- Home

- Food Packaging

- Tape Backing Materials Market Size, Future Growth and Forecast 2033

Tape Backing Materials Market Size, Future Growth and Forecast 2033

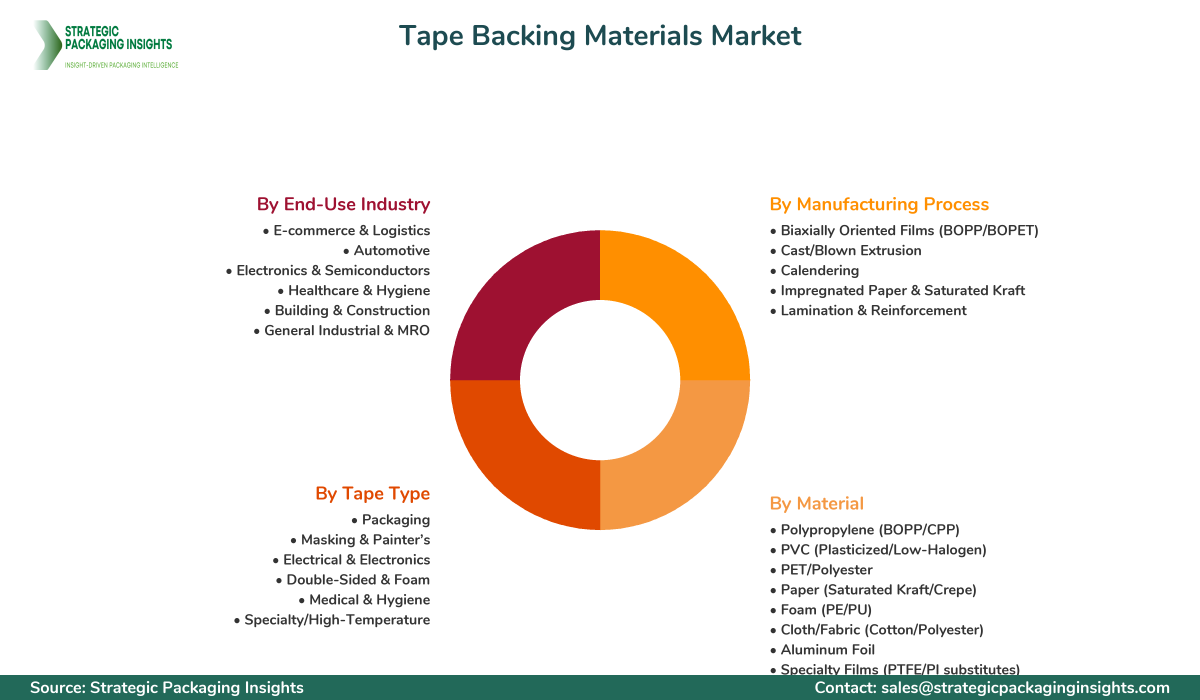

Tape Backing Materials Market Segments - by Material (Polypropylene, PVC, PET/Polyester, Paper, Foam, Cloth/Fabric, Aluminum Foil, Others), Tape Type (Packaging, Masking & Painter’s, Electrical & Electronics, Double-Sided & Foam, Medical & Hygiene, Specialty/High-Temperature), Manufacturing Process (Biaxially Oriented Films, Cast/Blown Extrusion, Calendering, Impregnated Paper & Saturated Kraft, Lamination & Reinforcement), End-Use Industry (E-commerce & Logistics, Automotive, Electronics & Semiconductors, Healthcare & Hygiene, Building & Construction, General Industrial & MRO) - Market Dynamics, Growth Opportunities, Strategic Drivers, and PESTLE Outlook (2025–2033)

Tape Backing Materials Market Outlook

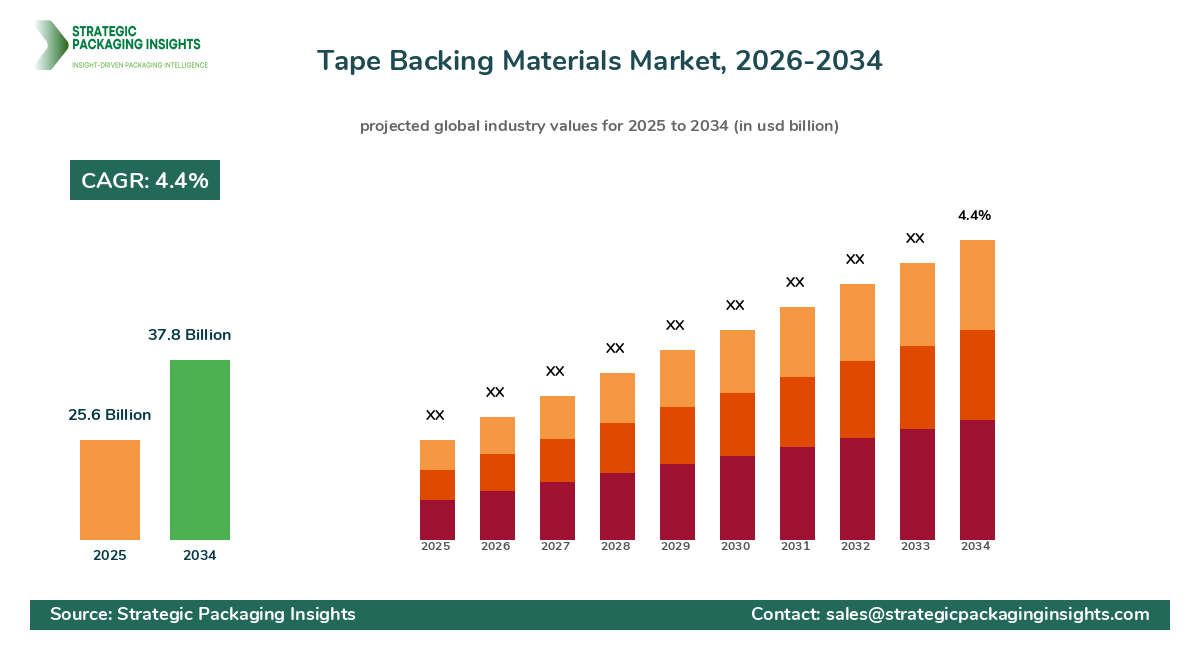

The tape backing materials market was valued at $25.6 billion in 2024 and is projected to reach $37.8 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2025–2033. Demand tracks the expansion of e-commerce shipping volumes, ongoing replacement of mechanical fasteners with lightweight bonding solutions, and the shift toward cleaner, faster assembly in electronics, automotive, building products, and healthcare. Polypropylene (especially BOPP) remains the workhorse for packaging tapes, while PET and PVC dominate in electrical, electronics, and high-durability uses. Paper backings are gaining in painter’s masking and sustainable consumer goods, and foam/cloth substrates continue to deliver gap-filling and conformability benefits in sealing and automotive NVH. Major converters are investing in multi-resin film lines, calendered PVC, saturated kraft, and advanced lamination to balance strength, heat resistance, and hand-tearability under tightening performance specs. With rising substrate complexity, converters are coordinating closely with adhesive suppliers to dial in modulus, surface energy, and thermal stability for specific end-use profiles. The market’s center of gravity is tilting toward Asia Pacific on the back of logistics growth, electronics production, and integrated film capacity, while North America and Europe invest in sustainable chemistries and recycling-ready structures.

Supply conditions improved in 2024 as resin availability stabilized and freight costs fell from pandemic highs, but cost discipline is still crucial. Regulatory convergence on recyclability, VOC limits, and extended producer responsibility (EPR) is reshaping substrate choices and converting practices. The best-positioned players are retooling product slates to incorporate mono-material films, bio-based papers, and halogen-free, phthalate-free PVC alternatives without compromising adhesion-to-substrate, temperature range, or die-cutting performance. Standardization is spreading in carton sealing and painter’s tapes, while premium niches such as battery assembly, semiconductor cleanroom, and medical skin-contact tapes sustain above-market growth via high-spec substrates like PET, PTFE, and specialty papers. Strategic M&A continues among film makers, paper specialists, and foam producers to secure integrated value chains and regional presence, creating tighter alignment between backing, adhesive technology, and downstream application engineering.

Report Scope

| Attributes | Details |

| Report Title | Tape Backing Materials Market Size, Future Growth and Forecast 2033 |

| Base Year | 2025 |

| Historic Data | 2018-2024 |

| Forecast Period | 2026-2034 |

| Number of Pages | 102 |

| Material | Polypropylene (BOPP/CPP), PVC (Plasticized/Low-Halogen), PET/Polyester, Paper (Saturated Kraft/Crepe), Foam (PE/PU), Cloth/Fabric (Cotton/Polyester), Aluminum Foil, Specialty Films (PTFE/PI substitutes) |

| Tape Type | Packaging, Masking & Painter’s, Electrical & Electronics, Double-Sided & Foam, Medical & Hygiene, Specialty/High-Temperature |

| End-Use Industry | E-commerce & Logistics, Automotive, Electronics & Semiconductors, Healthcare & Hygiene, Building & Construction, General Industrial & MRO |

| Manufacturing Process | Biaxially Oriented Films (BOPP/BOPET), Cast/Blown Extrusion, Calendering, Impregnated Paper & Saturated Kraft, Lamination & Reinforcement |

| Customization Available | Yes* |

Opportunities & Threats

Opportunity momentum is strong in e-commerce and omnichannel logistics, where high-throughput fulfillment centers demand consistent BOPP performance across cold-chain and humid environments. Converters that provide tough, low-noise, printable backings with proven compatibility across hot-melt and acrylic systems are winning share. In electronics and EVs, PET, PI substitutes, and engineered nonwovens open pathways for flame-retardant, high-temperature, and dielectric tapes used in cell wrapping, harnessing, EMI shielding, and thermal management. Automotive lightweighting supports double-sided PET and foam carriers that replace rivets in trim and sensor mounts while reducing assembly labor. In construction, weatherization and air-sealing codes expand the need for robust films and laminated backings that bond to rough substrates in variable climates. Healthcare presents another durable growth pocket as sterilization-ready, breathable, and skin-friendly paper and PE backings feed diagnostic wearables, wound care, and surgical drapes. There is also a margin-rich opportunity in sustainability-led product redesigns—mono-material backings that align with dominant recycling streams, bio-based paper with FSC/PEFC certification, solvent-free processing, and downgauging strategies without sacrificing tensile strength or shear.

Process technology offers compelling upside for manufacturers that adopt high-precision orientation, gauge control, and surface treatment. Biaxially oriented lines for PP and PET enable tighter modulus profiles and consistent adhesion anchorage; calendered PVC production with improved plasticizer packages extends life and reduces migration; and impregnation methods for kraft backings enhance moisture resistance and tear propagation control. Surface-engineering advances—corona and plasma treatment, primer chemistries, and microtexturing—give converters greater latitude to pair backings with new adhesive platforms, from low-VOC acrylics to silicone and UV-curable systems. Digitally printable surfaces and smart markings embedded into backings can bring track-and-trace and brand security features into everyday tapes. As brand owners seek SKU simplification, vertically integrated suppliers that standardize backbone backings across regions and applications can capture volume and reduce customer total cost of ownership with universal, audit-ready compliance documentation and shorter lead times.

On the risk side, resin price volatility for polypropylene, PVC, and polyester can pressure margins, especially when long-term contracts cap passing through increases. Sustainability scrutiny is elevating compliance costs, particularly for PVC formulations, fluorinated release systems, and solvent-based processing. Fragmented regional regulatory schemes complicate product harmonization, and the move toward recycled content targets requires careful resin selection and process adjustments to retain tensile and elongation properties. Competition is intense in commodity packaging tapes, where price-based bidding persists and new local producers in Asia and Latin America add capacity. Logistics disruptions, while easing, remain a latent threat for cross-border film and paper rolls. Finally, performance expectations keep rising as automated carton sealers, faster SMT lines, and more demanding OEM specs expose any variability in gauge, surface energy, and dimensional stability—forcing continuous investment in quality systems and inline inspection.

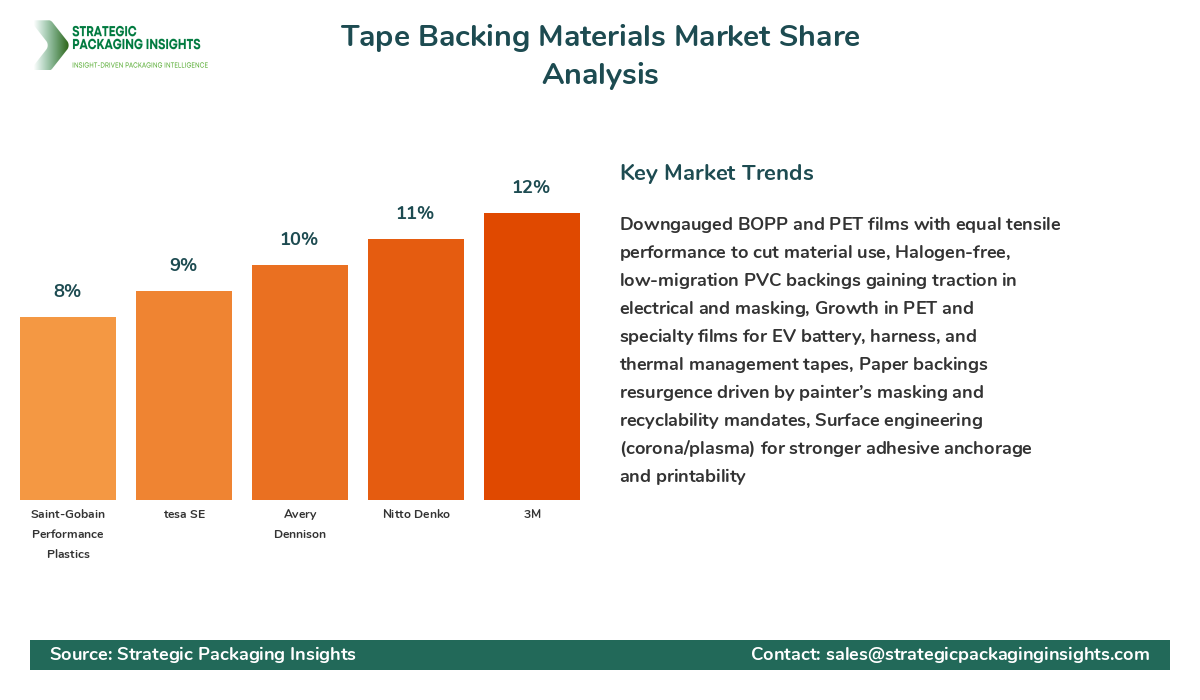

The competitive landscape blends global leaders with strong film and specialty portfolios and a long tail of regional players focused on packaging and masking. Large integrated firms leverage multi-resin extrusion, orientation, and coating assets to deliver BOPP, PET, PVC, and paper backings at global scale, while niche specialists excel in foam, cloth, and engineered papers. In 2024, the top tier collectively captured roughly 55–60% of revenue, with Asia Pacific capacity expansions reshaping sourcing patterns for BOPP and PET. Price competition is sharp in packaging tapes, but premium growth clusters around electronics, automotive, and building envelopes where qualification times are long and product failure risks are high. Strategic partnerships between backing suppliers and adhesive formulators are increasingly decisive, enabling rapid co-development and tailored surface energy profiles. Private label share rose in commodity segments, but brand-heavy specifications in industrial and healthcare insulated leading innovators.

Based on industry estimates, Toray Industries accounted for about 9.1% market share in 2024 on the strength of PET and engineered films used across electrical and Industrial Tapes. Berry Global held around 8.4% with a diversified film slate and global footprint in packaging and specialty backings. 3M maintained roughly 7.6% through integrated films, papers, and in-house converting knowledge that shapes substrate standards across multiple end-uses. Nitto Denko stood near 7.2% driven by electronics and automotive specifications in Asia and the U.S. Avery Dennison was close to 6.8% with strong presence in films and engineered papers for double-sided and specialty tapes. tesa SE posted about 5.9%, particularly strong in masking and industrial backings. Intertape Polymer Group achieved approximately 5.1% anchored in packaging and water-activated paper solutions. Lintec held 4.8% in high-spec films and cleanroom-compatible materials. Saint-Gobain Performance Plastics had around 4.5%, notable in PTFE and high-temperature substrates. Ahlstrom captured roughly 3.7% with saturated and specialty papers. Jindal Poly Films and UPM Specialty Papers rounded out the next tier at about 3.6% and 3.2% respectively, while numerous regional film, paper, foam, and cloth suppliers collectively represented the remaining share.

Market leaders are investing in sustainability and advanced process control to differentiate beyond price. They are rolling out downgauged BOPP with equivalent tensile properties, halogen-free and low-migration PVC designs, and PET platforms that support higher recycling content without compromising thermal stability. Many are expanding in Asia for scale and proximity to electronics and EV customers while maintaining technical centers in Europe and North America to serve regulated end-markets. As OEMs push for supplier consolidation and multi-region supply assurance, vendors with redundant global capacity, rigorous CoA/CoC systems, and rapid tech support are steadily gaining share. Over the next five years, expect an uptick in alliances that pair paper specialists with film producers to co-create hybrid backings and recyclable mono-material solutions aligned with EPR frameworks.

Looking ahead, share dynamics will hinge on three levers: speed of innovation in sustainable formats, ability to meet high-spec qualification in EV/electronics, and operational excellence that protects service levels in dynamic resin environments. Companies that lag in LCAs, product carbon footprints, and solvent-free processing may face delisting risks with global brands. Conversely, those synchronizing backing innovations with adhesive upgrades will benefit from stickier customer relationships, premium pricing, and preferred-supplier status in strategic programs. As price competition persists in commodity tapes, winners will use scale, automation, and formulation know-how to protect margins while deploying consultative selling in value-added applications to deepen share of wallet.

Key Highlights Tape Backing Materials Market

- Global market reached $25.6 billion in 2024, on track for $37.8 billion by 2033 at a 4.4% CAGR.

- Asia Pacific leads volume growth with expanding BOPP and PET capacity and electronics-centric demand.

- Premium growth pockets: EV battery and harness tapes, construction air/water sealing, medical wearables.

- Sustainability is a core design axis: mono-material films, FSC/PEFC-certified papers, solvent-free processing.

- Process advances in biaxial orientation, calendering, and impregnation improve modulus control and durability.

- Downgauging strategies deliver material savings without sacrificing tensile strength and shear performance.

- Regulatory pressure on PVC plasticizers and VOCs accelerates low-halogen, low-migration formulations.

- Digital printability and surface treatments enable brand security, traceability, and automation-friendly tapes.

- Vertical integration and multi-region redundancy become key vendor selection criteria for global brands.

- Long qualification cycles in automotive and electronics create defensible moats for high-spec suppliers.

Competitive Intelligence

Toray Industries and Berry Global are gaining ground by combining film science, global footprints, and scalable PET/BOPP capacity, giving them cost and service advantages in both commodity and specialty backings. 3M and Nitto Denko leverage deep application engineering and end-market intimacy, converting backing know-how into high-qualification wins in electronics, healthcare, and automotive. Avery Dennison and tesa focus on engineered papers and high-performance films that integrate smoothly with double-sided systems and painter’s masking, supported by strong regulatory documentation and global technical service. Intertape Polymer Group is consolidating share in packaging and water-activated systems through consistent quality and logistics execution. Lintec and Saint-Gobain maintain strongholds in cleanroom-compatible and high-temperature backings, while Ahlstrom’s saturated kraft and barrier-enhanced papers ride the sustainability wave in painter’s and consumer goods tapes.

Across the top ten, year-over-year revenue growth typically ranges from 3–7%, with outliers in EV and medical segments posting double digits off smaller bases. Geographic reach skews global for the leaders, with production and tech centers across North America, Europe, and Asia; client retention is high in qualified programs where revalidation costs dissuade switching. Differentiation stems from laboratory-to-line support, consistent gauge and surface energy, and readiness for recycled content. Strengths include robust quality systems (ISO 9001/14001), audited supply chains, and cross-functional innovation teams. Weaknesses cluster around resin cost exposure and the complexity of harmonizing global SKUs under diverse regulatory regimes. Companies gaining share emphasize sustainability-backed redesigns and automated inspection, while those losing share are slow to update PVC systems, lack recycled-content offerings, or face service gaps in fast-growing APAC corridors.

Strategy comparisons show a split between vertical integration and partnership-led models. Vertically integrated players invest in extrusion/orientation, saturation, and lamination to control quality and cost. Partnership-led players double down on adhesive synergies, co-development roadmaps, and rapid customization. Innovation focus increasingly targets downgauging, printable surfaces, solventless coating compatibility, and circularity. Expect accelerated investments in Asia for volume backings and in Europe/North America for specialty development and regulatory compliance support. Overall, the top tier is widening its lead through a mix of scale, technical depth, and a credible sustainability story that aligns with brand-owner scorecards.

Regional Market Intelligence of Tape Backing Materials

The global market distribution reflects manufacturing hubs and end-use intensity. North America accounted for about $6.3 billion in 2024 and is projected to reach $8.9 billion by 2033, supported by resilient e-commerce, high adoption of automation-friendly packaging tapes, and a strong base in medical and building envelope applications. Local production of PET and PVC backings, combined with stringent quality and compliance requirements, underpins pricing power in premium segments. Productivity upgrades and solvent-free transitions are top themes, and supplier consolidation is visible among specialized converters.

Europe reached roughly $6.0 billion in 2024 and should advance to $8.0 billion by 2033. Growth is shaped by sustainability policies, EPR directives, and tight restrictions on plasticizers and VOCs. This environment favors paper-based and recyclable mono-material solutions, with painter’s masking, automotive assembly, and construction sealing contributing steady demand. OEM qualification pathways in Germany, France, and Italy reward suppliers with deep documentation and LCA capability. Energy costs remain a watch item, pushing efficiency investments and product mix optimization toward higher-value backings.

Asia Pacific was the largest and fastest-growing region at approximately $10.5 billion in 2024, projected to reach $16.4 billion by 2033. Scale in BOPP and PET production, robust electronics and EV supply chains, and booming e-commerce logistics in China, India, and Southeast Asia drive outsized volume gains. Local champions and global leaders are both expanding film and lamination capacity, with increasing emphasis on quality control to meet global OEM specs. As brands push sustainability, regional producers are investing in recycled-content films, halogen-free PVC alternatives, and high-clarity PET backings that withstand high-temperature processes.

Latin America stood near $1.7 billion in 2024 and is expected to reach $2.5 billion by 2033. Growth comes from packaging tapes linked to retail and agriculture exports, modernization in construction sealing, and rising automotive content in Mexico and Brazil. Currency swings and import dependence on specialty films create volatility, but local converting is scaling, especially for BOPP-based carton sealing. Suppliers that pair technical support with competitive regional logistics are gaining traction with large distributors and global 3PLs.

Middle East & Africa recorded around $1.1 billion in 2024 with a forecast of $2.0 billion by 2033. Infrastructure development, logistics corridors, and localized FMCG manufacturing support consistent demand for packaging and masking backings. Governments are advancing waste management and recycling frameworks, spurring interest in mono-material film solutions and paper backings. While a portion of high-spec films is imported, regional film extrusion is gradually increasing, and distributors are broadening stocking programs to meet diversified end-use needs.

Top Countries Insights in Tape Backing Materials

China: Market size was about $6.9 billion in 2024 with a CAGR of 5% through 2033. Growth is propelled by dominant BOPP/PET capacity, aggressive EV and electronics investments, and rapid e-commerce adoption. Policy push for recycling and low-VOC operations accelerates solventless processing and recycled-content films. Challenges include price competition from new entrants and the need to meet increasingly stringent export-market compliance for premium programs.

United States: The market reached approximately $5.2 billion in 2024 with a projected CAGR of 4%. Drivers include resilient fulfillment networks, building envelope upgrades, and healthcare product innovation. Regulatory scrutiny on plasticizers and VOCs is shaping PVC and paper substrate choices, while reshoring trends support domestically produced PET and specialty papers. Capacity rationalization and upticks in automation help protect service levels amid resin cost fluctuations.

Germany: Estimated at $2.1 billion in 2024 with a 3% CAGR outlook. Automotive and industrial engineering standards favor high-spec PET, PVC, and engineered paper backings. Strong sustainability policies and EPR mechanisms push recyclable and bio-based options. Local OEM qualification processes are rigorous, but suppliers that meet documentation and testing demands secure long-term, defensible positions in premium niches, especially in masking and double-sided bonding.

India: Valued near $1.8 billion in 2024 with a CAGR of 6%. A surging e-commerce ecosystem, expanding BOPP film base, and investments in electronics assembly and EVs boost demand. Policy support for manufacturing and growing interest in recycled-content films enhance the supply base. Key challenges include infrastructure disparities and the need to scale quality systems to meet global export standards for high-spec applications.

Japan: Around $1.7 billion in 2024 with a 3% CAGR. The country’s precision manufacturing environment sustains strong demand for PET, cleanroom-friendly films, and high-temperature backings. Strict environmental and product safety standards drive continuous upgrades to low-VOC, low-migration systems. Aging demographics and labor costs reinforce automation, creating a premium on highly consistent, machine-friendly backings with exacting gauge control.

Tape Backing Materials Market Segments Insights

Material Analysis

Material choice determines performance, cost, and sustainability profile across applications. Polypropylene (especially BOPP) dominates packaging tapes due to tensile strength, cost efficiency, and printability, with downgauging programs improving yield without compromising tear resistance. PET/Polyester is the preferred backbone in electrical, electronics, and high-temperature applications where dimensional stability and dielectric strength are critical. PVC maintains relevance in insulation and masking where flexibility and abrasion resistance matter, yet low-halogen and alternative plasticizer systems are increasingly required. Paper backings, including saturated kraft and crepe, are climbing in painter’s masking and consumer goods tapes as brand owners pursue recyclable and bio-based options with precise unwind and conformability. Foam (PE, PU) and cloth/fabric (cotton, PET) deliver gap-filling, cushioning, and rugged handling in automotive and construction sealing, where adhesion to rough substrates and environmental resistance are critical. Aluminum foil and specialty films such as PTFE and PI substitutes serve niche, high-temperature or barrier applications, often with strict certification requirements.

Competition in materials centers on balancing performance specifications with regulatory and sustainability targets. Film leaders push recycled-content PET and BOPP, high-clarity grades for optical uses, and enhanced treatment profiles for stronger adhesive anchorage. Paper specialists scale FSC/PEFC-certified grades, improved moisture resistance, and surface uniformity for clean paint lines. Foam suppliers tailor cell structure and compression set for consistent die-cutting and long-term sealing. Cloth backings focus on abrasion resistance and hand-tear performance without linting. The winning strategies integrate end-use testing, life-cycle assessment, and rapid custom formulation, supported by supply chain resilience to manage resin shocks and ensure continuity for qualified OEM programs.

Tape Type Analysis

Packaging tapes remain the largest volume sink, with BOPP backings paired to hot-melt or acrylic adhesives for carton sealing across temperature profiles and automated lines. Masking & painter’s tapes lean on crepe paper and specialty papers that deliver crisp paint edges, controlled adhesion, and clean removal—particularly in professional markets with higher recoat cycles. Electrical & electronics tapes leverage PET, PVC, and engineered films for insulation, harnessing, EMI shielding, and component protection, where dielectric strength, thermal stability, and low outgassing drive specifications. Double-sided & foam tapes use PET and PE/PU foam carriers to replace mechanical fasteners in automotive trims, consumer electronics assembly, and building interiors, balancing bond strength with vibration damping and thermal expansion. Medical & hygiene tapes prioritize breathable paper and soft PE backings compatible with skin-contact adhesives and sterilization cycles. Specialty/high-temperature tapes employ foil, PTFE, and engineered polymers for extreme environments in aerospace, metal processing, and battery assembly.

Growth rate variance across tape types is pronounced. Packaging grows steadily with e-commerce and retail logistics, while electronics and EV-related tapes post faster gains with new device architectures and battery pack formats. Painter’s masking benefits from renovation cycles and pro paint demand, especially where regulatory drivers favor low-VOC and recyclable solutions. Double-sided foam tapes expand as design teams prefer clean aesthetics and lightweight assemblies. Specialty segments, though smaller, command premium pricing and long qualification locks, creating attractive, defensible niches for suppliers with deep application expertise.

End-Use Industry Analysis

E-commerce & logistics drive high-throughput packaging tape demand with performance focused on adhesion in variable climates, low-noise unwind, and printability for brand messaging. Automotive increasingly adopts double-sided PET and foam tapes to reduce weight, simplify assembly, and meet NVH targets; battery systems and wire harnesses require heat-resistant and flame-retardant backings. Electronics & semiconductors need ultra-clean films with precise thickness control, dielectric properties, and low ionic contamination for device assembly and protection. Healthcare & hygiene requires gentle, breathable, and sterilizable papers and films for wearables, wound care, and drapes, often with comprehensive biocompatibility and process validation. Building & construction relies on durable backings for air/water sealing, flashing, and HVAC applications, demanding weatherability, adhesion to rough surfaces, and code compliance. General industrial & MRO uses a wide mix of masking, duct, and sealing tapes, where reliability and availability are key buying criteria across maintenance teams and contractors.

Procurement preferences vary by industry. Automotive and electronics emphasize supplier qualification, PPAP-like documentation, and long-term reliability, making switching rare once a product wins. Healthcare buyers demand compliance, lot traceability, and consistent roll-to-roll performance. Construction and MRO prioritize stock availability, ease of application, and proven performance in field conditions. E-commerce/logistics looks for cost-effective, machine-friendly backings that ensure consistent seal quality and carton integrity throughout the last mile. Suppliers that bundle technical support, quick sampling, and regional inventory often command preferred-supplier status and expand share of wallet across adjacent use cases.

Manufacturing Process Analysis

Biaxially oriented film lines (BOPP, BOPET) provide tight control over tensile properties, gauge, and clarity, making them the backbone for high-volume and high-spec backings. Cast/blown extrusion supports specialty structures and thicker gauges where conformability and clarity matter. Calendering for PVC delivers smooth surfaces, dimensional stability, and controlled plasticizer diffusion tailored to electrical and masking applications. Impregnated paper and saturated kraft processes enhance strength, moisture resistance, and edge tear control essential for painter’s masking and water-activated tapes. Lamination and reinforcement bring together films, foils, fabrics, and scrims to engineer multi-layer backings for demanding environments, balancing stiffness, flexibility, and barrier properties.

Process innovation is moving toward automation, inline inspection, and solvent-free compatibility to reduce defects and environmental footprint. Advanced surface treatments (corona/plasma) and primer systems extend adhesive compatibility and anchorage. Gauging technology and digital twins support tighter process windows and faster product development cycles. Suppliers investing in redundancy across regions and processes can assure continuity for global programs, synchronize quality standards, and compress lead times. As brand owners pursue circularity, processes are being tuned for recycled-content resins and mono-material designs, without compromising slit quality, adhesion, or convertibility.

In summary, the market’s share distribution reveals a clustering of leadership among integrated film giants and specialty innovators, while a competitive mid-tier focuses on regional service and cost-effective packaging solutions. Leaders are growing share by marrying sustainability with performance, deepening collaboration with adhesive partners, and backing it with data-rich quality systems that reduce customer risk, protect uptime, and support global standardization.

Tape Backing Materials Market Segments

The Tape Backing Materials market has been segmented on the basis of

Material

- Polypropylene (BOPP/CPP)

- PVC (Plasticized/Low-Halogen)

- PET/Polyester

- Paper (Saturated Kraft/Crepe)

- Foam (PE/PU)

- Cloth/Fabric (Cotton/Polyester)

- Aluminum Foil

- Specialty Films (PTFE/PI substitutes)

Tape Type

- Packaging

- Masking & Painter’s

- Electrical & Electronics

- Double-Sided & Foam

- Medical & Hygiene

- Specialty/High-Temperature

End-Use Industry

- E-commerce & Logistics

- Automotive

- Electronics & Semiconductors

- Healthcare & Hygiene

- Building & Construction

- General Industrial & MRO

Manufacturing Process

- Biaxially Oriented Films (BOPP/BOPET)

- Cast/Blown Extrusion

- Calendering

- Impregnated Paper & Saturated Kraft

- Lamination & Reinforcement

Primary Interview Insights

Which backing materials are seeing the fastest growth?

How are sustainability requirements changing product specs?

Where are supply risks highest today?

What are key qualification hurdles in EV/electronics?

Latest Reports

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.

The shrink film packaging market was valued at $4.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The connected packaging market was valued at $31.2 billion in 2024 and is projected to reach $82.1 billion by 2033, growing at a CAGR of 11.2% during the forecast period 2025–2033.

The active packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The Intelligent Packaging market was valued at $18.5 billion in 2024 and is projected to reach $31.2 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033.

The IoT-Enabled Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The NFC Packaging market was valued at $12.5 billion in 2024 and is projected to reach $35.7 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025–2033.

The RFID Packaging market was valued at $12.5 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The sensor-enabled packaging market was valued at $18.5 billion in 2024 and is projected to reach $45.3 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2025–2033.

The Temperature-Indicating Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.8 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025–2033.

The Time-Temperature Indicator (TTI) Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Anti-Microbial Packaging market was valued at $10.5 billion in 2024 and is projected to reach $18.7 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The Oxygen Scavenger Packaging market was valued at $1.8 billion in 2024 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025–2033.

The moisture absorber packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Ethylene Absorber Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Spoilage Indicator Packaging market was valued at $1.2 billion in 2024 and is projected to reach $2.5 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025–2033.

The Tamper-Aware Smart Packaging market was valued at $2.5 billion in 2024 and is projected to reach $6.8 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025–2033.

The connected beverage packaging market was valued at $1.2 billion in 2024 and is projected to reach $3.5 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The QR-Code Packaging market was valued at $3.5 billion in 2024 and is projected to reach $9.8 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2025–2033.

The AR-Enabled Packaging market was valued at $2.5 billion in 2024 and is projected to reach $12.8 billion by 2033, growing at a CAGR of 20.1% during the forecast period 2025–2033.

The Digital Printing Smart Packaging market was valued at $15.2 billion in 2024 and is projected to reach $28.7 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025–2033.

The blockchain-enabled packaging market was valued at $1.2 billion in 2024 and is projected to reach $5.8 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2025–2033.

The Supply Chain Traceable Packaging market was valued at $12.5 billion in 2024 and is projected to reach $25.8 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2025–2033.

The counterfeit protection packaging market was valued at $89 billion in 2024 and is projected to reach $145 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025–2033.

The Authentication Packaging market was valued at $3.5 billion in 2024 and is projected to reach $7.8 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025–2033.

The flexible food packaging market was valued at $161.5 billion in 2024 and is projected to reach $237.8 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2025–2033.