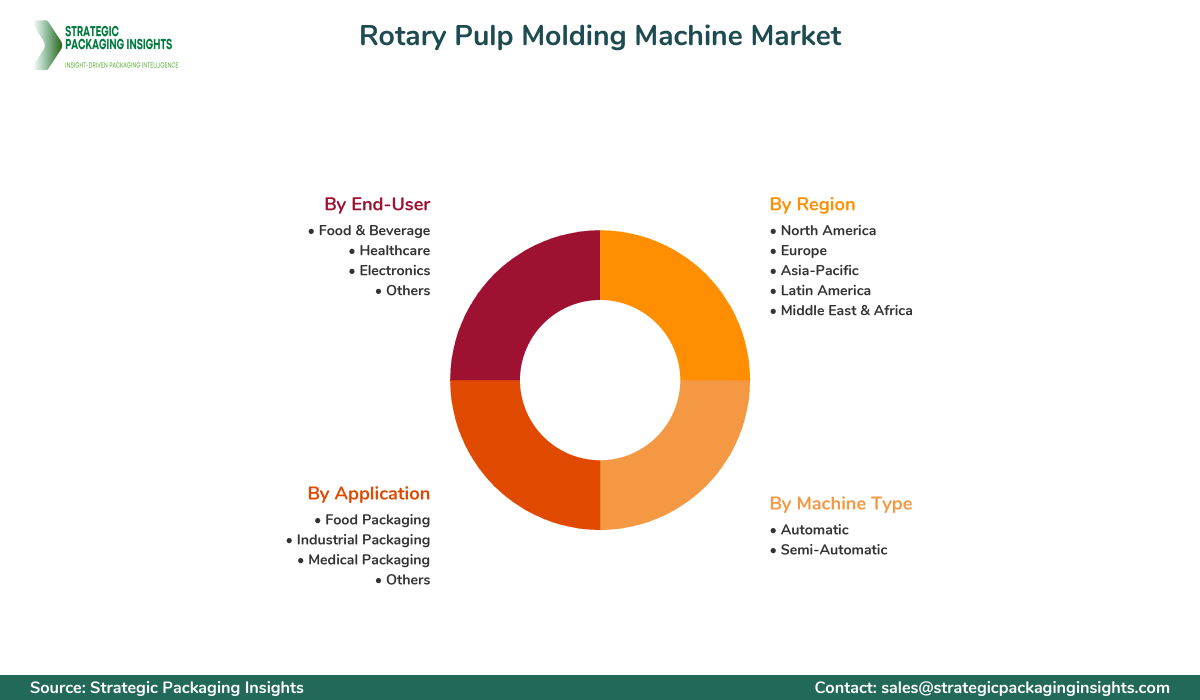

Rotary Pulp Molding Machine Market Segments - by Machine Type (Automatic, Semi-Automatic), Application (Food Packaging, Industrial Packaging, Medical Packaging, Others), End-User (Food & Beverage, Healthcare, Electronics, Others), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Rotary Pulp Molding Machine Market Outlook

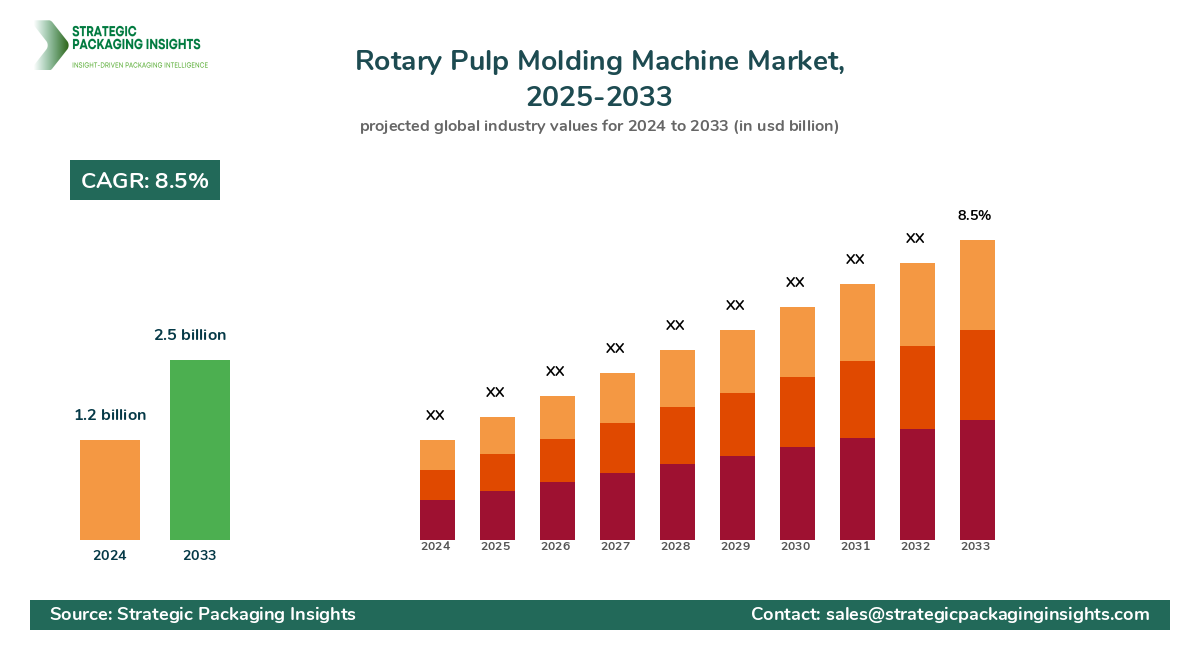

The rotary pulp molding machine market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025-2033. This market is driven by the increasing demand for sustainable packaging solutions, as industries worldwide shift towards eco-friendly practices. The versatility of rotary Pulp Molding Machines in producing a wide range of packaging products, from egg trays to industrial packaging, is a significant factor contributing to market growth. Additionally, advancements in automation and technology have enhanced the efficiency and output of these machines, making them more appealing to manufacturers looking to optimize production processes.

However, the market faces challenges such as high initial investment costs and the need for skilled labor to operate and maintain these machines. Regulatory constraints related to environmental standards and waste management also pose potential hurdles. Despite these challenges, the market holds substantial growth potential, driven by the increasing adoption of Molded Pulp packaging in various sectors, including food and beverage, electronics, and healthcare. The growing awareness of environmental issues and the push for sustainable packaging solutions are expected to further propel market expansion.

Report Scope

| Attributes | Details |

| Report Title | Rotary Pulp Molding Machine Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 169 |

| Machine Type | Automatic, Semi-Automatic |

| Application | Food Packaging, Industrial Packaging, Medical Packaging, Others |

| End-User | Food & Beverage, Healthcare, Electronics, Others |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Customization Available | Yes* |

Opportunities & Threats

The rotary pulp molding machine market presents numerous opportunities, particularly in the realm of sustainable packaging. As consumers and businesses become more environmentally conscious, the demand for eco-friendly packaging solutions is on the rise. Rotary pulp molding machines, which utilize recycled paper and other biodegradable materials, are well-positioned to meet this demand. The versatility of these machines allows for the production of a wide range of packaging products, from egg cartons to protective packaging for electronics, catering to diverse industry needs. Furthermore, advancements in technology are enabling manufacturers to enhance the efficiency and output of these machines, making them more cost-effective and appealing to a broader range of industries.

Another significant opportunity lies in the expansion of the food and beverage industry, which is a major consumer of molded pulp packaging. As the global population continues to grow, so does the demand for packaged food products. Rotary pulp molding machines are ideal for producing food-safe packaging solutions, such as trays and containers, that meet stringent health and safety standards. Additionally, the increasing trend of online food delivery services is driving the need for sustainable packaging options, further boosting the demand for rotary pulp molding machines.

Despite the promising opportunities, the rotary pulp molding machine market faces certain threats that could hinder its growth. One of the primary challenges is the high initial investment required for purchasing and setting up these machines. Small and medium-sized enterprises may find it difficult to afford the upfront costs, limiting their ability to enter the market. Additionally, the operation and maintenance of rotary pulp molding machines require skilled labor, which can be a barrier for companies in regions with a shortage of trained personnel. Furthermore, regulatory constraints related to environmental standards and waste management could pose challenges for manufacturers, as they must ensure compliance with stringent regulations to avoid penalties and maintain their market position.

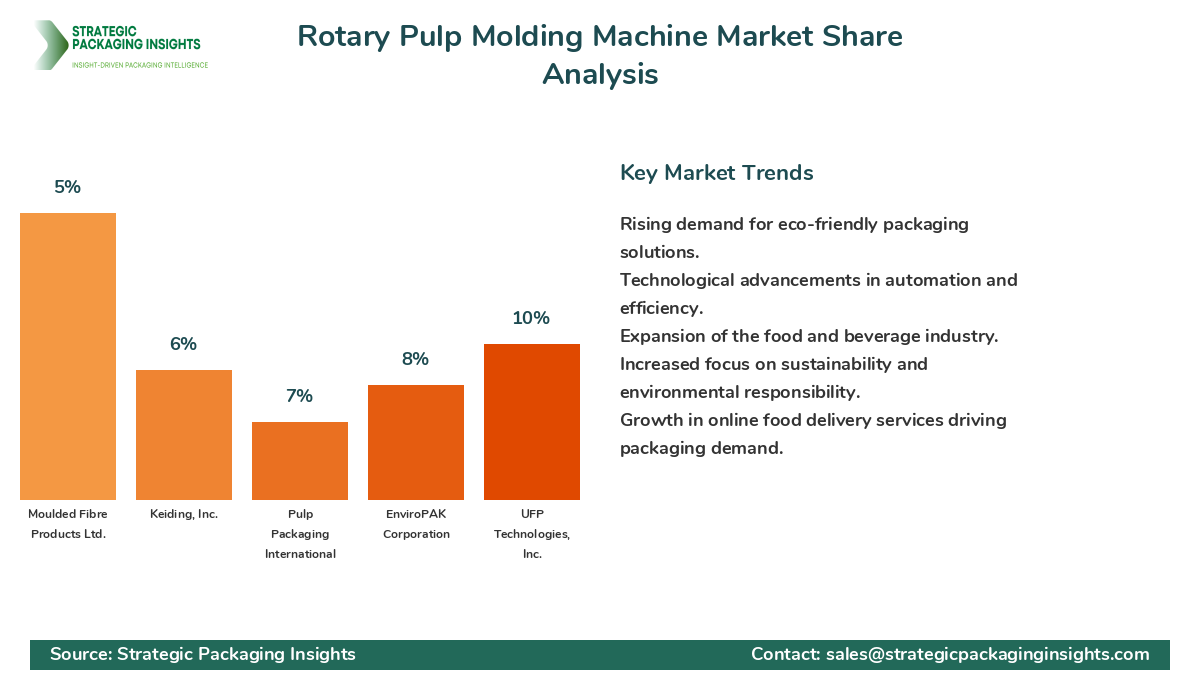

The rotary pulp molding machine market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a few major companies that have established themselves as leaders through innovation, strategic partnerships, and a strong global presence. These companies are continuously investing in research and development to enhance their product offerings and maintain a competitive edge. Additionally, they are focusing on expanding their geographic reach to tap into emerging markets and capitalize on the growing demand for sustainable packaging solutions.

Among the leading companies in the rotary pulp molding machine market is Huhtamaki Oyj, which holds a significant market share due to its extensive product portfolio and strong focus on sustainability. The company has been at the forefront of innovation, developing advanced pulp molding technologies that cater to a wide range of industries. Another major player is Brødrene Hartmann A/S, known for its high-quality Molded Fiber Products and commitment to environmental responsibility. The company has a strong presence in Europe and is expanding its operations in other regions to capture new growth opportunities.

Other notable companies in the market include UFP Technologies, Inc., which specializes in custom-engineered molded fiber solutions for various applications, and EnviroPAK Corporation, a leader in sustainable packaging solutions. These companies are leveraging their expertise and experience to develop innovative products that meet the evolving needs of their customers. Additionally, they are focusing on strategic collaborations and partnerships to enhance their market position and drive growth.

Overall, the competitive landscape of the rotary pulp molding machine market is dynamic, with companies continuously striving to differentiate themselves through innovation and sustainability. The market share distribution is influenced by factors such as product quality, technological advancements, and customer service. Companies that can effectively address these factors are likely to gain a competitive advantage and increase their market share. As the demand for sustainable packaging solutions continues to grow, the market is expected to witness increased competition, driving further innovation and development in the industry.

Key Highlights Rotary Pulp Molding Machine Market

- Increasing demand for sustainable packaging solutions is driving market growth.

- Advancements in automation and technology are enhancing machine efficiency.

- The food and beverage industry is a major consumer of molded pulp packaging.

- High initial investment costs pose a challenge for market entry.

- Regulatory constraints related to environmental standards are a potential hurdle.

- Expansion of online food delivery services is boosting demand for sustainable packaging.

- Skilled labor shortage may impact machine operation and maintenance.

- Strategic partnerships and collaborations are key to gaining market share.

- Innovation and sustainability are critical factors for competitive advantage.

- Emerging markets offer significant growth opportunities for market players.

Competitive Intelligence

The rotary pulp molding machine market is highly competitive, with several key players striving to maintain and expand their market share. Companies such as Huhtamaki Oyj, Brødrene Hartmann A/S, and UFP Technologies, Inc. are leading the market with their innovative products and strong focus on sustainability. These companies have established themselves as leaders through strategic partnerships, extensive product portfolios, and a strong global presence. They are continuously investing in research and development to enhance their product offerings and maintain a competitive edge.

Huhtamaki Oyj, a major player in the market, is known for its extensive product portfolio and commitment to sustainability. The company has been at the forefront of innovation, developing advanced pulp molding technologies that cater to a wide range of industries. Brødrene Hartmann A/S, another leading company, is recognized for its high-quality molded fiber products and environmental responsibility. The company has a strong presence in Europe and is expanding its operations in other regions to capture new growth opportunities.

UFP Technologies, Inc. specializes in custom-engineered molded fiber solutions for various applications, leveraging its expertise and experience to develop innovative products that meet the evolving needs of its customers. EnviroPAK Corporation, a leader in sustainable packaging solutions, is focusing on strategic collaborations and partnerships to enhance its market position and drive growth. These companies are continuously striving to differentiate themselves through innovation and sustainability, which are critical factors for gaining a competitive advantage in the market.

Overall, the competitive landscape of the rotary pulp molding machine market is dynamic, with companies continuously striving to differentiate themselves through innovation and sustainability. The market share distribution is influenced by factors such as product quality, technological advancements, and customer service. Companies that can effectively address these factors are likely to gain a competitive advantage and increase their market share. As the demand for sustainable packaging solutions continues to grow, the market is expected to witness increased competition, driving further innovation and development in the industry.

Regional Market Intelligence of Rotary Pulp Molding Machine

The global rotary pulp molding machine market is segmented into several key regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Each region presents unique growth opportunities and challenges, influenced by factors such as economic conditions, regulatory frameworks, and consumer preferences.

In North America, the market is driven by the increasing demand for sustainable packaging solutions and the presence of major market players. The region's well-established infrastructure and technological advancements further support market growth. However, stringent environmental regulations and high labor costs pose challenges for manufacturers.

Europe is another significant market for rotary pulp molding machines, with a strong focus on sustainability and environmental responsibility. The region's stringent regulations on packaging waste and recycling drive the demand for eco-friendly packaging solutions. Additionally, the presence of leading companies such as Brødrene Hartmann A/S contributes to market growth.

The Asia-Pacific region is expected to witness the highest growth rate, driven by the expanding food and beverage industry and increasing consumer awareness of sustainable packaging. Rapid industrialization and urbanization in countries such as China and India further boost market demand. However, the lack of skilled labor and regulatory challenges may hinder market growth.

In Latin America, the market is driven by the growing demand for sustainable packaging solutions in the food and beverage industry. The region's abundant natural resources and favorable government policies support market growth. However, economic instability and infrastructure challenges may pose obstacles for manufacturers.

The Middle East & Africa region presents growth opportunities due to the increasing demand for eco-friendly packaging solutions and the expansion of the food and beverage industry. However, political instability and regulatory challenges may hinder market growth in certain countries.

Top Countries Insights in Rotary Pulp Molding Machine

In the rotary pulp molding machine market, several countries stand out due to their significant market size and growth potential. United States is a leading market, with a current market size of $300 million and a CAGR of 8%. The country's strong focus on sustainability and technological advancements drive market growth. However, stringent environmental regulations pose challenges for manufacturers.

China is another major market, with a market size of $250 million and a CAGR of 12%. The country's rapid industrialization and urbanization, coupled with increasing consumer awareness of sustainable packaging, drive market demand. However, regulatory challenges and a lack of skilled labor may hinder growth.

Germany is a key market in Europe, with a market size of $200 million and a CAGR of 7%. The country's strong focus on environmental responsibility and the presence of leading companies such as Brødrene Hartmann A/S contribute to market growth. However, high labor costs and stringent regulations pose challenges for manufacturers.

India is an emerging market, with a market size of $150 million and a CAGR of 15%. The country's expanding food and beverage industry and increasing consumer awareness of sustainable packaging drive market demand. However, infrastructure challenges and regulatory hurdles may hinder growth.

Brazil is a significant market in Latin America, with a market size of $100 million and a CAGR of 10%. The country's abundant natural resources and favorable government policies support market growth. However, economic instability and infrastructure challenges may pose obstacles for manufacturers.

Rotary Pulp Molding Machine Market Segments Insights

Machine Type Analysis

The rotary pulp molding machine market is segmented by machine type into automatic and semi-automatic machines. Automatic machines are gaining popularity due to their high efficiency and ability to produce large volumes of molded pulp products with minimal human intervention. These machines are equipped with advanced technologies that enhance production speed and reduce labor costs, making them an attractive option for large-scale manufacturers. The demand for automatic machines is driven by the increasing need for high-quality, consistent packaging solutions in industries such as food and beverage, electronics, and healthcare.

Semi-automatic machines, on the other hand, are preferred by small and medium-sized enterprises due to their lower initial investment costs and flexibility in production. These machines require manual intervention for certain processes, allowing manufacturers to customize their production according to specific requirements. The demand for semi-automatic machines is driven by the growing number of small-scale manufacturers entering the market, particularly in emerging economies where labor costs are relatively low.

Application Analysis

The application segment of the rotary pulp molding machine market includes food packaging, industrial packaging, medical packaging, and others. Food packaging is the largest application segment, driven by the increasing demand for sustainable and food-safe packaging solutions. Rotary pulp molding machines are ideal for producing trays, containers, and other packaging products that meet stringent health and safety standards. The growing trend of online food delivery services further boosts the demand for molded pulp packaging in the food industry.

Industrial packaging is another significant application segment, driven by the need for protective packaging solutions for electronics, automotive parts, and other industrial products. Rotary pulp molding machines are used to produce custom-engineered packaging solutions that provide excellent protection during transportation and storage. The demand for industrial packaging is driven by the expanding e-commerce industry and the increasing need for efficient supply chain management.

End-User Analysis

The end-user segment of the rotary pulp molding machine market includes food and beverage, healthcare, electronics, and others. The food and beverage industry is the largest end-user segment, driven by the increasing demand for sustainable packaging solutions that meet health and safety standards. Rotary pulp molding machines are used to produce a wide range of packaging products, from egg cartons to trays and containers, catering to the diverse needs of the food and beverage industry.

The healthcare industry is another significant end-user segment, driven by the need for sterile and eco-friendly packaging solutions for medical devices and pharmaceuticals. Rotary pulp molding machines are used to Produce Packaging products that meet stringent regulatory requirements and provide excellent protection for sensitive medical products. The demand for Healthcare Packaging is driven by the increasing focus on patient safety and the growing trend of home healthcare services.

Region Analysis

The rotary pulp molding machine market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Each region presents unique growth opportunities and challenges, influenced by factors such as economic conditions, regulatory frameworks, and consumer preferences. North America and Europe are mature markets, driven by the increasing demand for sustainable packaging solutions and the presence of major market players. The Asia-Pacific region is expected to witness the highest growth rate, driven by the expanding food and beverage industry and increasing consumer awareness of sustainable packaging. Latin America and Middle East & Africa present growth opportunities due to the increasing demand for eco-friendly packaging solutions and the expansion of the food and beverage industry.

Market Share Analysis

The rotary pulp molding machine market is characterized by a competitive landscape with several key players vying for market share. The market is dominated by a few major companies that have established themselves as leaders through innovation, strategic partnerships, and a strong global presence. These companies are continuously investing in research and development to enhance their product offerings and maintain a competitive edge. Additionally, they are focusing on expanding their geographic reach to tap into emerging markets and capitalize on the growing demand for sustainable packaging solutions. The market share distribution is influenced by factors such as product quality, technological advancements, and customer service. Companies that can effectively address these factors are likely to gain a competitive advantage and increase their market share. As the demand for sustainable packaging solutions continues to grow, the market is expected to witness increased competition, driving further innovation and development in the industry.

Rotary Pulp Molding Machine Market Segments

The Rotary Pulp Molding Machine market has been segmented on the basis of

Machine Type

- Automatic

- Semi-Automatic

Application

- Food Packaging

- Industrial Packaging

- Medical Packaging

- Others

End-User

- Food & Beverage

- Healthcare

- Electronics

- Others

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Primary Interview Insights

What are the key drivers for the rotary pulp molding machine market?

What challenges does the rotary pulp molding machine market face?

Which regions are expected to witness the highest growth in the market?

How are companies gaining a competitive edge in the market?

What opportunities exist for new entrants in the market?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.